ETH Breaks $4,300, Reaching New High Since January 2022

MarsBit News, on August 10, market data shows that ETH broke through $4,300, currently trading at $4,314.99, with a 24-hour increase of 2.28%, reaching a new high since January 2022.

Trump's Second Son: Stop Shorting BTC and ETH, or You'll Be Completely Crushed

MarsBit News, on August 9, Eric Trump posted on social media, saying he was delighted to see Ethereum shorts being crushed today. "Don't bet on shorting Bitcoin and Ethereum anymore - or you'll be ruthlessly run over by the market."

US Stocks ETH Strategy Stocks Rise, BMNR Surges 24.59%, Daily Trading Volume Exceeds Strategy (MSTR)

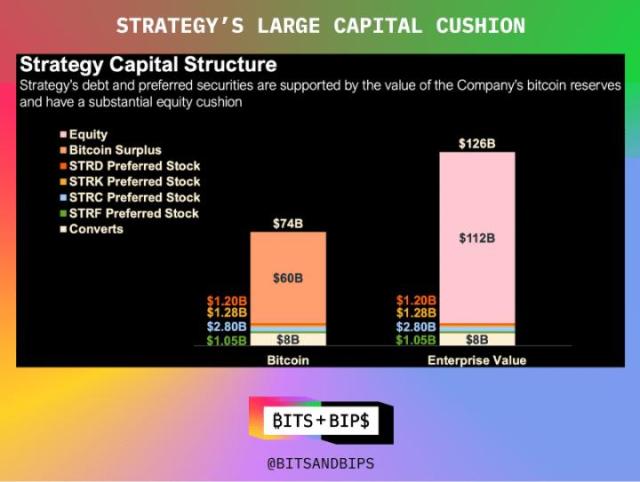

MarsBit News, on August 9, according to Rockflow market data, US stocks closed higher on Friday, with the Dow initially rising 0.47%, S&P 500 up 0.78%, and Nasdaq up 0.98%. US ETH strategy stocks generally rose, including: Circle (CRCL) up 3.99%, trading volume $1.417 billion; Strategy (MSTR) down 1.71%, trading volume $4.449 billion; Bitmine (BMNR) up 24.59%, trading volume $4.533 billion; BTCS (BTCS) up 11.11%, trading volume $45.7975 million; Bit Digital (BTBT) up 1.36%, trading volume $106 million; SharpLink Gaming (SBET) up 2.40%, trading volume $1.935 billion. Notably, Bitmine (BMNR), with a market cap of only $5.308 billion, had a single-day trading volume exceeding MSTR's market cap of $112.04 billion, with an intraday turnover rate of 99.53%, closing at $51.43.

Pump.Fun Sends $5.6 Million SOL to New Address for PUMP Buyback

MarsBit News, on August 9, according to Arkham monitoring, Pump.Fun sent $5.6 million worth of SOL to a new address for PUMP buyback. So far, they have bought back $6.68 million worth of PUMP at this address and sent $5.72 million to Squads Vault.

[Rest of the translation continues in the same manner, maintaining the professional and accurate translation of the original text]

MarsBit News, on August 7, according to The Block, Geoffrey Kendrick, global head of digital assets at Standard Chartered Bank, stated that Ethereum treasury companies are now "very investable" and more attractive to investors compared to the US spot Ethereum ETF. The net asset value (NAV) multiple of Ethereum treasury companies - that is, market value divided by the value of held ETH - has now "started to normalize" and is expected to remain above 1, making them a better investment target than the US spot ETH ETF. Kendrick said: "I don't think there's any reason for the NAV multiple to be below 1.0, because I think these companies offer investors a regulatory arbitrage opportunity." With the normalization of the NAV multiple, Ethereum treasury companies can provide better opportunities for Ethereum price appreciation, staking returns, and ETH per share growth - which the US spot ETH ETF currently cannot participate in staking or DeFi. Kendrick noted that since June, Ethereum fund management companies have purchased 1.6% of all circulating ETH, comparable to the purchase rate of ETH ETF during the same period. This update was released in his report last week, when he predicted that ETH held by fund management companies could grow to 10% of all circulating ETH - equivalent to 10 times their current holdings.

Trump: Vance Most Likely to Be Next Presidential Candidate

MarsBit News, US President Trump said on Tuesday that current Vice President Vance is "most likely" to be the heir to his "Make America Great Again" (MAGA) movement.

Secretary of State Rubio earlier told Fox News that Vance would be an excellent nominee if he decides to run, to which Trump responded: "I think he (Vance) is the most likely."

He added: "We also have some very outstanding talents, some of whom are sitting on this stage today. So it's too early to talk about this now, but what's certain is that Vance is doing very well right now, and he might be the most favored candidate." Earlier that day, Trump told CNBC that he "might not" seek a third presidential term.

Tether CEO: 40% of Blockchain Fees Consumed by USDT Transfers

MarsBit News, on August 6, Tether CEO Paolo Ardoino disclosed that "40% of blockchain fees are used for USDT transfers. This covers 9 chains: Ethereum, TRON, TON, Solana, BSC, Avalanche, Arbitrum, Polygon, and Optimism. In emerging markets, hundreds of millions of people use Tether's digital dollar USDT daily to protect their families from local currency depreciation and inflation. In the future, blockchains that focus on reducing gas fees and support paying fees with USDT will dominate the world."

Trump Celebrates US Stock Rally: More Such Rises to Come

MarsBit News, on August 5, US President Trump posted on social media, "US stocks performed well today (Dow +585.06, 1.34%; S&P 500 +91.93, 1.47%; Nasdaq +403.45, 1.95%), and there will be many such days. America is becoming wealthy again and stronger than ever."

IPO Imminent, Grayscale Founder Barry Silbert Returns as Board Chairman

MarsBit News, on August 5, according to The Block, after submitting a confidential IPO application, Grayscale Investments announced four executive appointments and welcomed founder Barry Silbert back as board chairman. The newly appointed executives include: COO Diana Zhang, CMO Ramona Boston, Chief Communications Officer Andrea Williams, and Chief HR Officer Maxwell Rosenthal. The four executives will report to Grayscale CEO Peter Mintzberg and come from traditional financial giants, including Bridgewater Fund, Apollo Global Management, Goldman Sachs, and Castle Investment. Barry Silbert, who founded Grayscale in 2013 and resigned as chairman in late 2023, will replace Mark Shifke as board chairman. Shifke will continue to serve on the board, and the board now has five members. The company is considering adding independent directors.

Barry Silbert stated: "I am honored to rejoin the Grayscale board at a critical moment for the company and the broader digital asset ecosystem. I have always believed in the company's long-term positioning and the leadership team driving it forward."