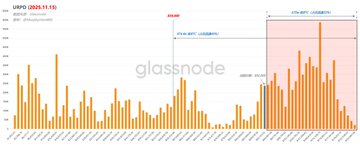

During the period from Nov 22 to Nov 23, BTC’s PSIP (Percent Supply in Profit) briefly dipped below the “boom-bust line” at 65%. This was a pretty dangerous signal, since even during the May 19, 2021 crash, BTC’s PSIP never fell below that threshold. It wasn’t until April 2022 that it finally broke down, marking the real entry into a deep bear market. That’s why, in our Nov 20 post, we highlighted the potential for a rebound once market sentiment is extremely compressed. Right now, PSIP has temporarily bounced back to 67.6%, but it’s still stuck in that tight 65%-70% “coin toss” zone. A move up could moderately restore confidence, while a move down could trigger more panic. (Figure 1) Here’s another interesting shift to share with you guys: Last time, we noticed that whenever PSIP < 50%, it marked a major bear market bottom (41% in Dec 2018, 47% in Dec 2022). Some followers asked me to back-calculate what BTC price would be required for PSIP to drop below 50% in this cycle. As I explained in the quoted thread, this is a dynamic value, depending on how coins change hands as prices fluctuate. But if we assume that low-price holders don’t sell, then the price would need to fall to $59,000 for PSIP to drop below 50%. But now, that price isn’t $59,000 anymore—it’s $62,000! In other words, as coins keep circulating, if we use PSIP = 50% as the “bear market bottom” pricing range, the next cycle’s bottom would be at least above $62,000. That means any BTC below $62,000 is extremely high value and high conviction (plenty of English-speaking analysts have pointed this out too). For me, this is just a rough expectation range. I’m not betting we’ll see that level in 2026, but I’ll factor it into my trading plan as a scenario to prepare for. No matter where the market goes or what the narrative is, all I need to do is wait patiently and execute my strategy with conviction. ---------------------------------------------- This post is sponsored by @Bitget| Bitget VIP: lower fees, bigger perks.

This article is machine translated

Show original

Murphy

@Murphychen888

11-20

PSIP(盈利供应百分比)也是一个用来观察市场乐观/恐慌程度的参考数据。上一次分析该数据时,我说当前PSIP的7日均值已低于70%,在过往周期里牛转熊的第一波下跌大致都会到这个位置,然后会出现一波情绪极端受压后的反弹。 x.com/Murphychen888/…

Sector:

Signal Square

Channel.SubscribedNum 52160

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content