Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total cryptocurrency market cap is $3.86 trillion, with BTC accounting for 60% at $2.3 trillion. The stablecoin market cap is $269.8 billion, with a 1.04% increase in the last 7 days, of which USDT accounts for 61.21%.

Among the top 200 projects on CoinMarketCap, most are up with some down, including: MNT up 41.91% in 7 days, PENDLE up 31.81% in 7 days, PUMP up 29.16% in 7 days, MYX up 1420.3% in 7 days, TOSHI up 22.52% in 7 days.

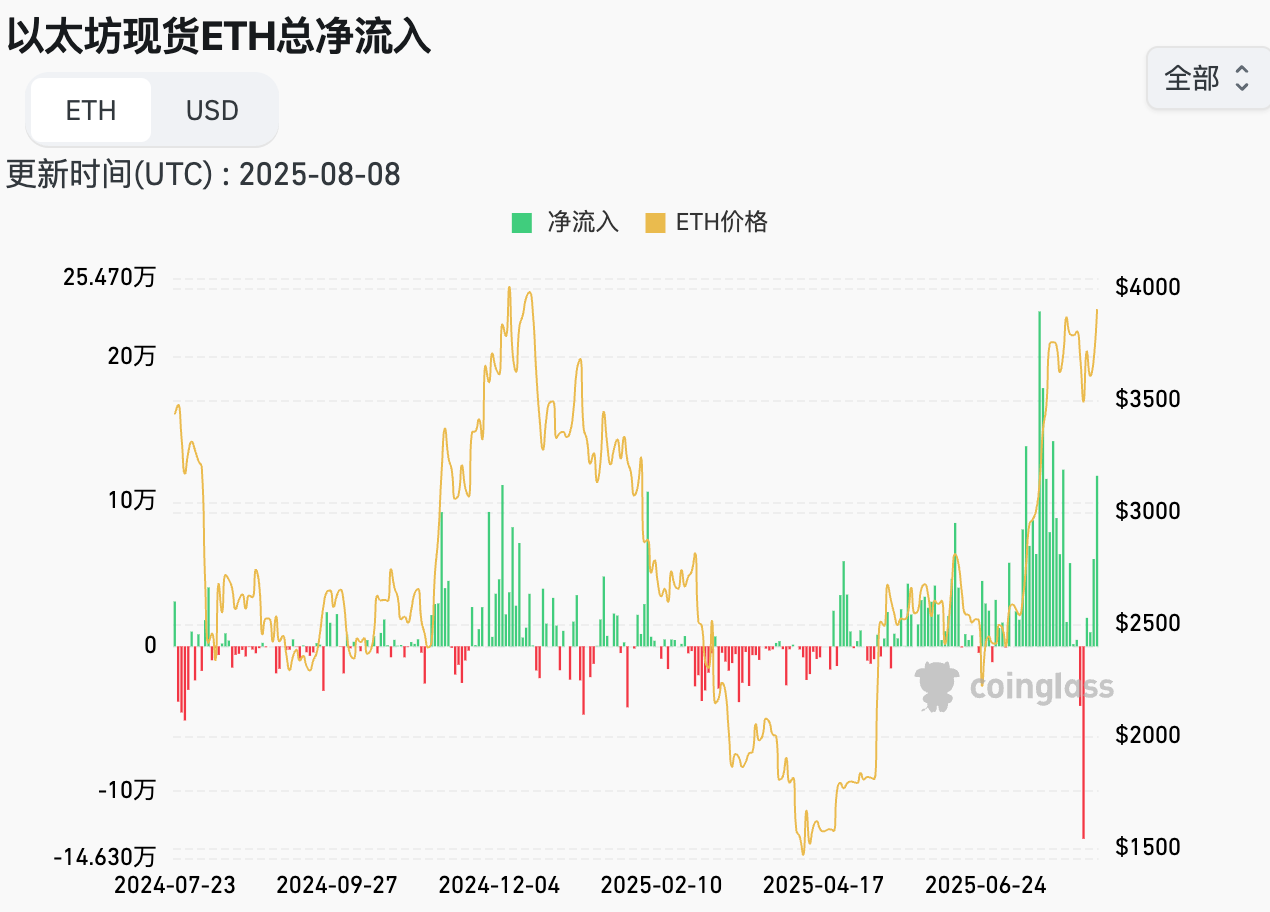

This week, US Bitcoin spot ETF net inflow: $253.6 million; US Ethereum spot ETF net inflow: $326.4 million.

Market Forecast (August 11-August 15):

This week, stablecoins continued to be issued, with US Bitcoin and Ethereum spot ETFs experiencing continuous net inflows. Ethereum broke through $4,000 this week, showing impressive performance. The RSI index is 62.75, indicating overbought conditions. The Fear and Greed Index is 68 (higher than last week).

BTC: Likely to oscillate in the $114,500-$118,500 range, with the breakthrough direction depending on US CPI data. If the data supports rate cut expectations, it may test $120,000; if the data is strong, it might fall back to the $112,500 support;

ETH: May continue to outperform BTC, with the main fluctuation range between $3,750-$4,200. Any positive signals from the SEC regarding spot ETFs could push ETH to continue breaking through.

Short-term investors: Can adopt range trading strategies, buying near support levels and partially taking profits near resistance levels.

Medium to long-term investors: Should use potential pullbacks to build positions in batches, focusing on strong support areas around BTC $112,500 and ETH $3,300.

Current Insights

Weekly Major Events Review

1. On August 6, the US Securities and Exchange Commission issued a statement on liquidity staking activities, stating that liquidity staking is not considered a security;

2. On August 6, Base released an outage report, experiencing a 33-minute block generation interruption on August 5 due to switching to a backup sequencer that was not correctly set up to handle transactions;

3. On August 5, JD.com's JD Coin Chain stated that they are preparing for a Hong Kong stablecoin license application in response to market rumors;

4. On August 7, according to Etherscan data, Ethereum network daily transactions rose to 1.87 million, close to the historical high of 1.96 million on January 14, 2024;

5. On August 6, Cboe BZX, under the Chicago Options Exchange (CBOE), submitted a 19b-4 file to the SEC, requesting permission for VanEck Ethereum ETF to stake ETH through trusted staking providers to earn rewards as income;

6. On August 6, the SEC officially ended its 4-year legal battle with Ripple, maintaining the first-instance ruling;

7. On August 8, Trump announced nominating "crypto-friendly" official Stephen Miran as a Federal Reserve board member.

Macroeconomic Developments

1. On August 6, the White House announced that Trump signed an executive order imposing an additional 25% tariff on goods from India in response to continued Russian oil purchases;

2. On August 7, the Bank of England cut rates by 25 basis points, lowering the base rate from 4.25% to 4%, the fifth rate cut in this cycle, in line with market expectations;

3. On August 7, US initial jobless claims for the week ending August 2 were 226,000, compared to the expected 221,000;

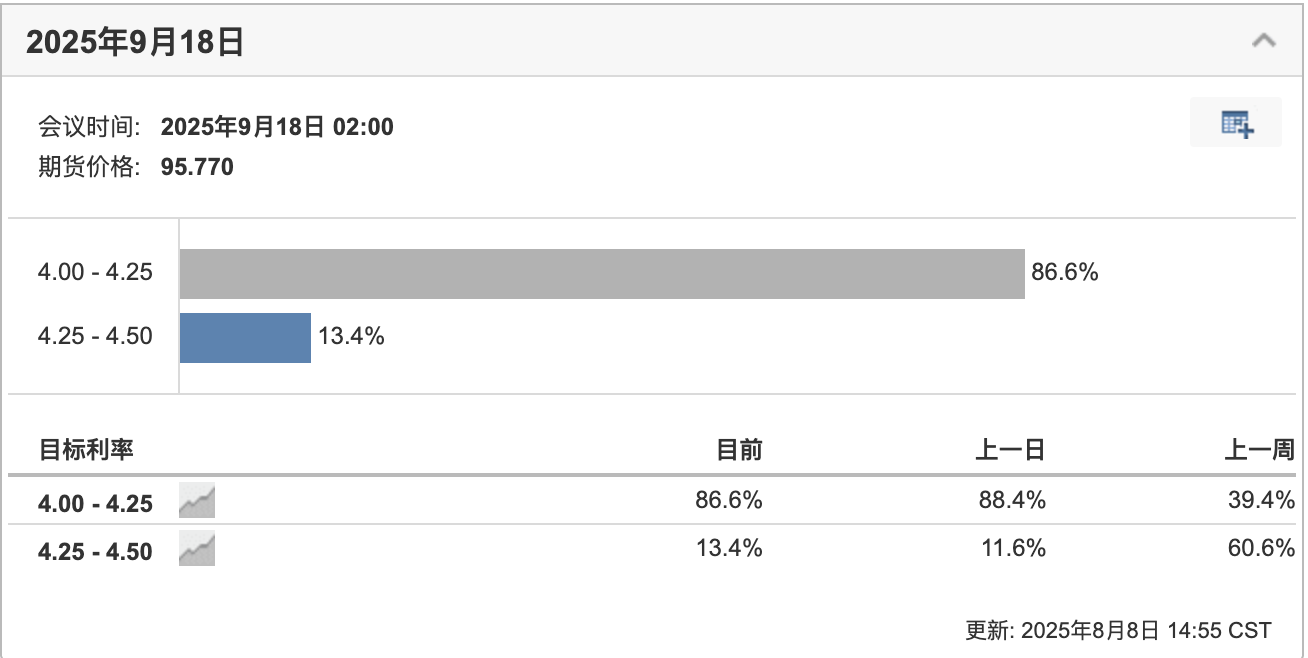

4. On August 8, according to CME "Fed Watch", the probability of a 25 basis point rate cut in September is 92.7%, with a 7.3% chance of maintaining current rates.

ETF

According to statistics, from August 4-8, US Bitcoin spot ETF net inflow: $253.6 million; as of August 8, GBTC (Grayscale) has outflowed $23.662 billion, currently holding $21.058 billion, IBIT (BlackRock) currently holding $85.956 billion. Total US Bitcoin spot ETF market cap: $152.024 billion.

US Ethereum spot ETF net inflow: $326.4 million.

Future Outlook

Event Announcements

1. Coinfest Asia 2025 will be held from August 21-22 in Bali, Indonesia;

2. WebX Asia 2025 will be held from August 25-26 in Tokyo, Japan;

3. Bitcoin Asia 2025 will be held from August 28-29 at the Hong Kong Convention and Exhibition Centre.

Important Events

1. August 12, 12:30, Australian Central Bank will announce rate decision;

2. August 12, 20:30, US will release July Unadjusted CPI (Year-on-Year);

3. August 14, 20:30, US will release Adjusted Initial Jobless Claims (Thousands) for the previous week (as of 0809).

Token Unlocks

1. Aptos (APT) will unlock 11.3 million tokens on August 12, valued at $53.04 million, representing 2.2% of circulating supply;

2. Avalanche (AVAX) will unlock 1.67 million tokens on August 15, valued at approximately $39.14 million, representing 0.33% of circulating supply;

3. Starknet (STRK) will unlock 126 million tokens on August 15, valued at $16.18 million, representing 5.98% of circulating supply;

4. Sei (SEI) will unlock 55.56 million tokens on August 15, valued at approximately $17.12 million, representing 1.21% of circulating supply;

5. Arbitrum (ARB) will unlock 92.63 million tokens on August 16, valued at approximately $39.11 million, representing 2.04% of circulating supply.