XRP has undergone nearly a 30% correction over the past 30 days. The price has been trading below $3 for almost a month. The Directional Movement Index (DMI) shows a strong downtrend, and the Average Directional Index (ADX) has risen above 35, indicating that the downtrend is strengthening.

However, if the SEC drops its lawsuit against XRP, a potential reversal could occur, triggering a rally towards key resistance levels.

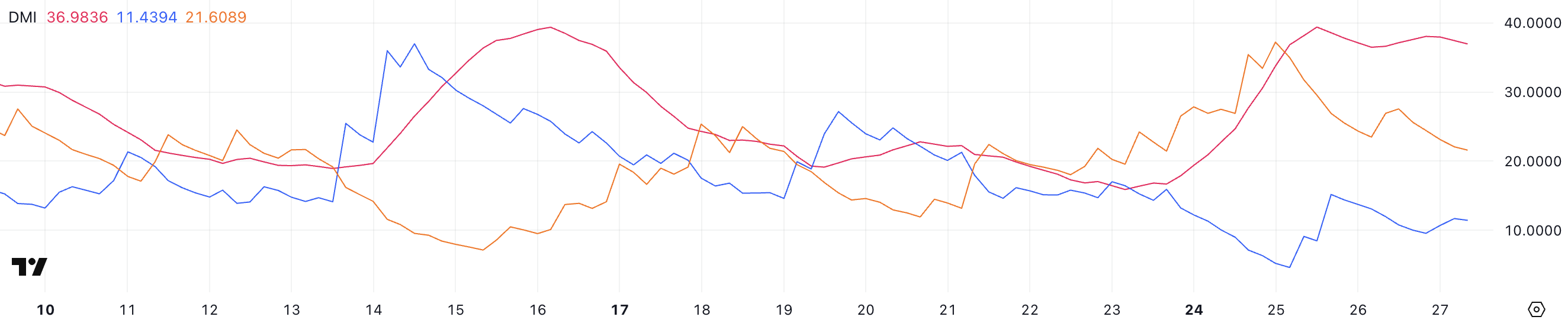

XRP DMI, Lack of Clear Directionality

According to the Directional Movement Index (DMI) of XRP, the Average Directional Index (ADX) currently stands at 36.98, a significant increase from 15.89 four days ago.

ADX measures the strength of a trend, but does not indicate the direction of the trend. Generally, an ADX value above 25 suggests a strong trend, while a value below 20 indicates a weak or non-trending market.

The sharp rise in XRP's ADX above 35 indicates that the current downtrend is strengthening.

The surge in ADX suggests that market participants are showing stronger conviction, and the likelihood of the existing trend continuing is higher.

Meanwhile, XRP's +DI (Positive Directional Indicator) has declined to 11.4 from 15.1 two days ago, indicating a weakening of bullish pressure. On the other hand, -DI (Negative Directional Indicator) has decreased from 37.2 on February 2 to 21.6, suggesting a reduction in bearish momentum.

Despite the decrease in bearish pressure, -DI remains above +DI, confirming that the downtrend is still in place. The widening gap between ADX and the directional indicators suggests that the downtrend is strong and persistent.

Until +DI crosses above -DI, XRP is likely to remain in a bearish phase.

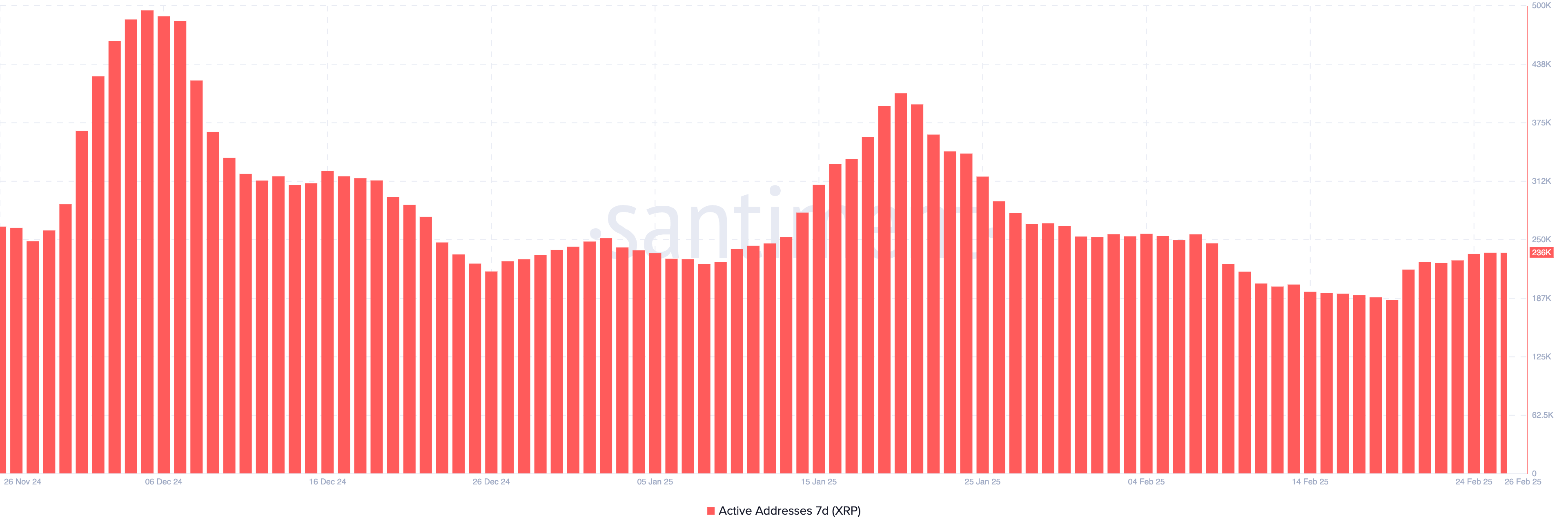

XRP Active Addresses, Recovering from 3-Month Low

The 7-day XRP active addresses declined from 407,000 on January 20 to around 186,000 on February 19, the lowest level since November 2024.

This metric is an important indicator of user engagement and network activity, reflecting the demand for XRP. A decrease suggests a decline in interest and bearish sentiment, while an increase indicates rising participation and potential buying pressure. A sharp decline implies a reduction in investor interest, contributing to the bearish outlook for XRP.

Recently, XRP active addresses have started to recover, reaching 236,000, a 26.8% increase from the previous week. This increase suggests that user activity and interest in the network are growing.

Historically, an increase in active addresses can precede a price recovery, as increased participation can lead to increased demand. If this trend continues, it could support a potential price rebound, but sustained growth is needed to confirm a bullish reversal.

XRP's Upside, Hinges on SEC and Ripple Lawsuit

XRP's EMA lines currently show a bearish configuration, with the short-term EMA below the long-term EMA. The price has been trading below $3 since February 1.

This alignment suggests that the short-term EMA is reflecting the recent bearish sentiment, indicating persistent downward momentum. If the downtrend continues, XRP could test two strong support levels at $2.15 and $2.06.

If these support levels are breached, XRP's price could drop to $1.77, which would be the first time it falls below $2 since November 2024.

However, a trend reversal could be possible, especially if the SEC drops its lawsuit against XRP in March. The SEC has recently dropped lawsuits against Gemini, Uniswap, Robinhood, and Coinbase, suggesting a shift in regulatory pressure.

If the lawsuit is dropped, XRP could test resistance levels at $2.36 and $2.52, triggering an upward rally. If these levels are breached, XRP could continue to rise to $2.71, potentially reversing the bearish outlook.