Expectations for the altcoin season are weakening due to recent indicators. While the FTX's scheduled $5 billion payment on May 30 could provide new liquidity to the market, capital is moving back to Bitcoin.

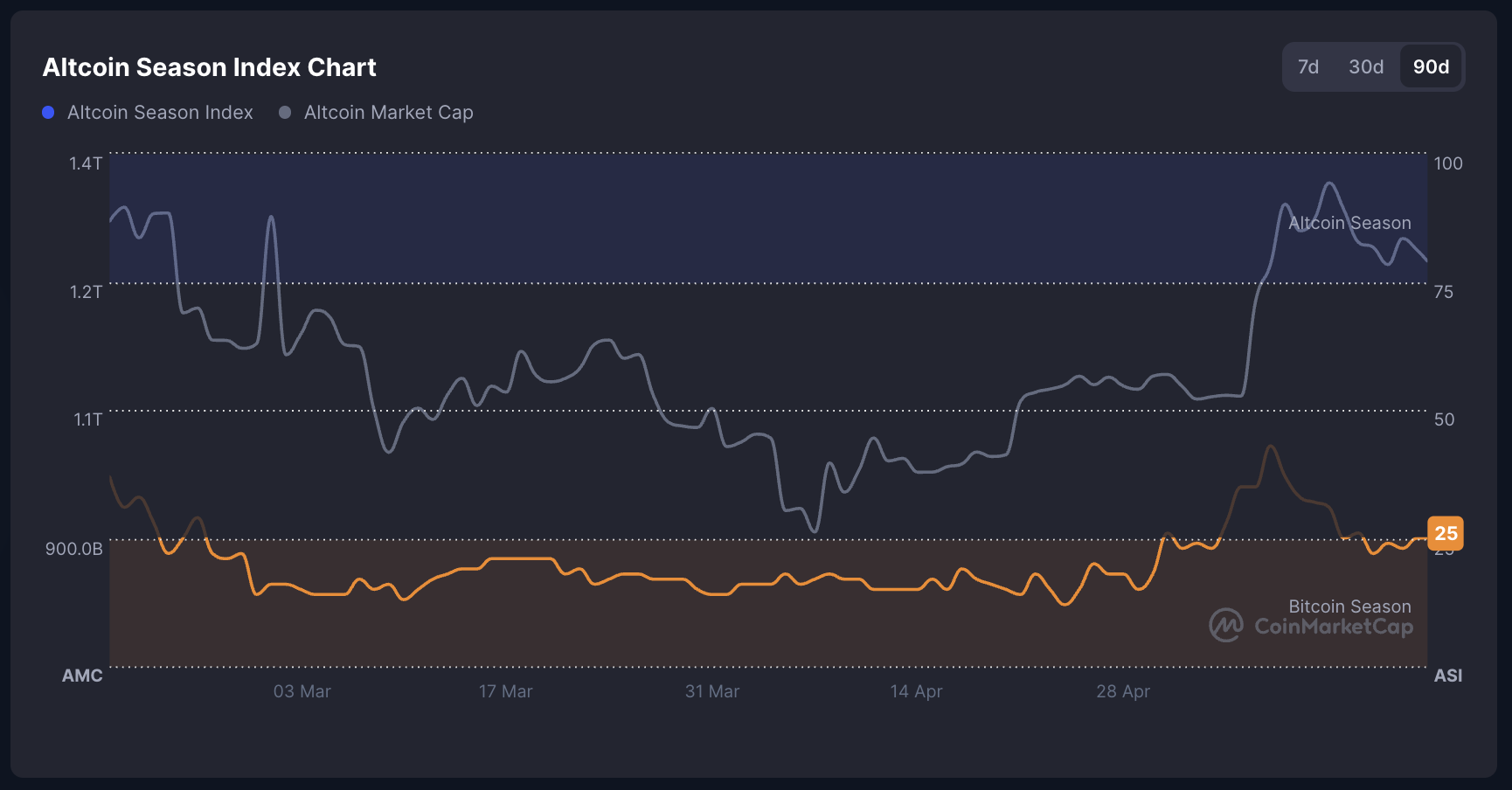

BTC dominance has recovered, and the ETH/BTC ratio has declined, suggesting altcoins are showing weakness. The altcoin season index has dropped to 25, confirming that Bitcoin is currently firmly in control.

FTX, $5 Billion Repayment... Altcoin Season in June Triggered? Momentum Weakens

FTX is set to distribute $5 billion to approved creditors on May 30. This is one of the largest single payments in cryptocurrency bankruptcy history.

Many analysts believe this sudden liquidity injection could reignite altcoin momentum in June, as recipients are likely to reinvest in the market.

That optimism briefly aligned with market structure. From May 7 to May 13, Bitcoin dominance plummeted from 65.5% to below 62.2%. This nearly 5% drop sparked speculation that the altcoin season was beginning.

However, that sentiment has since cooled. From May 14 to May 20, BTC dominance increased by 3%, largely reversing the previous week's change. This suggests capital is rotating back to Bitcoin.

Another key signal, the ETH/BTC ratio, tells a similar story. From May 7 to May 13, Ethereum showed a significant rise against Bitcoin. The ratio increased by almost 38%, strengthening the belief that a broader altcoin breakout was beginning.

However, in the following week from May 14 to May 20, that ratio dropped by 8.7%. This indicates a weakening of ETH's relative strength and a decrease in altcoin season expectations.

These changes suggest that while FTX payment could inject new capital, the altcoin season narrative is currently losing momentum.

Altcoin Momentum Weakens, Index at 25... FTX Liquidity Change?

The total market capitalization of cryptocurrencies excluding Bitcoin is currently $1.17 trillion. This increased from $1.01 trillion on May 7 but sharply decreased from $1.26 trillion on May 13.

This trend suggests that while altcoins saw a brief inflow in early May, momentum has weakened. Approximately $90 billion flowed out in just one week. This retreat highlights the ongoing lack of confidence in a comprehensive altcoin rally.

However, the $5 billion liquidity injection from the FTX payment on May 30 could help altcoins regain momentum and potentially trigger an altcoin season in June.

Meanwhile, the altcoin season index tracked by CoinMarketCap has dropped from 43 on May 9 to 25. This officially indicates entry into the Bitcoin season zone.

This index measures the number of top 100 coins (excluding stablecoins and wrapped assets) that outperformed Bitcoin in the past 90 days. 75 and above indicates an altcoin season, while 25 and below indicates Bitcoin dominance.

With only a quarter of top coins outperforming BTC, the index confirms that Bitcoin is currently dominating again. However, the upcoming liquidity surge could potentially reverse this trend.