Author | OKG Research

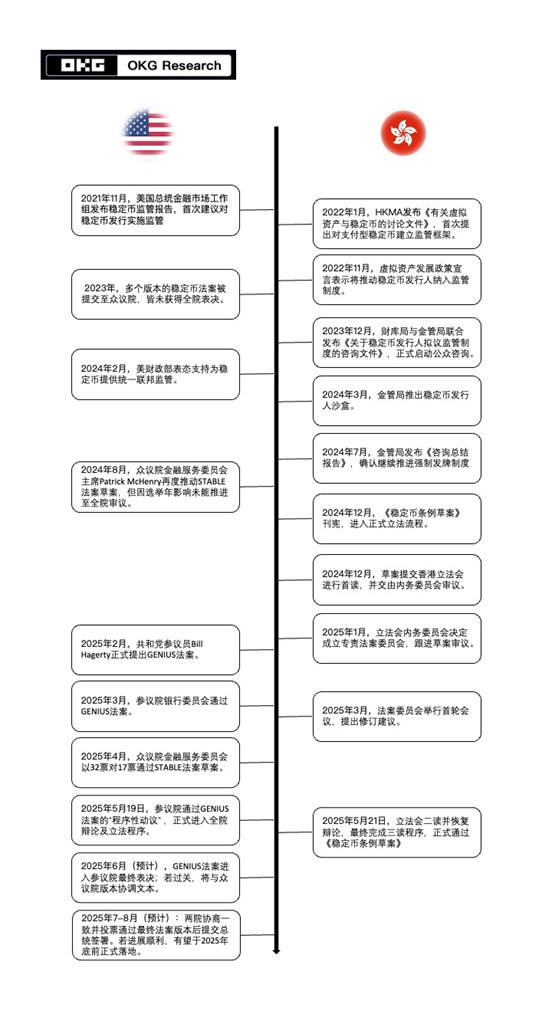

The U.S. Senate and Hong Kong Legislative Council almost simultaneously took key steps in stablecoin regulation this week: the former overwhelmingly passed a procedural motion for the GENIUS Act, clearing obstacles for the first federal stablecoin law in the United States; the latter passed the Stablecoin Ordinance through its third reading, making Hong Kong the first jurisdiction in the Asia-Pacific region to establish a stablecoin licensing system. The highly coincident legislative pace between East and West is not just a chance collision, but a contest for future financial discourse.

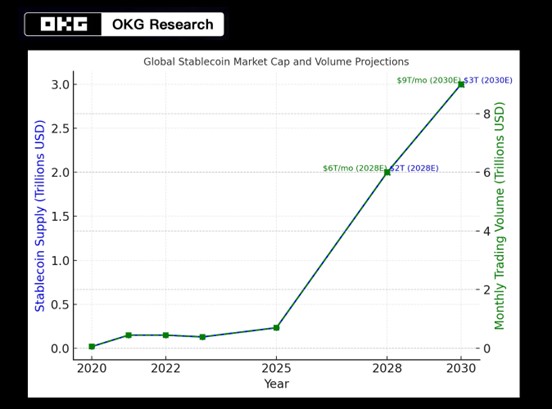

Stablecoin Annual Transaction Volume May Exceed $100 Trillion by 2030

According to OKG Research's incomplete statistics, the current global stablecoin market value is approaching $250 billion, growing over 22 times in the past 5 years; from the beginning of 2025 to now, on-chain transaction volume has exceeded $3.7 trillion, with an estimated annual total approaching $10 trillion. U.S. dollar stablecoins represented by USDT and USDC are widely used for trading and remittances in emerging markets, with volumes in some regions even surpassing traditional payment systems. Stablecoins have risen from marginal assets to key nodes in global payment networks and sovereign competition, and the near-simultaneous acceleration of legislation in the U.S. and Hong Kong means the global stablecoin market has entered a compliance acceleration period.

Based on this, OKG Research referenced Standard Chartered Bank's previous calculation model and combined current regulatory signal release rhythm and institutional fund attitudes, maintaining the current stablecoin turnover rate, calculated:

Under an optimistic scenario of gradually expanding global compliance frameworks and widespread adoption by institutions and individuals, global stablecoin market supply is expected to reach $3 trillion by 2030, with monthly on-chain transaction volumes of $9 trillion, and annual transaction totals potentially exceeding $100 trillion. This means stablecoins will not only be on par with traditional electronic payment systems but will also occupy a structural foundational position in global clearing networks. In terms of market value, stablecoins will become the "fourth category of basic monetary assets" after government bonds, cash, and bank deposits, becoming an important medium for digital payments and asset circulation.

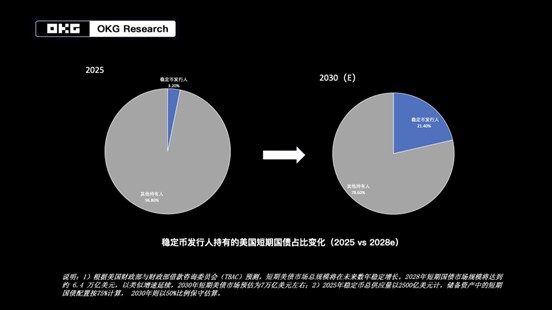

More notably, under this growth trend, the reserve structure of stablecoins will also generate feedback effects on the macroeconomic environment. OKG Research previously noted that the existing scale of stablecoins has absorbed approximately 3% of maturing short-term U.S. Treasury bonds, ranking 19th among overseas U.S. Treasury bond holders.

Considering the GENIUS Act explicitly requires 100% high-liquidity U.S. dollar assets as reserves, short-term Treasury bills are viewed as the primary choice (currently over 80% of USDT/USDC reserve assets are related to U.S. Treasury bonds). Estimating at a 50% allocation ratio, a $3 trillion market value would correspond to at least $1.5 trillion in short-term U.S. Treasury bond demand. This scale is close to the current overseas U.S. Treasury bond holdings of China or Japan, and stablecoins are poised to become the U.S. Treasury's "largest hidden creditor".

U.S. and Hong Kong Stablecoin Regulatory Frameworks: Consensus Amidst Differences

Although the U.S. and Hong Kong differ in legislative paths and some details, they have reached a high consensus on basic principles such as "fiat currency anchoring, full reserves, and licensed issuance".

[The rest of the translation follows the same professional and accurate approach, maintaining technical terms and preserving the original meaning.]