Welcome to the US Cryptocurrency Morning Briefing. We'll briefly summarize today's key cryptocurrency developments.

Prepare your coffee while examining Bitcoin's key asset position and the impact of Treasury yield increases. As investors increasingly distrust the US debt sustainability and worry about deficits, the Federal Reserve (Fed) purchases bonds, indicating inflation concerns, which enhances Bitcoin's appeal as a hyperinflation hedge.

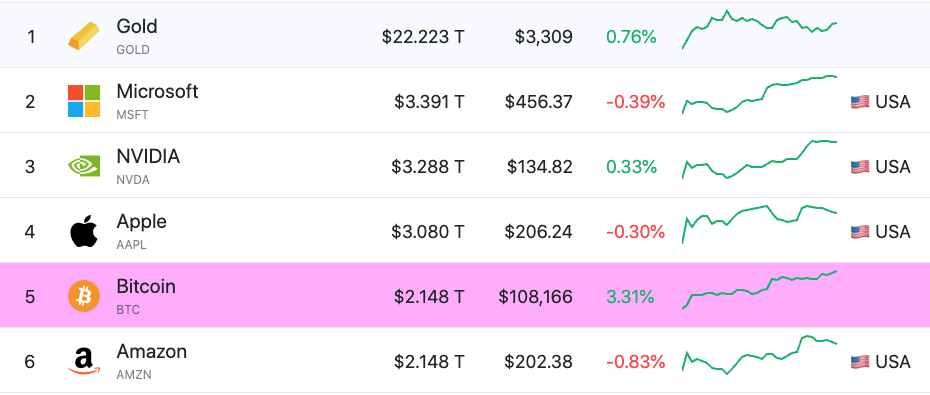

Bitcoin Surpasses Google and Reaches All-Time High

According to recent US cryptocurrency news, Bitcoin has overtaken Google in market capitalization rankings. At the time, its market cap was $1.86 trillion.

Latest data shows Bitcoin's market cap has increased to $2.16 trillion, a 14% increase since April 23rd. This has elevated Bitcoin to 6th place in market capitalization, surpassing Google and approaching Amazon.

"Bitcoin has surpassed Google and is now the 6th largest asset globally, crossing $2 trillion in market cap and overtaking Alphabet. BTC now follows gold, Microsoft, Nvidia, Apple, and Amazon. This is not just a number, but a historic moment." – Dariusz Kowalczyk, co-founder and COO of Bitward Investment wrote.

X (Twitter) sentiment suggests Bitcoin will soon overtake Amazon, with only a 2.7% market cap difference that could be realized soon.

Other users are optimistic that Bitcoin could become the largest asset by market cap, surpassing gold.

Indeed, Bitcoin remains one of the major assets to achieve a $1 trillion market cap in record time, making such optimism valid.

Amount of Time It Took To Reach $1 Trillion

— Documenting ₿itcoin 📄 (@DocumentingBTC) May 12, 2025

Bitcoin: 12 years

Facebook: 17 years

Tesla: 18 years

Google: 21 years

Amazon: 24 years

Apple: 42 years

Microsoft: 44 years

Meanwhile, Bitcoin's surge is unsurprising as its economic uncertainty influence grows. For instance, in Japan, Bitcoin is emerging as an alternative amid sharp inflation. Japan's inflation has reached 3.6%, exceeding the US Consumer Price Index (CPI).

In the same context, recent US cryptocurrency news mentioned Bitcoin's role as a hedge against US Treasury and traditional finance (TradFi) risks.

"I see Bitcoin as a hedge against TradFi and US Treasury risks. Bitcoin's primary purpose in a portfolio is to hedge against risks in the existing financial system. This is thanks to its decentralized ledger." – Jeff Kendrick, Head of Digital Assets Research at Standard Chartered, said in a recent interview with BeInCrypto.

Robert Kiyosaki: No One Wants US Bonds

On the other hand, Rich Dad Poor Dad author Robert Kiyosaki mentions that the US Treasury auction failed on May 20th, with the Fed purchasing $50 billion in bonds.

"What if you threw a party and nobody came? That happened yesterday. The Fed held a US bond auction, and nobody showed up. So the Fed quietly bought fake money with fake money." – Kiyosaki wrote.

Famous Columbia professor Charles Calomiris warned of this scenario in 2023. He noted that investor distrust in US debt sustainability could increase money supply and promote inflation.

Specifically, Kiyosaki predicts hyperinflation and financial ruin for many, anticipating massive price surges in alternative assets.

"Good news. Gold will go to $25,000, silver to $70, and Bitcoin will go to $500,000 to $1 million," he added.

This sentiment emphasizes assets' role as inflation hedges amid money supply increase concerns. His $500,000 Bitcoin target aligns with Standard Chartered's prediction, which was also reported in recent US cryptocurrency news.

However, according to Kiyosaki, a broken monetary system causes economic problems, and investors are advocating for sound money like gold or Bitcoin.

Today's Chart

Today's Key News

Summary of today's notable US cryptocurrency news:

- SEC Claims Unicoin and Management Misled Investors. The regulatory authority claims that over 5,000 investors were deceived by inflated figures and SEC registration claims.

- Trump Meme Coin Surges 13% Ahead of Private Dinner. A dinner with President Trump and the top 220 holders.

- Bitcoin Spot ETF Records Over $300 Million Inflow on Tuesday. BlackRock's IBIT led with $287.45 million.

- Over 86 Million PI Tokens Withdrawn from OKX. Pi Network's price surged 11% amid speculation of a supply shock.

- Ethereum Co-Founder Jeffrey Wilke Moved ETH Worth $262 Million to Kraken. There were speculations about a potential sale, but concerns were later mitigated.

- Metaplanet, Most Shorted Stock in Japan, Gains Attention. Short selling increased due to rising inflation and bond market turmoil, along with its Bitcoin financial strategy.

- The Golden Age of Effortless Airdrops is Over. Projects now prefer VC alignment and stricter participation criteria.

- XRP Faces $470 Million Selling Pressure. Whale holders are intensifying selling pressure.

- Korean Presidential Candidates Compete to Gain Support from 15 Million Crypto Investors. Promising digital asset reforms like crypto ETFs and stablecoin markets.

Cryptocurrency Stock Pre-Market Overview

| Company | May 20th Closing Price | Pre-Market Overview |

| Strategy (MSTR) | $416.92 | $417.21 (+0.07%) |

| Coinbase Global (COIN) | $261.38 | $262.35 (+0.37%) |

| Galaxy Digital Holdings (GLXY.TO) | $30.52 | $29.58 (-3.08%) |

| Marathon Holdings (MARA) | $16.19 | $16.09 (-0.62%) |

| Riot Platforms (RIOT) | $8.93 | $8.87 (-0.68%) |

| Core Scientific (CORZ) | $10.92 | $10.86 (-0.55%) |