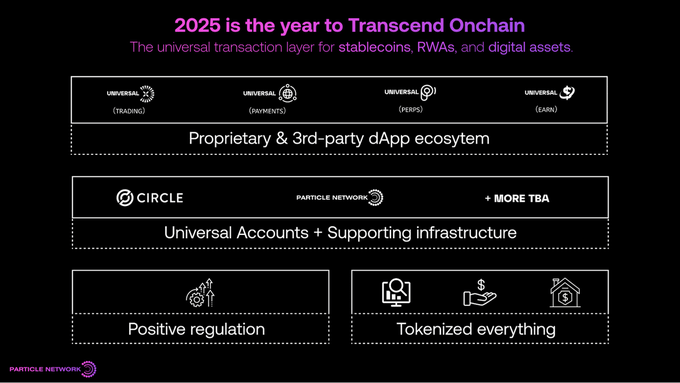

From chain abstraction full-stack infrastructure to launching an end-to-end comprehensive SDK for RWA and stablecoins, to be honest, such a rapid "track switching" happening at @ParticleNtwrk is not surprising, but there is a question more worth pondering: How can Particle grab the first bite before the trillion-level RWA market explosion? First, a doubt: Why does Particle shift from relatively mature chain abstraction infrastructure to RWA trading layer? The answer is actually not difficult to understand: infrastructure can only truly release value by finding rigid demand application scenarios. Previously mentioned, processing $670 million in transaction volume in 6 months, Particle's Universal Account multi-chain liquidity layer has been verified on UniversalX. But it's important to understand that the chain abstraction track is ultimately serving existing Crypto users, with very limited ceiling. The RWA track is completely different, a true "breaking circle" scenario that can bring traditional financial users into Web3. In this scenario, projects face a major pain point in onboarding users: how to simplify operational processes and enhance experience? It's worth knowing that this is Particle's accumulated experience advantage. Therefore, Particle did not just do RWA asset tokenization solution like other providers, but directly chose to build a universal RWA asset trading layer - users holding dollars can seamlessly trade tokenized assets worldwide, including US stocks, Hong Kong stocks, etc. Because, compared to projects building RWA platforms from scratch, Particle has ready-made and verified technology stack, with development efficiency and user experience leading by a notch. As for the series of changes in the US regulatory environment, I won't reiterate. Undoubtedly, RWA is moving from the gray area to compliant mainstream, with RWA market prospects and capacity being sufficiently tempting, so, here it comes, here it comes, here it comes! The question is, assuming stablecoin supply chain grows to $3.7 trillion by 2030, plus $30 trillion in RWA and $3.8 trillion in real estate tokenization market. How much market share can Particle capture? From product positioning, Particle is taking the "universal trading layer" route, similar to "Uniswap" in the RWA field. This positioning is smart, avoiding reinventing the wheel for specific asset tokenization, instead focusing on providing optimal trading infrastructure. $PARTI as the ecosystem's core Token, will capture value from on-chain and off-chain universal trading, with tokenomics design also being reasonable. However, competition in the RWA track will be exceptionally fierce. Traditional financial giants, crypto-native teams, and regulatory-friendly compliant platforms will all crowd in to grab this cake. Particle's advantage lies in Web3 native technology and user experience, but to truly establish a foothold in the trillion-dollar market, it depends on whether it can quickly expand its partner network and continue investing in regulatory compliance. But I think, ultimately, "the early bird catches the worm". Being able to complete layout before the RWA explosion with solid technical foundation and excellent market sensitivity is enough.

This article is machine translated

Show original

Particle Network

@ParticleNtwrk

08-04

TRANSCENDING ONCHAIN: ANNOUNCING THE UNIVERSAL LAYER FOR RWAS, STABLECOINS & DIGITAL ASSETS

The stage is set for Trillions of dollars to come into Web3.

Stablecoins may hit a $3.7T supply by 2030.

Onchain RWAs are projected to be worth $30T by 2034.

Tokenized real‑estate

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content