Original Author: @Mercy_okx, OKX

Last weekend, I was very happy to have the opportunity to interview OG Frank @qinbafrank at the office.

This low-key senior investor and trader was clear-headed and comprehensive when discussing stablecoins and macro markets. He took me through a decade of Bitcoin consensus, the American ambitions behind stablecoins, and the future of crypto-stock integration.

Frank believes that the Crypto market is becoming more efficient, and stablecoins and crypto-stock integration will force the entire crypto industry to "self-revolutionize", moving from speculation to fundamentals, and from narrative to implementation. He also candidly pointed out the essential differences between ETH and BTC, as well as the fierce competition in the future of stablecoins.

This was an interview with extremely high information density. If you still have questions about stablecoins, RWA, and recent hot narratives, or are looking for a thinking model to understand the new order of the crypto world - I recommend everyone to read it carefully.

Chapter One: The "Positive Conspiracy" of Stablecoins and the Reinforcement of the US Dollar Status

Mercy: You mentioned that stablecoins are a "positive conspiracy". What specifically do you mean?

Frank: I believe stablecoins are a "positive conspiracy" by the United States. There are three deep-seated reasons behind this:

First, the United States hopes to strengthen the dollar's status through on-chain dollars. Today, many countries and regions are de-dollarizing, and the overseas holdings of US Treasury bonds are also declining. The United States needs to find more application scenarios for the dollar.

Stablecoins, especially dollar-pegged stablecoins, are essentially the tokenization of the dollar, or "on-chain dollars". Through this method, the United States can bypass central banks and directly distribute dollars to the global crypto community, achieving a B2C retail model.

If the crypto community grows larger, stablecoin issuance increases, and the proportion of dollar-pegged stablecoins becomes higher, the United States can directly "intercept" the crypto community in non-US regions, allowing them to use dollar stablecoins for transactions and payments.

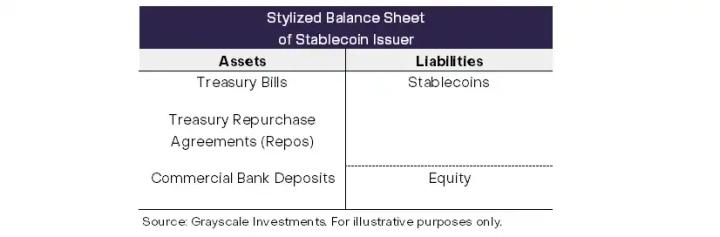

Second, issuing stablecoins can find new purchasing power for US Treasury bonds. Why do stablecoin companies buy large amounts of short-term US Treasury bonds? I believe this trend accelerated after the Luna crash in 2022, the FTX collapse, and the Silicon Valley Bank failure in 2023.

These events made stablecoin issuers like Tether and Circle realize that holding only Bitcoin or keeping large amounts of US dollars in banks is risky. Therefore, they began to increase their holdings of US Treasury bonds, especially short-term Treasury bonds, because they have good liquidity, high yields, and relatively low risk.

Third, the United States' ambitions go beyond this - they want more. Vigorously promoting stablecoins is to compete in advance for the future pricing rights of on-chain assets.

Therefore, the introduction of the stablecoin bill is to expand dollar influence through on-chain dollars, find new buyers for US Treasury bonds, and ultimately control the pricing of on-chain assets. This is a natural evolutionary process driven by events like the Luna crash, Evergrande commercial paper, Silicon Valley Bank failure, and Federal Reserve interest rate hikes.

Mercy: We launched OKX PAY this year and just officially announced a strategic cooperation with Circle a few days ago. Stablecoins have become the new mainstream. How do you see the positions of Tether and Circle in the stablecoin market?

Frank: Circle currently has a first-mover advantage. It was the first to obtain a compliant license and has a comprehensive custody and compliance system.

At the same time, it is deeply connected with giants like Coinbase and BlackRock and is actively expanding payment scenarios. However, the competition in stablecoins will definitely become more intense in the future, and Circle is now feeling competitive pressure and thus running faster.

But Tether also has its unique advantages. It is widely used in cross-border payments, with a large part of its usage scenarios being in trade scenarios outside the crypto world.

The US government also hopes that Tether can continue to "expand territory". As long as it is under control, does not do evil, and continues to increase US Treasury bond holdings, the United States is willing to allow it to "conquer cities". In the future, Tether may still dominate the dollar-pegged stablecoin market in non-US regions.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms.]Mercy: What New Opportunities Will Stock-Crypto Convergence Bring?

Frank: Stock-crypto convergence will bring new asset types and wealth effects.

First, for quantitative funds and large investors in the crypto market, perpetual contracts of major US stocks will become new trading targets, expanding their options.

Second, pink sheet markets in US stocks and some small-cap stocks in the Hong Kong stock market, if tokenized and put on-chain, could bring massive wealth effects.

Finally, equity trading of unlisted companies (exclusive beasts), and even future startups directly issuing tokens, will become possible. This will allow ordinary people to participate in investments that were previously only accessible to high-net-worth individuals.

Mercy: How Do You Think the Crypto Industry Will Evolve?

Frank: I believe the crypto market is going through a process of "squeezing out water" and "forcing improvement".

The massive crypto VC expansion in 2020 and 2021 pushed up first-market valuations, with too many projects having inflated valuations; now we've entered a "liquidation period". Meanwhile, core teams of crypto projects have a moral hazard of "having rights without obligations", with low costs for misconduct. These issues have made the market unhealthy.

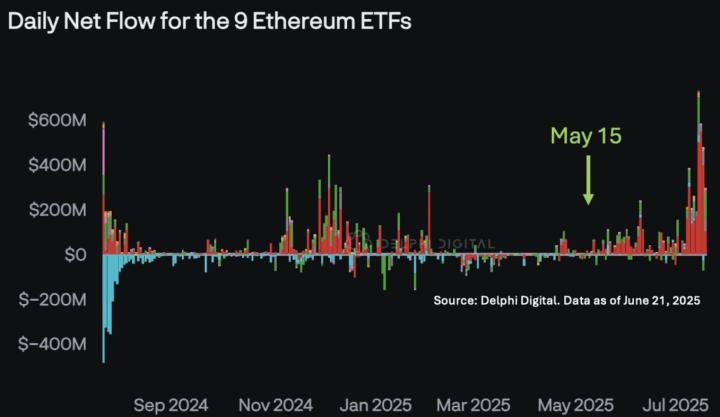

Now, with the introduction of ETFs and the maturation of investor structure, the market will become more efficient. Investors will pursue more certainty rather than blindly chasing high returns.

This will lead to market segmentation, with funds flowing to high-quality projects with fundamentals, innovative narratives, and growth potential, while copycat projects with unequal rights and obligations that don't improve will be eliminated. This "squeeze" will force crypto practitioners to focus more on project quality and compliance, making team rights and obligations more balanced.

In the future, we may see more projects with actual business progress, where earnings are highly linked to token value, and even companies directly issuing tokens on-chain, rather than pure cryptocurrencies. This will make the entire crypto market healthier and more mature.

Click to learn about BlockBeats job openings

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia