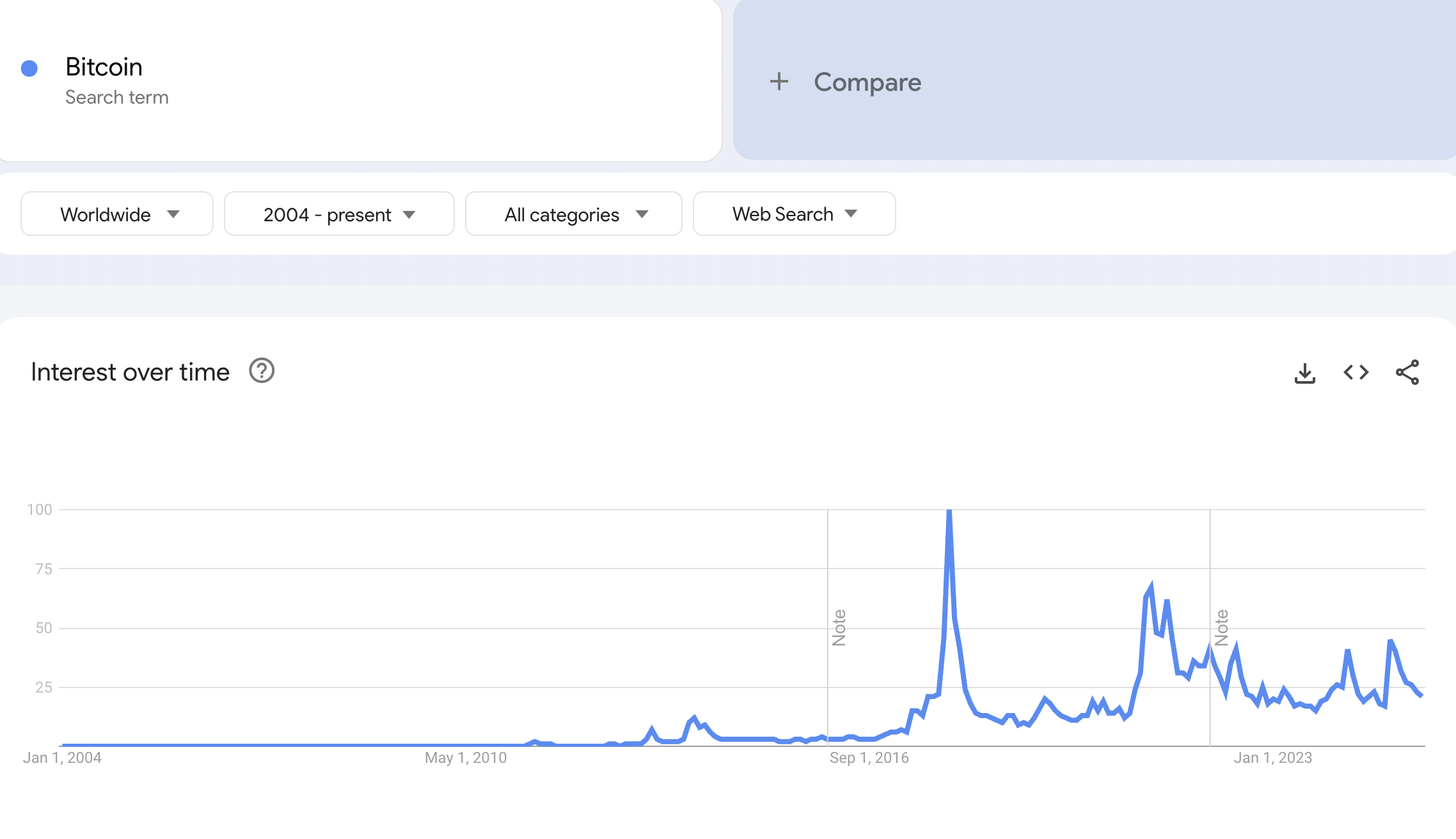

Bitcoin (BTC) is very close to its all-time high (ATH), but Google Trends search interest in Bitcoin remains at a low level.

This level is similar to the bearish period in 2022 when BTC was trading around $16,000. The contrast between Bitcoin's price surge and public indifference is sparking debate within the cryptocurrency community.

Bitcoin Near ATH...Lowest Search Volume

Bitcoin was trading at around $106,000 at the time of writing. However, according to Google Trends data, searches for the keyword "Bitcoin" have not increased correspondingly.

Notably, the search volume is identical to the bearish period in 2022 when BTC was trading around $16,000.

This indicates that public interest is currently very low, despite Bitcoin's value increasing more than sixfold since 2022. This is an abnormal signal, as retail investors' interest typically surges when Bitcoin reaches a new high, triggering FOMO.

Explaining this phenomenon, an X user suggested that retail investors are not significantly interested in Bitcoin's price surge. The user says that price appreciation alone is not enough to trigger FOMO. Only when the altcoin market explodes will "new blood" enter the market. This creates an opportunity for large institutions to sell and transfer risk to new investors.

This perspective aligns with Matrixport's insights, which emphasized that long-term investors are the main Bitcoin holders. Meanwhile, retail investor participation remains very low.

The absence of retail investors can explain why Google Trends search volume has not increased despite Bitcoin approaching its all-time high.

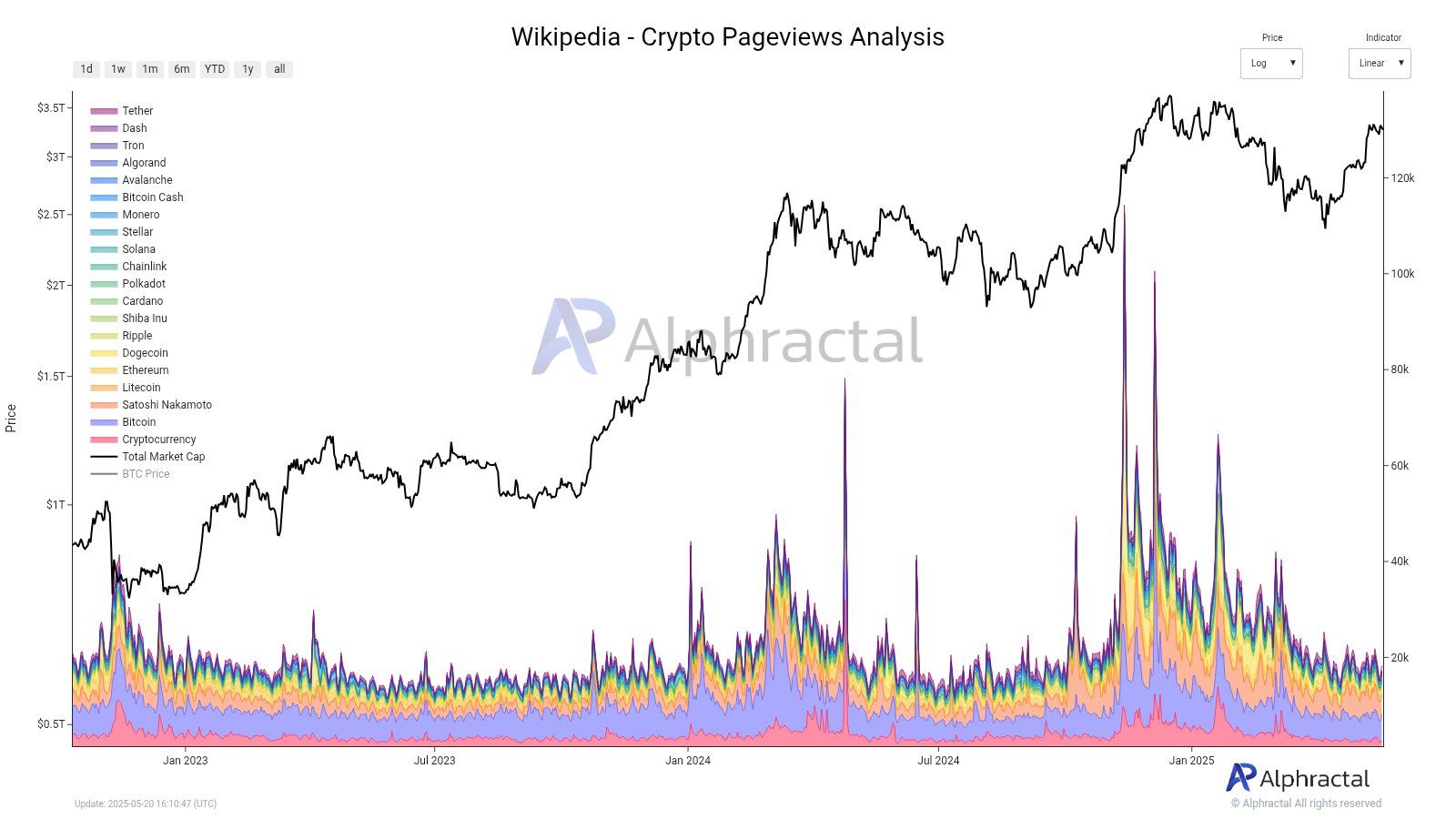

Moreover, Wikipedia interest also remains low compared to previous periods. This suggests a lack of trust and indicates that the market is not enthusiastic. Historically, the market becomes euphoric whenever interest rates rise sharply, coinciding with price peaks.

Calm Before the Storm...Lack of Market Momentum?

Some voices in the cryptocurrency community view this phenomenon positively. X user The_Prophet_ claims that the current Google Trends chart indicates "silence before an explosion". They suggest that public indifference could be a sign of a larger price surge.

This view is supported by X user SerSigma, who points out that Bitcoin's volatility is currently at its lowest level but will not last long. The user says Bitcoin will continue to rise in the near future as the market begins to recognize its potential.

The lack of public interest reflected in Google Trends could provide both opportunities and risks for the Bitcoin market in 2025. Positively, the absence of retail investor participation means the market has not been inflated by FOMO, helping Bitcoin avoid a price bubble like in 2021.

Conversely, the lack of retail investors raises questions about the sustainability of the current rally. If Bitcoin continues to rise without widespread public participation, the market may lack the liquidity needed for long-term growth.

This is particularly important given that large institutions currently hold most of Bitcoin. Without "new blood" entering the market, institutions may struggle to sell at high prices, which could lead to sharp price corrections in the future.

In the long term, Bitcoin is still expected to create significant market momentum. Many financial companies and major banks have announced optimistic views on Bitcoin. Recently, HashKey Group predicted that BTC could exceed $300,000 in 2025.