An unusually weak US non-farm payroll report recently sent shockwaves through global capital markets. Job creation plummeted to 22,000, and the unemployment rate jumped to 4.3%. Meanwhile, recent comments from Federal Reserve officials signaled an interest rate cut. Consequently, market expectations for a Fed rate cut continue to rise. The CME Group's "FedWatch" tool indicates a 96.6% probability of a 25 basis point rate cut in September, with a high probability of 50 to 75 basis points (two to three cuts) for the year.

As a result, risk appetite has rebounded in both the stock and crypto markets, the US dollar has weakened, and investment assets like Bitcoin are gaining popularity. Stablecoins offer unique advantages. The TRON ecosystem, with its diverse stablecoin portfolio, is taking center stage. From USD1, a compliant stablecoin backed by the Trump family, to TRC20-USDT, the world's largest stablecoin in circulation, to USDD, a decentralized over-collateralized stablecoin, the TRON ecosystem is fully equipped to handle the transition from a high-interest rate environment to a period of easing global liquidity.

At this critical juncture, the latest episode of SunFlash Space featured several senior industry analysts for an in-depth discussion on how interest rate cuts will reshape the global liquidity landscape. What new opportunities does the TRON ecosystem present during this interest rate transition cycle? The panelists engaged in a fascinating roundtable discussion on these topics. The following is a recap of the highlights from this episode.

Where is the crypto market headed as interest rate cut expectations rise? Analysts urge caution.

With the US unemployment rate climbing to 4.3% and non-farm payrolls showing significant weakness, the market is highly predicting a September interest rate cut by the Federal Reserve. At this critical policy turning point, panelists offered their respective perspectives from various perspectives.

Black Eye Circles was the first to offer a stark perspective, arguing that the current slowdown in the job market makes the Fed's rate cut more of a "temporary adjustment" than the beginning of a new cycle. 0xPink also favors the "temporary adjustment" view, noting that at a macro level, the Fed still faces inflationary pressures and cannot afford to flood the market with money without limits, raising questions about the sustainability of funding.

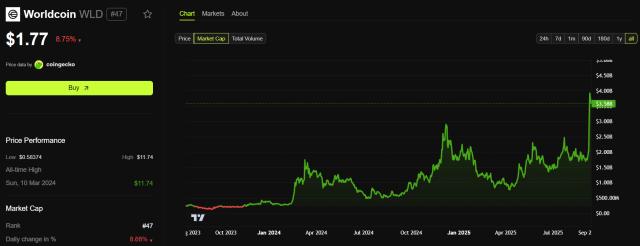

In the short term, however, the panelists generally believed that a rate cut would stimulate liquidity in the crypto market. Sweet noted that Altcoin liquidity has remained sluggish over the past six months, while recent significant activity in tokens like the AI sector and Worldcoin suggests a resurgence of capital. He concluded that a rate cut by the Federal Reserve would likely trigger a policy-driven rebound .

0xPink agrees that interest rate cuts and a weakening dollar are a powerful combination of positives for the crypto market. A weaker dollar will inevitably drive investors to seek higher-yielding assets, and the crypto market, with its high volatility and inflation-resistant properties, will become a target of investment. However, he also made it clear that this should not be simply viewed as the start of a "bull market."

0xPink emphasized that the crypto market structure has changed, with increased regulation and institutional participation ensuring that the market is no longer driven solely by retail investors. Therefore, he believes that while short-term positive sentiment will ignite the market, investors must pay more attention to whether funds can be retained over the long term and which sectors can truly absorb liquidity. He recommends proceeding cautiously to seize opportunities.

In the interest rate cut cycle, RWA and stablecoins may become the biggest winners, and the TRON ecosystem is optimistic about the trend.

If interest rates are cut, how will funds be allocated among crypto assets? Will they prioritize Bitcoin, a representative store of value, or Ethereum, a platform with a rich ecosystem? Or will they directly enter the RWA and stablecoin sectors, which offer compliance and profitability?

Xiaozhi explicitly stated that one should "always trust the vision of capital." Citing Nasdaq's landmark application to list tokenized stocks, he argued that this is undoubtedly a significant boon for RWAs and compliant stablecoins. Even if the application is not approved, its symbolic significance is immense. He further analyzed that traditional institutional capital prioritizes security and compliance when entering the market. The RWA and stablecoin sectors inherit the logic of the traditional financial system while offering on-chain operational efficiency and relatively manageable risks.

Heiyanquan also holds a similar view. He proposed that stablecoins, as an important "liquidity reservoir" and safe haven in the crypto market, play a prominent role in the market fluctuations caused by interest rate cuts . Their transaction medium attributes also help attract institutional funds that pursue efficiency and convenience.

In terms of stablecoin layout, the TRON ecosystem has built a diversified stablecoin matrix of "mainstream stablecoin USDT + decentralized stablecoin USDD + compliant stablecoin USD1" , which comprehensively covers the different needs of institutions, ordinary users and compliant business scenarios, and provides a smooth, secure and efficient entry for traditional funds to enter the crypto world.

USD1, a regulated stablecoin issued by crypto institution World Liberty Financial, has been natively minted on TRON and deeply integrated into the TRON ecosystem . In July, SUN.io, the core DEX in the TRON ecosystem, launched USD1 trading pairs, providing users with convenient trading channels. In August, the lending protocol JustLend DAO fully supported USD1 deposits and lending, further expanding its use cases. As of September 8th, USD1 issuance on the TRON chain had exceeded 56.57 million.

The mainstream stablecoin TRC20-USDT has become the most popular on-chain stablecoin due to its advantages such as fast transfer speed, high security and low transaction fees. Its circulation has exceeded 82.6 billion and it has gained support from many mainstream exchanges and wallets. Its usage scenarios cover financial trust, shopping payment, travel settlement, live streaming consumption and many other aspects, playing an important role in value circulation globally.

The decentralized over-collateralized stablecoin USDD has surpassed $530 million in TVL . Its multi-currency over-collateralization and real-time on-chain verification ensure that every USDD is fully backed by assets, significantly boosting user confidence. Notably, through deep collaboration with the TRON DeFi ecosystem, USDD not only provides investors with a safe haven against market volatility but also offers multiple income scenarios, including collateralized lending and liquidity mining, making it a crucial tool for users to combat inflation and realize asset appreciation.

0xPink concluded by stating that institutional funds seeking returns will not remain solely in Bitcoin but will inevitably flow into sectors that combine returns with traditional financial logic. RWA and DeFi protocols, which are deeply integrated with stablecoins, will become the preferred direction for institutional investment. TRON deeply integrates the DeFi ecosystem with stablecoins, providing funds with yield management and liquidity tools. Furthermore, the regulatory compliance advantages brought by its Nasdaq listing will make the TRON ecosystem a key hub for attracting traditional institutional funds and connecting real-world assets with the on-chain yield ecosystem during this period of interest rate cuts.