In July, the global market witnessed a key turning point. Trump rarely pressured the Federal Reserve, attempting to push for rate cuts to alleviate government debt pressure. However, Powell maintained independence and kept rates unchanged. The market's expectation of a September rate cut dropped from 60% to 47%. Meanwhile, the tariff war entered the "post-era". Although the game is not completely over, the market reaction has become increasingly calm. The three new main themes in the post-tariff era are rate cuts, AI, and the institutionalization of crypto assets.,Post-tariff era rate cuts,AIand crypto assetinstitutionalizationarethree newmain themes.

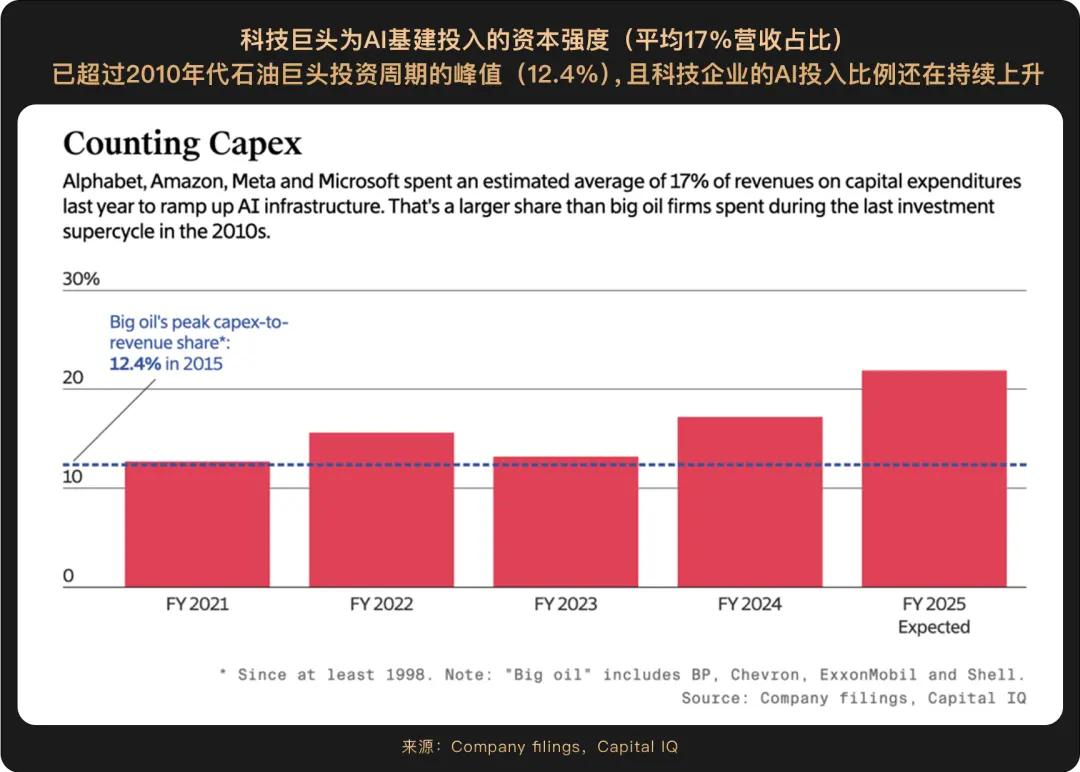

[Rest of the translation continues in the same manner, maintaining the original structure and translating all text while preserving HTML tags and special terms like AI, Meta, Nasdaq, etc.]The current market is shifting gears: The dominant landscape of trade friction in recent years is gradually receding, and new technology tracks represented by AI are beginning to attract more attention, thereby further changing the market's capital allocation pattern.

In this wave of technological investment,WealthBee observed that digital assets are becoming a new option on corporate balance sheets, with an increasing number of listed companies beginning to incorporate cryptocurrencies like Bitcoin intocorporate reserve assets. These pioneering companies often have two characteristics: first, they generally pay attention to global monetary policy shifts and potential inflationary pressures, viewing the scarcity and decentralized nature of cryptocurrencies, especially Bitcoin, as effective tools for hedging inflation and systemic risks; second, they have a natural affinity for new asset classes due to their position in the technology industry. Against the backdrop of global monetary policy facing a turning point, the scarcity of cryptocurrencies naturally makes them a potential tool for these companies to hedge against inflation.

Unlike the market sentiment in recent years driven by retail investors' FOMO,the approval of Bitcoin spot ETFs in early 2024, with 11 institutions including BlackRock and Fidelity obtaining SEC entry permits, has fundamentally reshaped the capital structure and operating logic of the crypto market. By July 2025, this transformation becomes even more profound.

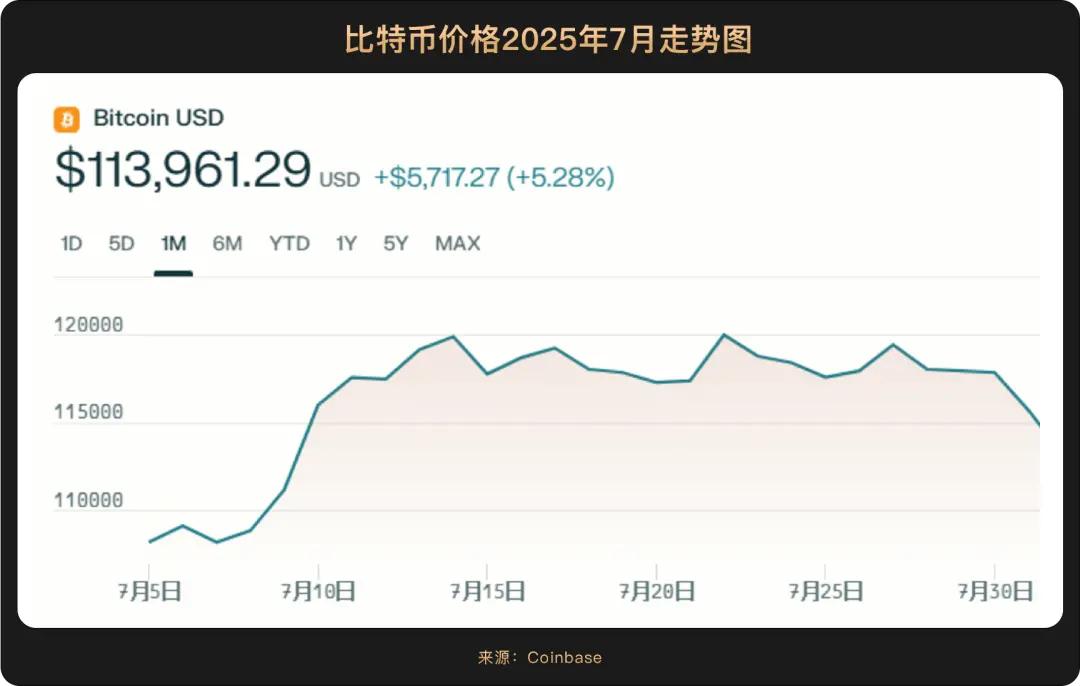

ThroughoutJuly, Bitcoin prices started a sharp upward trend from the beginning of the month, breaking through key resistance levels in the first half, showing an overall oscillating upward trend compared to the beginning of the year, with a cumulative increase of over 20%. The capital inflow also showed explosive growth, with institutional investors making large-scale positions through ETFs. As of July 2025, the total scale of US Bitcoin ETFs is around $110 billion, maintaining a rapid growth trend. Among them, BlackRock's iShares Bitcoin Trust ETF occupies nearly 48% of the market share, holding over 540,000 Bitcoins, with a market value of approximately $51.5 billion.

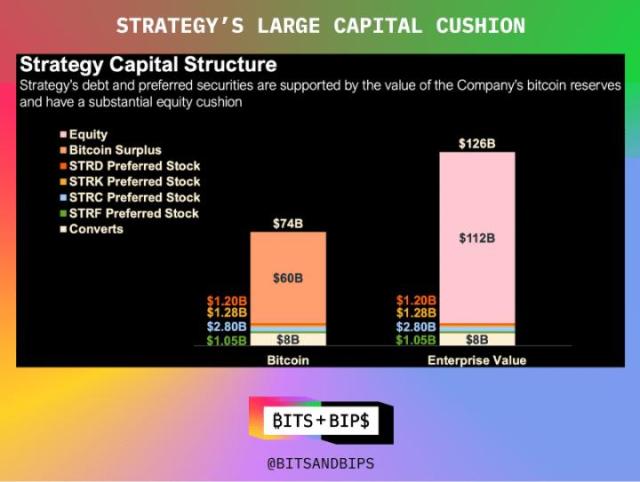

Institutional investors no longer view Bitcoin merely as a high-risk speculative asset, but have incorporated it into long-term asset allocation frameworks, initiating acorporate-level holding competition, driving the formation of a more complex "crypto-stock linkage" mechanism: Strategy (Nasdaq: MSTR), the absolute king of corporate Bitcoin holdings, continued to add spot Bitcoin positions in July without fear of high levels, disclosing in the latest 8-K filing that the company purchased Bitcoin worth $2.46 billion in the last week of July; the Japanese listed companyMetaplanetalso followed Strategy's lead, acquiring Bitcoin as a core strategic asset through a series of purchases, with Bitcoin reserves increased to 4,206, ranking among the top ten listed companies in global Bitcoin holdings, and planning to accumulate 21,000 Bitcoins by the end of 2026.

Notably,companies are no longer simply"buying and holding"Bitcoin, but havedeveloped reserve structures with mixed equity/debt/derivatives, such asMetaplanet's approach of issuing zero-coupon bonds → granting stock appreciation rights (SARs) → redeeming bonds with exercise funds at maturity, achieving zero-cost financing for Bitcoin accumulation,and the market isgiving a premium to these companies'financial engineering capabilities.

Looking at regulation, the US SEC has issued general listing standards for crypto asset ETPs, allowing assets with over 6 months of futures trading history to apply for ETFs, with the first batch of Altcoin ETFs expected to be approved in September-October 2025; the Stablecoin Genius Act is just a step away from presidential signature, and the "US Digital Asset Market Clarification Act" has begun its Senate process, clearing legal ambiguities for institutional participation. Hong Kong's Stablecoin Regulation came into effect on August 1, requiring 1:1 reserves, a 25 million HKD capital threshold, and transparent audits, with Chinese companies (such as JD.com) accelerating their layout. Evidently, the focus of this regulatory coordination is toclear regulatory obstacles for traditional capital entryand improve entry efficiency.

The crypto market in Q3 2025 is no longer solely driven by ETF funds, but has firmly stood at a new starting point of "institutional leadership + financial engineering + regulatory compliance" The era of price speculation driven by emotions is quietly fading, and a more mature, growth-resilient market ecosystem is unfolding through the resonance of rules and innovation.

Overall,although changes in interest rate reduction pace and AI commercialization expectationswillstill trigger periodic market fluctuations, systemic risks have significantly decreased, and anew digital economic cycle is accelerating, with the deep integration of crypto assets and the traditional financial system becoming irreversible.

Overall,although changes in interest rate reduction pace and AI commercialization expectationswillstill trigger periodic market fluctuations, systemic risks have significantly decreased, and anew digital economic cycle is accelerating, with the deep integration of crypto assets and the traditional financial system becoming irreversible.