As Bybit, Kraken, and Robinhood successively announced their entry into US stock tokenization trading, another milestone moment of integration between the crypto world and traditional finance has arrived. This is not only a positive signal of the crypto field gradually moving towards regulatory compliance, but also indicates that the grand narrative of "everything on-chain" is gradually moving from an abstract concept towards reality.

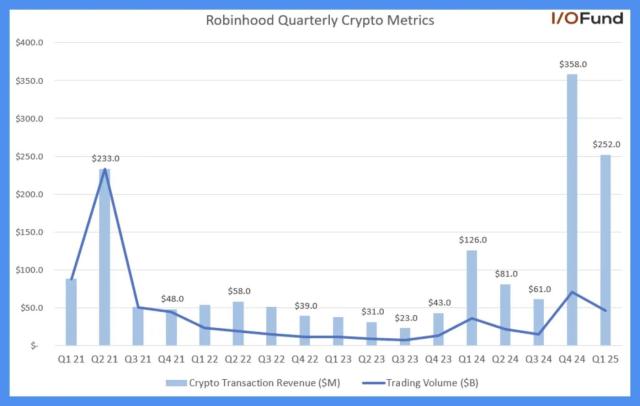

According to rwa.xyz platform data, the market response has been enthusiastic. As of July 18, 2025, the US stock tokenization market has shown explosive growth: total market value reached $512.94M, growing 46.14% compared to the past 30 days; the number of holders increased nearly 20 times, with monthly active addresses growing 165 times. Despite rapid growth, its scale is still just the tip of the iceberg compared to traditional securities markets. The US stock tokenization market remains in its early stages, with immense future development potential.

Image source from rwa.xyz

In fact, US stock tokenization is not a completely new concept in the crypto market. As early as 2019-2021, top exchanges like Binance and FTX had launched related products, but quickly removed them due to regulatory pressure. With the gradual clarification of global crypto regulatory environment and accelerated compliance process, RWA investment concepts have become popular. From crypto exchanges to traditional financial institutions, they are once again exploring US stock tokenization products, reigniting the trend and developing multiple models. MEXC, leveraging its own competitive advantages, has launched US stock token products, helping more crypto native users efficiently participate in US stock market investments through a familiar approach.

What is MEXC's Intention in Launching US Stock Contracts?

MEXC's US stock perpetual contracts primarily provide users with the following three aspects of value:

- Amplify Earnings Potential:

Leveraged trading allows users to participate in larger market scales with smaller funds, significantly improving capital efficiency. For example, $1,000 in funds can control a $5,000 position under 5x leverage, suitable for retail investors with limited capital.

- Flexible Trading Strategies:

Spot trading can only profit through "buy low, sell high", limiting users' profit opportunities in declining markets. TheMEXC US stock contract's long and short bidirectional mechanism allows users to bet on price declines, providing traders flexibility to profit under different market conditions. Even when prices fall, traders can profit by shorting.

- Risk Management and Hedging Tools:

For investors already holding tokenized stocks (such as TSLAx spot), US stock contracts are an essential risk management tool. When market pullback risks emerge, holders can hedge without selling spots by establishing an equivalent perpetual contract short position, locking in portfolio value. Furthermore, traders can use contracts for cross-market arbitrage, constructing market-neutral strategies to achieve more stable risk-adjusted returns in complex market fluctuations.

Horizontal Comparison of Active US Stock Contract Players

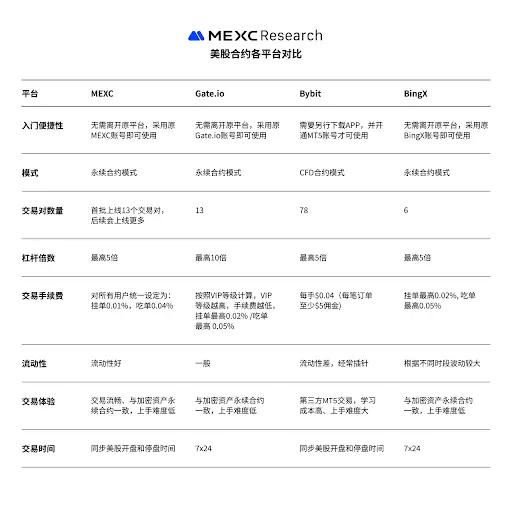

Currently in the crypto market, US stock contract trading remains a broad blue ocean. Among centralized exchanges, the most active players include MEXC, Gate.io, BingX, and Bybit. Overall, MEXC, Gate.io, and BingX rely on perpetual contract models, while Bybit adopts a CFD contract mechanism. Notably, MEXC has built a differentiated competitive barrier with 0 slippage and top market depth.

Liquidity

In liquidity performance, MEXC significantly leads the second place with deep trading depth and strong order book support. Taking TSLA, NVDA, COIN, and HOOD trading pairs as examples, within one day of launch, MEXC's tradable amounts in the 0.2% price fluctuation range were 613,839, 610,693, 602,640, and 391,799 USDT respectively, and 412,883, 351,630, 316,234, and 195,668 USDT within 0.1% range, demonstrating extremely high market liquidity and order execution capabilities. In comparison, the second place's 0.2% depth was only 3,429, 23,414, 37, and 46 USDT, with the highest 0.1% depth at merely 13 USDT, significantly lower than MEXC. This indicates that within the same depth range, MEXC has greater liquidity depth, enabling lower slippage and stronger market stability in matching transactions, significantly outperforming competitors and providing users with more efficient trading experiences.

Trading Costs

US stock contract trading costs are a primary factor users consider. In this core competitiveness, MEXC sets the lowest cost benchmark with its fixed 0.01%/0.04% Maker/Taker rates. In contrast, Gate.io and BingX use VIP tiered rates, with most users bearing higher initial costs of 0.02%/0.05%. Bybit charges $0.04 commission per hand, with a minimum $5 commission per order, and overnight position holders might also pay swap fees.

MEXC's low rates not only save users substantial fee expenses but also apply this policy equally to all users without additional KYC or VIP level restrictions. This non-discriminatory access principle directly benefits cost-sensitive high-frequency and large-amount traders while fundamentally lowering participation barriers for all users.

Ease of Use

MEXC, Gate.io, and BingX all use perpetual contract models with liquidation and closing processes consistent with traditional perpetual contracts. For crypto contract traders, there are almost no additional learning costs, and for beginners, the rules are intuitive and easy to understand. Bybit's CFD model relies on the MT5 platform, involving more complex understanding and calculations, with a steeper learning curve and higher entry barriers.

Additionally, MEXC, Gate.io, and BingX users can directly use existing platform accounts for seamless US stock contract trading, while Bybit CFD contracts require users to download the MT5 platform and register a new MT5 account, adding extra operational steps.

Trading Hours

Platforms differ in US stock contract trading hours. Gate.io and BingX's 7x24 trading mode is flexible, but liquidity insufficiency during market closure (like weekends) is a major concern. Market makers, unable to hedge risks, must widen bid-ask spreads or withdraw liquidity, further exacerbating liquidity shortage, increasing trading costs, causing significant slippage, and potentially triggering liquidation risks even with small orders in low-liquidity environments. MEXC synchronizes with US stock market opening and closing times, restricting high-risk operations during market closure, such as prohibiting order placement while allowing order cancellation and margin supplementation, effectively avoiding extreme market risks in low-liquidity environments and prioritizing user fund safety.

Product Selection

In contract varieties, Bybit, leveraging the MT5 platform, offers 78 US stocks, leading in asset selection; Gate.io currently provides 13 US stock contracts; MEXC follows, with an initial selection of 13 and accelerating expansion of more trading pairs; BingX offers only 6.

Regarding leverage multiples, Gate.io offers up to 10x leverage, attracting traders seeking high-risk, high-return opportunities. MEXC, Bybit, and BingX maintain a relatively stable 5x leverage, seeking balance between earnings potential and risk control.

Summary

MEXC, with its extreme cost advantages (lowest fees) and careful consideration of user security (synchronized opening times), has gained an early lead in attracting crypto native traders. In terms of liquidity, MEXC significantly outperforms its competitors with its deep order book, ensuring users can efficiently execute orders with extremely low slippage, maximizing cost and efficiency advantages. Bybit leads in asset richness, but its complex MT5 model and higher trading costs constitute major barriers. Gate.io leads with 10x leverage, BingX offers 24/7 trading flexibility, but its liquidity risks during non-active periods are worth noting.

In this cycle, new attempts have not been limited to superficial mimicry of tokenizing traditional assets. For example, MEXC fully leverages its core competitive advantages in derivatives (zero slippage, deep liquidity) by offering US stock perpetual contracts, providing users with a new channel to participate in the US stock market. By speaking the language most familiar to crypto users, it effectively transmits the value of traditional finance to the crypto world, offering crypto users a solution to access the traditional US stock market without changing their trading habits.