US President Donald Trump announced plans to impose a 50% tariff on all goods imported from the European Union starting June 1st. This announcement created some tension in the cryptocurrency market, and the previous upward momentum was adjusted.

The proposed tariffs came in response to what Trump described as ongoing trade imbalances and regulatory barriers. He accused the EU of maintaining unfair trade practices that harm US companies.

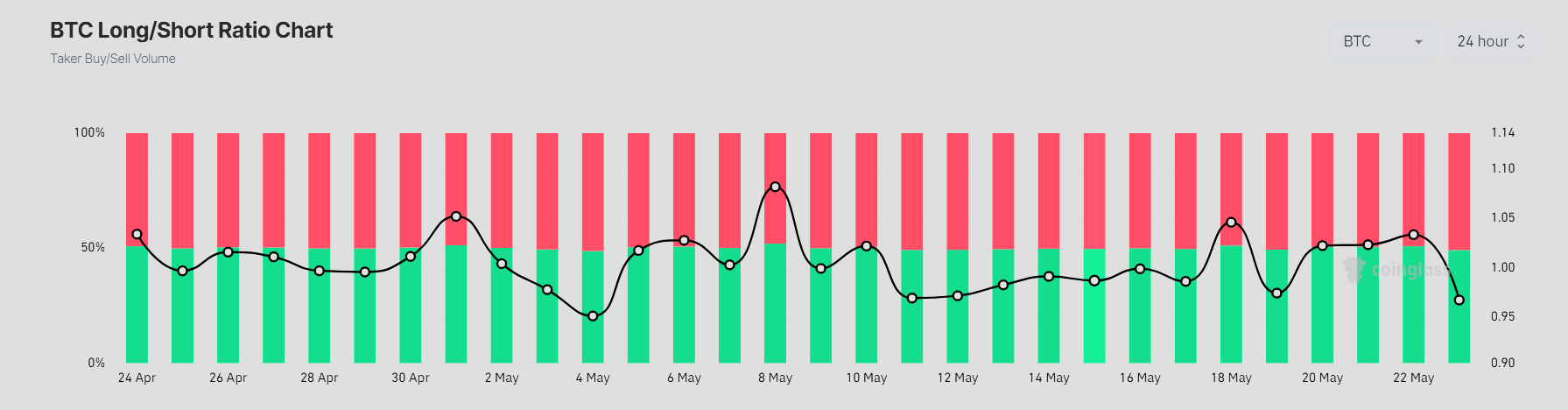

Longing-Short Ratio Shows Market Confusion

Bitcoin fell to $108,000 after the announcement, dropping from the session high of $111,000. It later recovered to around $109,000 but remains under pressure. The overall cryptocurrency market declined by 4% in the past 24 hours.

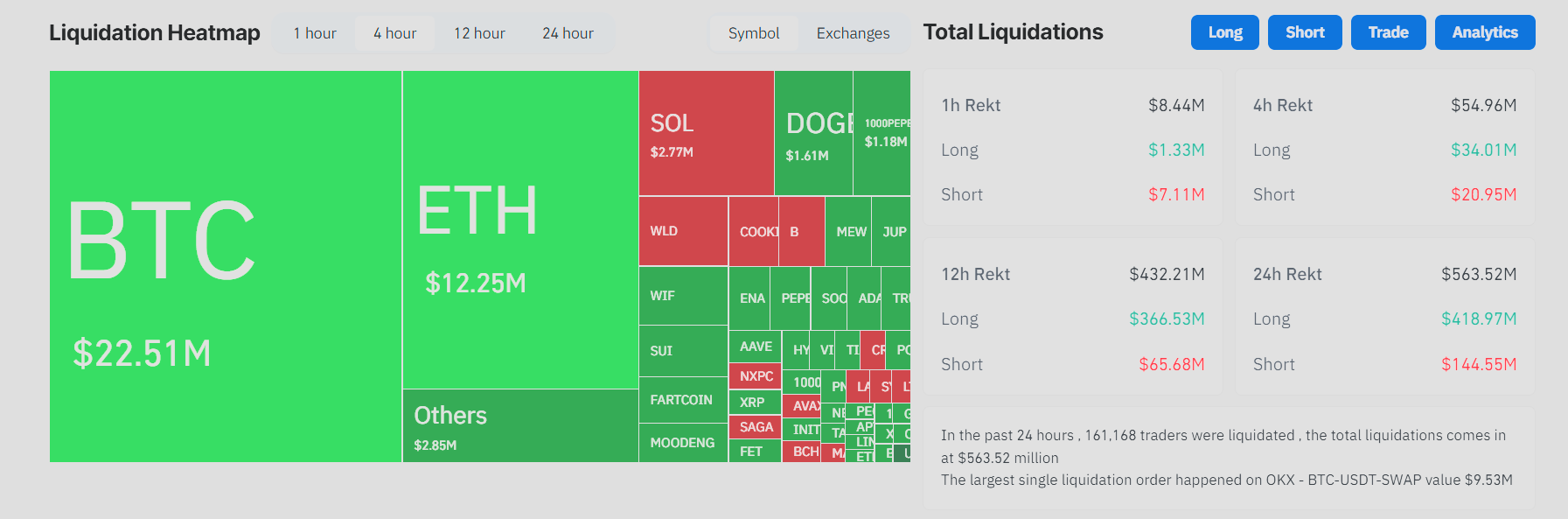

According to Coinglass data, $64.13 million in cryptocurrency liquidations occurred in the past 4 hours. Long positions accounted for $34.05 million, while short positions were $30.09 million.

Bitcoin alone saw $24.4 million in liquidations, with Ethereum at $15.16 million.

Meanwhile, Bitcoin's longing-short ratio remains almost identical, indicating short-term uncertainty about market direction. Yesterday, Bitcoin long positions dominated at 54%.

Solana, XRP, and several altcoins also experienced significant volatility, reflecting overall increased volatility.

Most altcoins saw larger losses in long positions, suggesting retail traders were surprised by the sudden policy change.

Increasing Macroeconomic Volatility Concerns

The US-China trade agreement earlier this month provided necessary vitality to the cryptocurrency market. This showed that macroeconomic uncertainties could be reflected in prices. However, Trump's EU threat raised new concerns.

Analysts warn that the tariff announcement could be the beginning of broader economic chaos. European stock indices plummeted, and US tech stocks also faced selling pressure.

The trade war is back:

— The Kobeissi Letter (@KobeissiLetter) May 23, 2025

After a brief pause, Trump just threatened 50% tariffs on the EU beginning June 1st and 25% tariffs on Apple.

In 5 days, the S&P 500 has erased -$1.5 trillion of market cap.

What's next? Here's why you NEED to watch the bond market.

(a thread) pic.twitter.com/8np3sevfA7

In cryptocurrencies, the liquidation heatmap reflects a market caught between fears of decline and attempts to rise.

The situation remains fluid. If the tariff threat escalates into a full trade dispute, risk assets, including cryptocurrencies, could face additional headwinds. Traders are carefully watching for the EU's response or signs of negotiation.

In the past 24 hours, 162,419 traders were liquidated, with total liquidations reaching $567.65 million. While cryptocurrencies have often served as a hedge during traditional market stress, today's movements show they are not immune to global policy shocks.

Volatility may continue as geopolitical uncertainties increase.