Author: Paul Veradittakit, Partner at Pantera Capital; Translated by: AIMan@Jinse Finance

The GENIUS Act is truly a genius move!

On May 19th, the U.S. Senate voted to initiate the procedure to end debate on the GENIUS Act. This procedural vote passed with 66 votes in favor and 32 against, with over 15 Democratic and Republican senators joining forces to surpass the 60-vote threshold needed to overcome prolonged debate. This prevents senators from blocking the bill through extended discussion. As a result, the Senate can now officially begin debating the GENIUS Act, with up to 30 hours of discussion. Afterward, the Senate must hold a final vote on the GENIUS Act. If the Senate approves the GENIUS Act, the bill will be submitted to the House of Representatives for further review.

As I mentioned in my previous article, the market capitalization of stablecoins has reached $230 billion, and Pantera Capital has been at the forefront of this trend, making early investments in Circle, Ethena, M^0, Ondo, and Figure Markets. Now, let's analyze the GENIUS Act and its significance.

Decoding the GENIUS Act

The GENIUS Act is an acronym for Establishing National Innovation for U.S. Stablecoins Act of 2025, the first comprehensive federal framework for regulating payment stablecoins in the United States. The bill was proposed by Republican Senator Bill Hagerty from Tennessee and co-sponsored by bipartisan lawmakers, aiming to clearly define stablecoins and their issuers.

In this act, payment stablecoins are digital assets designed for payment and settlement. Their issuers are obligated to exchange them for a fixed monetary value and maintain stability relative to that fixed amount. This definition covers two main characteristics of stablecoins: they must be pegged to a fixed amount and remain stable relative to that amount.

The most interesting part is the requirements for stablecoin issuers. Approved payment stablecoins must be subsidiaries of insured depository institutions, federally qualified non-bank payment stablecoin issuers, or state-qualified payment stablecoin issuers. Issuers with a market cap below $10 billion can also choose to be state-regulated. According to this definition, the privilege of issuing stablecoins is not limited to FDIC-insured banks. We believe that more institutional issuers and smaller state-level issuers will enter this space in the near future.

Payment stablecoin issuers should maintain reserves at a minimum 1:1 ratio. Reserves include U.S. dollars, demand deposits at insured depository institutions, insured stocks, Treasury bills with terms of 93 days or less, money market funds, and central bank reserve deposits. This section is extremely valuable as it precisely outlines which assets are eligible for stablecoin reserves. It's worth noting that all bonds and money market funds with terms less than 93 days have lower yields compared to other financial assets.

Consumer protection protocols have been established, such as monthly publication of reserve composition value and outstanding stablecoins on the issuer's website, to promote transparency and consumer trust in the sector.

Both U.S. political parties clearly support maintaining the dollar's global dominant currency status through stablecoins. The 66 senators supporting the bill believe that without a comprehensive legislative framework, the dollar would be threatened by foreign stablecoins. However, the main concern with this act or in the cryptocurrency space is the Trump family using crypto to evade regulation. The primary opponent, Democratic Senator Elizabeth Warren from Massachusetts, released a two-page report outlining how the bill "paves the way for Trump's crypto corruption; expands Tether's massive national security vulnerabilities; allows big tech companies to issue their own stablecoins; and fails to address several fundamental flaws".

Several Senate Democrats have proposed bills targeting Trump's crypto investments to prevent the president from profiting. Senator Michael Bennet plans to introduce the STABLE Act, which would prohibit elected officials or federal candidates from issuing or supporting digital assets.

JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and other major U.S. banks have announced plans to create a joint crypto stablecoin, and the industry views the GENIUS Act as a positive step towards regulatory certainty.

Looking Forward

Last year, we published a comprehensive paper on stablecoins. Combining recent developments, let's delve deeper into how we believe the GENIUS Act will transform the stablecoin landscape.

Stablecoins Will Become a Transfer Mechanism, Not a Store of Value

As mentioned in the previous section, we believe the low-yield characteristics of stablecoin reserves will encourage consumers to view stablecoins as a transfer mechanism rather than a store of value. In other words, why would I hold stablecoins for a 4% yield when I could get higher returns from stocks or cryptocurrencies? Therefore, consumers will frequently buy and sell stablecoins before and after transactions.

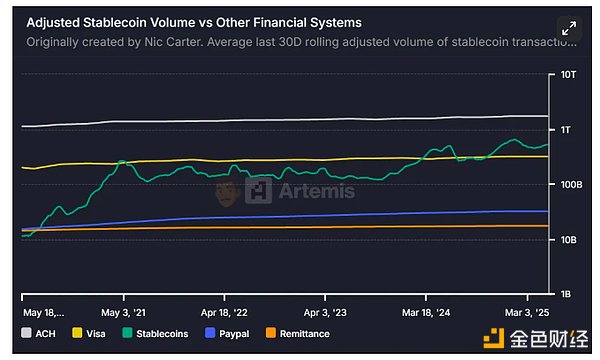

The GENIUS Act will reduce the number of fixed stablecoins while increasing liquid stablecoins. Once regulation is clear, we believe stablecoins will gradually eat into ACH payments and remittance methods, ultimately capturing a $1.8 trillion market.

Source: Artemis Analytics

M0 Has Unique Advantages to Ride the Wave of Increasing Issuers

Since the GENIUS Act opens the door for three different institutions to issue stablecoins, we believe the number of issuers in this space will significantly increase in the near future.

As early supporters of M0, we believe M0 will lead the wave of new stablecoin issuers. M0 democratizes the generation and management of programmable digital cash tools. Through M0, any of the three qualified issuers in the GENIUS Act can easily and quickly issue stablecoins compliant with the act.

Minting Compliant Stablecoins Using M0

The M0 protocol lowers the entry barrier for stablecoin issuers. Let's analyze the key participants in the M0 model and how it operates:

Minters: Minting institutions connected to the protocol to generate and manage $M (the stablecoin cornerstone on the M0 protocol). According to the GENIUS Act, minters can be subsidiaries of insured depository institutions, federally qualified non-bank payment stablecoin issuers, or state-qualified payment stablecoin issuers.

Verifiers: An independent entity responsible for timely providing information about off-chain collateral used for generating $M. Traditional verifiers are typically independent audit firms like KPMG or Deloitte.

Beneficiaries: A group of entities eligible to receive interest from the protocol. This allows the M0 platform to customize interest distribution.

After understanding the definitions of minters and verifiers, let's look at how to mint M0-compliant stablecoins:

Minters, verifiers, and beneficiaries must obtain governance permission. Governance permission is crucial because malicious minters could mint $M without sufficient backing, leading to $M value dilution.

Minters disclose their collateral proof to verifiers. According to the GENIUS Act, eligible collateral includes U.S. dollars, demand deposits at insured depository institutions, insured stocks, Treasury bills with terms of 93 days or less, money market funds, and central bank reserve deposits.

Verifiers will value the collateral and publish its value as on-chain collateral for the minter.

Minters can mint $M equal to the on-chain collateral amount. Since on-chain collateral is the upper limit of $M value that minters can mint, M0 guarantees that minted stablecoins have at least a 1:1 collateralization rate, ensuring the minted stablecoins are compliant.

If the minter wants to extract a certain amount of collateral from the protocol, the minter must first burn an equivalent amount of $M to maintain the 1:1 support of the remaining minted $M.

Expand Your Advantages with M0

There are many advantages to minting stablecoins on M0, including but not limited to:

Shared Liquidity: All stablecoins minted on M0 belong to a unified liquidity pool. If platform A mints "A coin" on M0 and platform B also mints "B coin", users can immediately exchange A coin for B coin at face value without price discovery. Both stablecoins can be used in DeFi applications, exchanges, or wallets that support M0.

Decentralized Issuance: M0 allows multiple independent institutions (called "minters") to issue stablecoins without relying on a single centralized company. This reduces single points of failure and increases system resilience. Given that large banks like JPMorgan and Citigroup have just announced plans to explore joint stablecoin issuance, such built-in features are particularly important today.

Collateral-Backed Support: Stablecoins on M0 must have 1:1 support, in compliance with the GENIUS Act

Rapid Deployment: M0 provides SDK and infrastructure, allowing builders to quickly launch new, feature-rich stablecoins without developing complex custody, compliance, or minting systems from scratch.

Cross-Chain Support: M0 operates on multiple blockchains (such as Ethereum and Solana) and supports cross-chain transfers, making stablecoins usable across various wallets, DeFi protocols, and payment networks.

Monetization: Builders and platforms can earn income shares from the underlying collateral (such as US Treasury bonds) by specifying income recipient groups at the protocol level, creating new revenue streams beyond simple transaction fees.

Pantera Capital has long been a supporter of the stablecoin industry and has made anchor investments in M0 and other stablecoins. We look forward to seeing more stablecoin innovation based on the regulatory certainty provided by the GENIUS Act.