Bitcoin is weak, with a surge in Altcoin contract positions. Is the crazy Altcoin season just around the corner?

Written by: UkuriaOC, CryptoVizArt, glassnode

Translated by: AididiaoJP, Foresight News

Summary

Despite BTC reaching a new historical high of $124,400, its capital inflow continues to decline. This period of weak capital inflow highlights the significantly reduced investment demand at the current stage.

As BTC reached its historical peak, the total open interest of mainstream Altcoins also hit a historical high of $60 billion, highlighting the high level of market leverage. However, this situation was short-lived, and as prices pulled back, open interest decreased by $2.6 billion, marking the tenth-largest decline on record.

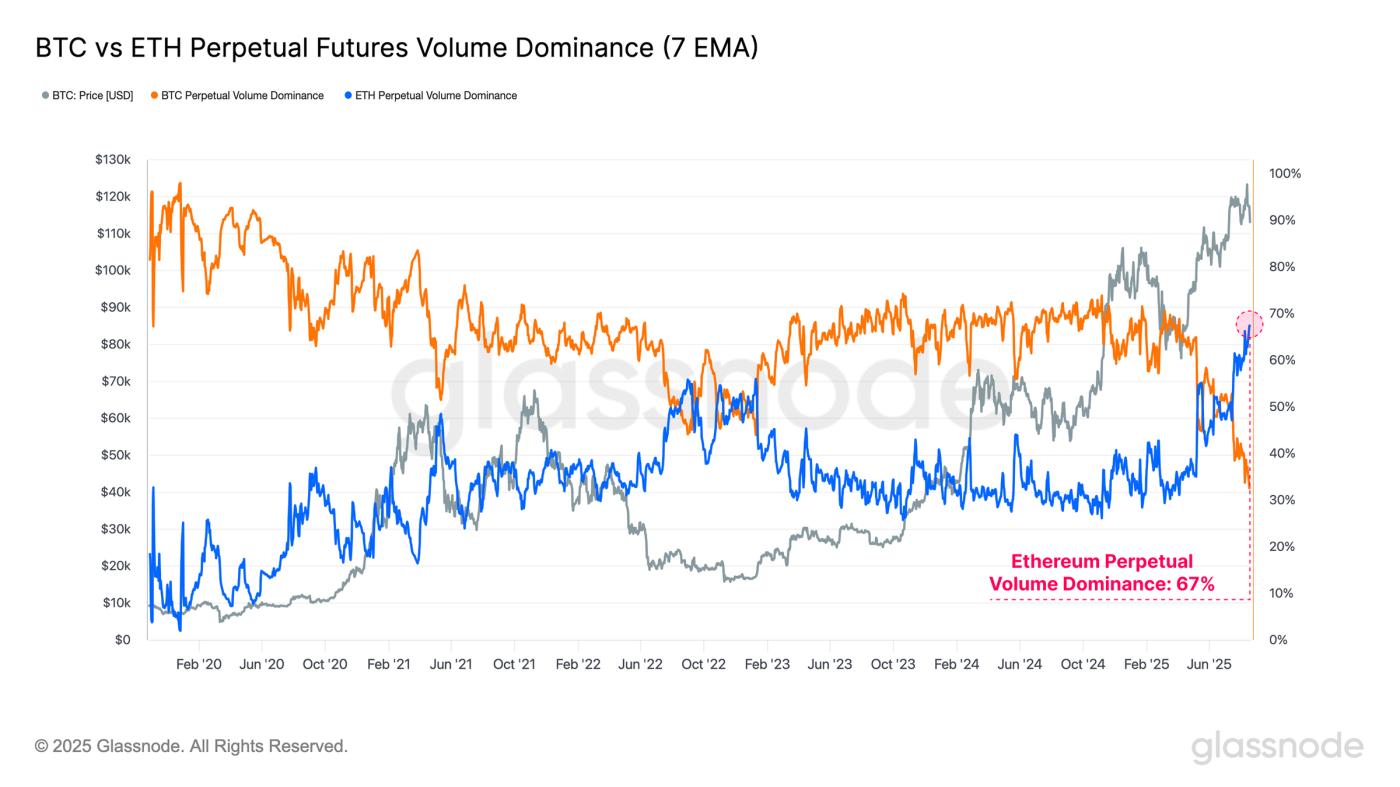

Ethereum is typically viewed as a bellwether asset, with its outstanding performance often associated with the broader "Altcoin season" phase in the digital asset market. Notably, Ethereum's open interest dominance has reached the fourth-highest level on record, while its perpetual futures trading volume dominance has surged to a new historical high of 67%.

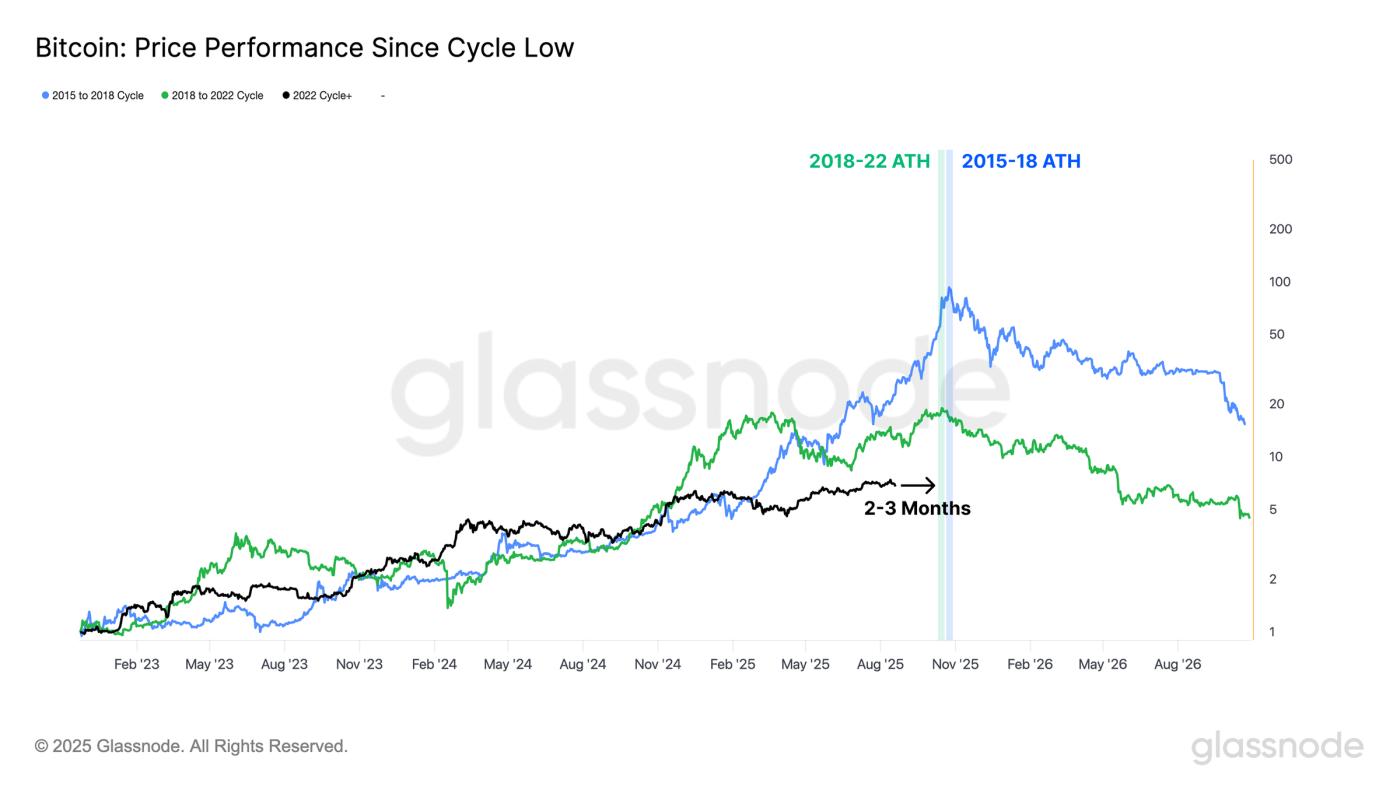

When observing BTC's performance from each cycle's low point, we can see that in the 2015-2018 and 2018-2022 cycles, the time to reach the historical high point was approximately 2-3 months later than our current position in this cycle.

Slowing Capital Flow

After reaching a high of $124,400 last week, BTC's upward momentum has stalled, with prices falling to a low of $112,900, a pullback of nearly 9.2%. This decline, accompanied by noticeably weak capital inflows in recent weeks, indicates investors' reluctance to inject new funds at these high price levels.

Comparing the current capital inflow rate with previous breakthroughs of historical highs, we can see that the realized market cap growth percentage is far lower than the levels during the March and December 2024 historical high breakthroughs. When first breaking $100,000 in late 2024, the monthly realized market cap growth rate reached +13%, while the current peak is much lower, at only +6% per month.

This period of weak capital inflow highlights the significantly reduced investment demand at the current stage.

[Rest of the translation follows the same professional and accurate approach]Real-time Chart

When viewed from the perspective of trading volume, this trend becomes even more astonishing. Ethereum's perpetual futures trading volume dominance has soared to a new historical high of 67%, marking the strongest transformation on record.

Such significant trading activity has dynamically shifted investors' attention to the growing Altcoin domain, pointing to an acceleration of risk appetite in the current market cycle.

Real-time Chart

Crossroads

When we observe Bitcoin's performance from each cycle's low point, we can see that in the 2015-2018 and 2018-2022 cycles, the time to reach the historical high point was approximately 2-3 months later than the current cycle's point in time.

While these are only two examples before a mature cycle, and thus insufficient to assume this synchronicity will continue, it is still a noteworthy data point. This perspective is especially relevant when considering the wave of on-chain profit-taking over the past two years and the high level of speculative activity visible in today's derivatives market.

Real-time Chart

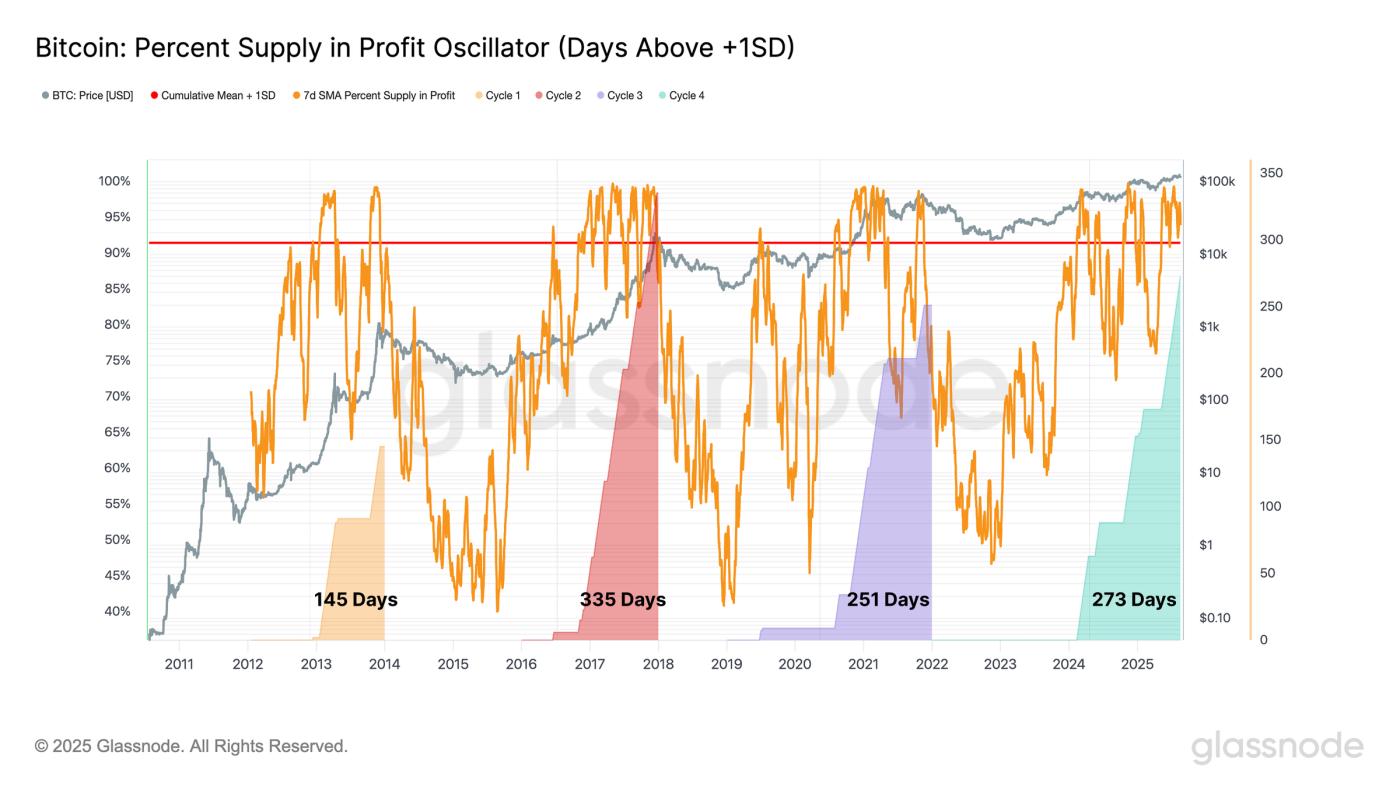

To further support this observation, we can look at the duration during which the percentage of Bitcoin's circulating supply remains above the +1 standard deviation band in each cycle.

In the current cycle, this period has now extended to 273 days, making it the second-longest period on record, just behind the 335 days in the 2015-2018 cycle. This indicates that when measured from the perspective of the vast majority of supply being held at a profit, the current cycle's duration is comparable to previous cycles.

Real-time Chart

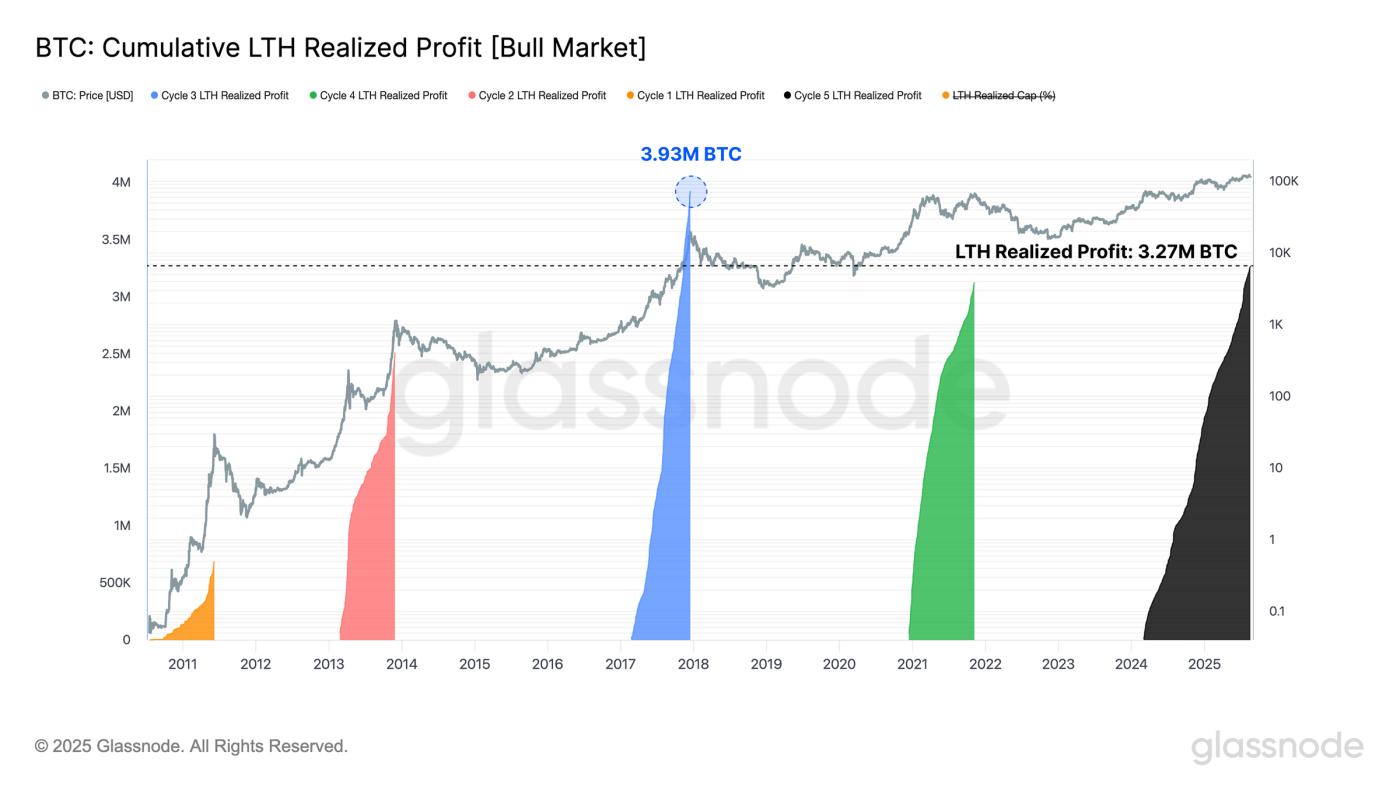

We can also measure the cumulative profits realized by long-term holders from reaching a new cycle high to the cycle's ultimate peak. From this perspective, we find that the long-term holder group (typically most active at cycle extremes) has realized more profits than all previous cycles except one (the 2016-2017 cycle).

This observation is consistent with previous indicators, adding another dimension through the perspective of sell-side pressure. Taken together, these signals reinforce the view that the current cycle is in its late historical stage.

However, each cycle has its own characteristics, and there is no guarantee that market behavior will follow such a fixed time pattern.

Nevertheless, these dynamics raise an interesting question. Is the traditional four-year cycle still effective, or are we witnessing its evolution? These questions will be answered in the coming months.

Real-time Chart

Conclusion

Bitcoin's capital inflow shows signs of weakness, with demand declining even when the price reached a new historical high of $124,400. This slowdown coincides with a surge in speculative positions, with the total open interest of major Altcoins briefly reaching a historical high of $60 billion before pulling back, reducing by $2.5 billion.

Ethereum, long considered a bellwether for the "Altcoin season", is again at the forefront of this rotation. Its open interest dominance has climbed to the fourth-highest level on record, while its perpetual futures trading volume dominance has soared to a new historical high of 67%, marking the strongest structural transformation to date.

From a cyclical perspective, Bitcoin's price movement also echoes previous patterns. In the 2015-2018 and 2018-2022 cycles, the time to reach the historical high point was only 2-3 months later than the current point in time. Meanwhile, the profit levels realized by long-term holders are comparable to past market euphoria stages, reinforcing the impression that the market is in its late cycle.

Taken together, these signals highlight increased leverage, profit-taking, and speculative intensity, characteristics typical of mature market stages in history. However, each cycle has its own characteristics, and it cannot be certain that Bitcoin and the broader market will follow a fixed time blueprint.