Compiled by TechFlow

Guests: Christopher Perkins, Managing Partner and President of CoinFund; Brian Rudick, Chief Strategy Officer of Upexi

Moderators: Ram Ahluwalia, CFA, CEO and Founder, Lumida; Steve Ehrlich, Executive Editor, Unchained

Podcast source: Unchained

Original title: Bits + Bips: Think the DAT Trend Is Over? It May Have Only Just Begun

Air Date: September 5, 2025

Summary of key points

Are DATs the current trendy solution, or the next cryptocurrency cash machine?

In this episode, CoinFund's Chris Perkins and Upexi's Brian Rudick, along with Ram Ahluwalia and Steven Ehrlich, dive deep into why certain DATs (Digital Asset Treasuries) may be a better fit for certain investors than traditional ETFs (Exchange Traded Funds), explaining how the math behind the premiums supports a bullish view and what investment vehicles stand out.

This episode also discusses whether this is a breakout season for Altcoin or a false alarm, the significance of Galaxy launching tokenized stocks on Solana, and a key unlocking point proposed by Perkins that could completely change the market landscape.

Are DATs an alternative to traditional banks, or are they the best investment tool found in the cryptocurrency sector for traditional financial capital?

Summary of highlights

The current market fundamentals are very strong. A rebound in the crypto market is only a matter of time. November is expected to be a major turning point, and investors need to seize the opportunity and be prepared.

For DATs to truly work, five key elements are needed: first, the market must be ready for the development of DATs; second, the token has to have good fundamentals; third, you need excellent advisors and bankers who know what they are doing; fourth, you need a strong management team and excellent asset managers; and perhaps most importantly, you need a KOL who can transform this data into beautiful technological innovations.

The current advantage of DATs lies in their transparency and functionality. The goal of DATs is to allow investors to access not only the assets themselves, but also the potential returns of the assets, such as through DeFi and other innovative mechanisms.

Personally, I think Solana’s DATs have higher potential.

I am very bullish on altcoins, primarily based on the gradual easing of regulatory risks we are seeing. I am particularly bullish on tokens at the intersection of AI and crypto.

Many people still don’t fully believe in the value created by DATs . For me, the key is to help investors understand the value accumulation mechanisms of DATs, which have a compounding effect that ETFs cannot achieve.

Is the market headed for another September slump?

Steve Ehrlichn:

Ram, you can go first and give us a quick recap of the month and your thoughts on the current market conditions. September is typically a down month for Bitcoin and cryptocurrencies. Do you see any positive signs this time around?

Ram Ahluwalia:

In our last show, we mentioned the negative seasonality of Bitcoin. I believe it will be difficult for Bitcoin to break through the $125,000 mark , not only due to seasonality, but also for a number of other reasons. The recent discussion surrounding the passage of a stablecoin bill sparked market enthusiasm, but the market has since seemed to lack sustained momentum. Furthermore, I've noticed a weakening of animal spirits in the market, with recent weakness in high-volatility stocks favored by mainstream investors, a phenomenon typically seen during this period. So, overall, this year's situation is similar to last year and the year before.

Bitcoin's four-year halving cycle has also sparked some concern. Some investors who monitor this cycle believe Bitcoin could reach a cyclical peak in November of this year. Others believe the cycle is already over, but I personally disagree. I tend to be pessimistic when market sentiment is overly optimistic, and slightly more optimistic when it turns pessimistic. The market is currently experiencing a period of heightened uncertainty, which we will discuss in more detail later.

I'm also observing weakness in the debt market. Excess debt is accumulating and forming a bubble, something we've discussed for a long time. Investors need to be wary when Wall Street oversells certain financial products. I believe Bitcoin, Ethereum, and Solana remain leading asset classes, akin to mainstream brands in the market, like Bitcoin is "Coca-Cola" and Ethereum is "Pepsi." However, other crypto assets may not receive as much attention.

At the same time, some assets are trading below their true market value. Michael Saylor's MicroStrategy changed its rules for buying Bitcoin, which has somewhat impacted market confidence. While Bitcoin's core characteristic is immutability, the rule change has put market sentiment to the test.

The rule change was eventually withdrawn, but this did not have a positive impact on the market. The market is currently undergoing a series of tests, and future trends remain to be seen.

Why does the bullish case for DATs still hold?

Steve Ehrlichn:

I think this is the first time we've had a representative from a DAT on the show. Brian, Upexi was an early player in the Solana reserve narrative. Let's talk about the past few weeks and your observations.

Brian Rudick:

Not much has changed. We're focused on two things right now: First, we're working hard to raise our profile in the market and get more people to know us. When investors think, "I want to invest in Solana," we'll be the first to consider them. This morning, we announced that we'll be attending three traditional finance conferences later this month. I'd be disappointed if we didn't accelerate our presence over the next year. So, one of our core priorities is expanding our reach. There are other initiatives, of course, but this is one of them.

The second point is issuing stock. If we can issue stock at a premium to book value, it creates value for shareholders. For example, MicroStrategy once sold stock at twice its book value. Although the stock price has declined slightly, this is equivalent to selling one dollar of assets for two dollars, or buying Bitcoin at half the price. This approach has enabled MicroStrategy to create value for shareholders over the past six quarters, equivalent to $26 billion in free Bitcoin. This model is worth learning from and emulating.

We are actively exploring how to achieve breakthroughs in this area. We currently have an equity financing plan in the works, and we are also exploring various potential market opportunities. This isn't a secret financing exercise; it's an open business model. Therefore, we are doing our utmost to achieve this goal.

Christopher Perkins:

I think Ram's view is a bit overly pessimistic. From a broader perspective, this summer can be considered the summer of DATs. 2021 was the summer of DeFi, and DATs debuted there and established themselves as a core innovation. Many DATs benefited from the gradual liberalization of regulatory policies. We are now seeing the effects of these regulatory unlockings. While there are indeed bubbles in the market, I believe, as Brian mentioned, that DATs will become an essential part of the market structure of the crypto ecosystem.

The innovations in DATs are significant, both publicly available and supported by foundation labs. Not all of these projects will succeed, as achieving these goals is incredibly difficult, but we are very active in this area.

For DATs to truly work, five key elements are needed: First, the market must be ready for them to develop, and prolonged market closures can undermine the importance of timing. Second, the token must have strong fundamentals. As we move away from Bitcoin and toward yield-generating assets, the potential of DATs becomes even more compelling. Through staking and re-staking, tokens can achieve a natural alignment with the underlying value. Third, you need excellent advisors and bankers who know what they are doing. Fourth, you need a strong management team and excellent asset managers who understand how to manage these underlying assets and drive returns. Perhaps most importantly, you need a KOL – someone who can tell the story and translate this data into beautiful technological innovation. I believe they are here to stay.

While the market may be undergoing a shakeout, the ultimate winners will be very special projects. We are very excited about this and believe that we are still in the early stages of the development of DATs, and there are many exciting projects in the pipeline.

Steve Ehrlichn:

Brian, there was an interesting trend when DATs first emerged. After Michael Saylor, the earliest companies chose to focus on Solana over Ethereum. For example, your company, Sol Strategies, and Defi Development Corp. Now, financial firms in the Ethereum ecosystem are raising billions of dollars, and Solana seems to have become something of an Ethereum "follower."

What do you think about this shift? When raising funds, do investors ask about the differences between Solana and Ethereum? What tough questions do they raise, and what are your responses?

Brian Rudick:

That's a good question. Frankly, understanding of these issues in traditional finance is still limited. The most common question is, "What's the difference between Bitcoin and Solana?" Not even "What's the difference between Ethereum and Solana?" So we're past that stage.

Of course, there are also some investors who are more familiar with cryptocurrencies or digital assets. They will ask more in-depth questions, but they will not ask technical questions like "When will Solana implement multiple concurrent leaders?"

I believe many people still aren't fully convinced of the value created by DATs. For me, the key lies in convincing investors to understand the value-accrual mechanisms of DATs, which have a compounding effect. For example, by issuing equity at a premium to book value, this can be achieved in a variety of ways, including ATMs, equity financing lines, and even the issuance of convertible notes. These notes have longer maturities and higher volatility in the underlying assets, so most pricing models indicate a greater than 90% probability of converting them into equity. This mechanism allows DATs to sell equity at a significant premium to the current market price.

Furthermore, when we invest in pre-mined or proof-of-stake tokens, we can also earn returns through staking. For example, we can earn over 8% returns by staking Upexi tokens, transforming our fiscal assets into productive assets. We also purchase locked tokens at a 15% discount, which effectively doubles our staking returns. We employ a buy-and-hold strategy and don't plan to sell any Sol, so this approach works well for us.

These value accumulation mechanisms are not achievable with native tokens or ETFs. The power of these models lies in their foundational importance in designing the right tokens and mechanisms, and educating investors is key to understanding the potential and advantages of these models.

Why does Brian think “DATs are banks”?

Ram Ahluwalia:

Brian, could you elaborate on your initial point? You said, "Banks operate like DATs, with FDIC insurance, the ability to remortgage, and the advantage of speed." What's your point?

Brian Rudick:

Yes, this is a simplified analogy. Banks primarily profit from interest rate spreads. They raise funds from depositors and then lend them to borrowers, earning the difference between the loan proceeds and the deposit costs. Similarly, DATs profit from interest rate spreads. Investors typically discount a bank's future interest rate spreads and include them in its asset value. As a result, bank stocks often trade at a premium to their book value. While banks typically don't issue shares frequently, some, such as MNT, have historically issued shares at a premium to finance expansion and acquisitions.

Ram Ahluwalia:

To be more precise, I'd say DATs are more like BDCs (Business Development Companies), similar to publicly traded private credit funds. They earn interest margins by making loans, while also using leverage to amplify returns. The operating model of DATs does bear some resemblance to this structure.

Brian Rudick:

That's right. Our DATs raise funds from the capital markets and invest them in Solana. Our goal is to achieve a return on Solana investments that exceeds our cost of capital, generating a positive carry. If the market believes Solana's returns can consistently exceed our cost of capital over the next few years, this carry will be discounted by investors and included in the Net Asset Value (NAV), bringing the NAV above 1. In this way, we can create real value for shareholders.

Christopher Perkins:

This kind of education is incredibly important, as we're seeing many traditional investors starting to look at Solana and explore its potential as a yield-generating asset. This kind of education not only helps investors understand how DATs work, but also helps the entire crypto ecosystem grow. I believe this is one of the ecosystem's greatest strengths right now.

Brian Rudick:

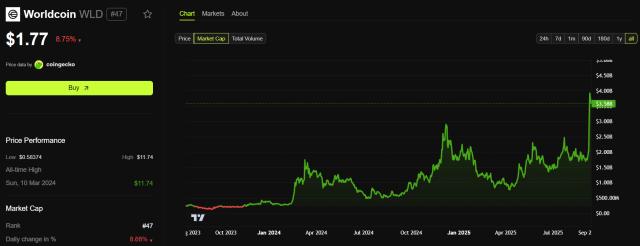

When we first started, many questioned whether DATs were merely a short-term arbitrage opportunity, and even worried that they posed a threat to the token ecosystem, potentially leading to forced sell-offs during market volatility. However, Ethereum's success later changed people's minds. For example, Tom Lee's almost daily promotion of Ethereum on CNBC helped drive its price from $2,700 to $4,700. Now, many other token ecosystems are actively promoting DATs as a tool to raise market awareness, particularly among traditional investors.

Ram Ahluwalia:

There are a ton of DATs on the market right now. I imagine if you asked someone on Twitter, "Can you list eight DAT tickers?" no one would be able to answer. Sure, Chris and Brian could probably, but for the average investor, it's like remembering eight children's names. MicroStrategy is an exception, having spent years building brand recognition. But in the crypto market, investor attention spans are limited, and you need to stand out from the crowd. This isn't just a competition for product; it's a competition for attention. Brian and Chris, you're focused on building a value creation machine, a fundraising machine, and a staking yield packaging machine, but the market's attentional resources are ultimately limited, and this presents a challenge for everyone involved.

Steve Ehrlichn:

Brian, what do you think about this "attention game"? For example, Tom Lee and Bitmine's MNAV (Net Market Asset Value) is now 1.1 and has been declining. What do you think of this situation?

Brian Rudick:

I don't follow other token ecosystems specifically, but I think the Bitcoin market is saturated. By comparison, some company stocks have NAVs between 0.7 and 0.8. I don't think Ethereum's market is completely saturated yet, but it's definitely a competition. Companies like MicroStrategy typically sell their shares when the NAV reaches 1.6 or 1.7, not when it's close to 1x.

I understand why other ecosystems choose to sell shares when NAV is close to 1. They want to be the largest player in the market because the largest player has the most trading volume and can also issue more shares.

Personally, I believe Solana's DATs have higher potential . They offer the highest staking returns in the market, while also offering discounted purchases of locked tokens, generating additional returns for shareholders. Therefore, Solana's DATs justify trading at a higher MNAV than other token ecosystems. So far, this strategy has been successful. However, we still need to increase market awareness and address some of the criticism and attacks directed at Solana. These factors may impact MNAV performance, but currently, our MNAV is 1.7.

Are DATs a better option for investors than ETFs?

Ram Ahluwalia:

Chris, what are your thoughts? For investors, is it better to hold spot assets directly or invest in DATs? Taking Ethereum as an example, the mechanisms of some DATs lead to forced buying, a form of cumulative buying. When DATs issue shares, there's a certain dilution effect, which can lead to selling pressure. This investment approach isn't simply buying; rather, the mechanism forces investors to purchase certain assets.

Christopher Perkins:

This is a question worth exploring. Currently, DATs are still in their early stages of development. For example, last week we submitted a letter to the SEC and FASB regarding the classification of LSTs (liquid staking tokens) as intangible assets in accounting. The industry still has much room for improvement.

Many DAT projects are just now starting to work. I see some companies in our portfolio, like Ethereum, benefiting from these mechanisms. For example, ETHZilla is doing some work in the Ethereum ecosystem, where DAT development is still in its early stages.

Taking Ethereum as an example, the mechanics of ETFs are more complex. Investors can choose to invest in ETFs or directly purchase spot assets. However, for many traditional investors, direct exposure to spot assets is unavailable, as it's outside their investment mandate. Therefore, they often turn to ETFs. However, ETFs present a key problem: they don't generate returns. Due to daily liquidity constraints on ETFs, such as the 13-day unlock window, investors cannot directly stake through ETFs. While total return products may emerge in the future, currently, ETFs are not designed to provide the returns investors require. This makes ETFs a relatively inferior product, especially for long-term investors, for whom returns are paramount.

In contrast, DATs offer similar convenience to ETFs. Investors can easily purchase DATs through their brokerage accounts while still receiving the returns of the underlying assets. This makes DATs a superior investment tool, particularly for traditional investors who lack direct access to spot assets.

Of course, a more transparent total return product may emerge in the future, but for now, the strength of DATs lies in their transparency and functionality. The goal of DATs is to give investors access not only to the asset itself, but also to the underlying returns, such as through DeFi and other innovative mechanisms. This design not only makes an investment case but also provides a packaging format that investors are familiar with and empowered to use.

Furthermore, DATs open up investment opportunities across the entire U.S. equity capital market. Investors can integrate DATs into their prime brokerage accounts, gain leverage, and even use them as collateral. This makes DATs more similar to traditional stock investments.

Of course, Ram, the bubble issue you mentioned is real. I mentioned before that all the key elements of DAT need to come together for it to succeed, and it's a very complex process. It sounds like Brian has found some solutions, but this is the current situation.

The Mathematical Logic Behind Premiums

Brian Rudick:

I would like to add that I believe the market has yet to fully appreciate the powerful potential of DATs, particularly the value that can be gained through compounding of net asset values (NAV) over time.

Let me illustrate this with a simple mathematical example. Let's say I launch a DAT to invest in Solana, while similar projects in the market are trading at a 5x market cap multiple. I raise $100 from Steve Ehrlich and issue 100 shares, each worth $1. At this point, Steve Ehrlich owns 100% of the company, and my DAT holds $100 in funds.

Next, I invested my $100 in Solana. Since Solana has a 5x market cap multiple, my investment instantly grew to $500. At this point, my company's total market cap also became $500, and Steve Ehrlich's 100 shares of stock were worth $5 each.

Then, I raise another $100. This time, because my stock is trading at $5, I only need to issue 20 shares to raise this amount. This additional offering gives me another $100, which I invest in Solana. Solana's market capitalization increases by another $500, bringing my company's total market capitalization to $1,000.

Although Steve Ehrlich's ownership stake was diluted to 85%, the value of his holdings increased from $500 to $850. This is the logic behind value-added issuance. By leveraging market cap multiples and premiums, we can continuously compound NAV, thereby achieving continuous growth in shareholder value.

Furthermore, I believe smaller DATs often enjoy a built-in growth premium. For example, if we issue $100 million in stock at a 2x multiple, that's very beneficial for us. For a larger company like MicroStrategy, the same offering would have a much smaller market impact. Therefore, smaller DATs often have greater growth potential.

Meanwhile, DATs supporting smaller tokens also have greater upside potential. For example, Solana's market capitalization is only 4% of Bitcoin's. In comparison, Bitcoin, already the world's fifth-largest asset, is unlikely to quintuple in value in the short term, while Solana's growth potential is far greater. Furthermore, Solana's DAT can generate additional returns for shareholders through staking and discounted purchases of locked tokens.

For these reasons, I believe other DATs should trade at a premium to MicroStrategy once market conditions stabilize. But this is just my perspective on multiples and growth potential.

Christopher Perkins:

If DATs can combine fundamentals with the meme effect of the market, they may even lead to a larger market reaction. In fact, we have witnessed this phenomenon in both the cryptocurrency and stock markets. This is a point worth paying attention to.

Ram Ahluwalia:

Indeed. Making an asset a meme is an important goal, but not all assets can achieve it. The nature of memes is that they're like a "only one survives" game. For example, Palantir and Tesla were memes, but you can't make every asset a meme. That's my opinion.

I have another question for you. As an investor, do you prefer a high market cap to NAV ratio or a low market cap to NAV ratio? I'm guessing you'd prefer a high market cap to NAV ratio because that way you can accumulate more underlying cash through additional share issuance.

Interestingly, however, investors may have greater value potential when the market capitalization to NAV ratio is low. This reflexive nature complicates investment strategies. I believe this strategy only works when the DAT is experiencing momentum. Once momentum disappears, investors are best to exit the market. Furthermore, if the market capitalization falls below the NAV, you may become an acquisition target; while if the market capitalization to NAV ratio is too high, additional issuance may cause the asset price to fall. This is a very complex game theory.

Brian Rudick:

I think it all depends on the future trajectory of MNAV (Net Asset Value). If one DAT is trading at 2x and another at 5x, and I think their multiples will converge, I'll choose the cheaper one. If I think the multiples will remain constant, I'll choose the one trading at 5x because its issuance will be more accretive.

Ultimately, it all comes down to a risk-reward trade-off . For example, Solana's strategy reached a MNAV of 15x last December, when market conditions were different and options were more limited. This suggests the potential for MNAV to reach highs. When DATs trade at higher MNAVs, they create greater opportunities for shareholder appreciation. Conversely, if NAV falls below 1x, or if Solana declines 50%, there could be significant downside risk. Therefore, I believe DATs offer a highly asymmetric risk-reward balance, which is why I'm willing to bet on them.

Is it time for counterfeiting to explode?

Steve Ehrlich:

A chart recently circulated on Twitter shows Bitcoin's market share at approximately 58%. During the peak of the pandemic, this percentage dipped below 40%. While history won't necessarily repeat itself, this suggests a potential market rotation away from Bitcoin and toward Altcoin. Brian, this could be an opportunity for investors. Chris and Ram, what are your thoughts on the current Altcoin cycle? What are your goals for the coming months?

Christopher Perkins:

I'm very bullish on altcoins, and this optimism is primarily based on the gradual easing of regulatory risks we're seeing. Even in the absence of clarity, like yesterday's announcement by the CFTC and SEC to collaborate on allowing spot token listings, this clarity regarding Altcoin as commodities will be a significant unlocking opportunity. Let me give you some insider information: a key area I'm watching is the listing of Altcoin futures in the US market. When futures start listing for these tokens, you'll know they're commodities because the SEC hasn't blocked them during the approval process. This unlocks basis trading, where people buy spot and sell futures, causing the spot price to rise. It also unlocks ETFs, as ETFs rely on the futures market for oversight. So, a key area worth watching is the listing of Altcoin futures in the US market. This is the missing link for many institutional buyers.

We're already seeing some initial futures, like with Solana, but as regulatory certainty increases, I think we'll see more of this. My conversations with regulators have been very positive, and that will be a huge boost. Furthermore, I think we're gradually focusing on the fundamentals of projects . There are good projects, bad projects, and even terrible projects. I also think the education process is crucial, like explaining what Solana is to investors. With deeper understanding, investors will see that these tokens are different and unique. I'm particularly bullish on tokens at the intersection of AI and crypto , where their utility makes sense to me. Therefore, I'm very optimistic and believe the Altcoin market still has a long way to go.

Brian Rudick:

My perspective is similar to Ram's. Short-term risks are increasing, such as national debt concerns, persistent inflation, tariff uncertainty, and overvalued assets. However, we have been dealing with these issues for some time. Therefore, I believe Altcoin prices will be impacted by policy risks in the short term. However, in the long term, I am very bullish on the Altcoin market.

I've always believed that the biggest issue hindering the development of cryptocurrencies is the lack of clear rules and regulation. I believe we may address this issue with the passage of the Clarity Act next year. Typically, large tech companies and financial institutions are reluctant to enter the crypto space due to the potential increased legal and regulatory risks. But once regulatory clarity is achieved, they will be compelled to enter en masse. These companies have billions of customers, built-in trust, billions of dollars in capital, and top-tier developers. This could be as simple as Google Chrome adding a crypto wallet or Amazon accepting stablecoins as payments. This presents us with the potential for large-scale user adoption. As a result, I believe we could be poised for one of the biggest booms in the Altcoin market in the medium to long term.

Christopher Perkins:

That's a good point. You have inflows into the stablecoin market, as well as first-time buyers of structural assets like 401Ks. This is very powerful. While there will always be macro noise, these trends are worth watching.

Ram Ahluwalia:

I'm optimistic about the macroeconomy. For example, falling interest rates are positive news, as is the fiscal deficit, and the upcoming income tax cuts—all positive factors. While there are some frictions regarding tariffs, the market has begun to price them in, with retailers importing from China performing well, for example. Therefore, I remain optimistic about the macroeconomy. I agree that timing is important. Furthermore, Chris's point about the DeFi boom following the stablecoin boom is spot-on. I think the theory makes a lot of sense.

Ethereum's spot market is performing strongly. Momentum is key for digital assets, and momentum reflects market attention. If attention follows a power law distribution, then the question is simple: What has momentum? What has attention? What benefits from regulatory clarity? What is heavily short and transitioning from non-consensus to momentum? The answer is Ethereum. If you look at the Ethereum chart, you wouldn't guess that market sentiment is depressed. In fact, the market is performing well. Overall, I'm very bullish on the DeFi thesis that Chris mentioned. For example, Aave, a leading DeFi protocol on Ethereum, is performing very well.

What is the direction of the macroeconomy and what are the key points that investors need to pay attention to?

Steve Ehrlich:

Ram, I'd like to ask you a question about the macroeconomic outlook. While I generally know your answer, I'd still like to get your perspective. Given the turmoil at the Federal Reserve and Trump's attempts to fire at least one official, is this likely to have an impact on the market? Obviously, this may have to wait for the Supreme Court to decide.

Ram Ahluwalia:

In the long term, the primary drivers of asset prices include earnings growth, interest rates and their dynamics, and inflation levels and their dynamics. These factors indirectly impact the market through their influence on policy. In the short term, however, asset prices are more influenced by market positioning and news flow. For example, if news about an official appointment negatively impacts market sentiment in the short term, it will be quickly priced in, and the market will move on. Simply put, every investor makes decisions based on the available context.

Currently, the market fundamentals are very strong. Corporate earnings were exceptionally strong in the past quarter. Furthermore, the economy is being buoyed by additional stimulus measures, such as interest rate cuts. While I personally disagree with these policies, from a market perspective, they are positive. My optimistic outlook on the market has led me to include small-cap stocks, interest-rate-sensitive stocks, as well as homebuilders and consumer staples. These sectors are all supported by strong consumer demand. While there are some divergences in the economy, the overall trend is positive.

The situation on the consumer side is also noteworthy. While lending pressures persist, high-income groups (the top third of earners) drive the majority of consumer spending, accounting for approximately two-thirds of total consumption. Performance varies across sectors, with travel and leisure and airlines performing well. Banks are seeing increased lending activity, with the gradual deregulation of regulations supporting credit expansion. Competition among private lenders is also intensifying. I recently spoke with a bank that operates as a private equity fund, but due to its FDIC (Federal Deposit Insurance Corporation) protection, they are beginning to decline some transactions due to the high availability of credit in the market.

Of course, excess credit may pose risks at some point in the future, but for now, the situation remains positive. Default risk has not increased significantly, and credit expansion has actually further fueled the economic cycle. There are currently no external pressures to prevent this trend from continuing.

Why is Galaxy launching tokenized shares on Solana significant?

Steve Ehrlich:

Why don't we talk about tokenization? There was some big news this morning, and we were discussing Galaxy on Telegram. I think they didn't tokenize some shares, but instead issued shares directly on the Solana blockchain, working with Super State.

Christopher Perkins:

Fast forward to today. This is a big deal because we've been discussing the tokenization of risk-weighted assets (RWAs). As a banker, I have a strong aversion to RWAs because they're a collection of different risk-weighted assets, which makes me anxious. So, the way it used to work was that the asset was put into a box, a token was issued to represent that asset, and then it was released into the ecosystem. But this is different because it's regulated. We're not locking up shares in a custodial account at a New York bank and then issuing a token on that representation. This is regulated. It's a regulated digital asset; we actually hold the shares, and it's the only representation of that share. When you put it on a blockchain and use Super State as a transfer agent, it's regulated. When you talk to people like SEC Chairman Atkins, he says, we need to make IPOs great again. We need to make capital markets great again. We need to make them more accessible. And what could be more accessible than a public blockchain? This was issued on Solana. Well done! Solana has been trying to position itself as the decentralized Nasdaq, and this is a major step forward for the team and the ecosystem. So now you have these assets, and while they're not perfect, it's a good first step and I would say an improvement over what we've seen in the past.

I'm also very excited about the tokenization of private equity, but it's not some special purpose vehicle (SPV) where you get a portion of the SPV. It's actual stock, tokenized equity.

Right now, you can't trade them on automated market makers (AMMs). There's a regulatory issue here called the National Market System (NMS). Simply put, it means that stocks need to be routed to the best price on an exchange. If you have a traditional system, they don't communicate well with each other. So, I think the SEC will address some of the challenges of what we call the NMS. But you can transfer stocks peer-to-peer between people who have gone through the right onboarding process. This is the beginning of opening up the global internet to buy assets like stocks.

Ram Ahluwalia:

I'm really excited about capital formation, and we need more of it. Registration and listing costs on public markets are too high. The activities companies like Securitize are doing on-chain, through regulated ATSs and the like, are simply trying to blend traditional finance with permissionless networks. This isn't working. So, this is a good direction to move in.

I think Galaxy's move is primarily symbolic. You can trade 24/7. That's the primary unlock, but the tokenism means there's more to come. It's funny, I took my family to the beach this weekend, and as usual on vacation, I was thinking about different things. I tweeted about tokenizing stocks on-chain. Then I saw the Galaxy news, which means no idea is original. A hundred people around the world have the same idea at the same time, and then it's execution. So I have no doubt we'll see more of this happening. I think it's primarily symbolic. What I really want to see is a way to launch a permissionless market that unlocks opportunities for participants.

There's also some really interesting things happening, like Credit Coup. I don't know if you've been following them, Chris. They're funding Rain Card, a credit card that allows crypto-native users to spend, using an on-chain digital asset wallet. You can fund on-chain, deposit, and earn a 14% yield. It's amazing. It's an on-chain bank. You can deposit on-chain, earn a 14% coupon, fully collateralized by T+2 ongoing risk. You get liquidity in two days. It's a dislocated, short-term, high-yield asset. It's all permissioned, but it's a step in the right direction.

The same is true for Galaxy. Paul Atkins specifically mentioned tokenization and the rise of super apps, and Michelle Bowman also talked about tokenization. As a result, regulators are starting to signal to the market that they will not intervene if things are legal and compliant. So we're heading in that direction now. You've seen 200 fintech companies apply for OCC charters, and dozens more will be approved in the coming months. So, I think Galaxy is very symbolic, but there's more to it than that. We need more permissionless frameworks to unlock the next phase.

Steve Ehrlich:

I want to explore this further because you raise an important point. Chris, you mentioned that Solana is clearly a permissioned chain, but Superstate is also very permissioned. I've been following tokenization for a long time, as I'm sure you all know. I can't tell you how many pilots there are, and I know this isn't a pilot, but there are about tokenizing some kind of credit instrument or something like that. There might be a huge nine- or ten-figure revenue stream, but no secondary market, no liquidity, because these things are static. I'm curious what the process of breaking down that barrier is like. Perhaps we need a lot of companies to agree to issue on Superstate, or a variant of it, or something else, all at the same time.

Christopher Perkins:

So what did we just do with stablecoins, right? How are stablecoins different from this? Stablecoins are locked up, but the issuer is responsible for KYC and AML. Then someone receives them, and based on that individual's activities, you know, if you send securities to North Korea, you're going to get in trouble because it's based on behavior and activity, right? That's the stablecoin model. Yes, they have freezes and customs, but it doesn't really work because of the delays.

But I think when you step back and look at what we're seeing right now, this goes back to what Brian is doing. We're normalizing equity into tokens. We're turning tokens into equity on DAs, so when will we normalize and issue your debt on-chain?

Brian Rudick:

Two thoughts. First, I completely agree with everything you've said about tokenization. It seems to me that finance is built on outdated infrastructure. Stablecoins are essentially tokenized dollars. They run on ECH, which was created 50 years ago. Even fintech is this front-end wrapper. If I send you $10 via Venmo, it uses ECH on the back end. So, blockchain and tokenization reimagine the infrastructure itself.

The second important thing is that finance is full of intermediaries. That's why DeFi is so important. So, this can help us eliminate all these unnecessary intermediaries because, given the development of technology, we really don't need them.

We've already announced our intention to tokenize Upexi equity through Superstate. If it helps, there are two main reasons for choosing to partner with them. First, as you mentioned, issuing shares directly on-chain enables global access, rather than a wrapper that distributes liquidity across different wrappers, not limited to a specific US market. Second, holders receive the same legal and regulatory rights as traditional equity.

So that's a big reason. The second reason is that we're very focused on compliance, legal, and regulatory risk. Superstate is doing everything the right way. They're meticulous about every detail, and they're an SEC-registered transfer agent. They're working with the SEC through programs like Project Open to gain regulatory clarity. When you tokenize equity through Superstate, it strictly adheres to securities laws. So, they have these allowlists that determine who can actually access your tokenized equity, and who has completed KYC. So, we're very comfortable working with them to ultimately put Upexi equity on-chain.

Steve Ehrlich:

I understand your point about regulation and so on, but I'm waiting for companies, especially large ones, to put everything on-chain, effectively forcing anyone who wants to own shares to participate in the on-chain market. Imagine if Tesla decided to go completely on-chain. I imagine how many of us own Tesla shares, even indirectly through ETFs, would be forced to participate. So, Brian, we're waiting for your big announcement, the delisting from Nasdaq and the move to a fully on-chain platform.

What are the key market unlocking points for counterfeit goods?

Christopher Perkins:

I believe we're entering a golden age of convergence, a significant moment for the entire crypto industry. Institutional investors are gradually entering the market, but the main obstacle currently is the lack of listed cryptocurrency futures in the US. These futures are crucial for addressing market liquidity issues and driving industry development. I believe this is an area to watch closely in the coming weeks.

Steve Ehrlich:

There are already futures available for Bitcoin, Ethereum, Solana, and XRP. What other assets do you think are worth watching?

Christopher Perkins:

All crypto assets beyond these four require futures support. A mature futures market will unlock further capabilities, such as promoting the development of ETFs, supporting basis trading, and further solidifying crypto assets as commodities. These are key steps in market maturity. However, the US market currently faces significant gaps in this area, primarily due to the SEC blocking exchanges' listing applications. However, I believe this window is gradually opening, and it is an urgent issue that the industry needs to address.

Steve Ehrlich:

Ram, what do you think about the current market situation?

Ram Ahluwalia:

I've been watching some traditional stock market performance lately, such as American Eagle's earnings report. Its stock price rose 24% after the market closed, suggesting a gradual recovery among undervalued retailers. I believe this trend will continue. The mortgage refinancing sector is also worth watching, as companies like Better Mortgage still have potential.

As for digital assets, I believe a market rebound is only a matter of time. We may need to wait a few more weeks, and market volatility will remain, but I expect November to be a major turning point. Investors need to seize the opportunity and be prepared.

Brian Rudick:

I'd like to add a point about the long-term value of the token market. I believe that in the long term, there are only three to five tokens that will truly create value, and behind each token, there are probably only three companies that can generate consistent returns for shareholders through compounding net asset value (NAV).

Historically, 95% of tokens experience a 95% price drop within five years. The most critical factor in a token's success is the underlying performance. Therefore, while the token market may offer good returns for short-term traders, long-term winners like Microstrategy are few and far between.

Steve Ehrlich:

My perspective is slightly different. I believe investors need to be more cautious in the current market environment, especially given the uncertainty surrounding the Federal Reserve's policy. However, I've also seen some interesting developments. For example, last night I rewatched an episode of "The Office" that featured a discussion about currency. The character Dwight mentioned that the very nature of money has become blurred since the US went off the gold standard in 1971. This perspective reflects the current market's redefinition of value.