Article source: Words Beyond Words

Let's first briefly discuss the market situation. In recent days, the market has re-entered a range-bound oscillation. For BTC, although the indicators look bearish and MACD seems about to cross again, the area around $112,000 is also a short-term support level. As long as this level is not broken, it will likely continue to oscillate for some time. As shown in the image below.

As for ETH, it may have risen relatively quickly recently. After being close to its historical high just a few days ago, it has re-entered a correction phase and is currently in a range-bound market. As shown in the image below. However, from the indicators, it may continue to oscillate in the short term. In extreme cases, it might retest the 3600-4000 area, but the medium-term direction remains bullish. There is a high probability of breaking the historical high this year and attempting to challenge the $5000 round number.

Of course, different people may have different views or reference points regarding market trends, and any judgment can only serve as an auxiliary. The above is just our own perspective. You can have your own judgment and make decisions suitable for your risk appetite.

In the previous article (August 14th), we mainly shared some data about ETH and stablecoins, and discussed opportunities and risks. Today, we continue to talk about opportunities and risks.

Based on historical experience, the market often goes crazy in the late stage of a cyclical period, and we seem to be in such a stage now. Compared to previous bull market cycles, the probability of topping out at any moment is much higher.

When the market is in an upward trend, it seems easy to make money, but it's actually difficult to hold onto gains. Although most people know that no one can accurately predict when the market will top out, human nature drives most people to hope to sell at the peak of the bull market cycle.

Recently, many people are still shouting: This time is different!

But frankly, shouting such slogans is meaningless. Each cycle is different, and we don't need to be rigid or always harbor new fantasies about the market.

A more reasonable approach is to always be prepared and set a Plan B for yourself, such as: If the current position is the top, are you satisfied with the profits you've already made?

Now, many people are waiting for a bull market finale like in 2017 and 2021. The question is, what if we directly skip the traditional bull market ending and form a stage top before entering a stage bear market (mini bear market)? How would you respond?

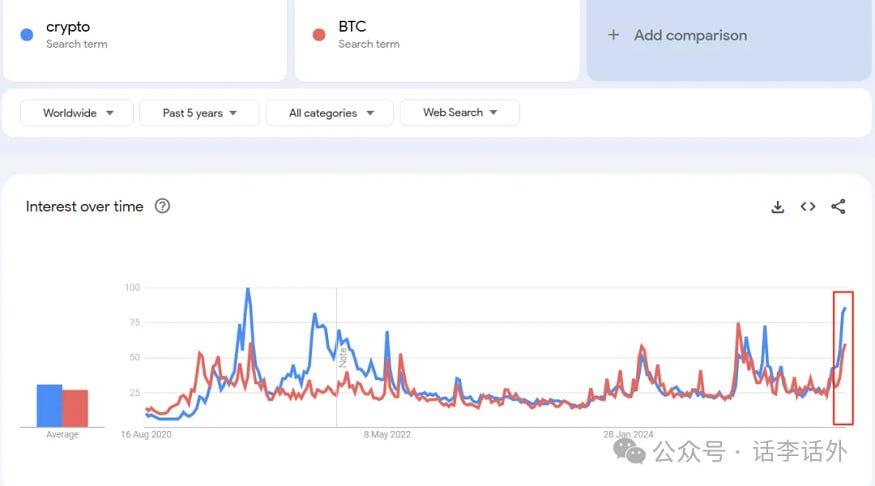

Currently, more and more people are believing in the super cycle theory, more celebrities and big names are promoting cryptocurrencies, and more people are searching and discussing cryptocurrencies... As shown in the image below.

Bitcoin continues to break historical highs, and Ethereum is close to its historical high... We always say that opportunities and risks coexist. Therefore, we should no longer embrace risks as we did at the beginning of the cycle, but gradually start taking profits in batches, which will make your mindset and positions more free, rather than being completely overwhelmed when a collapse suddenly arrives.

Let's compare Bitcoin's trend during the 2021 bull market:

From a time perspective, the top in 2017 to the top in 2021 lasted about 1435 days, and from the 2021 top to now has been about 1373 days. Without considering the super cycle, from a stage (4-5 year) cycle perspective, it seems there are only 2-3 months left. Even if you want to be rigid, now should be the time to start taking profits in batches.

For example, from the relationship between Bitcoin and Altcoins, in previous bull markets, Bitcoin's dominance would only decline in the final stage, followed by Altcoins rising. In the past few weeks, we seem to be at the beginning of this trend. Although the scale is different from previous bull markets, the trend direction seems unchanged, with Ethereum and some mainstream coins leading this trend.

Many people believe we shouldn't compare the present with history, but history sometimes represents human nature. Although many believe the current market sentiment is insufficient to support a market top and that the crypto market will continue to rise for much longer, breaking the four-year cycle, so far we see that the overall market trend remains unchanged. Bitcoin has entered the second wave of creating new historical highs, its dominance is declining, Ethereum continues to look bullish and prepare to create a new historical high, and many Altcoins follow Bitcoin and Ethereum's trend.

If the current momentum continues, after some effective adjustments and leverage clearing, before the end of the year, Ethereum's price will not only break new highs but may also reach around $6000. At that time, some liquidity might quickly shift to other mainstream Altcoins and rapidly move to some small-cap coins. This period in the Altcoin market looks to be the most rewarding but also the riskiest.

From historical patterns and probability, we also believe that the current cycle has not yet topped out, but theoretically seems close to a stage top. We won't get hung up on whether the four-year cycle is valid or whether the market will enter a super cycle. We are more inclined to the previously mentioned scenario: the market may form a stage top and directly enter a stage bear market (mini bear market), repeating this cycle. However, in a longer perspective (such as the next 10-20 years), we still believe the crypto market is positive and bullish overall.

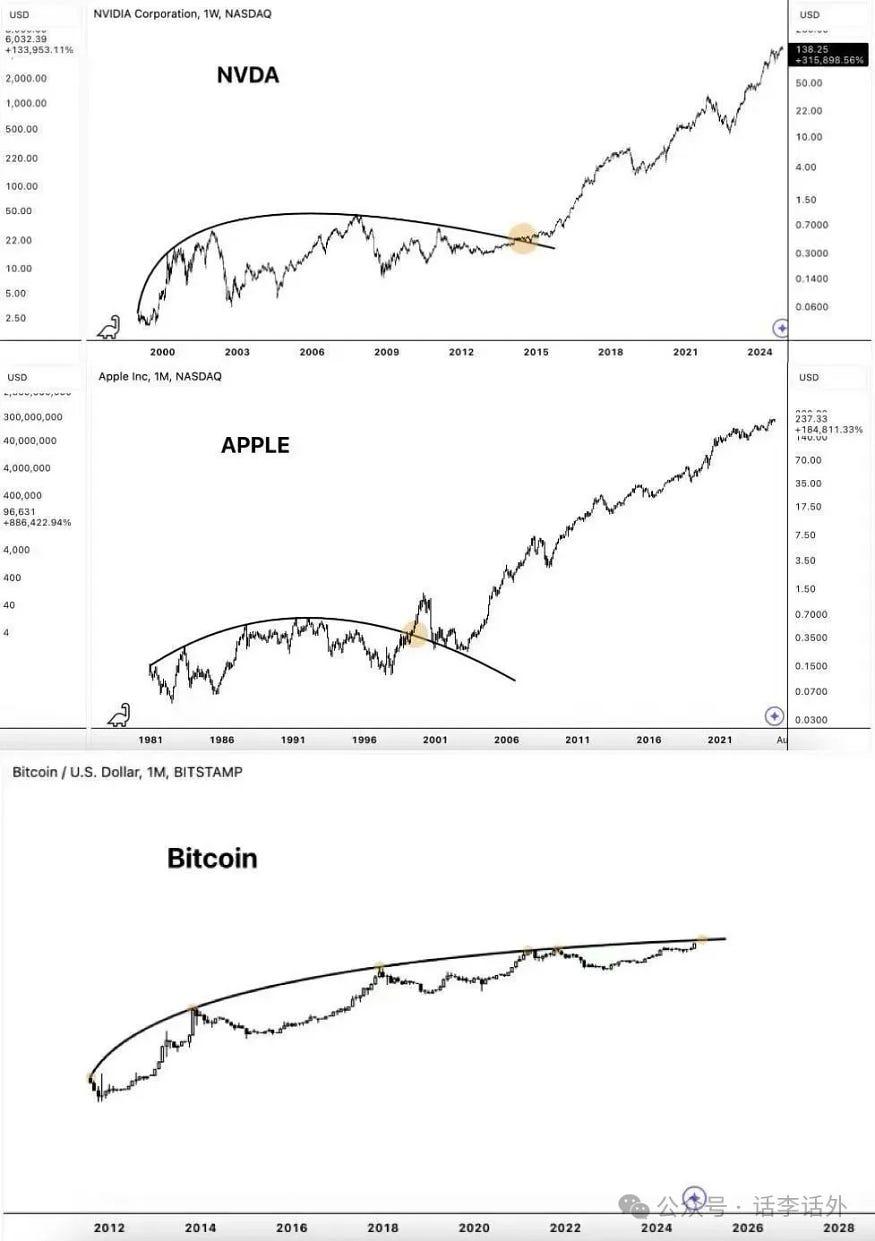

We remember sharing an image in our January 17th article, which we'll retrieve for everyone to see, as shown in the image below.