Macroeconomic shocks from China and the United States are drawing attention to Bitcoin (BTC), providing fertile ground for a narrative as a hedge against traditional financial (TradFi) instability.

Macroeconomic factors and forces affecting Bitcoin decreased in 2023 and are expected to increase from 2024 to 2025.

Bitcoin, China Interest Rate Cut... US Credit Rating Downgrade

On Tuesday, the People's Bank of China (PBOC) lowered its benchmark loan rates for the first time in seven months. Specifically, it reduced the one-year Loan Prime Rate (LPR) from 3.10% to 3.00%, and the five-year LPR from 3.60% to 3.50%.

This measure injects new liquidity into the global market. It aims to stimulate the sluggish economy due to weak domestic demand and strengthen the unstable real estate sector. This occurred amid recent trade tensions with the United States.

"The PBOC cut rates to support the economy amid growth slowdown and US trade pressure. Essentially, this provides cheaper liquidity and creates a positive sentiment towards risk assets, injecting additional momentum." – Axel Adler Jr., On-chain and Macro Researcher

China's easing measures are intended to increase local lending and spending, but they can also impact global asset markets, including cryptocurrencies.

Bitcoin is often considered a high-beta asset that benefits from such liquidity winds, especially when combined with fiat currency weakness or broad economic instability.

Simultaneously, the United States is facing its own credibility crisis. Moody's downgraded the US sovereign credit rating from AAA to AA1, citing persistent fiscal deficits, surging interest costs, and federal debt burden expected to reach 134% of GDP by 2035.

This is the third major downgrade in US history, following Fitch in 2023 and S&P in 2011. Data integrity analyst Nick Drendel highlighted market reaction volatility after previous downgrades.

"[The 2023 Fitch downgrade] caused a (-10.6%) correction that lasted 74 trading days until the Nasdaq exceeded its pre-downgrade closing price." – Nick Drendel

This downgrade reflects concerns amid massive debt, political gridlock, and increasing default risks.

Moody's Downgrade, US Fiscal Issues... Bitcoin's Safe Asset Attraction Rises

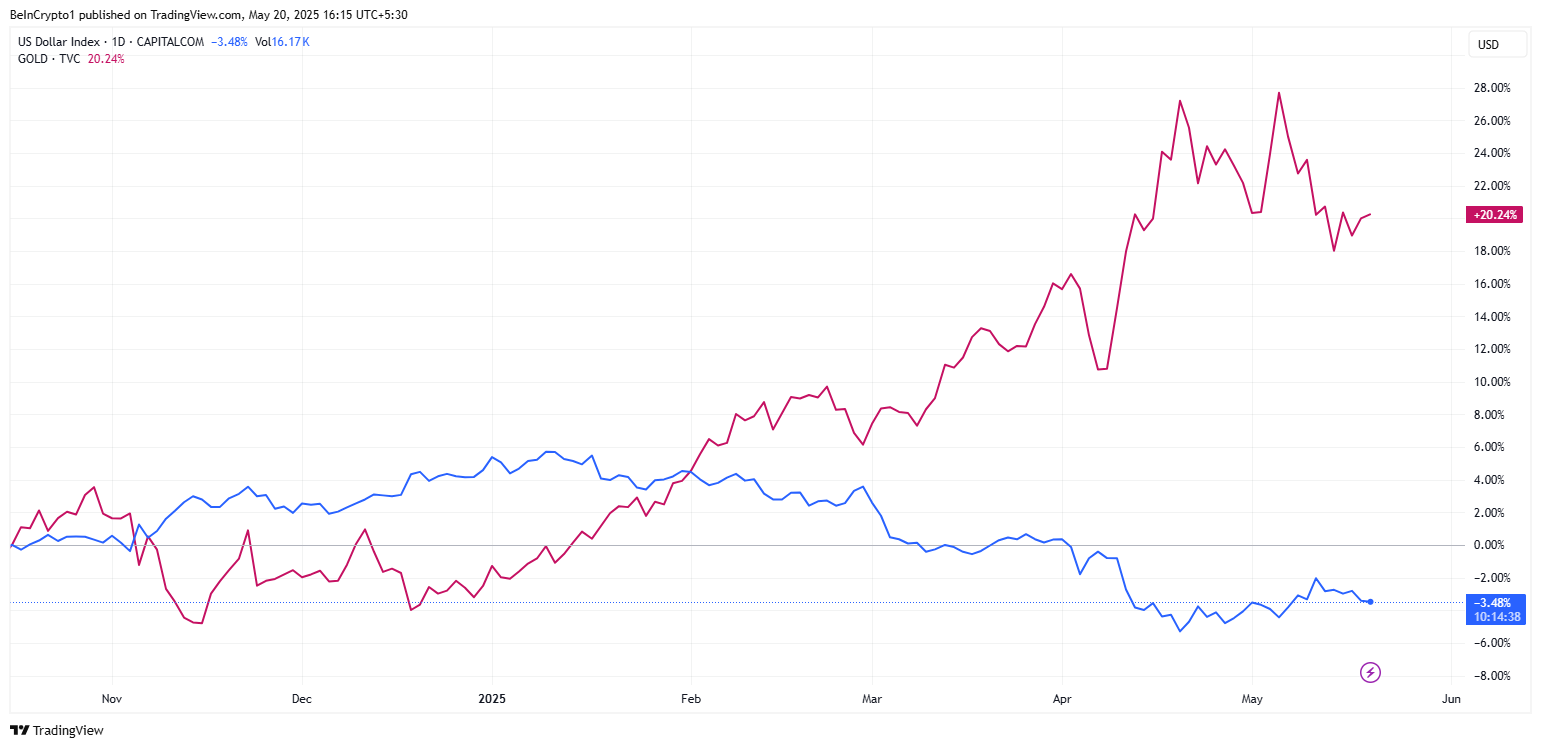

On-chain analyst Adler notes the market's swift response. The US Dollar Index (DXY) weakened to 100.85, and gold rose 0.4%, indicating a typical move to safe assets.

Bitcoin, often called digital gold, has renewed interest as a non-sovereign store of value.

"...Despite the current 'risk-off' mood, Bitcoin may be in a relatively strong position in the current environment due to the 'digital gold' narrative and weak dollar support effect." – Axel Adler Jr.

Bridgewater Associates founder Ray Dalio criticized credit ratings for underestimating broader currency risks.

"...They only assess the risk of governments not repaying debt. They do not include the greater risk that countries with debt will print money to repay, thereby reducing the value of money received by bondholders." – Ray Dalio

In this context, Dalio concluded that US government debt risks are larger than credit rating agencies convey.

Reflecting such views, economist Peter Schiff argued that inflation risk should be central when evaluating sovereign debt, especially when many foreign investors lack political influence.

"...When a country has significant debt to foreigners, the possibility of default on foreign-owned debt must be considered." – Peter Schiff

These dual macroeconomic changes—China's liquidity injection and US fiscal fractures—provide a unique tailwind for Bitcoin. Historically, BTC has thrived under similar conditions: increasing inflation fears, weakened fiat currency credibility, and global capital seeking strong alternatives.

While markets remain volatile, the combination of China's accommodative policy and new doubts about US fiscal discipline could draw institutional and individual investors to decentralized assets like Bitcoin.

If dollar attractiveness continues to decline and central banks adopt accommodative policies, Bitcoin's value proposition as a politically neutral and non-inflationary asset will become hard to ignore.

According to BeInCrypto data, BTC is currently trading at $105,156, showing a slight increase of 2.11% in the past 24 hours.