Compiled by: Jerry, ChainCatcher

Last Week's Crypto Spot ETF Performance

US Bitcoin Spot ETF Net Inflow of $253 Million

Last week, the US Bitcoin spot ETF had a three-day net inflow, with a total net inflow of $253 million, and a total net asset value of $150.7 billion.

Last week, 3 ETFs were in net inflow, with inflows mainly from IBIT, BITB, and BTC, at $188 million, $62.3 million, and $30.6 million respectively.

Data source: Farside Investors

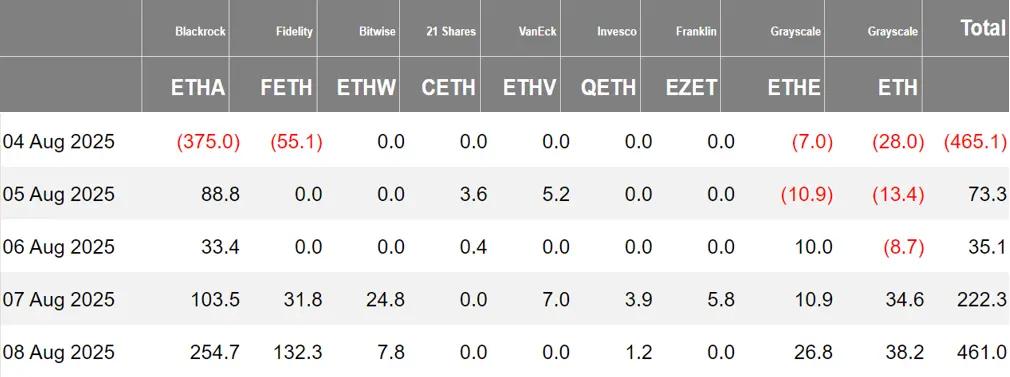

US Ethereum Spot ETF Net Inflow of $326 Million

Last week, the US Ethereum spot ETF had a consecutive four-day net inflow, with a total net inflow of $326 million, and a total net asset value of $23.38 billion.

Last week's inflow was mainly from Fidelity FETH, with a net inflow of $109 million. All 9 Ethereum spot ETFs were in net inflow.

Data source: Farside Investors

Hong Kong Bitcoin Spot ETF with No Capital Inflow

Last week, the Hong Kong Bitcoin spot ETF had no capital inflow, with a net asset value of $497 million. Among them, the issuer Jiashi Bitcoin holdings decreased to 292.92 coins, and Huaxia decreased to 2,290 coins.

The Hong Kong Ethereum spot ETF had a net inflow of 403.88 Ethereum, with a net asset value of $94.52 million.

Data source: SoSoValue

Crypto Spot ETF Options Performance

As of August 8, the nominal total trading volume of US Bitcoin spot ETF options was $1.69 billion, with a nominal total trading long-short ratio of 2.09.

As of August 7, the nominal total position of US Bitcoin spot ETF options reached $26.84 billion, with a nominal total position long-short ratio of 1.71.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with an overall bullish sentiment.

Additionally, the implied volatility is 40.97%.

Data source: SoSoValue

Last Week's Crypto ETF Dynamics Overview

(The rest of the translation follows the same approach, maintaining the specific terms and translating the rest of the text to English.)Nate Geraci, former president of The ETF Store and current president of NovaDius Wealth Management, stated on the X platform that he expects BlackRock to submit an XRP ETF application to the U.S. Securities and Exchange Commission after the Ripple lawsuit is resolved, to promote cryptocurrency ETF portfolio diversification.

However, Nate Geraci specifically clarified that he is willing to take responsibility if his prediction is wrong, but he candidly said that ignoring crypto assets beyond Bitcoin and Ethereum is meaningless, otherwise it would be like telling the market that only BTC and ETH have value.

Previously, both the SEC and Ripple dropped their appeals, and the related ruling remains unchanged.

According to The Block, Geoffrey Kendrick, global head of digital assets research at Standard Chartered Bank, stated that Ethereum treasury companies are now "very investable" and more attractive to investors compared to U.S. spot Ethereum ETFs. The net asset value (NAV) multiple of Ethereum treasury companies—market value divided by held ETH value—has now "started to normalize" and is expected to remain above 1, making them a better investment target than U.S. spot ETH ETFs. Kendrick said: "I don't think there's a reason for the NAV multiple to be below 1, as I believe these companies offer investors a regulatory arbitrage opportunity." As the NAV multiple normalizes, Ethereum treasury companies can provide better opportunities for Ethereum price appreciation, staking rewards, and ETH per share growth—while U.S. spot ETH ETFs currently cannot participate in staking or DeFi.

Kendrick noted that since June, Ethereum fund management companies have purchased 1.6% of all circulating ETH, comparable to the purchase rate of ETH ETFs during the same period. This update was released in his report last week, when he predicted that ETH held by fund management companies could grow to 10% of all circulating ETH—equivalent to 10 times their current holdings.

Arkham: ETF Issuers Recently Selling BTC, Bitcoin Treasury Companies Continuing to Accumulate

According to Arkham's post on the X platform, recent ETF issuers including Fidelity, Grayscale, and Ark have started selling BTC. For example, Fidelity outflowed 2,965 BTC yesterday, and BlackRock transferred 2,544 BTC to Coinbase Prime, seemingly preparing to sell.

Meanwhile, multiple institutional-level Bitcoin treasury companies continue to accumulate, including Nasdaq-listed companies Empery Digital, Strategy, H 100, and Metaplanet.

Bloomberg ETF analyst Eric Balchunas stated on the X platform that by specific ETF category, crypto ETFs had twice the inflows of other ETF categories in July. Additionally, small-cap stocks ranked at the bottom.

Bloomberg ETF senior analyst Eric Balchunas posted on the X platform that since the Bitcoin ETF listing, its volatility has significantly decreased. The 90-day rolling volatility dropped below 40 for the first time, compared to over 60 at the ETF launch. For comparison, combining GLD data, Bitcoin volatility is now less than twice that of gold, whereas it was previously over 3 times.