Bitcoin fluctuates below 120,000 USD after reaching 123,000 USD on 14/7, while altcoins have not been able to replace the dominant position of the market-leading currency.

Bitcoin is experiencing a prolonged sideways phase for nearly a week, trading at 118,745.25 USD at the time of reporting with a modest increase of 0.82% in 24 hours. Although the market sentiment remains relatively positive, as shown by CoinMarketCap's Greed Index reaching 70 points, altcoins have not been able to take advantage of the opportunity to dethrone the leading currency.

The Altcoin Season Index once touched 56 points at the beginning of the week after double-digit increases of Ethereum and XRP, along with the impressive breakthrough of Pudgy Penguins with a nearly 34% increase in the week. However, this momentum quickly weakened when Bitcoin retreated from its all-time high, causing the Altcoin Season Index to drop to 40 points and the Greed Index to fall to 67.

Particularly, the collapse of the PUMP token – the currency operating the memecoin pump.fun platform – has thrown cold water on expectations of a forming "2025 altcoin season". This indicates that the market is not yet ready for a strong capital rotation from Bitcoin to altcoins.

Derivative Market Reflects Cautious Sentiment

Data from the derivative market also reflects investors' caution. The total open interest for Bitcoin futures contracts decreased by 1.21% to 83.62 billion USD according to Coinglass, showing that traders are reducing leverage in a market lacking a clear direction.

Liquidation activity for the day reached 72.56 million USD, with longing positions dominating at 51.03 million USD liquidated compared to 21.54 million USD from short positions. This suggests that many investors were overly optimistic about Bitcoin's potential to continue rising from its recent peak.

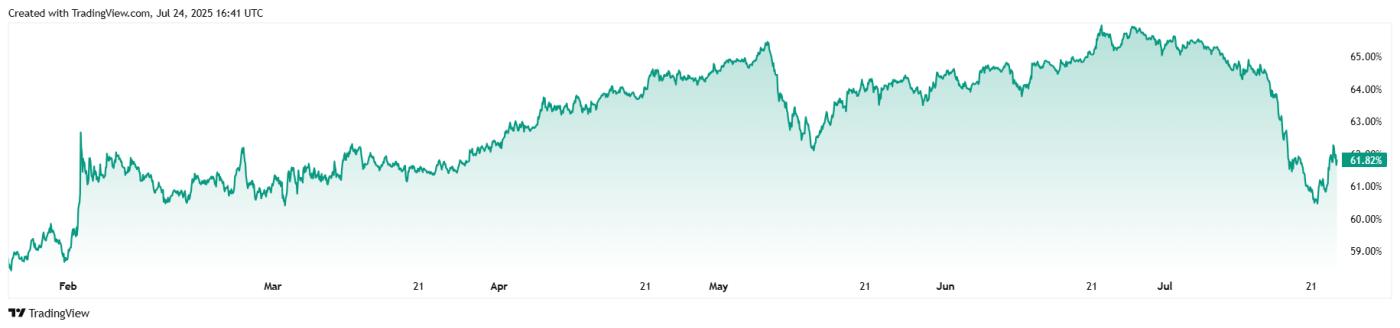

Bitcoin's trading volume in 24 hours increased by 9.94% to 74.27 billion USD, indicating significant market interest. Bitcoin's market capitalization slightly increased by 0.65% to 2.35 trillion USD, while the dominance index decreased by 0.07 percentage points to 61.83%.

The still-high dominance of Bitcoin shows that investors still prefer the safest cryptocurrency asset rather than risking altcoins. In the short term, Bitcoin may continue to fluctuate between 117,000-120,000 USD until there is a new catalyst from macro factors or positive news from the cryptocurrency market.

For the "altcoin season" to truly begin, the market needs to witness prolonged stability of Bitcoin at high price levels or significant new capital flowing into the altcoin ecosystem.