August for Ethereum is not just a seasonal rotation, but a grand declaration of comprehensive revival. Market records that have been silent for nearly four years have been continuously broken, with on-chain data bursting with vitality and the sharp upward trajectory of asset prices mutually confirming a epic market movement driven by underlying technology, institutional capital, and market sentiment. Behind the clamor of breaking through the key integer point of $3,700 lies the deep-seated logic of Ethereum ecosystem's value being redefined after technological iteration and application deepening.

On-chain Engine Roaring: Data Bursting Reveals Unprecedented Landscape in Four Years

The Ethereum network burst out remarkable momentum in July, with multiple core indicators simultaneously surging to historical peaks, outlining an active landscape comparable to previous bull market memories.

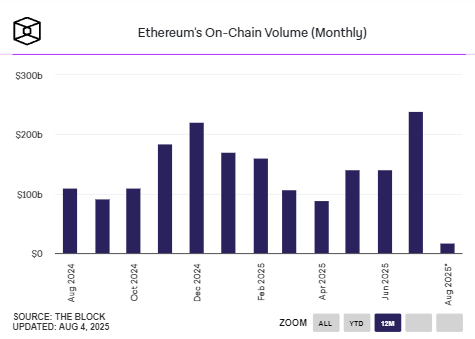

Total on-chain transaction volume, the core metric measuring network value flow, soared and broke through $238 billion, showing a stunning month-on-month growth of nearly 70%.

This figure is not only the highest monthly record since the crypto market peak in December 2021 but also sweeps away the long dormant period of nearly four years, clearly announcing that the recovery intensity has entered a brand new magnitude. Ethereum network transaction volume also reached 46.67 million transactions, creating a monthly record high, up 3.6% from the historical record in May 2021.

The steep rise in transaction volume not only reflects the frequent value transfer needs of market participants but also more profoundly demonstrates the significant recovery of activity in upper-layer application ecosystems such as DeFi protocols, NFT markets, and cross-chain bridges, with real economic activities achieving substantial expansion on Ethereum as the "settlement layer".

Meanwhile, the on-chain transaction count, an indicator reflecting the network's basic usage frequency, also demonstrated a historic breakthrough. The total monthly transaction count reached 46.67 million, creating a monthly record since Ethereum's inception, and even moderately surpassing the 2021 May on-chain activity frenzy period by 3.6%.

The emergence of high-frequency transactions is largely due to the large-scale implementation of Layer 2 expansion solutions (such as Optimism, Arbitrum, etc.), effectively reducing user interaction costs and improving network efficiency, making diverse on-chain activities from small payments to complex contract calls economically feasible, truly transforming the expansion blueprint into a perceivable user experience optimization.

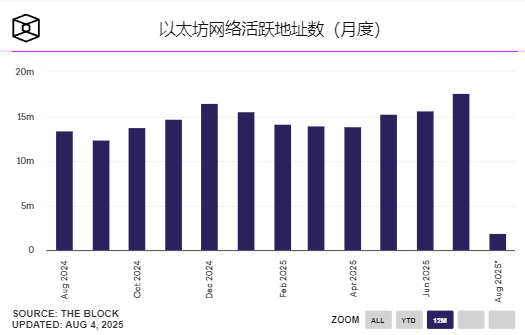

As a dual representation of network health and user base solidity, the number of active addresses reached 17.55 million in July. This value once again pulls the time pointer back to the market high point in May 2021, meaning a large number of new or "awakened" users are flooding into the Ethereum ecosystem to participate and interact. This is not an isolated data point, but together with transaction volume and transaction amount, forms a self-consistent and mutually reinforcing verification system - the network is carrying the surging flows of funds, information, and users with unprecedented density.

Price Breakthrough: Market Pricing Mechanism Confirms Recovery Logic

The comprehensive blooming of data ultimately received the most intuitive and intense response at the asset value level. As of the time of writing, ETH price has strongly attacked upward, closing above $3,700. This is not an isolated price point, but a comprehensive pricing reflecting the market's multi-dimensional value reassessment based on on-chain fundamentals, macroeconomic environment (such as expectations of Federal Reserve policy shift), and Ethereum's own technical narrative (Cancun upgrade's further optimization of Layer 2 performance). This price breakthrough has clear supporting anchors, rather than being driven by pure emotional speculation.

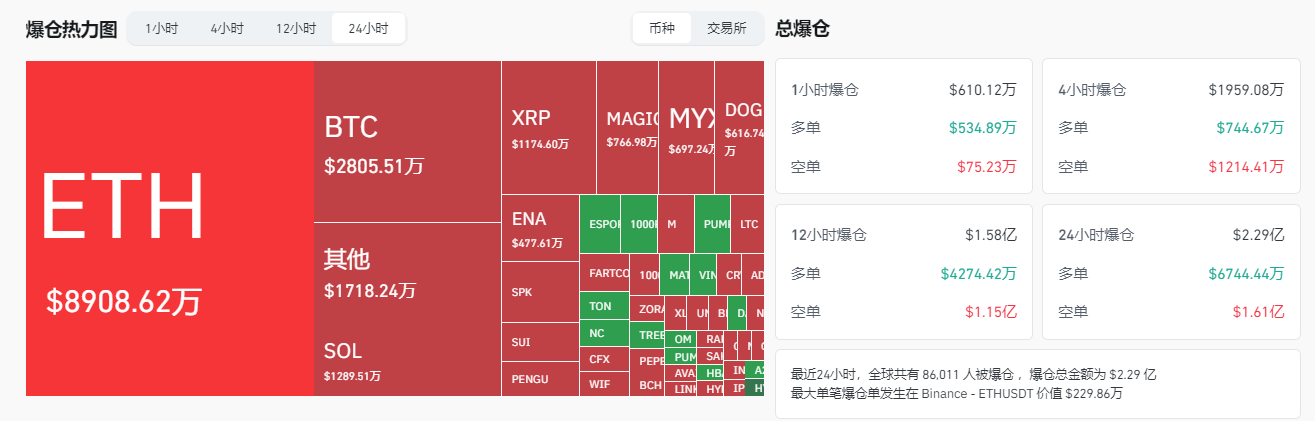

Market frenzy and cruelty often coexist. The process of Ethereum price quickly breaking through $3,700 became an indiscriminate liquidation storm for leveraged short positions. In the last 24 hours, the global crypto market's total liquidation amount reached $229 million, involving over 86,030 traders. Among them, liquidation losses for Ethereum short positions alone contributed nearly $90 million, accounting for almost 40% of the total market liquidation.

This vividly demonstrates the current market's unilateral momentum characteristics - investors trying to establish short positions against the trend are bearing enormous instantaneous risks. Notably, the single largest liquidation order on the ETH/USDT trading pair on Binance exchange reached an astonishing $2,298,600. Such a scale of single liquidation reveals that even professional traders or institutions with substantial funds find it difficult to withstand violent price fluctuations driven by improvements in on-chain fundamentals without sufficient risk preparation.

Institutional Advancement: Crypto Asset Strategic Allocation Becomes a "Clear Card" Move

In strong response to the surging on-chain data and market price breakthrough, institutional capital is engaging in unprecedented large-scale, public position-building.

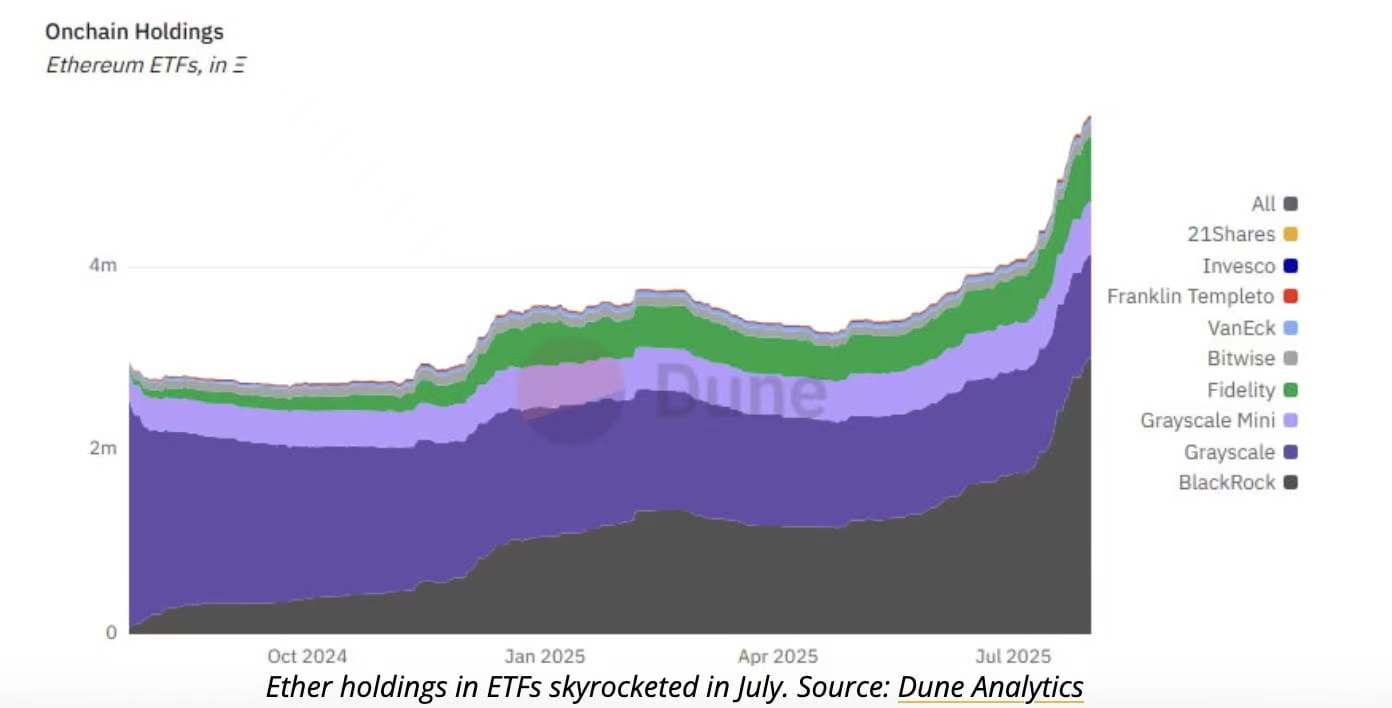

Against the backdrop of continuous inflows into Ethereum-based exchange-traded products (ETP), aggressive buying actions are underway, with BlackRock's iShares Ethereum Trust receiving $1.7 billion in inflows over the past 10 trading days.

dune analytics data shows that ETF's on-chain ETH holdings increased by 40% in the past 30 days.

Moreover, numerous listed companies, hedge funds, and emerging tech companies are incorporating Ethereum into their core asset allocation options with an unprecedented stance and determination, with this round of "institutional FOMO" being particularly prominent.

- Deep Layout in Traditional Fields: Listed company SharpLink Gaming (SBET) made another move on August 4th, acquiring 18,680 ETH for approximately $66.63 million. This is not an isolated operation, but a cumulative result of repeated investments: its total ETH reserves have risen to an astonishing 498,884 ETH, valued at around $1.8 billion at current prices. Such large-scale, systematic addition of ETH to the balance sheets of traditional industry listed companies signals a strong capital preference - ETH is being viewed as a value storage asset with long-term appreciation potential.

- Choice of Web3 Native Forces: The Web3-rooted tech company GameSquare made an important capital allocation decision on August 4th - approving a stock buyback plan of $10 million. The key detail is that the buyback funds are specifically designated from its Ethereum staking earnings. This marks that the core economic mechanism of the Ethereum network (such as PoS staking generating income) has matured and become reliable, capable of providing real, compliant, and sustainable cash flow for listed enterprises. More notably, GameSquare simultaneously invested in 2,717 ETH, raising its total treasury ETH holdings to 15,630.07 ETH. This reinvestment cycle of on-chain earnings feeding back into on-chain assets profoundly demonstrates ETH's central hub position in such companies' financial systems.

- Wall Street Entry Ticket Effect Highlighted: Bitmine Immersion Tech (BMNR), controlled by a company associated with famous analyst TOM LEE, was disclosed to hold over 833,000 Ethereum, with a total value of approximately $3 billion at current market prices. The entry of Wall Street background funds represents not just capital volume, but also signifies traditional financial compliance frameworks, risk management models, and allocation logic's recognition and acceptance of crypto assets. The stance of such heavyweight players far exceeds the impact of their capital volume on market psychology.

- New Whale Forces Quietly Laying Out: Onchain Lens monitoring information reveals the rise of emerging on-chain forces. Data on August 5th shows that newly created whale addresses are quietly hoarding ETH. For example, an address starting with "0x86F" received 15,000 ETH (approximately $55.91 million) from the compliant institutional-level trading platform FalconX in one operation, raising its total holdings to 39,294 ETH (approximately $146.45 million); another new address starting with "0x55C" received 9,968 ETH (approximately $37.12 million) from top crypto investment bank Galaxy Digital. These new addresses, combined with large ETH transfers from compliant sources, highly likely point to emerging capital forces or hidden family offices that are strategically building positions in Ethereum through mainstream compliant channels. This low-key yet decisive accumulation behavior lays an important groundwork for future market developments.

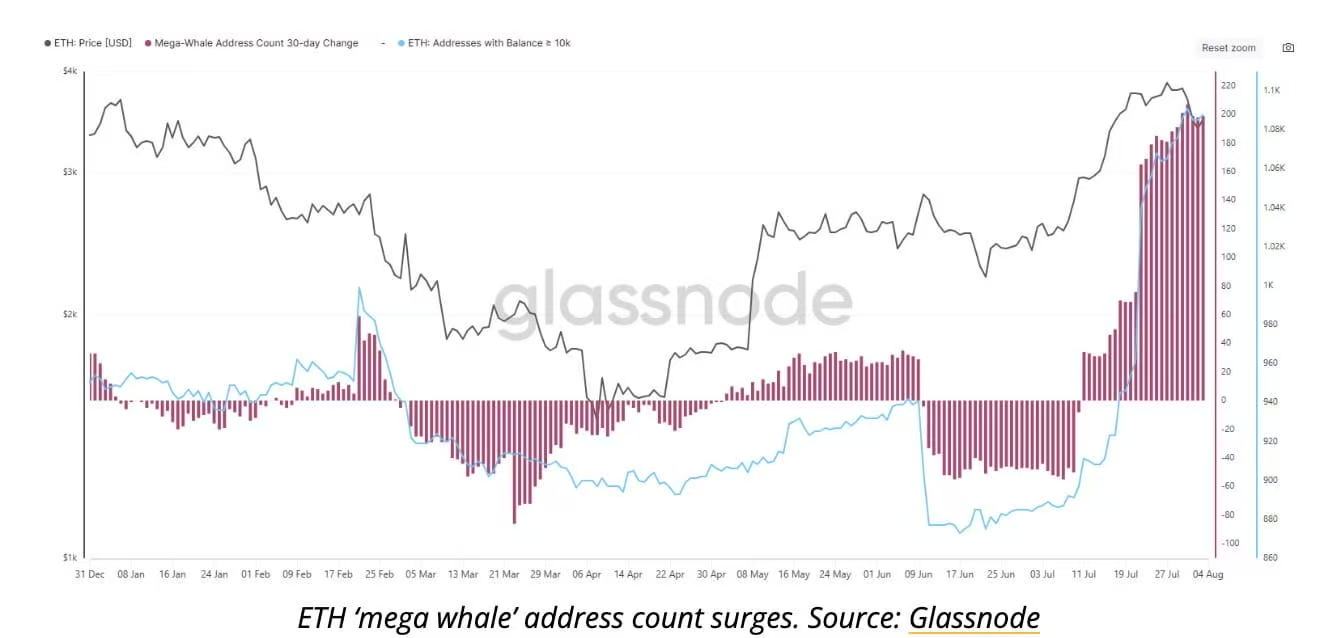

On-chain analysis company glassnode reports that since early July, the number of "whale" addresses - wallets holding over 10,000 ETH - has increased by more than 200. This includes wallets related to custodians, exchanges, and ETPs, indicating growth in institutional demand.

Ethereum price has stabilized at $3,710, recording over 5.4% growth in the past 24 hours. This sustained momentum has far exceeded a technical rebound. It is the result of a "turbo-charged" effect generated by three powerful forces: historical repair and breakthrough of network core indicators (transaction amount/volume/users), short-term "fuel boost" from forced short liquidations, and continuous, high-profile, and large-scale institutional capital entry from different backgrounds.

Every active interaction on the chain is like injecting fuel into an engine; each massive institutional buy order is like high-speed rotation of turbine blades, continuously pressurizing and propelling; while short liquidation stop-loss orders release a more violent upward impact wave in an instant. Under the synergistic effect of these three driving forces, Ethereum not only broke through the psychological barrier of $3,700 but also re-established its value hub position in the crypto economy, with its future development path being endowed with more solid foundations and broader imagination space.