Author: Thejaswini, Source: Token Dispatch, Translated by: Shaw Jinse Finance

In 1979, Republic National Bank offered several options. Deposit $1,475 for 3.5 years and receive a 17-inch color TV at the end of the term. Or deposit the same amount for 5.5 years and receive a 25-inch TV. Looking for an even better deal? Deposit $950 for 5.5 years and receive a sound system with built-in disco lights.

During the Great Depression, banking regulations prevented banks from offering competitive interest rates, which is how banks competed for deposits. Regulation Q of the Banking Act of 1933 prohibited banks from paying interest on demand deposits and capped interest rates on savings accounts. While money market funds offered higher yields, banks were left with giveaways of toasters and televisions, unable to provide real returns.

The banking industry calls money market fund investors "smart money" and their own depositors "dumb money," arguing they don't know they can get higher returns elsewhere.

Wall Street has embraced the term, using it to describe investors who always seem to buy high, sell low, chase trends, and make emotional decisions.

Fifty years later, it is the “dumb money” that has the last laugh.

The concept of "dumb money" is deeply ingrained in Wall Street psychology. Professional investors, hedge fund managers, and institutional traders have built their entire identities around the role of "smart money"—those who can see through the market noise and make rational decisions, while retail investors blindly follow the crowd in panic.

This argument works well when retail investors actually act in this way. During the dot-com bubble, day traders mortgaged their homes to buy tech stocks at their peak. During the 2008 financial crisis, retail investors fled the market at its bottom and missed the entire recovery cycle.

The pattern is that professional investors buy low and sell high, while retail investors do the opposite. Academic research confirms these biases, and professional fund managers point to these patterns as evidence of their superior skills and justification for the fees they charge.

What has changed? Access, education, and tools.

The new reality of retail investing

Today's data is quite different. In April 2025, President Trump announced tariffs, triggering a $6 trillion stock market plunge in two trading days. Professional investors sold off their stocks, while retail investors saw this as a bargain buy the dips opportunity.

Individual investors snapped up stocks at a record pace throughout the market turmoil, buying a net $50 billion in U.S. stocks and earning about 15% gains. During that period, Bank of America's retail clients bought stocks for 22 consecutive weeks, the bank's longest buying streak since 2008.

Meanwhile, hedge funds and systematic trading strategies had equity exposure in the lowest 12% range, missing out on the entire rally.

The same pattern played out during market volatility in 2024. Retail investors drove gains in major markets in late April, with individual investors controlling 36% of the market between April 28 and 29, a record high, according to JPMorgan Chase & Co.

Robinhood's Steve Quirk summed up the shift: "Every IPO is oversubscribed. Demand always outstrips supply. Issuers like that and want people who support their companies to get allocated shares."

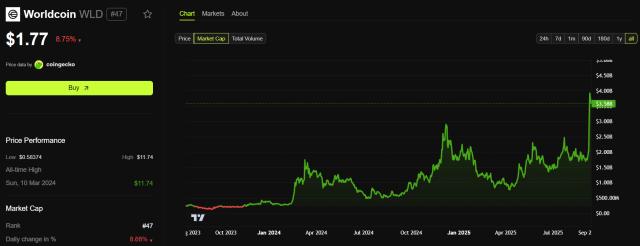

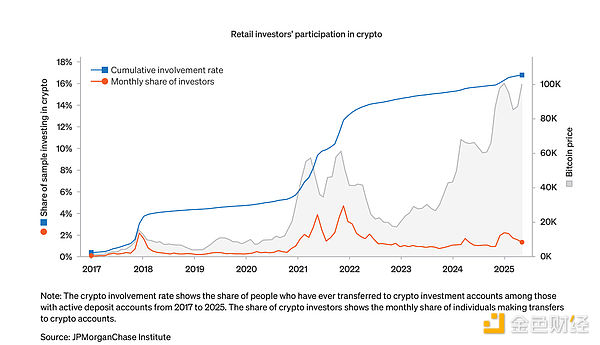

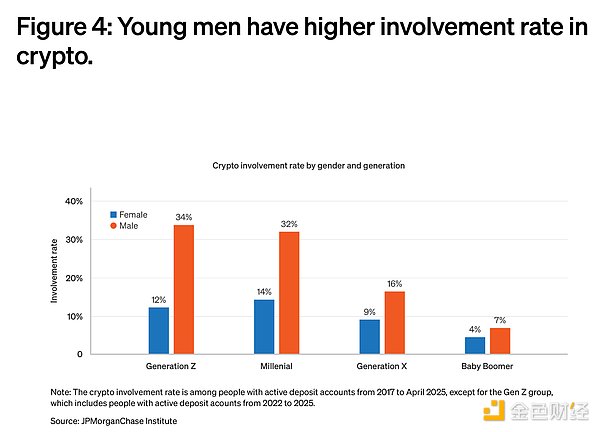

In the cryptocurrency sector, retail investor behavior has evolved from a typical "buy high, sell low" pattern to savvy market timing. JPMorgan Chase data shows that between 2017 and May 2025, 17% of active checking account holders transferred funds into cryptocurrency accounts, with participation surging during strategic moments rather than peak sentiment. The data shows that retail investors are increasingly exhibiting "buy the dip" behavior, with significant rallies in March and November 2024 coinciding with Bitcoin's all-time highs. However, notably, when Bitcoin reached a higher peak in May 2025, retail investor participation remained cautious rather than enthusiastic. This suggests that retail investors are learning and exercising restraint, rather than the fear of missing out (FOMO) traditionally associated with retail cryptocurrency investors. Median cryptocurrency investments remain modest, indicating prudent risk management rather than excessive speculation.

Industries like gambling, sports betting, and meme coins demonstrate that there is still a “constant supply of dumb money.” However, the data suggests otherwise.

Gambling and sports betting platforms do generate billions of dollars in transactions, with the online gambling market valued at $78.66 billion in 2024 and projected to reach $153.57 billion by 2030.

In the cryptocurrency world, meme coins often trigger speculative frenzy, leaving latecomers holding worthless tokens.

Yet, even within these so-called "dumb money" sectors, behavior is becoming increasingly sophisticated. Despite generating $750 million in revenue by creating a meme coin, Pump.fun saw its market share plummet from 88% to 12% when competitors offered better communication and transparency. Rather than blindly clinging to incumbent platforms, retail users are turning to those that offer a better value proposition.

The meme coin phenomenon isn’t so much about retail investor folly as it is about retail investors rejecting venture-backed token offerings that deny fair access. As one cryptocurrency analyst put it, “Meme coins give token holders a sense of belonging and foster connections based on shared values and culture”—they are both social and financial, not just speculative.

IPO Revolution

The growing influence of retail investors is most evident in the initial public offering (IPO) market, where companies are moving away from their traditional model of catering only to institutional investors and high-net-worth individuals.

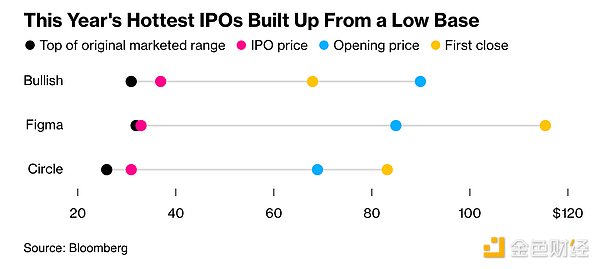

Bullish represented a watershed moment in the way companies conduct IPOs. Founded by Block.one and backed by major investors including Peter Thiel's Founders Fund, Bullish operates as both a cryptocurrency exchange and an institutional trading platform. The cryptocurrency company raised $1.1 billion in its IPO, allowing retail investors to participate directly through platforms like Robinhood and SoFi. Strong retail demand led to Bullish pricing its IPO at $37 per share, nearly 20% above the initial offering price. Its stock price soared 143% on its first day of trading.

Bullish sold a fifth of its shares to individual investors, valued at about $220 million, about four times what industry veterans consider normal. Moomoo’s clients alone placed orders worth more than $225 million.

This isn't an isolated incident. The Winklevoss brothers' Gemini explicitly allocated 10% of its funds to retail investors. Figure Technology and Via Transportation both used retail platforms for their IPOs.

This shift reflects a fundamental change in how companies view retail investors. As Jefferies’ Becky Steinthal explains:

“Issuers can choose to allow retail investors to take a larger share of the IPO process than they have in the past. This is all driven by technology.”

Robinhood data shows that demand for IPOs on its platform in 2024 is five times higher than in 2023. The platform currently has a policy prohibiting the reselling of stocks within 30 days of an IPO, which creates more stable buy-and-hold behavior that benefits both companies and long-term shareholders.

This shift is reflected not only in individual investment decisions but also in changes in market structure. Retail investors now account for about 19.5% of U.S. stock trading volume, up from 17% a year ago and well above the pre-pandemic level of about 10%.

More importantly, there has been a fundamental shift in retail investor behavior. By 2024, only 5% of Vanguard 401k investors had adjusted their portfolios. Target-date funds now hold over $4 trillion.

This means investors are placing more trust in systematic, professionally managed investment plans rather than frequent buying and selling. This shift helps avoid costly trading mistakes driven by emotion, leading to better retirement planning.

eToro's data shows that by 2024, 74% of its users were profitable, with premium members achieving a profit rate of 80%. This performance contradicts the basic assumption that retail investors continue to lose money compared to professional fund managers.

Demographics support this shift. Younger investors are entering the market earlier—the average age of Gen Z investors is 19, compared to 32 for Gen X and 35 for baby boomers. They have access to educational resources that previous generations lacked: podcasts, newsletters, social media influencers, and commission-free trading platforms.

The growing sophistication of retail investors is best exemplified by the rise in cryptocurrency adoption. While news about institutional investments in Bitcoin ETFs and corporate treasuries dominates the headlines, actual cryptocurrency usage is primarily driven by retail investors.

According to Chainalysis, India leads global cryptocurrency adoption, followed by the United States and Pakistan. These rankings reflect grassroots usage across centralized and decentralized services, rather than institutional accumulation.

In 2024, the stablecoin market was dominated by retail payments and remittances, with USDT alone processing over $1 trillion in monthly transactions. USDC's monthly trading volume ranged from $1.24 trillion to $3.29 trillion. These are not institutional flows. They represent millions of independent transactions for individual payments, savings, and cross-border transfers.

When we break down cryptocurrency adoption by World Bank income brackets, adoption peaks simultaneously among high-income, upper-middle-income, and lower-middle-income groups. This suggests that the current wave of cryptocurrency adoption is widespread, rather than concentrated among affluent early adopters.

Bitcoin remains the primary fiat currency on-ramp, with over $4.6 trillion purchased through exchanges between July 2024 and June 2025. However, retail investors are becoming increasingly sophisticated in diversifying their investment allocations, with Layer 1 protocol tokens, stablecoins, and Altcoin all receiving significant inflows.

The irony of the "smart money" versus "dumb money" debate can be best seen by examining the recent behavior of institutional investors: Professional investors consistently misjudge major market trends, while retail investors demonstrate discipline and patience.

During the institutional adoption phase of cryptocurrency, hedge funds and family offices made headlines for adding Bitcoin to their portfolios near cycle peaks, while retail investors accumulated Bitcoin during bear markets and held onto it during periods of market volatility.

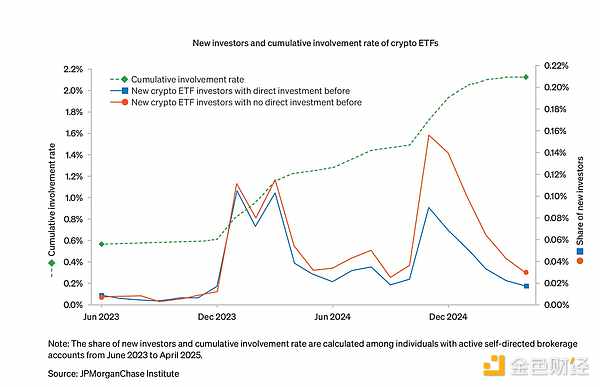

The rise of cryptocurrency ETFs perfectly illustrates this point. Over half of cryptocurrency ETF investors have never directly held cryptocurrency, suggesting that traditional channels are expanding rather than cannibalizing the investor base. Among ETF holders, the median portfolio allocation remains around 3%-5%, suggesting a prudent risk management strategy rather than excessive speculation.

Professional investors' recent behavior mirrors the typical mistakes they have long criticized ordinary investors for. When markets are volatile, institutional investors tend to flee to protect quarterly performance targets, while retail investors buy the dip to hold on for the long term.

Technology is the great equalizer

This shift in retail investor behavior is no accident. Technology has democratized access to information, tools, and markets that were previously available only to professionals.

Robinhood's innovations extend far beyond zero-commission trading. They've launched tokenized US stocks and ETFs for European users, enabled staking for Ethereum and Solana in the US, and are building a copy trading platform that allows retail users to follow verified top traders.

Coinbase has expanded its consumer cryptocurrency offerings with improvements to its mobile wallet, prediction markets, and a streamlined staking process. Stripe, Mastercard, and Visa have all launched stablecoin payment features, allowing cryptocurrency purchases at thousands of retailers.

Wall Street’s recognition of retail investors’ influence creates a feedback loop that further empowers individual investors. When firms like Bullish find success with their retail-focused IPO strategies, others tend to follow suit.

Jefferies' research identifies stocks with high retail trading volumes and low institutional investor interest as potential investment opportunities, including Reddit, SoFi Technologies, Tesla, and Palantir. The study suggests that "when retail investors account for a larger portion of trading, quality in traditional metrics becomes less important"—but this may reflect different evaluation criteria among retail investors rather than their poor decision-making ability.

The cryptocurrency industry's evolution toward mass accessibility exemplifies this dynamic. Major platforms now compete on user experience, not just institutional relationships. Features like convenient perpetual trading, tokenized stocks, and integrated payments are all aimed at engaging the average investor.

The “dumb money” narrative persists in part because it serves the economic interests of professional investors. Fund managers justify high fees by claiming superior skills. Investment banks maintain pricing power by restricting access to lucrative trades.

Data suggests these advantages are eroding. Retail investors are increasingly displaying the discipline, patience, and market-timing acumen that professionals tout. Meanwhile, institutional investors are often exhibiting the emotional, trend-following behavior they long attributed to retail investors.

This doesn't mean every retail investor makes optimal decisions. Speculation, abuse of leverage, and trend chasing are still prevalent. The difference is that these behaviors are no longer unique to "retail investors"—they exist among all types of investors.

This shift has structural implications. As retail investors gain more influence in IPOs, they are likely to demand better terms, greater transparency, and fairer entry. Companies that adapt will benefit from lower customer acquisition costs and a more loyal shareholder base.

In the cryptocurrency space, retail dominance means that products and protocols must prioritize usability over institutional functionality. Platforms that make complex financial services accessible to everyday users will succeed.

There's one fact worth acknowledging behind retail investors' recent success: nearly all assets have risen over the past five years. The S&P 500 rose 18.40% in 2020, 28.71% in 2021, 26.29% in 2023, and 25.02% in 2024. Only 2022 saw a significant decline, down 18.11%. Even 2025 is up 11.74% year-to-date.

Bitcoin's rise from approximately $5,000 at the beginning of 2020 to nearly $70,000 in 2021, despite continued volatility, has generally been an upward trend. Even traditional assets like Treasury bonds and real estate have seen significant gains during this period. In an environment where "buy the dip" strategies are proven to work, and holding nearly any asset for more than a year can generate positive returns, it's difficult to distinguish between skill and luck.

This raises an important question: Can retail investors' seemingly sophisticated skills survive a true bear market? The longest major decline experienced by most Gen Z and Millennial investors was the COVID-19 shock, which lasted just 33 days. The 2022 inflation scare, while painful, was followed by a swift recovery. Warren Buffett's famous quote, "Only when the tide goes out do you discover who's been swimming naked," holds true here. Perhaps retail investors are indeed smarter, more disciplined, and more informed than previous generations. Or perhaps they are simply the beneficiaries of an unprecedented bull run across nearly every asset class. The true test will come when easy monetary conditions end and investors face sustained portfolio losses. Only then will we know whether the shift in "dumb money" is permanent or simply a result of favorable market conditions.