This article is machine translated

Show original

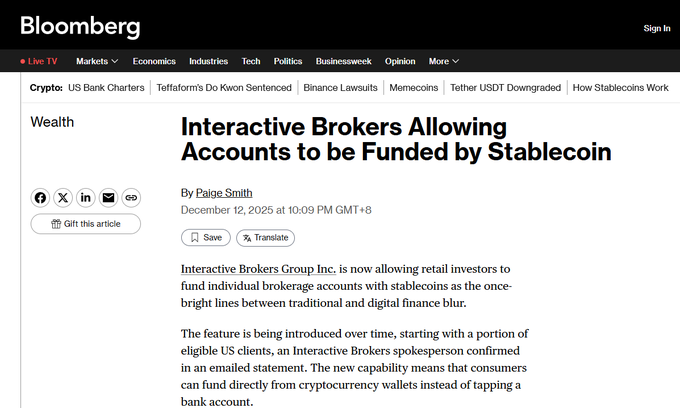

Interactive Brokers (IBKR) has supported USDC deposits ($USDC), further validating my point.

As one of the world's largest brokerages, what does IBKR's support for USDC deposits mean?

In a loose sense, IBKR could also be considered an L1 blockchain 😂.

Previous projects involving putting securities on-chain, and even securities trading chains, have somewhat lost their luster.

Since they're all data center blockchains anyway, instead of my money running on some unknown small chain, trading security tokens managed by some unknown market maker and held by some unknown brokerage, it's better to legitimately deposit USDC into IBKR and enjoy truly top-tier global liquidity and security.

Of course, this isn't a complete rejection of security tokens like RWA. After all, there's still DeFi on the chain, and some people can't open accounts with IBKR yet.

However, brokerages supporting stablecoin deposits is a major trend. The US is pushing it, Hong Kong is pushing it, and Singapore is hesitant (but I guess they'll follow suit once the US and Hong Kong have no problems).

Regarding brokerages specifically, while some people can't open an Interactive Brokers account, mainland Chinese citizens can still open accounts with many foreign brokerages, so this is only a matter of time.

---Separator--- Some other information: Interactive Brokers' stablecoin deposit gateways this time are Paxos and ZeroHash.

Depositing USDC results in USD being credited directly to the account. The gateway will take a 0.3% conversion fee (for reference: this is really low, much lower than the 1%-1.5% withdrawal fees common in our industry).

I originally used HashKey OTC, which had a fee of about 0.2%. This fee is slightly higher by 0.1%, but the pain is not noticeable. Moreover, traditional OTC withdrawals first go to the bank, then to the brokerage, but rapid in-and-out transactions can cause banks to be sensitive, so bypassing this step is quite good.

The monthly limit is $100,000, which is enough for retail investors. I wonder if there are any special channels for increasing the limit for large investors.

0xTodd

@0xTodd

12-03

戈多 @GodotSancho 这篇文章实在是切中要害的害中害了。

我私以为,未来全世界通用链只需要 5 条,而且其中 1 条是比特币。

其他链建议只做应用链,放弃做通用链。自己这条链*只跑自己旗下的 N 个应用*,别指望别人去你那发项目。小链搞 grant 除了有点面子没任何意义。

跨链的话,就用 wrap x.com/GodotSancho/st…

The example shows 0.03%, or 0.03%, but considering the issue of name duplication, it effectively eliminates all other industry channels. A 0.03% rate isn't enough to justify the lower rates; there are simply a bunch of lower-cost channels available.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content