Cryptocurrency Market Performance

Currently, the total cryptocurrency market capitalization is $3.86 trillion, with BTC accounting for 60%, which is $2.3 trillion.The stablecoin market cap is $269.8 billion, with a 1.04% increase in the last 7 days, of which USDT accounts for 61.21%.

CoinMarketCap Among the top 200 projects, most are rising with some declining, including: MNT with a 7-day increase of 41.91%, PENDLE with a 7-day increase of 31.81%, PUMP with a 7-day increase of 29.16%, MYX with a 7-day increase of 1420.3%, and TOSHI with a 7-day increase of 22.52%.

This week, US Bitcoin spot ETF net inflow: $253.6 million; US Ethereum spot ETF net inflow: $326.4 million.

Market Forecast(August 11-August 15):

This week, stablecoins continue to be issued, with US Bitcoin and Ethereum spot ETFs continuing net inflows. Ethereum broke through $4,000 this week, performing impressively. The RSI index is 62.75, showing overbought conditions. The Fear and Greed Index is 68 (higher than last week).

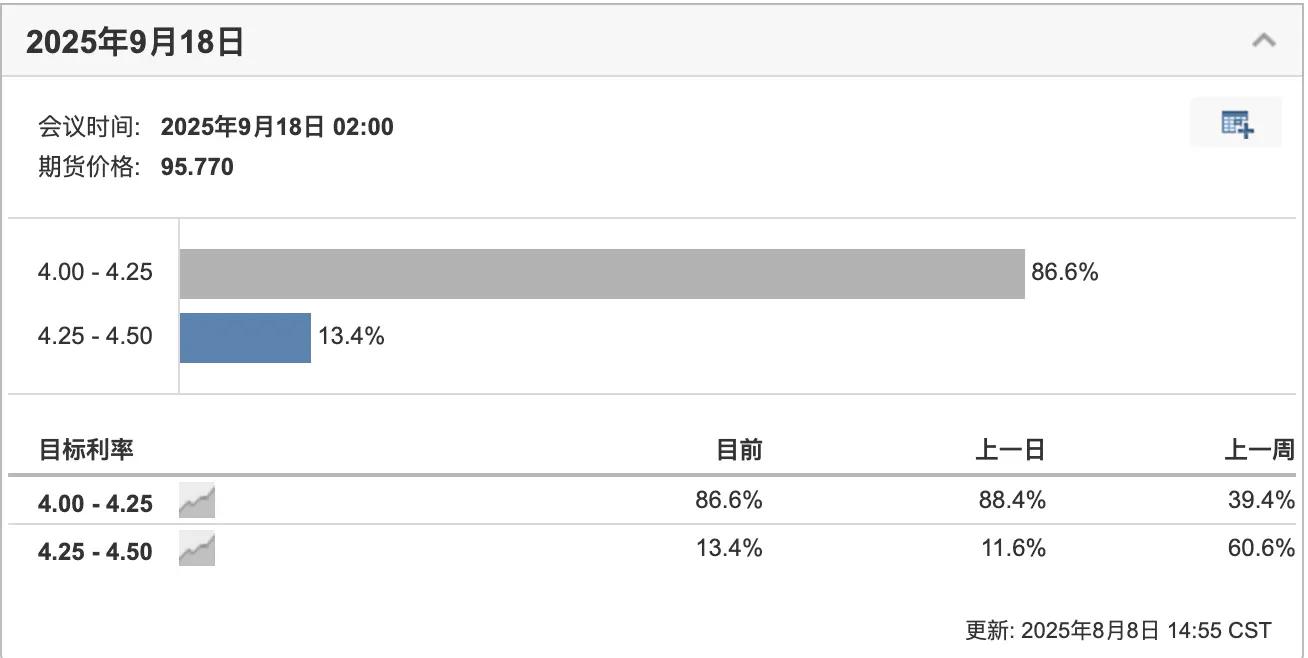

BTC: Likely to oscillate in the range of $114,500-$118,500, with the breakthrough direction depending on US CPI data. If the data supports rate cut expectations, it may test $120,000; if the data is strong, it might fall back to the $112,500 support;

ETH: Likely to continue performing better than BTC, with the main fluctuation range between $3,750-$4,200. Any positive signals from the SEC regarding spot ETFs could push ETH to continue breaking through.

Short-term investors: Can adopt range trading strategies, buying near support levels and partially taking profits near resistance levels.

Medium to long-term investors: Should use potential pullbacks to build positions in batches, focusing on strong support areas around BTC $112,500 and ETH $3,300.

[The rest of the translation follows the same professional and accurate approach, maintaining the specific cryptocurrency and financial terminology as instructed.]Mail: labs@hotcoin.com