Bitcoin has reached a new all-time high, and analysts predict that the largest altcoin season in history may be approaching.

Their claims are based on capital flow cycles and the historical behavior of the crypto market. Analysts believe that Bitcoin's excitement will soon spread to altcoins. This article analyzes the key factors behind this belief.

Why Expect the Largest Altcoin Season Ever?

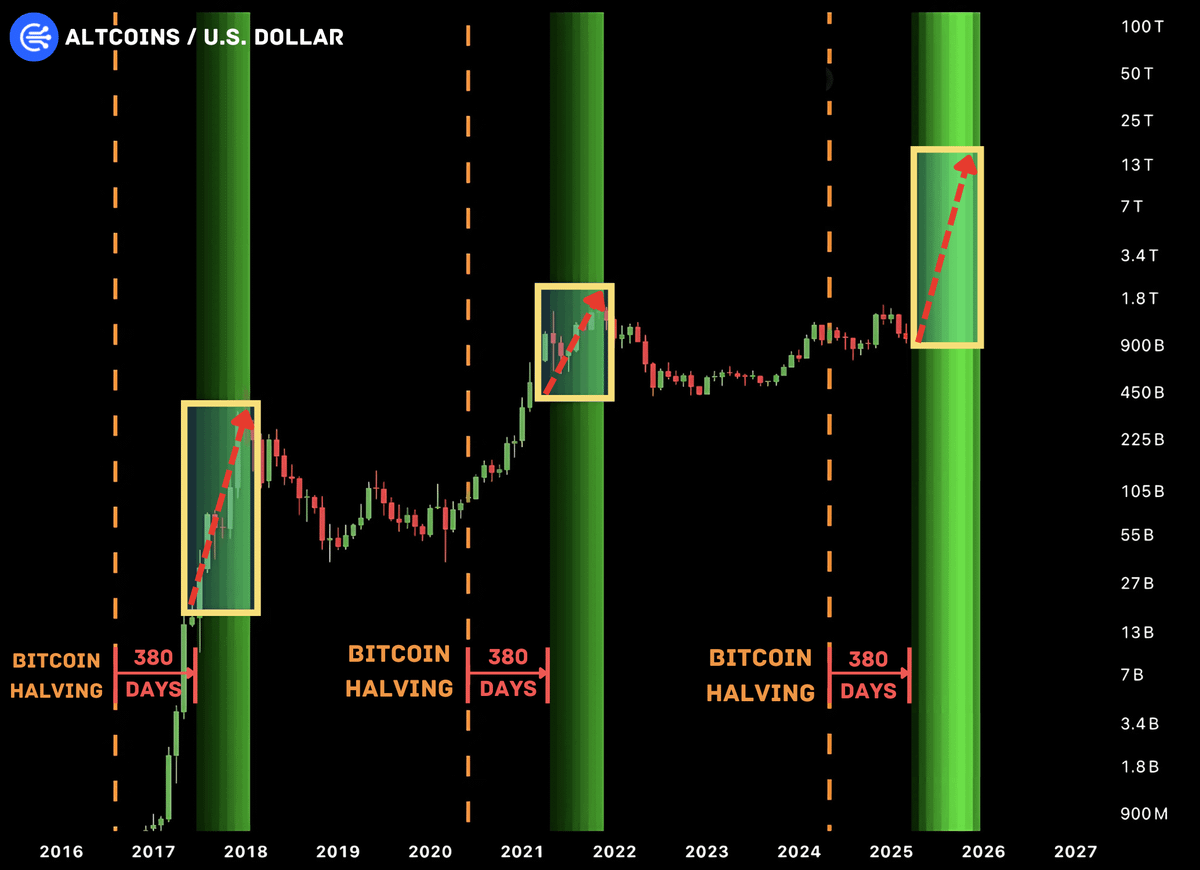

Analyst Wimar.X emphasizes one key factor. Historically, each altcoin season tends to start about 380 days after the Bitcoin halving event.

The most recent halving occurred in April 2024. According to this timeline, the altcoin season could begin in May 2025.

"The largest altcoin season in history will start on May 25th... The market capitalization of altcoins will reach $15 trillion in this cycle," Wimar.X predicts.

Wimar.X points out another common trigger for the altcoin season. It often starts when Bitcoin reaches a new all-time high (ATH) and enters a stabilization or slight correction phase. During this time, Bitcoin dominance (BTC.D) tends to decline. This is when capital moves from Bitcoin to altcoins, driving a surge.

BTC dominance compares Bitcoin's market capitalization to the total cryptocurrency market capitalization. Recent data shows that BTC.D has fallen from 65.4% to 62% and then stabilized at 63.7%.

"The crypto market operates in cycles—a consistent pattern every year. For the altcoin season, the formula is simple. Declining Bitcoin dominance + Bitcoin price stagnation or increase = Altcoin surge. This is an undeniable truth of the crypto market," Wimar.X emphasizes.

Carl Moon, founder of The Moon Show, shares the same view.

"Bitcoin dominance is declining! The altcoin season is imminent!" Carl Moon declared.

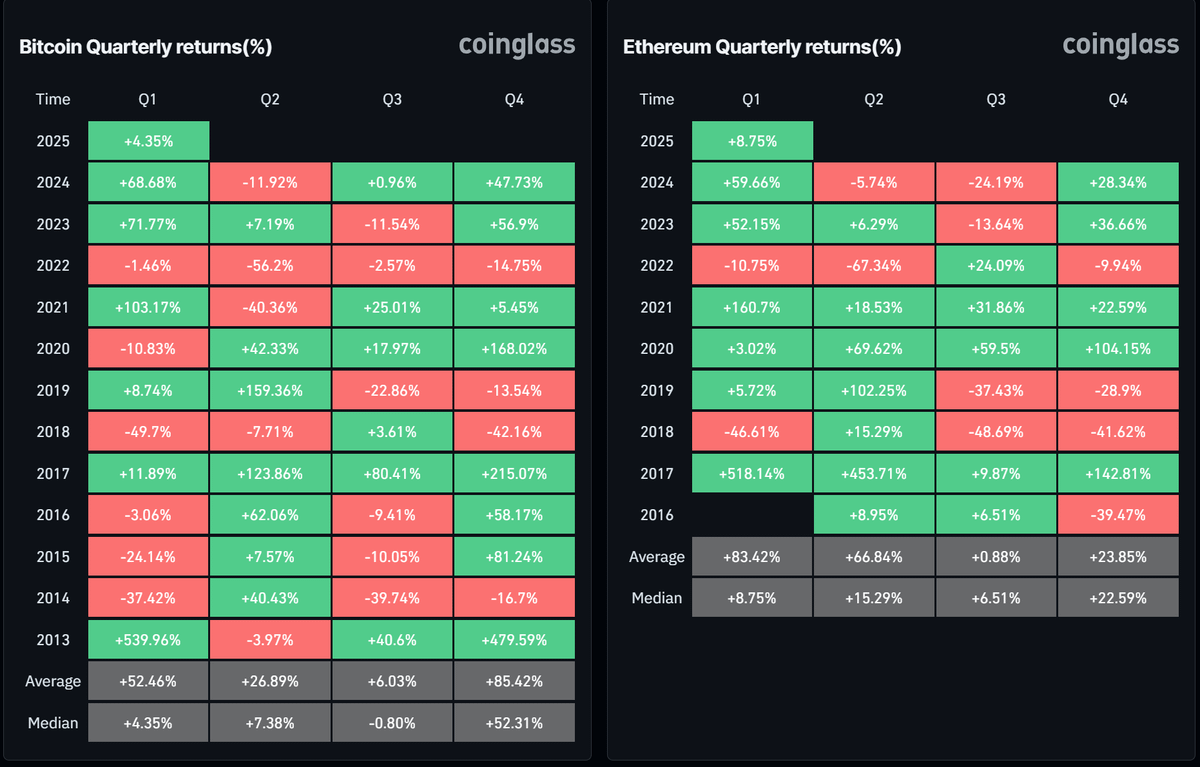

Another supporting factor is the historical performance of the cryptocurrency market in the second quarter (Q2). According to Coinglass data, Q2 is typically one of the strongest quarters for both Bitcoin and Ethereum.

Specifically, Bitcoin has recorded an average Q2 return of about 26.89%. Ethereum performed even better with an average return of 66.8%. Since altcoins often follow Ethereum's trend, similar or even higher returns can be expected. With Q2 2025 currently in progress, it could be the perfect time for altcoins to break through.

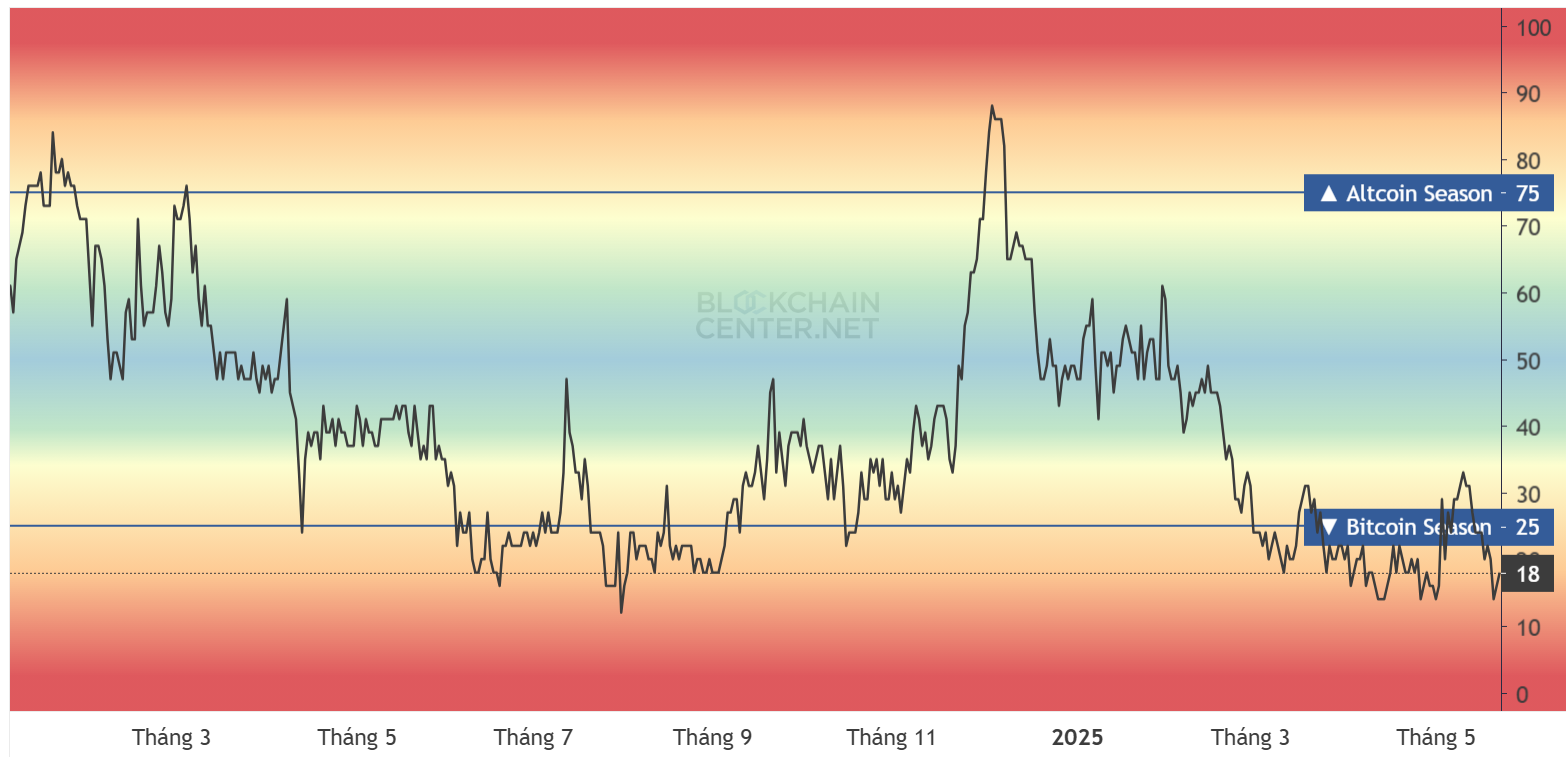

However, not all signals are positive. According to the Blockchain Center, the Altcoin Season Index dropped to its lowest point this year at 13 when Bitcoin reached a new ATH. At the time of writing, it had slightly increased to 18.

This index measures how well the top 100 altcoins have performed compared to Bitcoin over the past 90 days. If 75% of them outperform Bitcoin, the market is considered to be in an altcoin season. Despite the optimistic outlook, the recent decline suggests that altcoins are not yet leading the market.

This raises an important question: Will the altcoin season still follow historical patterns, or do investors need to wait longer before capital moves from Bitcoin to altcoins?