When Coinbase's stock price plummeted 15% on Friday, market focus was on the bleak numbers in the financial report: total revenue decreased by 26% quarter-on-quarter, trading revenue plunged by 39%, and cryptocurrency spot trading volume shrank by over 30% compared to the first quarter. However, amid the panic selling, Mark Palmer's team at Benchmark wrote a completely different suggestion in their Monday report: "These operational indicators are just noise, and buying the dip is very wise" - they not only reiterated the "buy" rating but also gave a target price of $421, implying over 30% upside from the current stock price.

I. Financial Report Storm: Hidden Deep Crisis

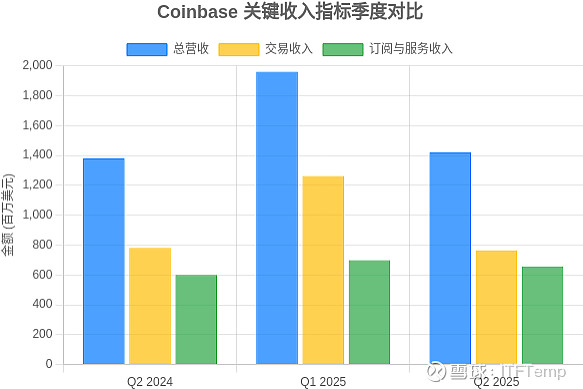

Coinbase Key Financial Indicators Quarterly Comparison (Unit: Million USD) Trading Revenue

Coinbase's 2025 second-quarter financial report was like a depth charge, stirring up huge waves in the cryptocurrency market. Behind the seemingly glamorous net profit of $1.43 billion, a dangerous financial structure was hidden - $1.5 billion came from unrealized gains on the strategic investment in Circle, and another $362 million from the book value increase of crypto assets. After removing these "water" elements, the adjusted net profit was only $33 million, a 37% year-on-year decline. The speed of core business bleeding far exceeded expectations: trading revenue plummeted 39% year-on-year to $764 million, far below market expectations.

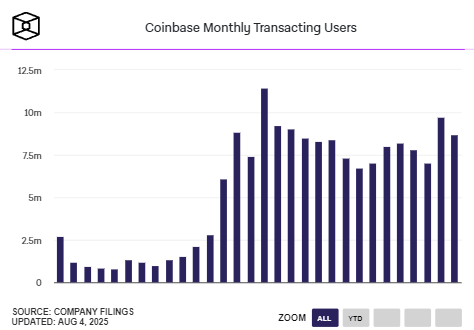

User loss and trading contraction formed a vicious cycle: the number of trading users in the second quarter sharply decreased by 1 million, falling back to 8.7 million. More critically, old users fell into "emotional panic", with per-user trading volume dropping cliff-like by 38%, directly leading to the platform's dismal trading volume. The total trading volume of $237 billion, though slightly increasing year-on-year, dropped by 40% from the first quarter, with retail trading volume decreasing by 45% and institutional clients reducing by 38%. Subscription and service revenue simultaneously declined by 6% to $656 million, with only the stablecoin business (mainly USDC) being a weak bright spot, with revenue increasing by 12% quarter-on-quarter to $333 million.

The market's punishment came swiftly and cruelly: after the financial report was released, the stock price dropped by over 9% after-hours to $377.7, and then continued to explore down to a low of $314, with market value evaporating by nearly $10 billion. This selling wave reflected investors' profound concerns about Coinbase's business model vulnerability - when trading revenue still accounts for 52.26%, the weakening of market volatility is enough to pierce the profit line.

II. Five Key Signals: Decoding Benchmark's Bullish Logic

1. Stablecoin Bill's "Policy Dividend"

Benchmark emphasized that the GENIUS Bill is far from empty talk. Coinbase is deeply integrated with the USDC ecosystem, with Q2 stablecoin revenue reaching $333 million, a 38% year-on-year increase, rising to 22% of total revenue. The average USDC balance on its platform reached $1.38 billion, with an external circulation of $47.4 billion, constructing a massive stablecoin network. If the bill passes, Coinbase and Circle's profit-sharing agreement will allow it to enjoy industry dividends, potentially even opening up stablecoin channels with traditional financial institutions like JPMorgan Chase and American Express.

2. Compliance Moat Under Regulatory Framework

Under the expected CLARITY Bill, Coinbase's compliance layout has become a key barrier. In June, it obtained the Luxembourg MiCA license, enabling retail and institutional services in 30 European Economic Area countries. Earlier in February, the US SEC withdrew its lawsuit, clearing major regulatory clouds. These actions have attracted over 240 institutional clients to its "Crypto-as-a-Service" model, including giants like BlackRock and PayPal, forming a hard-to-replicate B-end network effect.

3. Super App Ecosystem Ambitions

The "Western WeChat" strategy is accelerating implementation. The Base App launched by Coinbase has entered public beta, integrating wallet, payment, social, and DApp functions, with active addresses far exceeding Layer 2 solutions like Optimism and Arbitrum. CEO Brian Armstrong directly stated the goal is to build Coinbase into the "top financial service app of the next decade", aggregating trading, DeFi, Non-Fungible Token and other scenarios to transform from a trading platform to a financial ecosystem.

4. Decentralized Exchange Integration Revolution

Acquiring Deribit is just the first step in Coinbase's derivatives puzzle. This $2.9 billion acquisition (including $700 million in cash and 11 million COIN shares) brings the world's largest crypto options platform under its wing, instantly controlling over $30 billion in open interest and an annual trading ecosystem exceeding trillions. More critically, its "Everything Exchange" strategy plans to integrate decentralized exchange liquidity, allowing users to directly trade thousands of on-chain assets within the Coinbase App. Bernstein analysts compared this to the "Amazon of crypto financial services".

5. Early Signals of Trading Recovery

Despite the dismal Q2 trading, Benchmark pointed out a key turning point: July's expected trading revenue is $360 million, a 44% quarter-on-quarter increase. This rebound signal coincides with market recovery indicators like BTC price breaking $65,000 and Ethereum ETF capital inflows hitting new highs. Coinbase quietly increased its BTC holdings by 2,509 during the same period, with total holdings reaching 11,776 (current value $1.26 billion), showing its bet on the market's future direction.

III. Path to Breaking Through: Ambitions of Tokenizing Trillions

Facing the core business predicament, Coinbase has launched a disruptive strategy: tokenizing traditional financial assets. Product VP Max Branzburg revealed that the platform is about to launch tokenized stock trading, targeting the trillion-dollar traditional stock market. By using blockchain technology to achieve global coverage, 24-hour trading, and instant settlement, this move will directly challenge competitors like Robinhood - which already offers similar services in international markets.

"We are building an 'exchange for trading everything', where all assets will be traded on-chain." Behind Branzburg's declaration is Coinbase's ambition to leap into a comprehensive financial market. Prediction markets become another important battlefield, and despite facing competition from professional platforms like Kalshi and Polymarket, its compliance advantages and user base form differentiated weapons.

To support this grand vision, Coinbase's technical investment is fully turning towards on-chain. The Base chain privacy protection team has recently expanded, aiming to solve core pain points for institutional clients. Meanwhile, its cross-border payment strategy targets the $40 trillion B2B payment market, using USDC to open enterprise payment channels, and has already collaborated with e-commerce platforms like Shopify. The transformation from a trading platform to financial infrastructure is gradually dissolving its over-reliance on retail trading fees.

IV. Market Divergence: Tug of War Between Noise and Value

The violent fluctuation of Coinbase's stock price reflects the deep market split in its value judgment.Bears see: trading revenue still accounts for over half, user growth stagnation, and the $9.3 billion cash reserve decreasing by $590 million quarter-on-quarter (6% decline). But from the bulls' perspective, these are just growing pains of transformation:

"Investors should focus less on short-term operational performance and more on the actions the company is taking to build the 'everything exchange'." Benchmark's call directly points to the core divergence. When traditional brokers still value Coinbase using PE metrics, their real bet is: whether tokenized assets can pry open the walls of traditional finance, whether stablecoins can reshape the global payment network, and whether decentralized exchanges can subvert existing trading paradigms.

Wall Street's valuation model has not yet fully digested these variables. However, every move by Coinbase - acquiring Deribit for $2.9 billion, expanding the Base chain ecosystem, and obtaining regulatory licenses in Europe and the United States - is laying the foundation for its "on-chain financial empire". As Armstrong said: "All assets will eventually be on-chain", and Coinbase wants to become that indispensable track.

Conclusion: Crypto Titan at the Crossroads

While the market is anxious about Coinbase's quarterly fluctuations, true strategists are looking at the financial landscape five years ahead. Behind Benchmark's $421 target price is a reassessment of the ultimate value of "trading everything on-chain". Although short-term profitability pain will continue, Coinbase's strategic transformation is rewriting the rules of the game - evolving from an exchange dependent on market sentiment to a financial infrastructure supporting the tokenized world.

The risks of this bold bet are obvious: regulatory volatility, technological implementation challenges, and traditional financial backlash could all become stumbling blocks. But when Friday's panic selling subsides, calm investors need to answer a core question: Are we witnessing the early growing pains of an Amazon-like transformation? The answer will determine whether Coinbase falls into the abyss or navigates through the storm towards a trillion-dollar blue ocean.