Author: Ada, TechFlow

Original Title: Crypto Bull Market Quietly Unfolding

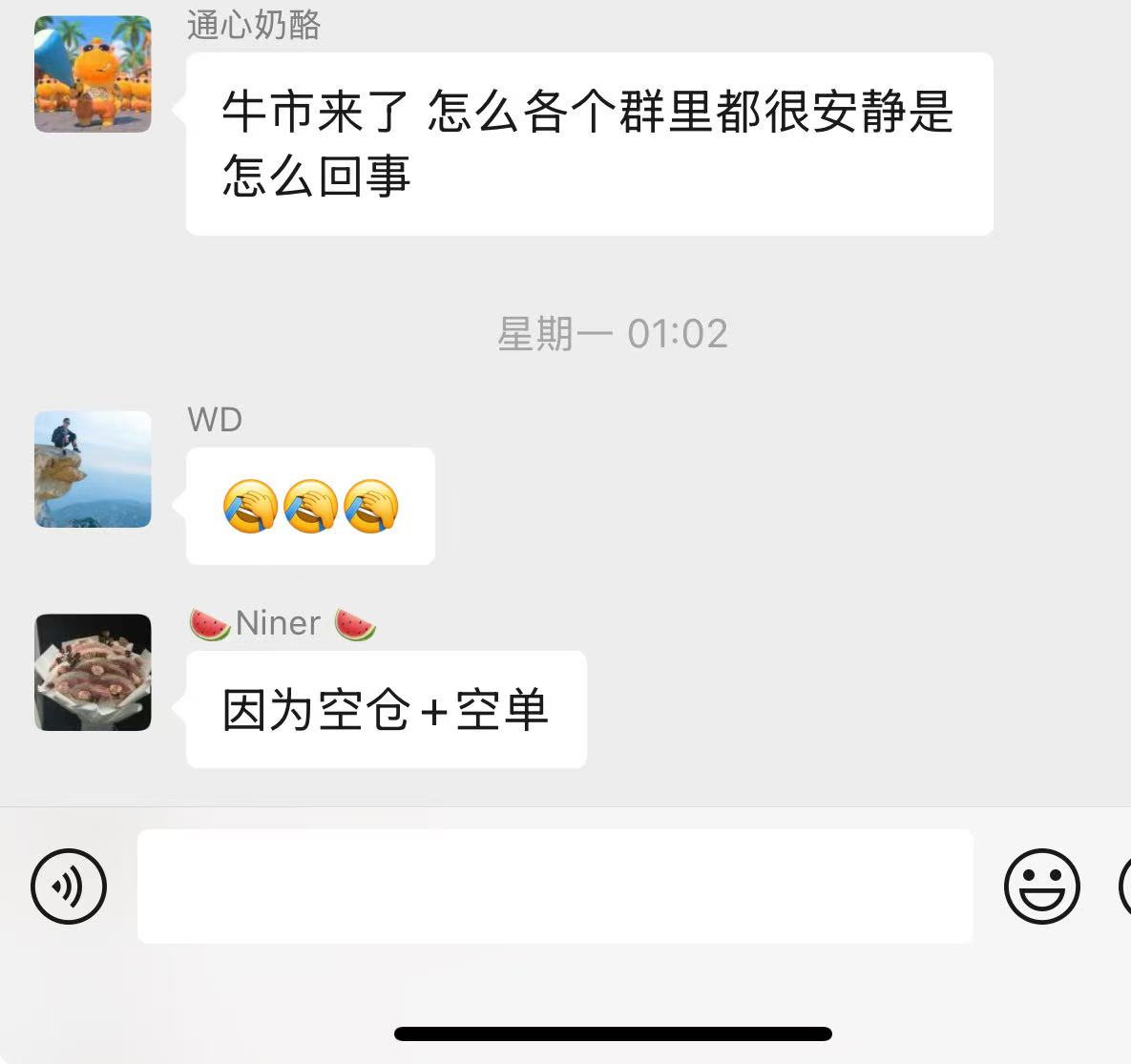

"The bull market is here, but why are all the groups so quiet?" netizen Tongxin Milk Cheese asked in the Opensky community group.

"Because of empty positions and short positions," group member Niner replied.

For Niner, who experienced the previous bull and bear cycle, this bull market should have been a great opportunity to make a fortune, but he frankly admits that he "hasn't made money in this market".

Full-time trader Johhny is in a similar situation, claiming he "hasn't made money since Trump posted Trump".

Such cases are not uncommon. Mark, partner at Wagmi Capital, stated in an interview that "90% of retail investors are not making money" in this bull market.

Although Niner hasn't made money yet, he has adjusted his investment strategy in time. "In the last cycle, I mainly 'held', but this time I'm focusing on swing trading, and because many new things have emerged, I need to continuously learn, and the pace is much faster."

Niner's adjustment was timely, but most people are still late to realize.

"The investment logic in this cycle is different from before, but most retail investors haven't realized this," KOL River Horse said in an interview.

As institutional funds massively enter the crypto market and mainstream coins repeatedly hit new all-time highs, this is no longer a "retail-friendly" market, whether in terms of capital, technical acceptance, or participation. Some believe the crypto dividend for retail investors is ending, and this might be their last cycle.

Based on this, TechFlow interviewed multiple deep participants in the crypto market, including notable KOLs, private fund partners, quantitative traders, and individual investors, to analyze this bull market from their perspectives and present a diverse crypto landscape.

A Different Crypto Bull Market

[Rest of the text continues in the same translation style...]

"For retail investors, the first thing to adjust might be their mindset, which is to give up the fantasy of getting rich quickly," Hippo said. "In the future, there might not be opportunities for Altcoins with dozens or hundreds of times returns, but there are still opportunities for mainstream cryptocurrencies, with around 3-5 times growth potential in each cycle. Then focus on Memecoin, as new phenomenon-level Memecoins will emerge in each round, which will definitely bring significant returns."

In the previous cycle, there were some low-threshold, retail-friendly, low-risk money-making projects like IPO participation and inscriptions, but such opportunities are now scarce in this round.

"Or do quantitative trading like me, which has barriers but relatively low risks," Chenghua said. "I actually think the opportunity with Bitcoin is quite fair for everyone, depending on how well one can grasp it. Dollar-cost averaging is a relatively easy strategy to execute, and if you extend the time horizon, you'll likely have decent returns."

Are retail investors' crypto dividends about to disappear?

In fact, during the previous cycle, with the entry of some institutional funds, there were already voices saying it was the last crypto cycle for retail investors.

While retail investors are still participating in this bull market, this round is more "institutionalized".

The total AUM of Bitcoin spot ETF will reach $137.4 billion in July 2025, with over 400 institutions investing in BlackRock's Bitcoin ETF, including pension funds and sovereign wealth funds.

Global listed companies hold 944,000 BTC, accounting for 4.8% of circulation, with a net increase of about 131,000 in a single quarter.

Platforms like Coinbase and Binance have seen a surge in ETH liquidity staking (LSD) product scale, with institutions packaging ETH's revenue attributes as fixed-income instruments.

These data all indicate that the crypto market is no longer a playground for retail investors.

Media reports suggest that the $120,000 Bitcoin was just a "capital feast without retail investors". That day, there were no "overnight riches" screenshots, only BlackRock's silent scrolling of 13 ETF subscription orders per second.

This scenario completely meets Mark's expectations. "I feel the golden age of retail investors making money is over, and it was quite obvious that last year's second half might have been the last window period," he said.

He has already realized profits on part of his funds and shifted to A-shares.

"But I won't completely exit. I think the meme market opportunities will always be there, and new things will keep emerging," Mark plans.

Relatively speaking, Niner is more optimistic. She says she will continue to immerse herself in this market because she feels "the chances of making big money are increasingly coming to retail investors."

"Many have been saying it's the last cycle for a long time. But I think the wild growth period is over, and now is the time for good opportunities to emerge," Niner said. "I won't leave. I want to be a true Alpha player."

Hippo is equally optimistic. He believes the market is developing in an orderly and regulated direction, which for retail investors means low risk and high returns.

"With institutional funds entering, as long as you follow mainstream cryptocurrencies, you can still obtain relatively good returns. Most importantly, this market is controllable, and risks have been significantly reduced," Hippo said. "At the cycle's low point, Bitcoin might retract 50%-70%, but it will rise several times in a bull market. Just by capturing this rhythm and managing expectations, investing in Bitcoin and other mainstream cryptocurrencies might be the easiest money-making project for retail investors."

For Hippo, who has been deeply involved in the crypto field for 9 years, his relationship with this market is like "fish and water" - "I'm already swimming freely in this market and have never thought about leaving. And I believe market opportunities for retail investors have always been present."