Author: The DeFi Investor Translation: Shan Ouba, Jinse Finance

Almost every bull market tends to give birth to a new crypto bubble, which often brings incredible wealth opportunities but inevitably ends in tragedy.

In the last cycle, we experienced the Terra Luna bubble. In 2018, it was the ICO bubble.

Until recently, this bull market seemed to lack a bubble of similar scale. However, with the emergence of a batch of "crypto vault companies", this is changing. Last week, I mentioned that vault companies like Strategy and SharpLink Gaming might positively impact prices by purchasing BTC or ETH.

Meanwhile, more crypto vault companies are announcing the accumulation of various crypto assets:

StablecoinX Inc. raised $360 million to buy $ENA

Nano Labs plans to raise $200 million to buy $BNB

Upexi plans to raise $200 million to buy $SOL

Bit Origin plans to raise up to $500 million to buy $DOGE

Sonnet is raising $888 million to buy $HYPE

Trump Media has already purchased $2 billion of $BTC for its vault strategy

And this is just the tip of the iceberg. Interestingly, traditional financial companies, who initially disparaged cryptocurrencies, have now become the "bagholders of our chips".

Why are crypto vault companies so important?

As I briefly mentioned in last week's newsletter, these companies can purchase large amounts of cryptocurrency because their stock prices are at a premium relative to the actual value of their crypto assets.

They typically adopt the following strategy:

A small public company begins accumulating a specific cryptocurrency

Publicly announce this action, triggering market hype and attention

In most cases, the company's stock price rises due to hype, exceeding the actual value of its held tokens

Leveraging this stock price premium, they raise funds by selling new stocks through ATM mechanisms

Use this new capital to continue purchasing more tokens, entering a "positive feedback loop"

This mechanism might allow them to buy billions of dollars worth of crypto assets, and you can imagine the powerful buying pressure this will create.

How to grasp this new trend?

My strategy is to closely monitor tokens that are being continuously and massively accumulated by vault companies in the coming weeks and invest simultaneously. Currently, the only two tokens with sustained strong demand are BTC and ETH. A few days ago, SharpLink Gaming just submitted an application to raise $5 billion to buy more ETH.

I believe this is just the beginning of the crypto vault company bubble. In the next few months, we will likely see hundreds of listed companies enter the crypto market as "bagholders".

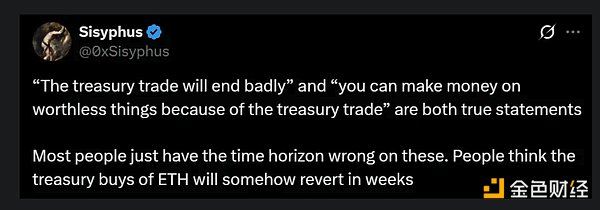

Is this sustainable in the long term?

I am skeptical. After all, this strategy depends on their stock always maintaining a premium. Once the stock price returns to rationality, the company can no longer continue buying. But for now, we may still be in the early stages of the vault bubble.

In the short to medium term, these companies might push the valuation of multiple tokens to crazy levels.

In the past, vault companies only bought BTC, which might be part of the reason for BTC's excellent performance in recent years. Now, billions of dollars are also starting to flow into some selected Altcoins.

If my judgment is correct, I believe the second half of 2025 (especially the fourth quarter) will be a harvest season for those who remain in the crypto market and still believe in the industry. Of course, don't be surprised by adjustments in the short term. For example, ETH has risen 50% in the past four weeks without any decent pullback.

Maintain patience and belief. This will ultimately yield huge rewards.