Bitcoin continued its six-week upward trend, breaking through the psychologically important barrier of $111,000. Although it dropped back below $108,000 due to Trump's tariff remarks, the fact that it left its upward footprint beyond $111,000 seems significant.

While concerns are growing that the upward momentum may reach saturation or decline, Bitcoin's recent performance and historical trends suggest that the king of cryptocurrencies is not yet finished and more growth is expected.

Bitcoin Investors, Additional Growth Signal

Historically, one of the key indicators representing the cryptocurrency market's upward cycle is the decrease in Bitcoin's average holding age. In the past five years, three major bull markets preceded this trend. After April 16th, Bitcoin's average dollar age decreased from 441 to 429 days.

This trend strongly suggests Bitcoin's continued upward movement. Circulating younger coins indicate that new investments are entering the market, representing strong sustained interest. If this trend continues, it further supports the potential to extend the current upward momentum and lead Bitcoin to new price milestones.

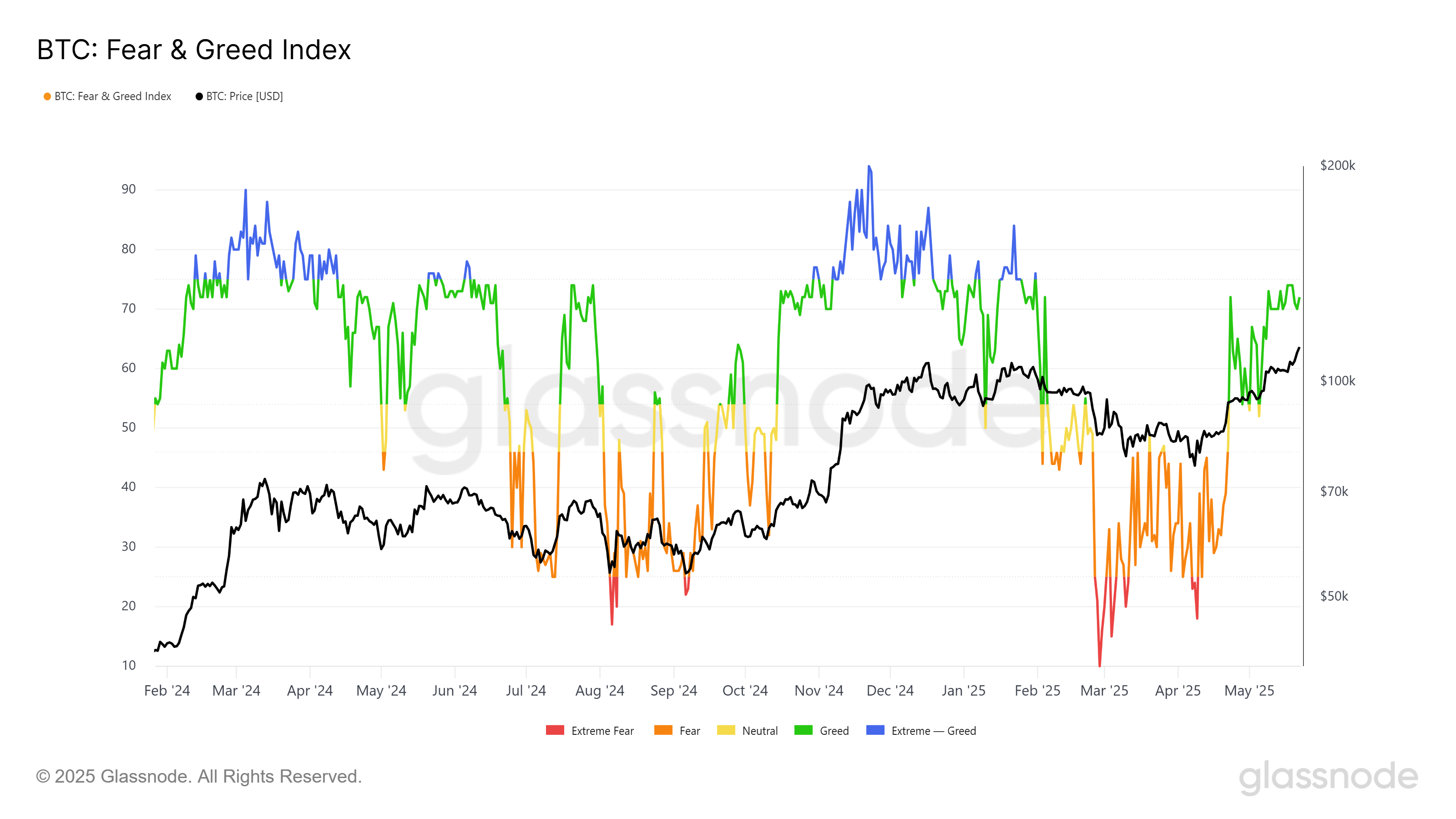

The Fear and Greed Index also indicates that Bitcoin's upward momentum has not yet been saturated. Historically, Bitcoin's price has surged when this index crosses the extreme greed zone.

However, Bitcoin has not yet reached this threshold, leaving room for additional price increases. This suggests that the market is not yet overbought and still has significant potential for growth. The index being in the greed zone indicates that investors are optimistic about Bitcoin's future price trajectory.

BTC Price Continuation Target

Bitcoin's price has steadily risen over the past six weeks, reaching a new all-time high (ATH) of $111,980. Lennix Lai, Global CCO of OKX, emphasized macroeconomic factors such as favorable market conditions and increased institutional interest contributing to Bitcoin's recent rise.

"Bitcoin breaking through $111,000 and setting a new all-time high demonstrates how technically robust it has become. It's particularly impressive that it pushed to higher prices after handling Moody's US credit rating downgrade almost without issue... This is not a typical cryptocurrency hype cycle. We are seeing genuine structural changes, such as the Senate's 66-32 GENIUS Act vote and companies buying Bitcoin three times faster than miners can produce." – Lennix Lai, OKX Global CCO

Moving forward, Bitcoin's price may potentially break its current ATH and reach $115,000. This continued growth will attract more investors, further fueling the upward trend. If positive momentum continues, Bitcoin can solidify its position as a leading asset in the market.

However, if investors begin selling their holdings to secure profits, Bitcoin may experience a short-term correction. A drop below $106,265 would indicate weakened investor sentiment and could lead to a decline to $102,734. In such a case, the bullish outlook could be invalidated, potentially leading to a temporary correction phase in Bitcoin's price.