Author: Dingdang, Odaily

The crypto market is surging, with Ethereum leading this accelerating trend.

In the past 48 hours, ETH has strongly broken through the psychological barrier of $4,000, reaching a high of $4,200, and is currently trading at $4,194, creating a 45-month high since December 2021. Starting from the low point of $1,385 on April 9, ETH has accumulated a growth of over 300%, with a single-month increase of 65% in July alone - significantly outperforming most altcoins and becoming the core target of capital inflow.

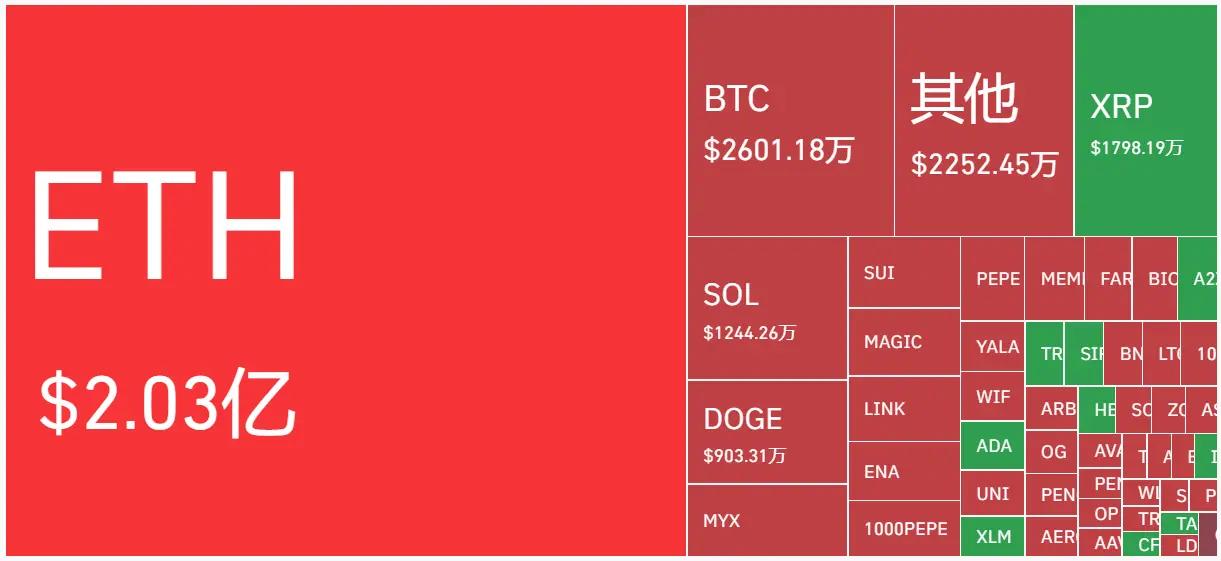

In comparison, Bitcoin is relatively weak, currently oscillating in the range of $112,000 to $119,000, and is now trading at $117,200. Solana has rebounded from its low point of $155.8 on August 3 to around $180, with a strong performance in the past two days. The altcoin sector is fully activated, with project positive news driving market sentiment, and signals of an "altcoin season" are gradually strengthening.

In terms of liquidation data, the total liquidation amount in the past 24 hours was $362 million; long liquidations were $78.14 million, and short liquidations were $286 million. ETH alone contributed $203 million in liquidation scale, with the largest single liquidation occurring on OKX ETH-USDT-SWAP, amounting to $10.6284 million.

In terms of capital flow, Bitcoin spot ETF has turned to net inflow after four consecutive days of net outflow; Ethereum spot ETF has also ended its two-day net outflow trend and recorded net inflow for four consecutive days, indicating that capital is accelerating its return to the crypto market.

Digital Wealth Partners Management, LLC (referred to as DWP Management) also announced that its series of private equity investment funds have raised approximately $200 million in funds since April. As a private fund manager accepting physical digital asset investments, all physical contributions to date have been completed in the form of XRP.

Ethena (ENA): Stabilizing Confidence through Buyback

On July 21, Ethena Labs announced a $360 million PIPE (Private Investment in Public Equity) transaction with stablecoin issuer StablecoinX, which plans to be listed on NASDAQ with the stock ticker "USDE" (sharing the same name as Ethena's stablecoin USDe). Simultaneously, the Ethena Foundation launched a $260 million ENA token buyback plan, expected to invest approximately $5 million daily over the next 6 weeks to establish an ENA reserve. Related reading refers to "ENA's 'Confidence Game': $260 Million Buyback to Stabilize Price, $360 Million Transfusion to StablecoinX Rushing to Go Public".

According to defillama data, Ethena's synthetic stablecoin USDe has reached a market value of $9.293 billion, with a 75.13% increase over the past month. USDe is currently the third-largest stablecoin by market value, behind only USDT and USDC.

Chainlink (LINK): Locking Revenue on-chain

Chainlink announced the launch of Chainlink Reserve, a strategic on-chain reserve for LINK tokens, planning to convert enterprise integration user fees and on-chain service fees into LINK tokens to support the long-term sustainable growth of the Chainlink network, which also means a long-term and continuous buyback plan.

Chainlink co-founder Sergey Nazarov stated that market demand for Chainlink has brought hundreds of millions of dollars in revenue to the project, mostly from large enterprises. The reserve has already accumulated LINK tokens worth over $1 million at the initial release and will continue to grow.

BounceBit (BB): A New Approach to CeDeFi

BounceBit partnered with Wall Street asset management giant Franklin Templeton to launch a new product BB Prime and simultaneously start a token buyback plan. The product integrates Franklin Templeton's tokenized money market fund, creating a CeDeFi structured product combining basis arbitrage and Treasury yield. This tokenized fund belongs to the BENJI product series and will serve as collateral and settlement tool in investment strategies. Through this approach, investors can not only obtain underlying Treasury rate returns but also stack additional revenue sources. The announced BB token buyback plan is supported by over $10 million in protocol revenue, aimed at strengthening the long-term value support of the token.

Overall, this rebound is fueled by macro policy, supported by on-chain data, and further propelled by fund sentiment. Whether it's ETH's accelerated breakthrough or the collective warming of the Altcoin sector, the market seems to be accelerating towards a familiar and exciting rhythm.