"I have been having phone conferences that last until two in the morning every day recently."

These words came from an old finance professional who has been working in the traditional brokerage industry for over a decade. As he spoke, he placed his phone face down on the coffee table. His eyes were slightly reddened, but his tone remained nonchalant.

His office in Beijing is located in a courtyard house in the West City District, with two doors slightly peeling. The afternoon light slanted into the yard, with some dust floating in the light beam. He sat by an old wooden table, dealing with regulatory, business cooperation, and project scheduling issues.

Having started in the financial industry over a decade ago, he has experienced the previous financial crisis and navigated global markets, managing funds, running products, and leading teams, almost traversing all continents. In recent years, he began turning towards a direction that the entire traditional financial industry initially thought was "uncertain" - virtual assets.

Traditional finance's attention to Web3 did not start in 2025. If tracing back to the starting point, many would mention Robinhood.

This platform, known for "zero-commission stock trading", had already launched Bitcoin and Ethereum trading functions in 2018. Initially just a product line supplement, users could buy crypto like buying Tesla stocks, without needing a wallet or understanding blockchain. This feature was not heavily promoted that year but became an explosive point years later.

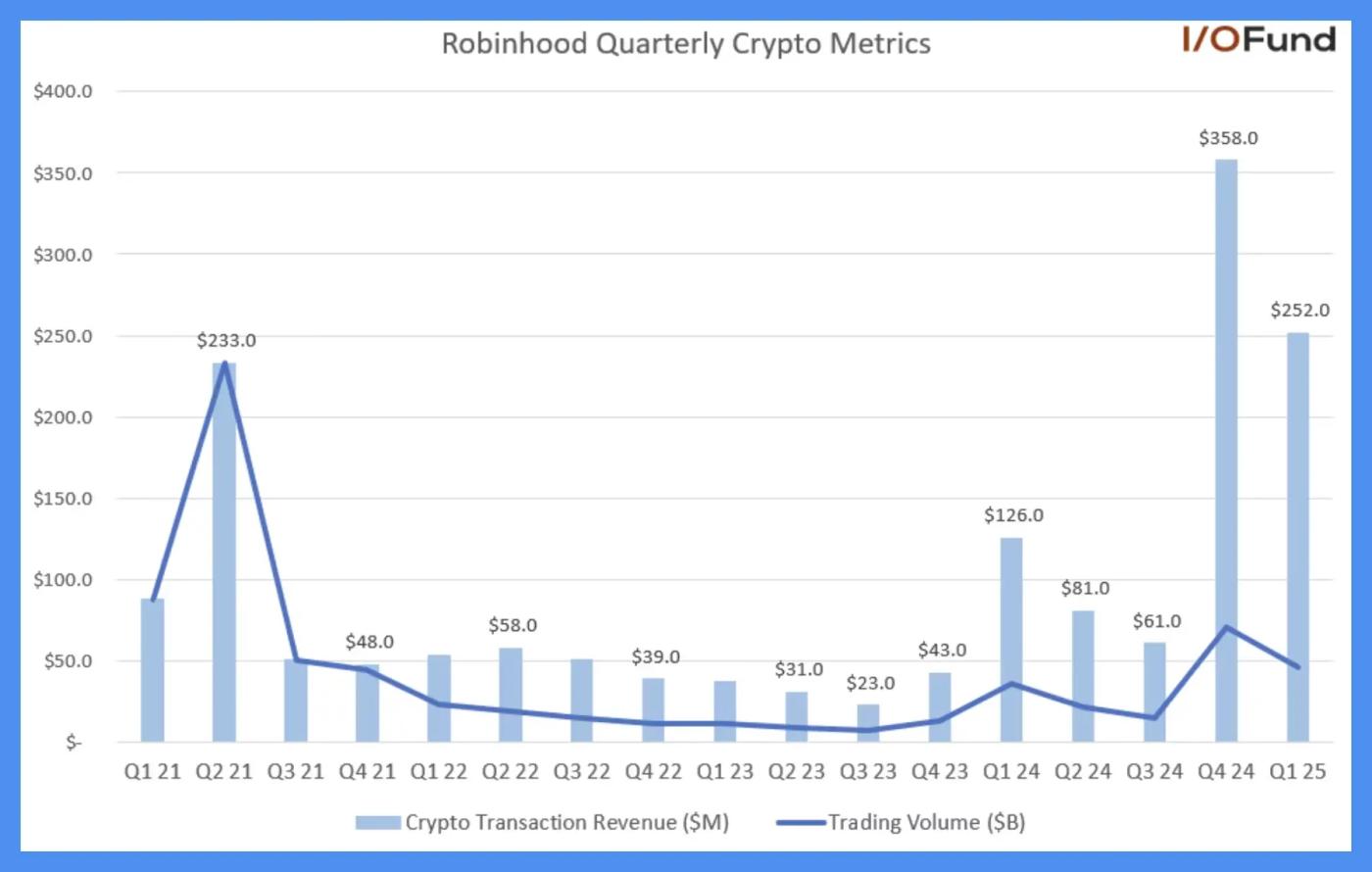

In the fourth quarter of last year, crypto contributed over 35% of Robinhood's total net revenue, with trading volume surging 455%, driving trading revenue to grow 733% year-on-year to $358 million, making crypto Robinhood's largest revenue source that quarter. In the first quarter of 2025, crypto contributed over 27% of total revenue, with trading revenue doubling year-on-year to $252 million.

Robinhood quarterly crypto asset trend, source: IO.FUND

What drove this change was not technology, but thousands of users' clicks. Robinhood did not narrate Web3, but simply followed user trading habits, and discovered that crypto trading was no longer a marginal business, but had become the company's core growth engine.

Subsequently, Robinhood gradually transformed from a centralized brokerage to a digital asset trading platform.

With Robinhood setting an example, traditional finance finally decided to collectively enter the market in 2025. They are not here to experience Web3 or invest in projects, but because "traditional finance will take over the crypto industry within 10 years."

We are already in the midst of this reshuffling of traditional brokerages against crypto natives.

In March 2025, Charles Schwab, one of the world's largest retail brokerages with over $10 trillion in assets under management, announced it would open spot BTC trading services within a year.

In May 2025, Morgan Stanley, one of Wall Street's most influential investment banks, announced plans to officially integrate BTC and ETH into its E*Trade platform, providing direct trading channels for retail users.

In May 2025, JPMorgan Chase, the largest US bank that has long been critical of crypto, announced it would allow clients to purchase Bitcoin.

In July 2025, Standard Chartered, a long-established British bank focusing on Asian, Middle Eastern, and African markets, announced spot trading services for Bitcoin and Ethereum for institutional clients.

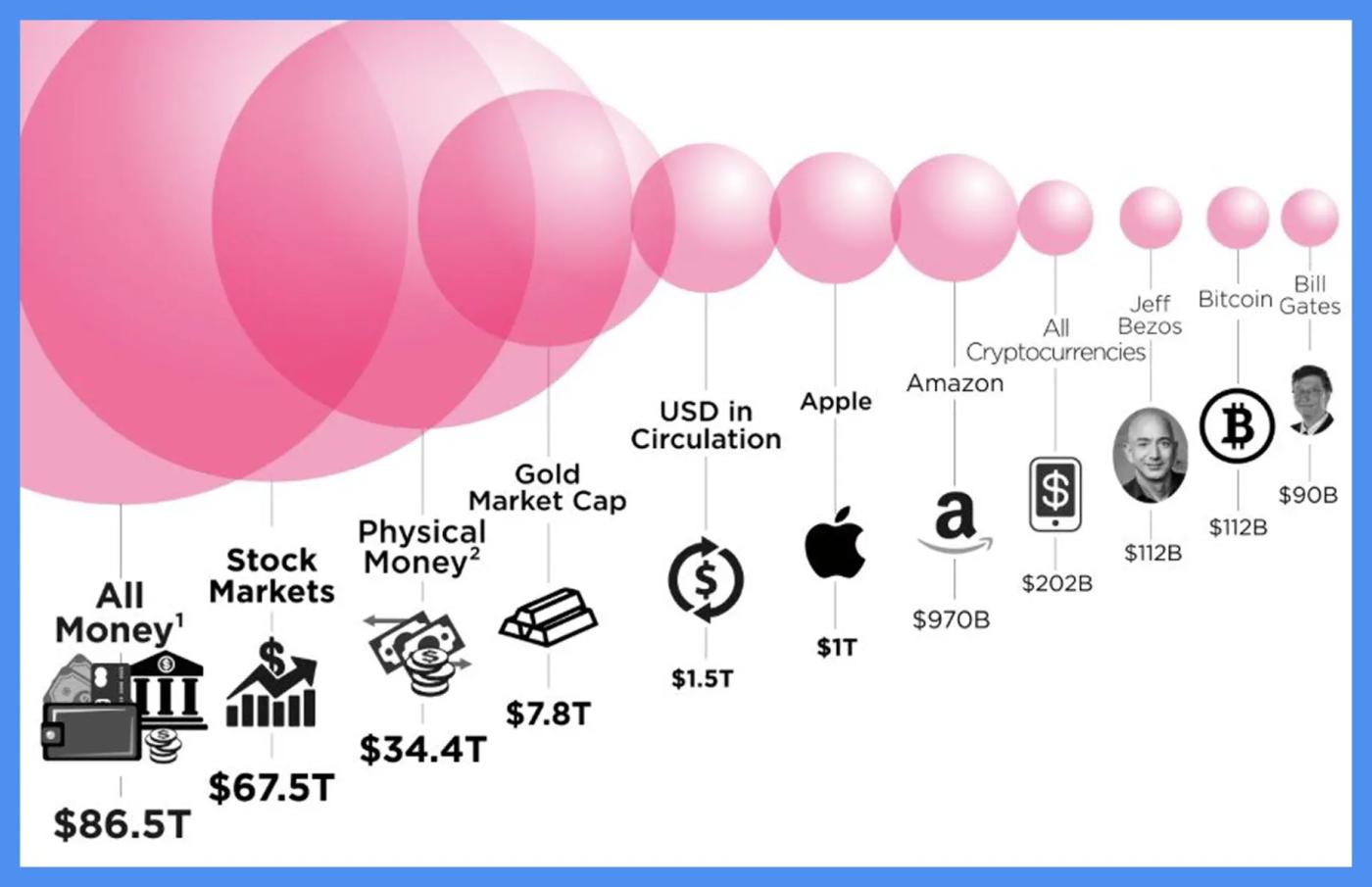

These are behemoths that dominate global financial system operations, controlling global fund flow channels, clearing networks, and fiat payment systems, holding assets worth tens of trillions of dollars. In comparison, the current crypto market capitalization is only $4 trillion.

Mainstream asset market value ranking, source: Steemit Community

They are gradually completing their layout in the crypto field based on traditional financial compliance frameworks. When an institution possesses both compliance trust and user traffic, as well as clearing and settlement capabilities, it has all the elements to build a crypto trading network.

In the traditional financial system, whoever controls account opening rights can control fund flow, customer relationships, and ultimately pricing power. For a long time, crypto trading platforms defined narratives by listing assets and controlled liquidity through deposits, but now, the "asset entry" role stolen by CEX for nearly a decade is being gradually taken back by traditional finance.

"Those crypto trading platforms should be anxious now."

His tone remained restrained, without a hint of schadenfreude. The source of anxiety might not just be due to a specific institution's entry or a policy's implementation, but an industry self-awareness that crypto trading platforms may no longer be the only ones dealing cards at this financial table.

(Translation continues in the same manner for the rest of the text)Perhaps he had already seen that the largest future competitor for crypto trading platforms would be securities firms, so he took the initiative. Looking back now, this model has been picked up by the industry again, but with a different flavor. After FTX's collapse, crypto stocks became a hemostatic bandage, no longer a battering ram.

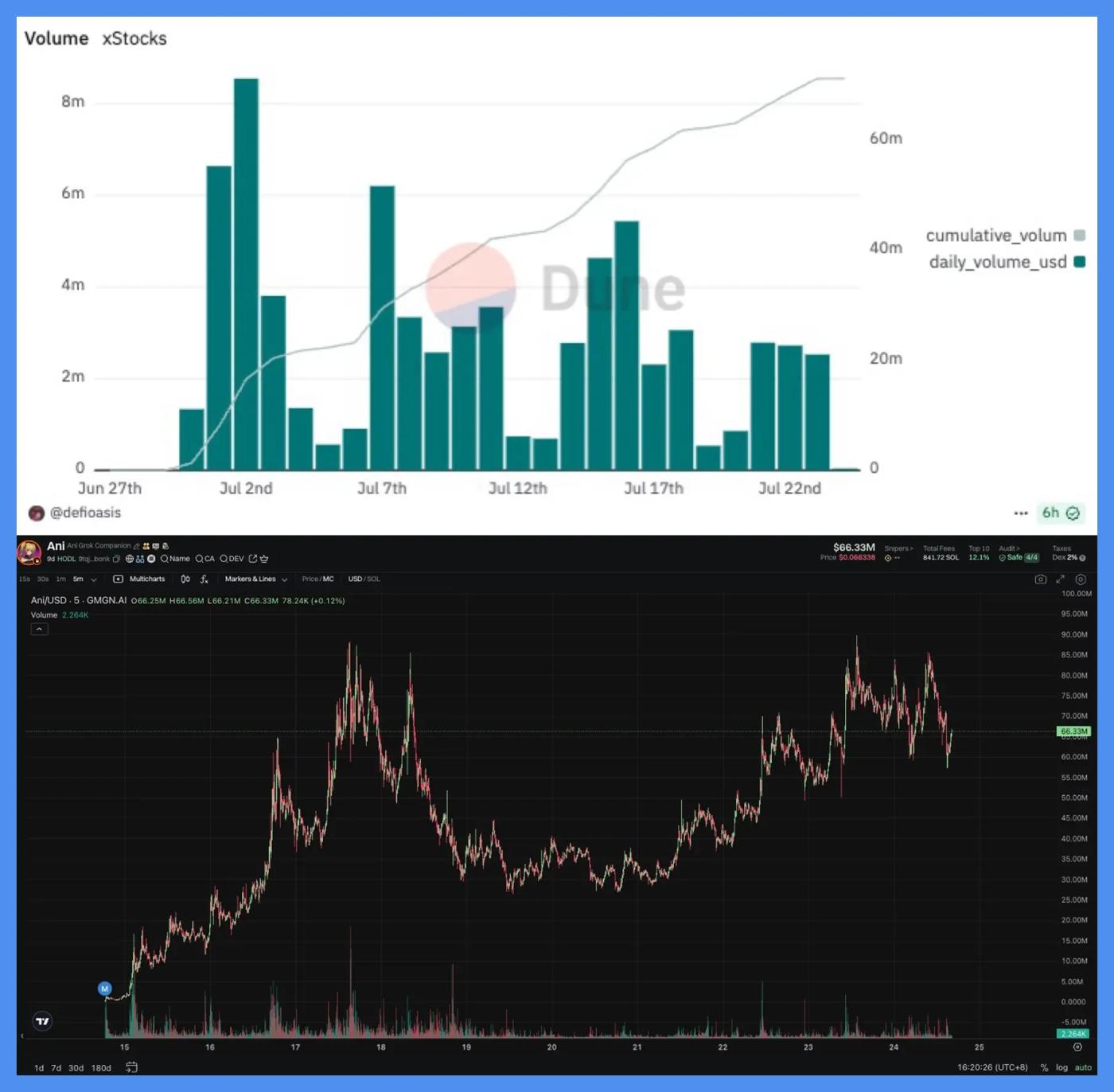

Data also confirms this point.

After the crypto stocks model was launched, it indeed gained initial community attention, but activity quickly fell, and attempts by various platforms failed to create much of a splash.

On the other side, in contrast, the meme coin trend on Solana during the same period took a completely different path. With a single tweet from Musk, related meme coins could quickly reach a market value of hundreds of millions, with daily trading volumes of tens of millions of dollars, much higher than the weekly trading volume of many crypto stock trading pairs.

Top: XStocks trading volume, source: Dune; Bottom: meme coin Ani trading volume, source: gmgn

New features, no new users.

At this stage, what features CEX launches is no longer important. What matters is why they are launching these features and whether these features can reclaim the role they are losing.

This wave of crypto stocks is not because the industry has progressed, but because no one dares to do nothing.

Kant said: "Freedom is not doing whatever you want, but being able to not do what you don't want to do."

Compliance is just an illusion

During this period, almost all crypto trading platforms have been talking about compliance. Each is trying to apply for licenses, adjust business structures, introduce executives from traditional financial backgrounds, and attempt to prove they have moved beyond the wild era and become a financial institution that can be regulated.

This is an industry consensus and a collective anxiety.

But in the eyes of traditional finance professionals, this understanding of compliance remains too shallow.

"Many trading platforms obtain licenses from small countries to prove compliance, but licenses from small countries are hardly licenses at all. Such licenses are not credible," he said, not sharply, but more like stating an industry common sense.

By "credible," he means not whether you have a business license, but whether you can access the real financial system - whether you can open accounts with mainstream banks, use clearing networks, be trusted by regulatory agencies, and truly collaborate on business.

This implies a reality that in the view of traditional finance, the crypto world has never been truly treated equally.

The traditional financial system is built on responsibility chains and trust loops, emphasizing penetrable customer structures, risk control, audit capabilities, and explainable fund paths. Crypto platforms, however, mostly grew in institutional gaps, maintaining high profits and growth in ambiguous areas, rarely capable of building these compliance foundations.

In fact, everyone in the industry understands these issues. But before, no one cared because no one was competing for this territory. Now that traditional financial institutions have entered, they play by their own rules, and the crypto industry's "industry practices" suddenly become fatal flaws.

Some platforms are indeed making adjustments, introducing compliance audits, establishing offshore trust structures, splitting businesses, and trying to appear more regulated.

But regulatory agencies in many countries don't buy it. They may superficially cooperate in discussing processes, but deep down, they never intended to treat these platforms as part of the formal financial system. No matter how much you look like one, it doesn't mean they will truly keep you.

However, not all trading platforms are just going through the motions. Bybit is one of the few platforms that truly broke through the regulatory shell. This year, they became one of the first centralized exchanges to obtain the European MiCA license and established their European headquarters in Vienna, Austria.

Bybit does not deny the difficulty of this process and is not shy about the industry's regulatory challenges. As Emily said, regulators are no longer the ones who didn't understand crypto five years ago. Now, regulatory agencies are beginning to truly understand the industry's business logic and technical structure. From technology and models to market promotion, their understanding is deepening, and the basis for cooperation is becoming more solid.

Additionally, Bitget's Chinese-language head, Xie Jiayin, told us that Bitget has currently obtained virtual asset licenses in multiple countries and has built local compliance frameworks according to regional regulatory requirements. He revealed that the team is actively pursuing the MiCA license, hoping to establish more stable business channels in the European market and lay the groundwork for cross-border operations under a unified regulatory framework in the future.

But even so, such cases are still rare. For most platforms, they neither have licenses, networks, and trust endorsements within the traditional financial system nor are they enjoying the high-growth dividends from the previous institutional vacuum. They find the compliance transformation threshold too high, and when trying to return to crypto native operations, they find other competitors eyeing the market.

So they can only continue to move closer to regulation, continue discussing compliance, applying for licenses, and following processes. Often, these actions are not strategic choices but a sense of anxiety of being pushed forward.

Midpoint of the game

At five in the morning in the community, Xie Jiayin is still replying to users' questions one by one. Some ask how to play crypto stocks, some ask about the platform's recent compliance progress, and others ask about the PUMP subscription situation. He says he and his colleagues often stay up late, and an all-nighter is nothing.

On a hot Beijing afternoon, in a courtyard house, a senior executive from a Hong Kong securities firm is having tea and discussing cooperation with several executives from listed companies. The reception room is separated by an intricately carved wooden door, with a courtyard paved with blue bricks and insect sounds in the tree shade.

Zooming out further, in Vienna, Austria, Bybit's new European headquarters has just completed its ribbon-cutting ceremony and officially started operations - their European outpost after obtaining the MiCA license. They have become the first centralized trading platforms to complete the crossing, while also clearly understanding that most of their peers are still feeling their way across.

They are in different places, different emotions, different rhythms, but their words have subtle echoes: all talking about "changes happening too fast," all saying "take it slow," all thinking about how the industry should continue.

And the premise of this continuation is different from a few years ago.

Crypto trading platforms may no longer be the most central role in this world, no longer the starting point for all traffic and narratives. They are standing on the edge of a new order, gradually being squeezed out of the core by an invisible set of rules.

More complex systems and larger capital are gradually replacing the original narratives and structures.

Crypto trading platforms still exist, new product features are still being launched, announcements are being issued one after another. Their expression is changing, their tone is changing, the context they want to integrate into is changing - everything is changing.

Some changes are actively chosen, some are passively accepted, but more often, they are just trying to maintain a sense of existence without being eliminated by the times.

However, not everyone is pessimistic. Both Xie Jiayin and Emily believe that crypto's impact on traditional finance is greater than the latter's squeeze on CEX. They are both optimistic about the trend of traditional financial institutions entering the market because each industry evolution needs new players and participants. Centralized exchanges have also been continuously expanding more institutional clients, starting to do wealth management, asset allocation, and more. The businesses of both sides are intersecting and merging - "the two financial worlds echoing each other is a romantic moment."

But at the same time, everyone is also clear that this advantage itself does not eliminate anxiety.

Many questions will not have clear answers. Such as whether regulators will truly allow these crypto trading platforms, or whether traditional finance is truly willing to co-build rather than replace.

Also, whether they have another chance to define themselves before the next industry main theme arrives.

No one dares to speak too definitively about these issues. Everyone is dealing with their own part of the work, attending meetings, improving products, running licenses, waiting for feedback, maintaining the status quo while waiting for an opportunity to regain the initiative.

Waiting for the wave of industry reshuffling.