Since MicroStrategy first purchased Bitcoin in 2020, initiating the trend of corporate Treasury crypto asset allocation, more and more companies have started to follow suit, attempting to enter the virtual currency market through massive fundraising. However, despite fund inflows amounting to hundreds of millions or even billions of dollars, cryptocurrency prices have not shown a significant increase. What structural phenomenon is hidden behind this?

According to the analysis by London financial technology analyst Boaz Sobrado in the article 'The Crypto Treasury Pump: Insiders Cashing Out Billions?' on July 24, 2025, these "Treasury companies" might just be an arbitrage exit for crypto whales.

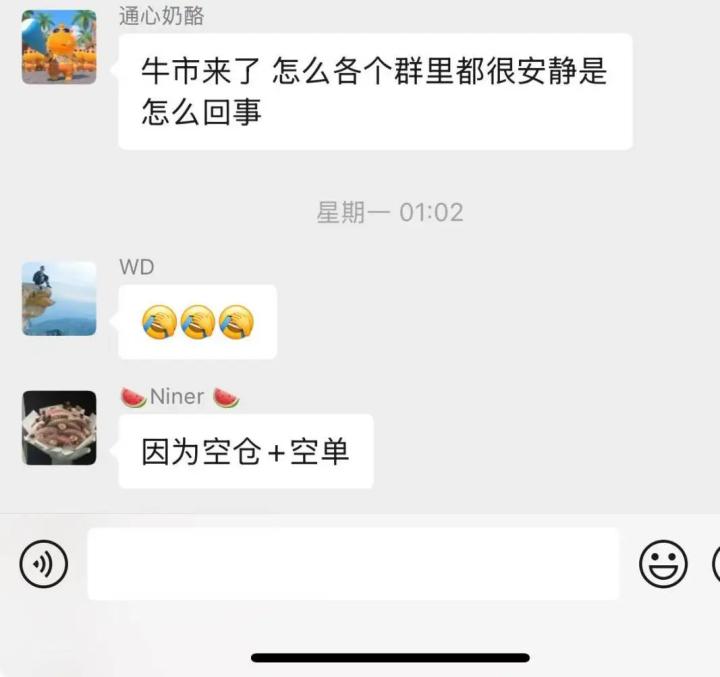

Unconditional ETH believers, colloquially known as E guards, enthusiastically praised this wave of listed company ETH Treasury trend, believing it represents ETH's institutional adoption; however, if the crypto Treasury is truly an arbitrage exit for crypto whales, they might have worshipped the wrong idol. Moreover, the E guards seeking to increase Ethereum network usage and promote decentralized infrastructure, if they pin their hopes on institutional hoarding as a spiritual victory, might be missing the point.

(From Joke to Belief: "E Guards" Become a New Meme in Ethereum Community)

[Rest of the translation continues in the same manner, maintaining the original structure and translating all text while preserving <> tags]Numerical Misalignment: Upexi and SharpLink Case Reveals Fictitious "Crypto Buying"

Upexi claims to have purchased 1.9 million Solana tokens, but data shows that most tokens were likely not bought through the open market, but obtained through locked discount forms or even converted from existing crypto investors. The shareholder structure also reveals familiar faces, such as Arrington Capital, Electric Capital, and Pantera, crypto funds that already hold large amounts of cryptocurrencies.

Neuner pointed out: "They did not inject new funds, but simply exchanged existing tokens for shares and then used stock market premiums for arbitrage."

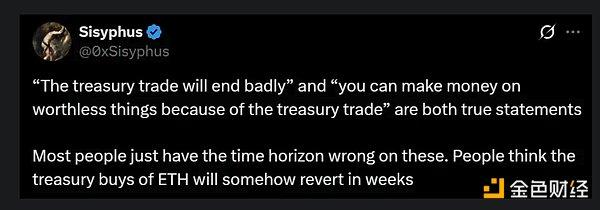

Treasury Companies Create Premium Illusion of "Virtual Crypto Assets" for Retail Investors

Treasury company stocks often trade at prices far higher than the actual value of their crypto holdings. For example, a company owning $100 million worth of ETH might have a total market capitalization exceeding $400 million. When retail investors enter, they are effectively "indirectly holding" tokens at a 3 to 4 times premium, completely ignoring the low-cost alternative of direct token purchase.

Neuner warned: "With ETH priced at $35,000, some prefer to buy shares of an indirectly holding company rather than directly buying on Coinbase. This is a bubble."

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating to English.]ETH Unstaking Surges: Why Are Funds Fleeing Staking Contracts?

Looking at the chart, the exit staking queue time for Ethereum has clearly spiked in the past two weeks. Ark Invest researcher Brett Winton also questioned: "Why is there such a massive unstaking demand recently?" This change may be related to investors moving funds to DATs or other high-yield tools. The attractiveness of staking rewards is gradually diminishing, and instead of locking funds and waiting for returns, investors prefer to move to asset types with faster returns.

Expanding "False Growth"? Concerns of an $8 Billion Bubble Emerge

According to a Forbes report on July 24, 2025, some so-called "crypto Treasury companies" like SharpLink Gaming have not actually purchased new ETH, but rather redistributed existing assets. This means that the alleged asset growth is built on inflated share value, not substantial capital increase. The report speculates that this operation could lead to a market value bubble of up to $8 billion.

Mainstream Financial Doors to Open: Bitcoin ETF May Enter Top Four Brokerages by Year-End

Bitwise's investment head stated that mainstream financial institutions like Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS are expected to open Bitcoin ETF trading by the end of 2025. This is a major positive for the market, meaning more compliant funds can legally flow into the crypto realm, echoing Cathie Wood's view of "Treasury stocks as an investment bridge".

From Robinhood's incentive policies to institutional investors moving ETH to Treasury platforms, and to mainstream brokerages considering BTC ETF openings, the crypto world and traditional finance are rapidly integrating. This trend not only changes fund flows but also reshapes the logic of future asset allocation. In the coming months, the destination of unstaking funds will be a key indicator of this asset reorganization wave.

Risk Warning

Cryptocurrency investment carries high risks, and prices may fluctuate dramatically. You may lose all your principal. Please carefully assess the risks.

SharpLink, an American online gaming company transformed into an Ethereum Treasury company, announced the hiring of Joseph Chalom, former digital asset strategy head at BlackRock, as co-CEO, enhancing its competitiveness in digital asset acquisition and management. The fusion of crypto native forces and traditional financial elites is redefining the new landscape of Ethereum Treasury.

Table of Contents

ToggleBlackRock Executive Joins Ethereum Treasury Company SharpLink

Joseph Chalom worked at BlackRock for twenty years, responsible for managing the company's strategy in digital assets, data, and technology ecosystem. According to a Bloomberg report, under Chalom's leadership, BlackRock launched the iShares Ethereum Trust ETF (ETHA, with over $87 billion in assets under management), iShares Bitcoin Trust ETF (IBIT, with over $10 billion in assets under management), and the first tokenized Treasury fund on Ethereum (BUIDL), making it the largest digital asset management company.

Chalom will join SharpLink as co-CEO, leading the company alongside current CEO Rob Phythian. Phythian will transition to company president next quarter while retaining his board member position.

SharpLink's Chairman, Ethereum co-founder, and ConsenSys founder and CEO Joseph Lubin stated:

"Very few executives have had such a massive influence in driving institutional adoption of digital assets as Joseph, who pioneered BlackRock's strategic entry into this field. His decision to join SharpLink fully validates our ETH financial strategy and vision of driving Ethereum's profound global digital transformation."

Crypto and Wall Street Collaborate to Build SharpLink's Ethereum Treasury Kingdom

Following Michael Saylor's MicroStrategy leading Bitcoin reserves, Ethereum Treasury companies have become the recent hot topic. Bitcoin miner BitMine led by Tom Lee and the online gaming company SharpLink led by Ethereum co-founder Joe Lubin have been aggressively buying, and according to strategicethreserve, these institutions now hold 1.91% of Ethereum's total supply.

As SharpLink and BitMine compete fiercely for the Ethereum Treasury company throne, they've also sparked a discussion about who is superior: crypto native players or Wall Street giants.

With Joseph Chalom's joining, SharpLink not only relies on its Ethereum network connections to potentially buy ETH at lower prices but also has a Wall Street veteran managing its digital assets, seemingly elevating its competition with BitMine to a new level.

(Crypto and Wall Street Perform Together: Is SharpLink or BitMine the MicroStrategy of Ethereum?)

Risk Warning

Cryptocurrency investment carries high risks, and prices may fluctuate dramatically. You may lose all your principal. Please carefully assess the risks.