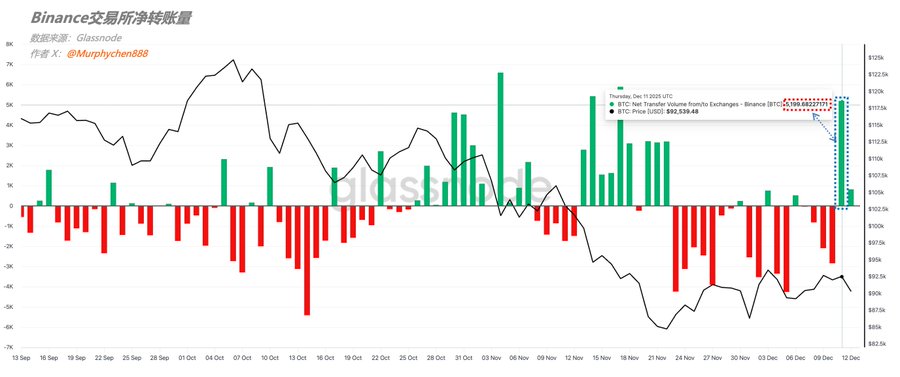

Let me break down my reasoning for going long here, mainly based on indicator signals: 1. There's a divergence between the trendline and price—when price approaches the midline, it's a decent spot to enter. 2. Momentum is showing a red oversold signal, which means price is seriously out of whack and likely needs to revert. 3. My price expectation indicator gives three levels: $91,066, $91,755, and $92,398. Also, yesterday I noticed Binance had a sudden net inflow of 5,200 BTC. That kind of move stands out, especially heading into the weekend and after three straight weeks of net outflows. So when my indicators flashed divergence around noon yesterday, I set up a short position as a preemptive play on this thesis. Then, during those two hourly candles from 11pm to 1am, Binance saw over 5k BTC dumped—almost the exact amount as the earlier inflow. Pretty suspicious, looks like someone was setting up ahead of time. Once those coins hit the market, volume dropped off and price went flat. All things considered, with BTC chopping back and forth on the hourly, I’m taking my shot at a quick trade. If I’m wrong, I’ll cut the loss—no bag holding here. --------------------------- Sponsored by @Bitget| Bitget VIP: Lower fees, bigger perks

This article is machine translated

Show original

Murphy

@Murphychen888

巧了不是,和小桂子一样,也窄止损赌一下,但我只喜欢大饼😂

上一个门没抓到,平多平早了。昨天的门抓到了,大晚上的,搞得我精神抖擞… x.com/guilin_chen_/s…

Sector:

Signal Square

Channel.SubscribedNum 52160

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content