Apart from the legend of 10,000 BTC for two pizzas, few stories can vividly demonstrate the huge value of cryptocurrency like the hard drive containing 8,000 bitcoins was accidentally thrown into the trash.

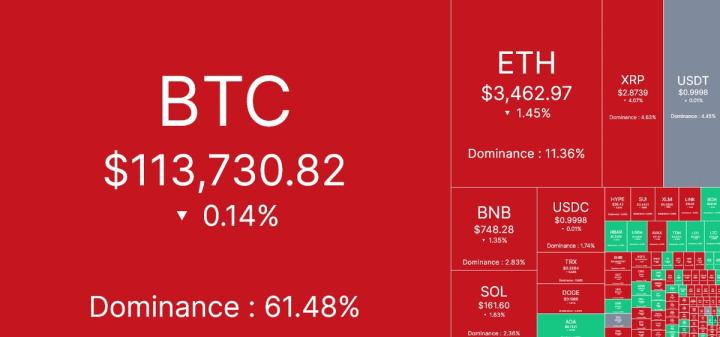

The story of the lost 8,000 bitcoins is retold every time a bull market hits, and this cycle is no exception. In the 12 years from 2013 to today, the value of these 8,000 bitcoins has risen from $1.4 million to $1 billion, yet they are still buried in a garbage dump the size of 15 football fields.

The man who lost this huge sum of money is James Howells, an IT engineer from Newport, England.

There have been recent rumors that he has given up his search, while others claim he remains steadfast. In fact, James has not given up and plans to tokenize his ownership of the BTC, issuing a new token and launching an ICO later this year.

The summer night when the hard drive was lost

In August 2013, James and his partner, Hafina, lived in a modest townhouse in Newport, Wales, a small English coastal town famous for its coal and steel ports.

They have two infant sons, and while the house is often filled with laughter, caring for them is not easy. James often works from home. During the day, he is an engineer maintaining the community emergency response system across Wales. He has to ensure that critical equipment such as alarm lines and backup power supplies are functioning properly, while also often trying to get the children to sleep. You can imagine how exhausted he is.

In order to relieve his fatigue, he decided to take a short vacation to completely relax, so he made an appointment with his friends to go to a nearby beach for a few days. He even named this trip "Boy's Vacation".

One night before his departure, James began tidying his cluttered study. "I'm going to have to drink on vacation, and I don't want to have to clean up after a hangover." It was this sudden flash of inspiration that changed James' life.

Hafina came in and began helping him pick up the scattered engineering drawings, discarded network cables, and various electronic components. A sea breeze blew in through the half-closed blinds, carrying a salty, damp smell. It was late, and the child in the next room was already fast asleep. James placed three or four bags of miscellaneous items by the door. When they were done, they both lay down on the bed, drowsy.

James hoped Hafina would take out the trash on her way to daycare the next morning. But Hafina refused, saying, "That's not my job. Go take it out yourself." Just before falling asleep, he suddenly thought of the hard drive.

Engineers have an almost instinctive sensitivity to data security: they know that hard drives often contain critical information such as system configurations, logs, and private keys. If lost, these important information could become irrecoverable. Therefore, engineers won't just throw away hard drives. So he silently thought about the hard drive, reminding himself to take it out.

But fatigue soon overwhelmed him, and he never had time to take out the hard drive.

The next day, Hafina woke up early. Unaware of the contents of the three or four bags, she took them to the landfill, as James had intended. Around nine o'clock, James woke up and groggily asked, "Did you take the bags to the landfill?" Hafina said yes, and James thought, "Oh shit, she threw them away." Still groggy, he quickly drifted back to sleep.

10 weeks of mining, 8,000 BTC earned

This lost hard drive is what James has been searching for for twelve years. It contains 8,000 bitcoins that James mined in his early years, which are now worth $1 billion.

It was 2009, and Bitcoin was still in its proof-of-concept phase, with only a handful of nodes on the network. James recalls, "I knew I was one of only five miners because when I connected to the network, it would say 'You are connected to x nodes' in the bottom right corner."

Influenced by his mother's work at a microchip factory, James began assembling computers at age 13 and spent his days online. He has worked in various IT jobs throughout his adult life and is a neoliberal. Following the 2008 financial crisis, James came to believe that fiat currency was a "scam," and he harbored deep skepticism towards those in power, which naturally led him to embrace Bitcoin's vision.

He first learned about Bitcoin on a forum. He was immediately drawn to the Bitcoin system, which works by connecting multiple computers together to form a large, secure network. It reminded him of two of his favorite applications: Napster, a rogue service for sharing music files, and SETI@home, a project that allows users to pool their computing power to search for extraterrestrial life.

James then used his Dell XPS laptop to download free software and mine Bitcoin, becoming an early adopter of the technology and earning himself some Bitcoin. This led many to believe that James had communicated with Bitcoin creator Satoshi Nakamoto and that his hard drive might even contain Satoshi's IP address, a figure far more valuable than 8,000 BTC.

But for James, his most valuable asset remains his 8,000 bitcoins. To prevent malicious actors from exploiting his holdings, he intentionally kept the number vague several times during subsequent searches: initially stating 4,000, then 7,500, before finally admitting the true number was 8,000 in recent years.

He had left his laptop in the bedroom, and the humming noise from the fan when the laptop was running prevented his partner Hafina from sleeping. Hafina felt irritable and complained many times.

Although he had no plans to spend the Bitcoin he mined, as it was worthless at the time and there was no reason to believe it would ever be, James initially mined for fun, "just an experiment." So, without hesitation, he stopped mining. During those 10 weeks of experimenting with the new cryptocurrency craze, the electricity needed to keep his computer running cost him about ten pounds.

Not long after, James spilled a glass of lemonade on his laptop, and despite his efforts to clean it up, it wouldn't work. He sold the parts, kept the hard drive, and transferred all the photos and music on it to a Mac. The only thing he couldn't copy was the small file containing the Bitcoin password, because it wasn't compatible with Apple's operating system.

He tossed the hard drive into one of those “long-forgotten” drawers most of us have at home and forgot about it for the next three years, focusing on work and family life.

Then, on that summer night in 2013, James said, "Throw this away, and look at that..." while chatting with his partner Hafina while cleaning the room, he threw the hard drive into the black trash bag next to him, and threw a bunch of cables and mice that he thought were "useless" into the trash bag. Hafina threw it into the landfill. At that time, the 8,000 BTC were worth about 1.4 million US dollars.

His despair is as big as 15 football fields.

On the second day of vacation, the sun and waves did little to soothe James's anxiety. Friends noticed that he kept putting away his glass without finishing his drink, and his face was gloomy.

"I feel very bad and I don't know why," he said to the people around him.

Then he stumbled upon a BBC report online: a 29-year-old Norwegian man used the proceeds from selling 1,000 Bitcoins to pay a down payment on a $400,000 apartment. The article stated that those Bitcoins were worth about $170,000 at the time. James was stunned to realize that he had mined 8,000 Bitcoins, seven times more than the Norwegian. By the fall of 2013, the total value of those coins exceeded $1.4 million. His engineer salary was a mere tens of thousands of pounds, and he still had to wake up at 3 a.m. to make the long trek to repair the town's emergency response system.

With a tight heart, James hurried back home, ran to the study and opened the drawer: there was only an empty hard drive inside, not the hard drive containing the private key and transaction records.

In a panic, he suddenly remembered that summer night a few months ago, when he threw the hard drive containing 8,000 bitcoins into the trash bag with his own hands.

He wanted to rush to the garbage dump immediately, but was afraid that others would not believe him: "It's not easy to explain Bitcoin to others." So, for a month, he often checked the market silently, watching Bitcoin soar from a few dollars to hundreds, thousands, and then to tens of thousands of dollars - the assets he lost evaporated more and more outrageously.

Finally, after the value of the Bitcoin soared from $1.4 million to around $6 million, James finally broke down and confessed everything to Hafina. Hafina was stunned, but she firmly encouraged him: "Go to the garbage dump. Maybe there's still a chance."

So they went to the Newcastle landfill and said to the landfill manager, "I might have dumped a hard drive with Bitcoin private keys in it, $6 million worth of garbage."

The manager was silent for a moment, then led them to a higher ground, and James' heart sank.

He saw the entire dump with his own eyes: piles of dirt, garbage, and waste formed a mountain the size of fifteen football fields. The garbage from three or four months ago was probably three to five feet deep.

One employee who worked at the landfill said, "People often come looking for things they accidentally threw away, even less than 24 hours ago. We always allow them to go to the landfill for a quick inspection. As soon as they see what they see, their faces turn pale. No one has ever found their belongings in this huge garbage dump, and the possibility of that happening is zero."

But James also learned some good news: the landfill wasn't just a random dump; it had a structure. The city had divided the landfill into different areas: asbestos went into one area, regular household waste went into another. "Once the hard drive is buried in a specific unit, locating it isn't impossible, but you'll need permission from the city."

After returning home, James opened Google Maps and carefully measured the landfill's boundaries and zoning. "Space is limited, and while the amount of garbage is huge, it's piled in an orderly fashion. Maybe I can find it."

With hope and direction, he quickly called the city's waste disposal department and left a voicemail requesting a search permit, but no one responded. Little did James know, as he waited for a call back, that he still hadn't received the permit 12 years later.

Searching became the main theme of his later life

From that day on, searching for Bitcoin became the main theme of his life.

He first submitted a formal application to Newport City Council, pleading for permission to enter the landfill to search it, but the council's response was repeatedly delayed: some questioned the environmental risks, some worried about public safety, and some dismissed it as "wishful thinking."

Initially, Newport officials said they would certainly return the hard drive if they found it, but later they took a harder line. How could Howells be sure the drive had actually been dumped in a landfill? They warned that it was likely unusable anyway: it would have been destroyed en route to its toxic burial site. Furthermore, the environmental risks of retrieving the drive were too great.

After studying the structure of the hard drive, James refuted the claim: although the outer shell is made of metal, the internal platters are coated with anti-corrosion cobalt, which makes them highly resistant to pressure and corrosion. He also cited the precedent of recovering data from the black box of the Columbia space shuttle in 2003, and invited Minneapolis Ontrack Data Recovery Company to conduct an assessment. The company optimistically estimated that as long as the platters were intact, 99% of the data could be salvaged.

But all this technical analysis was met with little more than empty talk by city officials. In 2017, the city again formally denied his request to excavate the hard drive, citing a consultant's statement that "there appears to be no practical way to recover the hard drive." The city later took a harder line, stating that searching the hard drive was illegal.

As the value of Bitcoin continued to rise, James's obsession with finding the hard drive grew deeper and deeper, even considering suing the city government, a move that is common in the United States but rare in the UK.

By early 2018, James had "buried" more than $100 million worth of Bitcoin in the landfill, but Congress still refused to give in.

Unwilling to accept this, James hired a team of lawyers and filed a judicial review against the City Council in the High Court, seeking on-site search rights. In court, he proposed donating 25% of the proceeds from the hard drive recovery (approximately £200 million at the time) to Newport's more than 300,000 residents, an average of £175 per person. He also envisioned establishing Newport as the UK's first "cryptocurrency hub," establishing blockchain education and crypto payment platforms.

“If the hard drive cannot be found or is damaged beyond recovery, who will bear the cost?” the city council countered.

In 2022, James' team upgraded their plan again, planning to introduce AI robotic arms for garbage identification, drones, and Boston Dynamics' "robot dogs" for safety, and to recruit dedicated environmental and data recovery experts. The overall budget increased to £10 million to £11 million. Meanwhile, a venture capitalist expressed willingness to cover this budget, but offered a 50/50 split on any recovered Bitcoin.

The latest news is that he gave a speech at the Bitcoin 2025 conference and said that he plans to buy the land where the landfill is located.

The lost Bitcoin completely changed the trajectory of his life

James's pursuit continues, and he has paid a huge price for it.

Since the summer of 2013, when Bitcoin prices fluctuated between $50 and $266, he spent a full 11 years battling the Newport City Council and the courts—conservatively estimated to have cost him over $100,000 in legal fees alone. Some quipped, "He should have spent his money on Bitcoin instead of legal fees." Indeed, if he had invested those legal fees directly in the market, he would be a billionaire today.

Using another way of calculating it, James once raised $5 million in an attempt to buy the entire landfill.

From an opportunity cost perspective, this investment is even more absurd: If he had raised $5 million in 2013, when he lost the hard drive, instead of buying the junkyard, and instead repurchased BTC at an average price of $192, he would have gained approximately 26,500 BTC. Today, the market value of these 26,500 BTC has reached $2.78 billion, more than 3.5 times his initial loss. Even more extreme, if James had invested $100 per month from that time on, he would have accumulated 10 BTC in nine years, enough to cover his expenses for the rest of his life without becoming destitute.

James also attempted to resume mining a few years ago, using a set of ten S9 processors—powerful processors he ran around the clock for a year and a half. However, the economics of Bitcoin mining had changed so dramatically that he decided it was no longer worthwhile: the electricity costs exceeded the value of the bitcoins he was mining. This venture was another failure.

In the end, he "screwed up" three times in his pursuit of the hard drive: once he lost the hard drive, once he wasted the funds he was looking for on expensive lawsuits and plans, and once he decided to give up mining again.

This is not the biggest failure. For James, the biggest trouble brought by the loss of 8,000 BTC is that it completely changed the trajectory of his life.

James and Hafina never spoke to each other again after the breakup

In the first few years of their Bitcoin exploration, James's partner, Hafina, was also deeply troubled.

Strangers, media reports, and friends around her kept tagging her online and commenting on her experience of her family losing 8,000 bitcoins. After all, it was she who threw away the garbage bag containing the hard drive.

“It’s not my fault,” Hafina said, tired of explaining it all and hearing this story of lost wealth. “He begged me to take the trash away, and I just did what he asked.” “I really hope he finds it because it will finally shut him up.”

Hafina, a mother of two, shared her conflicting feelings: "On the one hand, I think it would be good for his mental health if the city allowed him to dig the dump and try to find the fortune he dreams of. But on the other hand, I think it would be best for him to just let it go."

"It looks like he's blaming me, even though I know he's not really blaming me. We're not even talking right now."

James later admitted as much: "Publicly and in my daily life, I tried not to blame her, but I know subconsciously I did it."

So they divorced, and Hafina left the townhouse with her two children, leaving behind only their dog, Ruby. The sheets on the children's bunk beds were wrinkled and musty, the wallpaper was peeling, and the room was covered in dust.

Hafina stated that the relationship ended for other reasons, not Bitcoin. Losing the Bitcoin itself never bothered her: "It's not a physical object. Money has never been that important to me." "Whatever the Bitcoin he eventually finds is worth, I have no right to ask for it. Even though he's the father of my two sons, I don't want a cent."

James's life was completely disrupted. He lost motivation to work, for a while avoided checking the Bitcoin market, and studiously avoided the road to the garbage dump. He admitted, "Sitting at the console every day, I couldn't concentrate. The memory of all the wasted money was overwhelming."

More than a decade later, his children are now busy with other things and rarely visit him. He has tried other intimate relationships since Hafina, but the trauma remains in him.

James occasionally imagines a parallel self living a different life: perhaps he's still with Hafina, married and raising a family, just like the beginning. When they first got together, James was 20 and Hafina was 22. They should have had a happy life. And if he hadn't lost those bitcoins, they might still be living on a yacht.

Selling this story for ten years

James also became suspicious and extreme because of this incident. He deliberately blurred the number of bitcoins several times when announcing the figures to the public: he first said it was 4,000, then said it was 7,500, and only in recent years did he admit that the real number was 8,000, in order to confuse potential "thieves."

When the media or other partners asked him to verify more details, he refused because he was worried that the information would be leaked to the current excavation team's competitors and attract some "tomb robbers."

Those who have interacted with James often find him evasive and defensive. Once, a friend asked him what he thought of the COVID-19 vaccine still under development. He replied, "One thing I learned from the IT world is... never try the first version." Regarding the GameStop stock short squeeze in 2021, James called it a completely rigged game.

And more voices are saying that James oversold his story.

Los Angeles-based LEBUL Productions has been authorized to bring his life to the screen, titled "Buried Bitcoin: James's True Treasure Hunt," which is expected to be released at the end of 2025. His story will be presented in a "high-tech treasure hunt" scene with extensive CGI special effects.

"This is the tenth time he's sold his story and gotten it in the newspapers," one netizen remarked. For him, media exposure is both self-consolation and a last resort to maintain hope. Every time he's preparing for a documentary, he'll reveal new progress: claiming he's almost figured out the hard drive's location, or that he's already launched a new AI robotic arm screening solution. To keep onlookers interested, perhaps he can raise the next round of "search funding."

Recently, James unveiled a radical new concept: a token called Ceiniog Coin (INI), with a total supply of 800 billion, targeted for launch by the end of the year. Each INI will be embedded with Bitcoin's OP_RETURN data and integrated with protocols like Stacks, Runes, and Ordinals, anchoring the value of one satoshi of the lost 8,000 BTC. He claims that coin holders will be able to share in any future profits from the recovery or assetization of the hard drive.

All this sounds both imaginative and absurd.

Because of the story's dramatic nature, many suspect it's a fabricated lie from beginning to end. After all, in the UK, you can sell any small story to a tabloid for £250 per article, let alone a story this dramatic, reiterated every day for ten years. However, I disagree, as I see numerous details in this story, and as we all know, lies don't usually contain many details.

James's favorite movies in the past were "Fight Club" and "The Matrix" - for a person who is keen on technological utopianism, these two films carry his worldview.

Today, he often refers to Final Destination, where even a loose screw or a faulty pool drain can trigger a catastrophic chain reaction. He says this is exactly how he was portrayed: a seemingly insignificant hard drive rocked his world.

James Howells' life has been haunted since the summer night in 2013 when he lost his hard drive.

Click here to learn about BlockBeats' BlockBeats job openings

Welcome to join the BlockBeats official community:

Telegram group: https://t.me/theblockbeats

Telegram group: https://t.me/BlockBeats_App

Official Twitter account: https://twitter.com/BlockBeatsAsia