Author: Ethan, Odaily Planet Daily

Earnings season is the most honest moment in the capital market.

When Bitcoin and Ethereum are no longer just "investment targets to consider" but enter corporate financial statements as assets, they become more than just code and consensus, and become part of the valuation model - even one of the most sensitive variables in market capitalization.

In the second quarter of 2025, a group of listed companies strongly bound to crypto assets delivered vastly different "mid-term report cards": some achieved geometric expansion of net profit through BTC's rise, some flipped core business losses with ETH staking income, and some embedded "indirect exposure" to crypto assets in the form of ETFs.

Odaily selected six companies for in-depth analysis - DJT, Strategy, Marathon, Coinbase, BitMine Immersion, and SharpLink Gaming - distributed across different industries, markets, and strategic stages, collectively revealing a trend: when BTC is a valuation amplifier and ETH is a cash flow engine, corporate balance sheets are undergoing a paradigm shift.

Bitcoin in Financial Reports: Faith Remains the Main Theme, but Variables Are Increasing

DJT: Writing Stories with BTC, Amplifying Valuation with Options

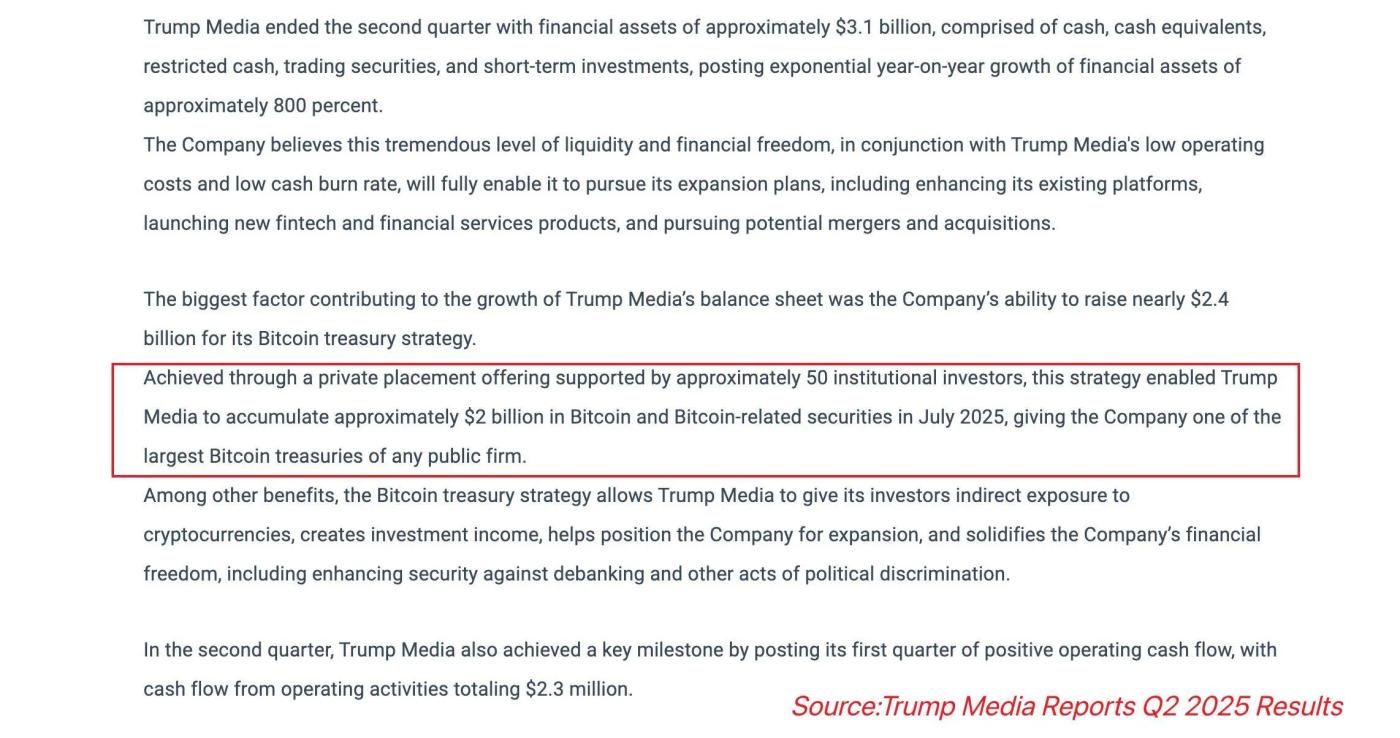

No one understands how to write Bitcoin into financial reports and amplify it as a valuation engine better than DJT (Trump Media & Technology Group).

In the second quarter of 2025, DJT disclosed holding approximately $2 billion in Bitcoin assets, structurally comprising about $1.2 billion in spot holdings and about $800 million in BTC call options. This structural combination is essentially a "leveraged digital asset bet" - not only capturing price increases but also embedding non-linear market value growth elasticity.

Its EPS jumped from -$0.86 in the same period last year to $5.72, with net profit breaking $800 million, almost entirely driven by BTC's unrealized valuation gains and option exposure market value changes.

Unlike Strategy's "long-term configuration", DJT's BTC strategy is more like an aggressive financial script experiment: leveraging market expectations of BTC's rise to write a narratively expandable valuation model, hedging risks of an underdeveloped business, and creating financial narrative spillover.

The DJT report also mentioned future plans to continue deploying Truth+ reward mechanisms and embedded wallet tokens, and simultaneously submit registration applications for multiple Truth Social brand ETFs, attempting to lock in broader liquidity through a "content platform + financial product" composite path.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations and formatting.]Media speculates that its Q2 unrealized earnings from ETH Staking reached $32 million to $41 million. However, since the company has not yet disclosed a complete financial report, we cannot confirm whether these earnings are included in the report or how they are accounted for (such as being recorded as "other income" or asset appreciation).

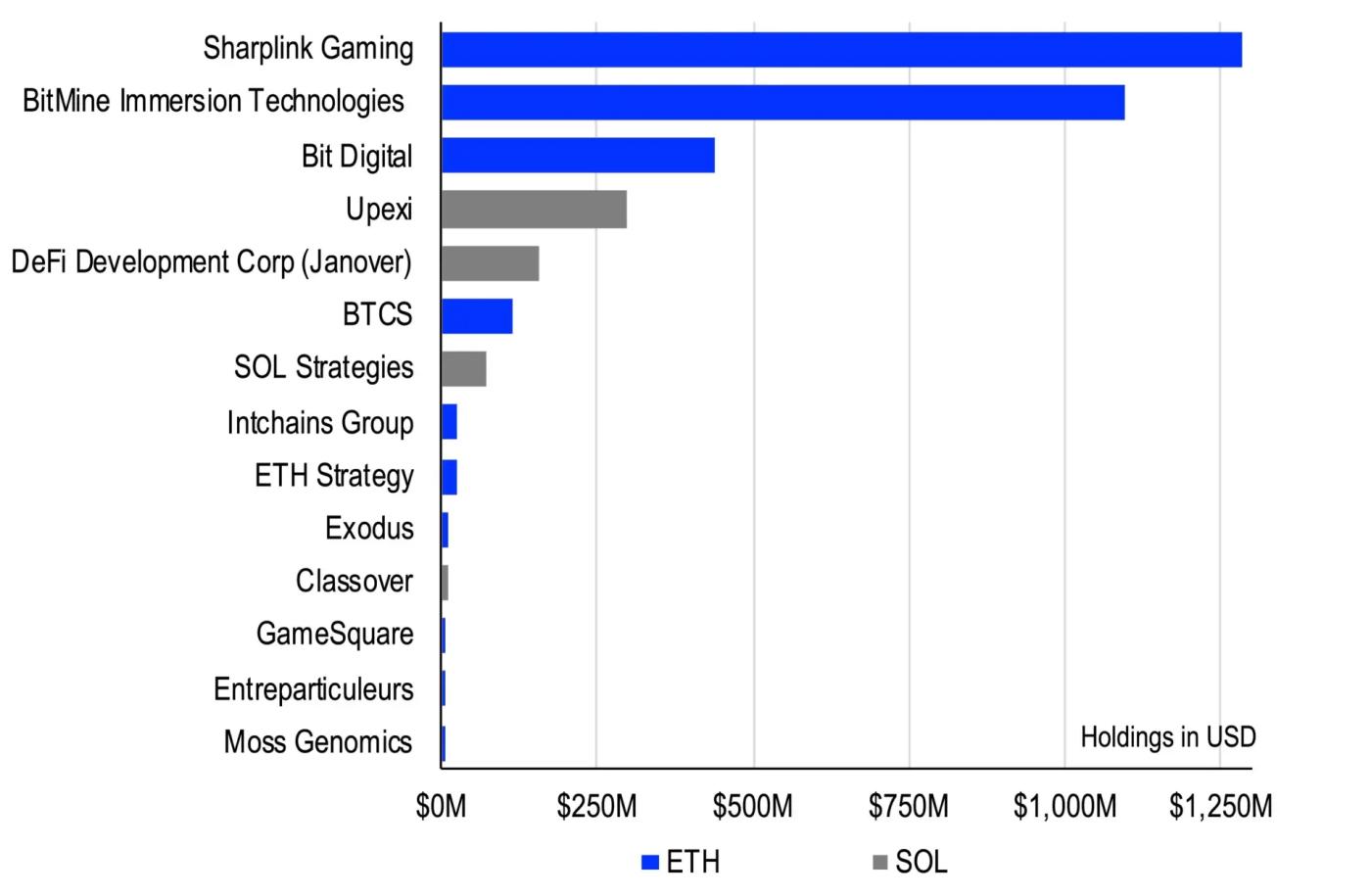

Nevertheless, BitMine's stock price rose by over 700% in Q2, with its market value breaking through $6.5 billion. It is widely viewed as a pioneer in ETH financialization, similar to MicroStrategy's positioning in BTC financialization.

SharpLink Gaming: The Second Largest ETH Reserve Enterprise, but Q2 Financial Report Not Disclosed

Based on publicly tracked ETH reserve data, SharpLink holds approximately 480,031 ETH, ranking second only to BitMine. The company has invested over 95% of its ETH in Staking pools (including Rocket Pool, Lido, and self-built nodes), constructing a structure similar to an "on-chain yield trust".

According to its Q1 financial report, ETH Staking earnings have already covered its core advertising platform business costs and recorded its first quarterly positive operating profit. If ETH price and yield remain stable in Q2, the estimated total earnings from ETH Staking are expected to be in the $20 million to $30 million range.

Notably, SharpLink conducted two strategic equity financing rounds in the first half of 2025, introducing an on-chain fund structure as collateral, with its ETH reserves used as "on-chain proof" for these financings, indicating the company is actively exploring ETH Staking as a "financial credit tool".

However, SharpLink Gaming (NASDAQ:SBET) has not yet released its 2025 Q2 financial report. Its ETH reserves and earnings structure are based on the 2025 Q1 quarterly report and media tracking data, and thus should only be used as a reference for financial report structure, not as investment data evidence.

Conclusion

From DJT to SharpLink, these enterprises collectively demonstrate a trend shift: crypto assets are no longer just speculative tools or hedging configurations, but are gradually being internalized as enterprises' "financial engines" and "report structure variables". Bitcoin brings non-linear valuation amplification to reports, while Ethereum builds stable cash flow through Staking.

Although currently still in the early stage of financialization, with compliance challenges and valuation volatility still present, the Q2 performance of these six enterprises suggests a possible direction - Web 3 assets are becoming the "next grammar" of Web 2 financial reports.