Bitcoin Market Dominance Drops to 60.5%, Altcoin Market Value Rises Over 15.44% in the Past Week

Mars Finance News, on August 11, according to market data, Bitcoin market dominance (BTC.D) dropped 3.22% in the past week, currently at 60.5%. During the same period, the total crypto market value increased by 9.51%, the total market value excluding Bitcoin (TOTAL 2) rose by 15.44%, and the total market value excluding Bitcoin and Ethereum (TOTAL 3) increased by 11.11%.

A Whale Further Accumulates 49,533 ETH, Approximately $210.68 Million

Mars Finance News, according to Onchain Lens monitoring, a whale/institution further accumulated 49,533 ETH from Galaxy Digital and FalconX, valued at $210.68 million. Currently, this whale holds a total of 221,166 ETH, worth $940.73 million, distributed across 6 different wallets.

Mars Finance News, according to Coinglass data, if ETH breaks $4,459, the liquidation intensity of accumulated short positions on mainstream CEXs will reach $2.661 billion. Conversely, if ETH falls below $4,040, the liquidation intensity of accumulated long positions on mainstream CEXs will reach $2.038 billion.

TRM Labs: Ransomware Group Embargo Transferred $34 Million in Crypto Since April

Mars Finance News, on August 11, according to Cointelegraph, blockchain intelligence company TRM Labs stated that the ransomware group named Embargo has transferred over $34 million in ransom-related cryptocurrencies since April. Embargo currently has about $18.8 million in cryptocurrencies stored in non-associated wallets, with experts believing this strategy may be to delay detection or create better money laundering conditions in the future. Embargo operates on a Ransomware-as-a-Service (RaaS) model, primarily targeting industries with high downtime costs, including healthcare, business services, and manufacturing, and tends to attack victims within the United States due to their potentially stronger payment capabilities. TRM's investigation suggests Embargo might be a renamed version of the notorious BlackCat (ALPHV) organization, which disappeared earlier this year amid suspected exit scam. While not as overtly aggressive as LockBit or Cl0p, Embargo employs a double extortion strategy: encrypting systems and threatening to leak sensitive data if not paid. In some cases, the group publicly names or leaks data on their website to increase pressure.

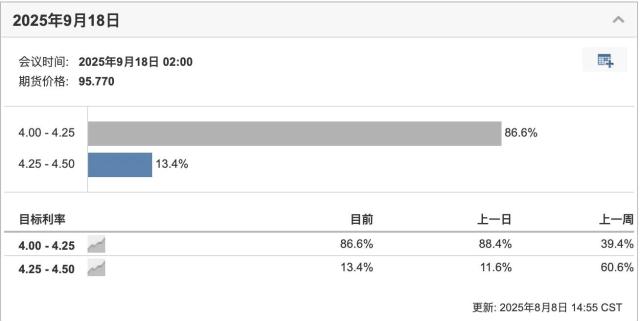

Mars Finance News, on August 11, Federal Reserve Governor Bowman stated that the recent significant downward revision of employment growth data highlights the reasons for the Fed to cut rates. The obvious weakness in the labor market outweighs the risk of future inflation increases. She expects to support rate cuts at each of the Fed's remaining three meetings this year. As economic growth slows this year and signs of labor market weakness become clear, gradually shifting from a moderately restrictive policy stance to a neutral one is appropriate. (Jinshi)

LayerZero Foundation Proposes to Acquire Stargate Cross-Chain Bridge and STG Token for $110 Million

Mars Finance News, on August 11, according to The Block, the LayerZero Foundation proposed acquiring the Stargate cross-chain bridge and its STG token for $110 million. According to the proposal terms, STG tokens will be discontinued, and STG holders can exchange their tokens for LayerZero's native token ZRO at a ratio of 1 STG to 0.08634 ZRO, equivalent to $0.1675 per STG and $1.94 per ZRO. Stargate will be integrated into the LayerZero Foundation, and its DAO will be dissolved. The proposal states: "This proposal aims to simultaneously accelerate the development of Stargate and LayerZero, provide resources for Stargate to advance its work under an active roadmap, expand its business scope beyond cross-chain bridges, and more deeply integrate an excellent protocol that directly engages with end-users and generates significant revenue into the LayerZero ecosystem."

Mars Finance News, on August 11, according to the Wall Street Journal, E.J. Anthony, chief economist of the conservative think tank Heritage Foundation, is a top candidate for BLS director. According to a senior government official, the Trump administration is interviewing BLS director candidates, including at least one long-time critic of the agency. Earlier this month, Trump dismissed the BLS director after a weak employment report, and officials are now considering potential successors. E.J. Anthony, as the Heritage Foundation's chief economist, has long questioned the agency's employment data collection methods. The White House spokesperson stated: "President Trump has selected the most talented individuals to lead the federal government and will announce the new BLS director after making a decision." The report suggests that the White House's consideration of appointing a known critic signals Trump's plan for significant reforms. (Jinshi)

Treasury Secretary Besant: Expects Trade Issues to be Resolved by Late October

Mars Finance News, on August 11, U.S. Treasury Secretary Besant, in an interview with Nikkei News, stated that President Trump's tariff policy aims to bring manufacturing back to the United States. When evaluating the effects of his economic policies since taking office, Besant said, "Trump's economic policy is like a 'three-legged stool' - taxes, trade, and deregulation. In terms of taxes, we completed the 'Big and Beautiful Act' at a record speed, signed into effect on July 4. Regarding trade, I believe we can basically complete the work by the end of October. As for deregulation, it's an ongoing process, with the president clearly requiring that for every new regulation introduced, ten old regulations must be eliminated." Besant noted that the shift to tariff policy was primarily to rebalance the current account deficit. He stated, "Over time, tariffs should be like a melting ice cube. If production returns to the United States, our imports will decrease." (Jinshi)