Welcome to the US Cryptocurrency Morning Briefing. We'll briefly summarize today's key cryptocurrency developments.

Prepare a cup of coffee while exploring Standard Chartered's bold Bitcoin outlook, Nick Perkin's reasons why true excitement has not yet begun, and the latest ETF flows reshaping investor sentiment. As Bitcoin sets new all-time highs and institutional adoption surges, today's briefing provides the most critical insights.

Standard Chartered Forecasts Bitcoin at $200,000 by Year-End

Standard Chartered Bank reaffirms a positive outlook on Bitcoin, predicting the cryptocurrency will reach $200,000 by the end of 2025 and potentially hit $500,000 by 2028.

This prediction is based on increasing institutional and government interest in Bitcoin, particularly through indirect investments in companies like MicroStrategy.

"My official Bitcoin forecast is $120,000 by the end of Q2, $200,000 by the end of 2025, and $500,000 by the end of 2028. Everything is progressing well," Kendrick said.

Jeff Kendrick, Global Head of Digital Assets Research at Standard Chartered, recently emphasized in documents submitted to the US Securities and Exchange Commission (SEC) that government agencies are increasing exposure to Bitcoin proxies.

In the first quarter, 12 government-related institutions, including US state pension funds and foreign central banks, increased their holdings in MicroStrategy, acquiring stocks equivalent to approximately 31,000 BTC.

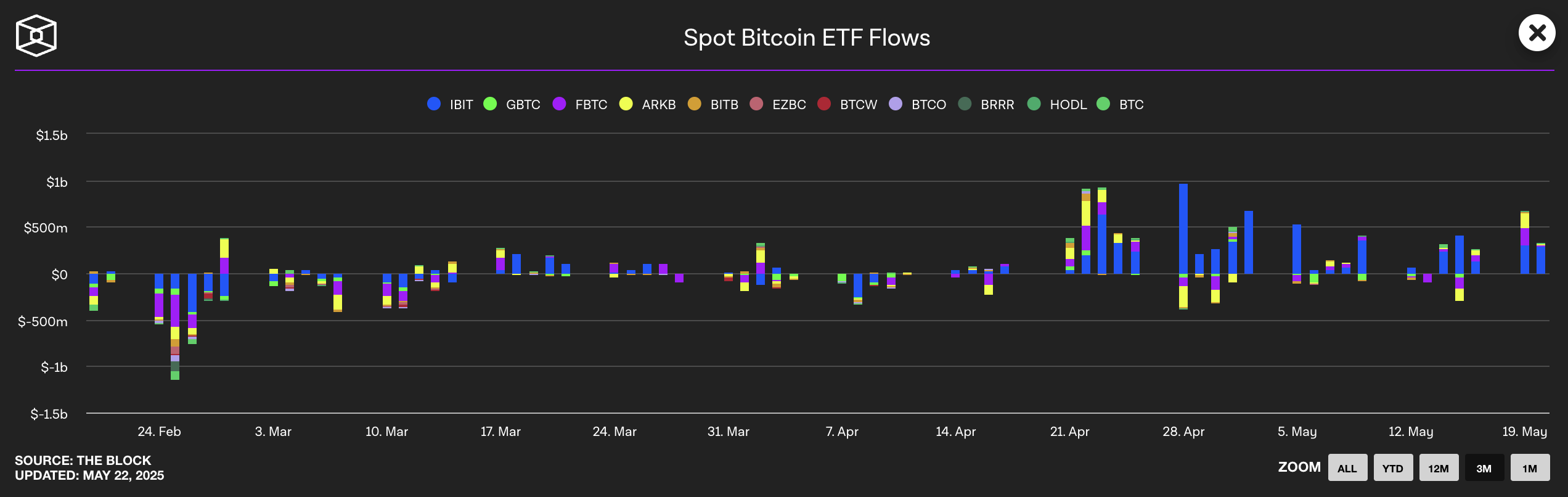

The bank also observed significant changes in investment patterns with substantial inflows into Bitcoin ETFs.

Over the past five weeks, US spot Bitcoin ETFs recorded total net inflows of $7.2 billion, while gold ETFs experienced $3.6 billion in outflows during the same period. This trend suggests Bitcoin is being preferred as a safer asset compared to traditional options like gold.

"The safe-asset rotation in ETFs continues, with gold ETP losing $3.6 billion since April 22 and BTC ETF adding $7.5 billion," Kendrick said. "The recently filed 13Fs showed expanded government purchases of BTC proxies, likely continuing into Q2."

Kendrick noted that such investments often occur due to regulatory constraints limiting direct Bitcoin holdings.

He observed that some government-related institutions are indirectly increasing exposure by investing in companies with substantial Bitcoin holdings, potentially influenced by regulatory restrictions on direct Bitcoin ownership.

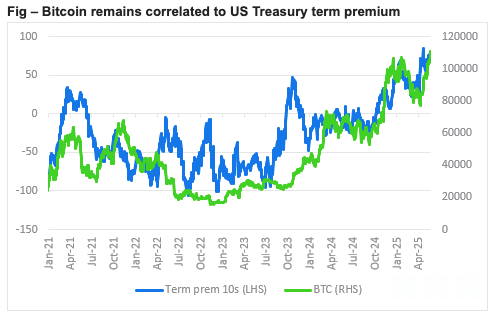

Additionally, Kendrick emphasized the correlation between Bitcoin's performance and macroeconomic factors, particularly the US Treasury's term premium.

He explained that high term premiums, influenced by factors like Japanese government bond (JGB) weakness, enhance Bitcoin's appeal amid risks in the traditional financial sector.

Beyond the $200,000 target for 2025, Standard Chartered maintains its long-term projection of Bitcoin reaching $500,000 by 2028, supported by continued favorable regulatory developments and increased institutional adoption.

Bitcoin Breakthrough... True Excitement Not Yet Started

Cryptocurrency analyst, investor, and founder of The Coin Bureau, Nick Perkin, told BeInCrypto:

"After months of struggle, Bitcoin has finally surpassed its previous all-time high, and closing above this level last night was decisive."

According to Perkin, this breakthrough indicates a significant change in market sentiment and strength.

"This time it's really different. This rally looks much more sustainable than what we saw in January, which was driven by unrealistic expectations about Trump's impact on the digital asset market."

As Bitcoin enters uncharted territory, he believes additional rises could be quickly realized.

"Now that we've entered the price discovery zone, we can relatively quickly rise to $120,000, though there might be some resistance around $115,000. Long-term, no one believes Bitcoin has hit its ceiling in this cycle. $150,000 remains my base scenario."

Perkin bases this view on broader indicators suggesting a lack of retail frenzy, beyond just price movements.

"There are several reasons. ETF flows, Bitcoin options' implied volatility, and Google search trends are relatively subdued compared to when BTC crossed $100,000. This suggests excitement hasn't started yet. Volatility will increase beyond $120,000, but BTC still has room to climb higher."

He also emphasizes global liquidity as a key factor in the macroeconomic context.

"I'm also confident we've only seen the tip of the iceberg of global liquidity flowing into the market."

However, Perkin warns against blind optimism when extreme predictions begin to dominate headlines.

"It's important to note that this does not mean Bitcoin will surge 360% like in 2017. It is not realistic to predict that Bitcoin's price will reach $300,000 or $600,000 in this cycle. The closer we get to the peak, the more such headlines we will see, and volatility will increase."

His final warning is to caution new investors against getting swept up in the high interest.

"Investors with little experience in the cryptocurrency market should be careful not to get swept up in this high interest. It is always exaggerated. This is the only thing that is 100% guaranteed."

Today's Chart

Today's Major News

Summary of today's notable US cryptocurrency news:

- US BTC demand reaches a 24-day high, with the coin reaching a new all-time high.

- US lawmakers push for cryptocurrency: New bill in Michigan and Emmer's blockchain proposal

- ZachXBT links 188 BTC to THORChain in Coinbase hack: Should unauthorized protocols be concerned?

- BTC crosses $110,000, with ETF inflows continuing for 6 consecutive days.

- Trump-backed USD1 stablecoin secures Binance listing, with trading volume surging 31.9%

- Worldcoin raises $135 million by selling WLD tokens to a16z and Bain Capital Crypto.

- Senator Gillibrand's role in stablecoin regulation – cryptocurrency donations of $217,000

- Who will join Justin Sun at Trump's meme coin dinner tonight?

- US federal court to handle LIBRA meme coin lawsuit.

Cryptocurrency Stock Pre-Market Overview

| Company | May 21 Close | Pre-Market Overview |

| MicroStrategy (MSTR) | $402.69 | $408.42 (+1.42%) |

| Coinbase Global (COIN) | $258.99 | $262.75 (+1.45%) |

| Galaxy Digital (GLXY) | $22.44 | $23.89 (+6.46%) |

| MARA Holdings (MARA) | $15.84 | $16.37 (+3.35%) |

| Riot Platform (RIOT) | $8.84 | $8.98 (+1.58%) |

| Core Scientific (CORZ) | $10.78 | $10.85 (+0.65%) |