Author: Erik Lowe, Content Director at Pantera Capital; Translated by Jinse Finance

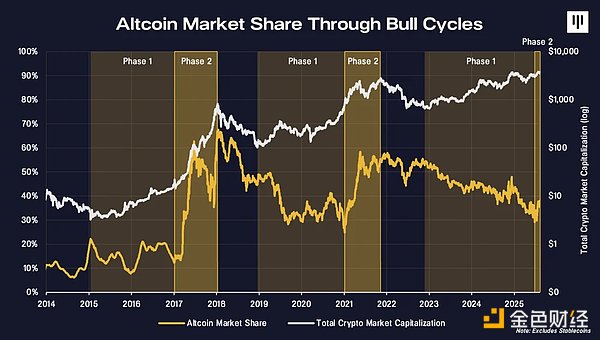

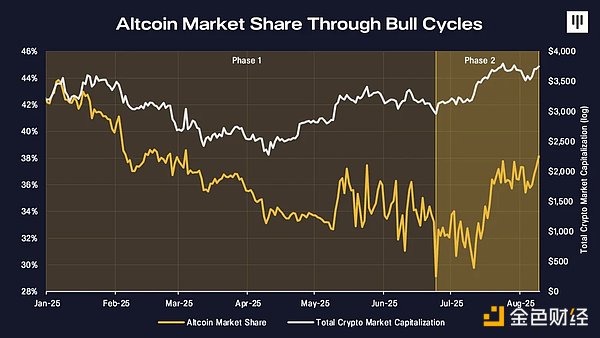

Bitcoin often leads the bull market cycle, with Altcoins lagging behind in the early stages. As the cycle progresses, Altcoins tend to gain momentum and outperform Bitcoin towards the end of the cycle. We call this the "first phase" and "second phase" of the bull market.

Importantly, in the past two cycles, Altcoins contributed most of the value creation. In the 2015-2018 cycle, Altcoins contributed 66% of the total cryptocurrency market cap growth. In the 2018-2021 cycle, Altcoins contributed 55%.

So far in this cycle, Altcoins have accounted for 35% of the overall market growth.

Historically, Bitcoin has benefited from regulatory clarity - not only in its commodity classification but also in its well-known role as "digital gold". This has been a key driver of Bitcoin's outperformance compared to Altcoins in the early stages of this cycle. Altcoins have traditionally faced greater regulatory uncertainty, which has only recently begun to change. Under the new US government's leadership, this landscape is shifting, with significant progress in driving digital asset innovation.

Historically, Bitcoin has benefited from regulatory clarity - not only in its commodity classification but also in its well-known role as "digital gold". This has been a key driver of Bitcoin's outperformance compared to Altcoins in the early stages of this cycle. Altcoins have traditionally faced greater regulatory uncertainty, which has only recently begun to change. Under the new US government's leadership, this landscape is shifting, with significant progress in driving digital asset innovation.

The historical favoritism towards Bitcoin's clarity and tailwinds is now beginning to extend to Altcoins. The market is starting to reflect this.

Momentum is building with continuous regulatory victories. Last month, President Trump signed the GENIUS Act, creating conditions for the flourishing of US-regulated stablecoins expected to become engines of global financial transactions. The CLARITY Act, passed by the House of Representatives, aims to establish clearer boundaries between digital commodities and securities, helping to address long-standing jurisdictional uncertainties between the US SEC and CFTC. A transformation is occurring, and we have reason to believe that non-Bitcoin tokens will be among the biggest beneficiaries.

Momentum is building with continuous regulatory victories. Last month, President Trump signed the GENIUS Act, creating conditions for the flourishing of US-regulated stablecoins expected to become engines of global financial transactions. The CLARITY Act, passed by the House of Representatives, aims to establish clearer boundaries between digital commodities and securities, helping to address long-standing jurisdictional uncertainties between the US SEC and CFTC. A transformation is occurring, and we have reason to believe that non-Bitcoin tokens will be among the biggest beneficiaries.

Innovation and development are accelerating, especially in the tokenization space. Robinhood recently launched stock tokens supported by Arbitrum, aimed at democratizing stock trading and creating more efficient markets. Major US banks like Bank of America, Morgan Stanley, and JPMorgan are exploring issuing their own stablecoins. BlackRock's BUIDL fund has accumulated $2.3 billion in tokenized government bonds. Figure has processed over $50 billion in blockchain-native RWA transactions. Beyond tokenized government bond funds, Ondo plans to list over 1,000 tokenized stocks on the NYSE and Nasdaq through Ondo Global Markets. On-chain migration is underway.

Innovation and development are accelerating, especially in the tokenization space. Robinhood recently launched stock tokens supported by Arbitrum, aimed at democratizing stock trading and creating more efficient markets. Major US banks like Bank of America, Morgan Stanley, and JPMorgan are exploring issuing their own stablecoins. BlackRock's BUIDL fund has accumulated $2.3 billion in tokenized government bonds. Figure has processed over $50 billion in blockchain-native RWA transactions. Beyond tokenized government bond funds, Ondo plans to list over 1,000 tokenized stocks on the NYSE and Nasdaq through Ondo Global Markets. On-chain migration is underway.

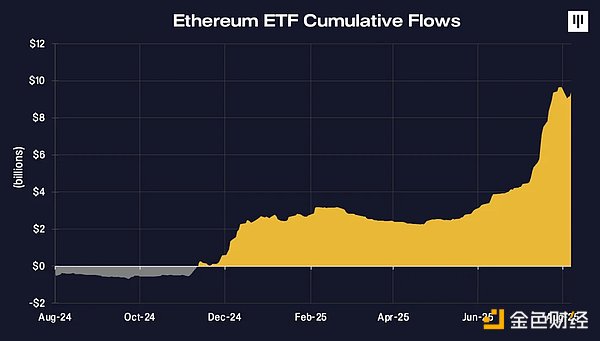

Ethereum Driving Non-Bitcoin Market Share Growth

Most real-world assets are flowing to Ethereum. In the $260 billion stablecoin market, 54% of stablecoins are issued on Ethereum. 73% of on-chain government bonds are on Ethereum. DAT is accumulating ETH at an unprecedented rate. Wall Street is gradually realizing this, and demand for ETH is skyrocketing.

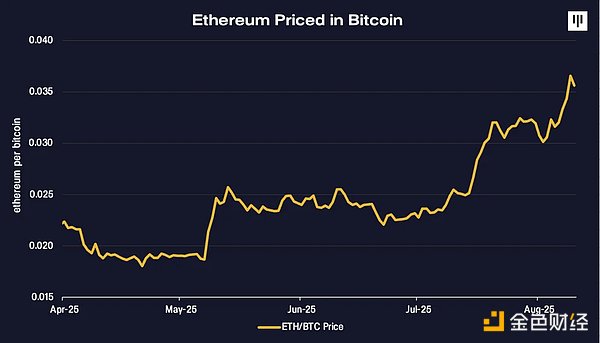

Ethereum's price in BTC terms has risen 103% since bottoming in April 2025.

Ethereum's price in BTC terms has risen 103% since bottoming in April 2025.