Source: Beating

Original Title: How Did He Break into the Circle of the Whale with 80,000 Bitcoins?

In the crypto world, the most impactful transactions are not those with loud fanfare, but those who can quietly pocket $9 billion through connections.

In July 2025, an address with 80,000 BTC that had been dormant for 14 years suddenly moved, which is one of the largest nominal Bitcoin transactions in history. Such a scale of transfer should have triggered a 30% market drop, but the reality was—no significant crash, no panic, and these Bitcoins were quietly absorbed by the market.

A $9 billion stake was "silently" consumed by the market. The operator was neither an exchange nor a hedge fund, but a somewhat obscure Wall Street player: Galaxy Digital.

At the Q2 earnings call on the evening of August 5th, someone asked the CEO: How did you secure the 80,000 BTC client? Was there a formal bidding process?

The CEO casually replied: "For this deal, relationships matter more than quotations."

Who is behind Galaxy Digital? What kind of political and business resources did they mobilize to acquire this epic transaction? And what new power structure is this network weaving for the crypto world?

I. High-Level "Social Circle": Political Capital in the Board of Directors

The key to this transaction is not in the front-end quotation, but in the backstage connections—everything points to an old Wall Street veteran.

The 56-year-old founder Mike Novogratz is a standard "Wall Street product".

[The rest of the translation continues in the same professional and accurate manner, maintaining the original structure and meaning while translating to English.]

Many people believe that Galaxy Digital's moat is capital, but its true advantage is its political and business sensitivity.

II. The Banker Behind the Crypto Treasury

80,000 bitcoins are just a corner of this network, and companies represented by CZ, the richest Chinese person, have also begun to view Galaxy Digital as a "political passport" to compliance.

By mid-2025, a new mainstream narrative in US stocks quietly emerged: crypto stocks. US stocks are staging a capital "shell replacement" strategy: putting BTC, ETH into listed companies, allowing crypto assets to enter Wall Street under the name of financial reports.

However, before the end of 2023, this was still considered a "forbidden zone" in the capital market.

US enterprises actually find it very difficult to "legally hold crypto" because the financial system cannot accommodate it. According to the FASB accounting standards at the time, crypto assets like Bitcoin could only be recorded as "intangible assets" - prices dropping require impairment, while price increases cannot be counted as revenue, leading to severely distorted company financial reports and difficult audits.

For example, if you bought 10,000 ETH, a price drop must be immediately recorded as a loss, but a price increase is ignored and cannot be counted as profit. This makes corporate financial reports look terrible and audits a mess.

The new FASB rules will only start valuing at "fair value" from the 2025 fiscal year, allowing price increases to be counted as revenue, truly opening the channel for "compliant crypto holding".

Galaxy was the earliest to enter and serve as a service provider bringing a group of listed companies "legally into the market".

The earliest to sense the opportunity were a group of ancient ETH whales. They quietly packaged their ETH into US stock shell companies, using a hand-to-hand transfer method to complete covert cash-out through US stock liquidity without disturbing the market. SharpLink Gaming was the leader in this "cash-out technique".

Soon, CZ, the richest Chinese person, followed suit - stuffing his platform's BNB into a US stock company, using shell companies, packaging, and listing to transform platform coins into compliant assets and enter the capital valuation system.

Behind this series of operations, Galaxy Digital had quietly surfaced - serving as the operational consultant for the entire script.

It customized a "crypto treasury" narrative plan for these companies: from OTC positioning, asset custody, to compliance disclosure and pledge income, every step unavoidably involves its established political and business channels, precisely treading the gray area between regulatory blind spots and capital leverage.

Galaxy Digital's core business has three directions: OTC trading + custody + strategic consulting.

It has top-tier crypto OTC trading capabilities in the US, able to complete large-scale matching and risk hedging for clients during volatility; provides ETF custody, pledge, tax reporting, and other compliant asset management services, managing digital assets worth billions of dollars; and deeply participates in enterprise-level client strategic planning, from PIPE financing to asset classification, financial accounting, disclosure paths, and even co-investing with its own funds to help traditional companies transform into "crypto treasuries".

Take SharpLink Gaming, the ETH treasury leader, as an example. The company purchased ETH through Galaxy's large-scale OTC and signed an asset management agreement with it. Part of the company's purchased ETH is custodied at Galaxy, and under Galaxy's guidance, the entire process from financing to disclosure was designed. It provides customers with a complete "on-chain financial structure" including PIPE structure, coin warehouse classification, and custody proof, helping enterprises achieve discreet yet compliant positioning.

According to SEC disclosure, Galaxy and ParaFi Capital charge 0.25% to 1.25% in tiered management fees annually, with a minimum of $1.25 million. As SharpLink's crypto holding scale expands, Galaxy will obtain stable long-term income.

This is no longer a single transaction, but a "on-chain treasury business" with a clear structure and stable revenue. In the institutional path of crypto finance, Galaxy is becoming an unavoidable entry point for companies wanting to "legally hold and account for crypto".

This template is not a simple copy-paste, but an entire pathway:

First, help you buy crypto discreetly yet compliantly: provide OTC channels, cooperate with PIPE investment structures, targeted placement, and warrant plans.

Second, teach you how to "put crypto assets into financial reports": how to make auditors confirm these coins actually exist?

Third, solve your US political channels: the compliance path for US stocks, how to disclose, solved in one go. In the process of traditional companies transforming into crypto treasuries, Galaxy has almost participated in every key move.

CEO Novogratz said in the Q2 call: "Almost all traditional Wall Street institutions are preparing for a completely new financial architecture - assets moving from accounts to wallets, funds and stocks beginning tokenization, stablecoins becoming the mainstream payment carrier."

And what Galaxy is doing is precisely turning these institutional changes from "concept" to "statements".

For many listed companies, choosing Galaxy Digital is not just selecting a crypto service provider, but more like choosing a channel with a "politically legitimate identity".

III. Reshuffling of Power in the Crypto Industry

In 2025, the crypto industry seems to be ushering in a spring of normalization: ETF approval, stablecoin legislation, enterprise crypto holding - everything is moving closer to traditional finance.

But in this "compliance" wave, the real winners are not the decade-long decentralization advocates, but a small group of political and business navigators who are proficient in institutional language and grasp policy rhythms.

From crypto to Wall Street, from wallets to financial reports, the path of crypto assets appears compliant on the surface, but fundamentally represents a typical institutional arbitrage - whoever can build a bridge between regulation and capital will have pricing power.

In the Q2 financial report call of 2025, an analyst asked: "How do you view the development opportunities of stablecoins and asset tokenization?"

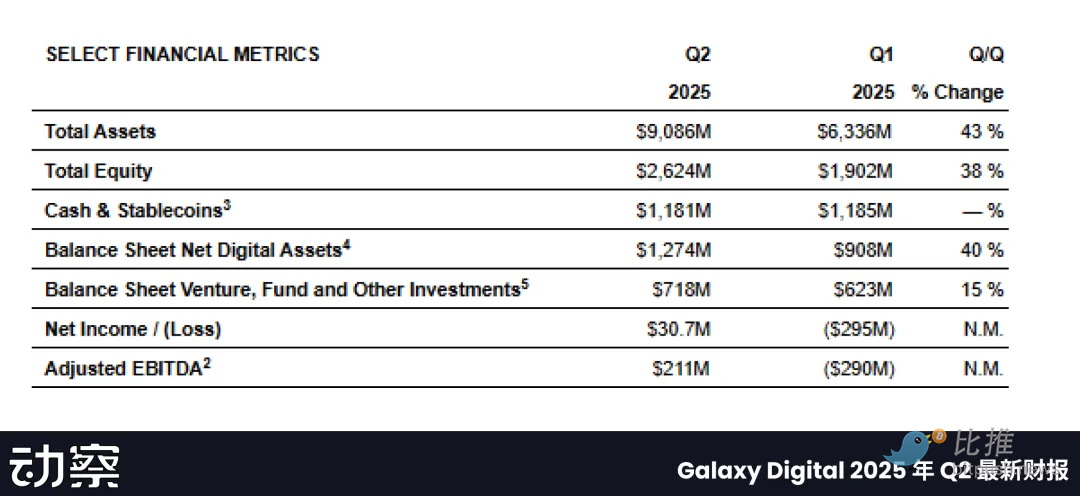

Novogratz's answer barely touched on products, but was a seemingly simple yet institutionally significant judgment: "Assets are migrating, accounts moving to wallets, compliance paths will become the core competitiveness." It was also in this quarter that Galaxy Digital began to turn losses into profits.

Galaxy Digital is the hidden intermediary in this power transfer. It doesn't issue coins or tell narratives, but is proficient in structural design, packaging on-chain assets into every link of PIPE financing, ETF custody, and audit disclosure, using a complete set of compliance grammar to legally onboard new finance.

What it sells is not service, but structure; what it earns is not market money, but the gaps in compliance systems.

This is the real power structure of the crypto industry: while surface-level market prices, protocols, and narratives rise and fall, the underlying institutional structure is already firmly controlled by a few.

More and more crypto projects and traditional companies are completing their "political entry" through it. But what's truly being fed are not developers or investors, but those with dual-language capabilities who can freely switch between crypto, traditional finance, and power.

When compliance becomes a scarce resource, a new hierarchical order is quietly taking shape: the era no longer rewards those who run fast, and power is returning to the rule-makers.

Twitter: https://twitter.com/BitpushNewsCN

Bitpush Telegram Group: https://t.me/BitPushCommunity

Bitpush Telegram Subscription: https://t.me/bitpush