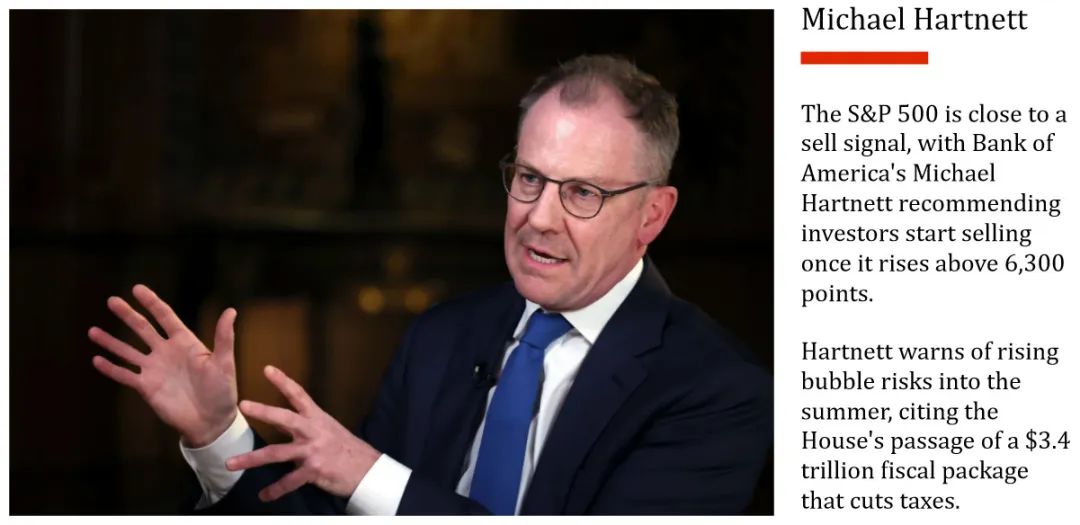

"All sell signals have been triggered."

When Michael Hartnett, Chief Investment Strategist at Bank of America (BofA), wrote this assertion in his highly anticipated research report, all of Wall Street seemed to feel a chill. In a market wrapped in AI hysteria and repeatedly hitting new stock index highs, this warning seemed particularly piercing. It was like an uninvited guest at a grand feast, reminding people of the fragility beneath the revelry.

However, the market's reaction was subtle. Most people seemed to selectively ignore these warnings, continuing to immerse themselves in the rally led by a few tech giants. But for keen observers, especially those of us in the crypto world closely tied to macro liquidity, these signals are far from baseless. They are puzzle pieces that, when combined, sketch a potential roadmap to a major turning point. This is not just a discussion about whether the stock market will correct, but a deep exploration of market structure, risk origins, and the future evolution of asset landscapes.

Cracks Beneath the Surface: A Bull Market Epic Written by the Minority

Hartnett's warning is primarily based on three core observations that collectively reveal a dangerous characteristic of the current market: extreme optimism coexisting with inherent fragility.

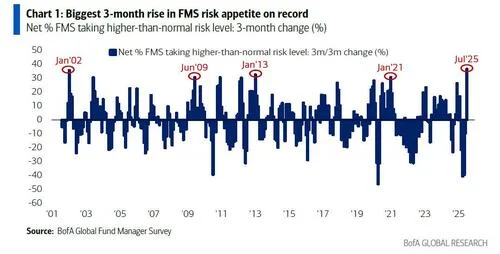

First is the depletion of the "ammunition depot". The cash proportion of institutional investors' asset management scale has dropped to 3.9%, an extreme level of a reverse indicator. In more vivid language, this means fund managers controlling massive funds have almost "gone all in", with virtually no cash reserves to handle potential pullbacks. Such extreme market optimism has historically been a precursor to market peaks. Since 2011, similar signals have triggered average S&P 500 pullbacks of about 2%. This might sound small, but it reveals a mindset: when everyone believes nothing can go wrong, risk quietly approaches.

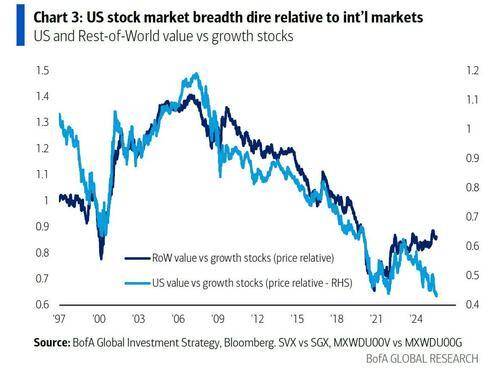

Second, the market's "internal health" is deteriorating. Despite the S&P 500 and NASDAQ surging forward, this is more like a solo performance by a few "superstar" performers. The market's breadth, or the universality of rising stocks, is significantly narrowing. We can imagine the market as an army where only a few generals are charging forward while the vast majority of soldiers are exhausted and quietly retreating. A direct way to measure this is by comparing the market-cap-weighted S&P 500 and the equal-weighted S&P 500 (RSP). The former rises due to extremely high weightings for giants like Apple and NVIDIA, while the latter, reflecting the performance of "ordinary companies", lags far behind. This divergence is typical of late-stage bull markets, indicating that the rally lacks a solid foundation and the entire market's fate is tied to the growth stories of just a few companies. Once these leaders' narratives waver, the market might create a dangerous "vacuum zone" due to lack of support from other sectors.

Lastly, global capital flows also confirm this "final hysteria". Recently, global stock and high-yield bond fund inflows have been massive, nearly triggering BofA's "sell" signal. This reflects strong FOMO (Fear of Missing Out) sentiment, with massive capital chasing gains at market highs - often a sign of purchasing power about to be exhausted. When the last batch of hesitant buyers enters, who else can drive prices higher?

[The translation continues in this manner, maintaining the original structure and translating all non-HTML content to English.]On the other hand, the source of risk is not limited to valuation bubbles, which bears a similarity to the global financial crisis of 2008. The crisis in 2008 was not essentially a stock market issue, but a systemic crisis that originated from the credit market (subprime mortgages) and ultimately spread globally through the financial system's leverage. Today, the risks lurking in the bond market, rooted in unsustainable macroeconomic policies and sovereign debt issues, similarly have the potential to trigger a systemic crisis.

What we are facing might be a complex situation that combines the "narrative bubble" of 2000 and the "systemic foundation shaking" of 2008. This hybrid crisis makes prediction and response extraordinarily difficult. Traditional valuation models may fail to capture systemic credit risks, while traditional credit risk models might overlook the extreme speculative bubbles driven by emotions in the stock market.

Crypto Assets: Storm, Safe Haven, or High-Precision "Barometer"?

In this grand macroeconomic shift, crypto assets, especially Bitcoin, are playing an extremely complex and critical "X factor". Its relationship with traditional markets is evolving from a simple "risk asset" to a more nuanced role.

First, in the short-term storm, the crypto market cannot remain unscathed. With the introduction of Bitcoin spot ETFs, the influx of institutional funds has significantly increased its correlation with the Nasdaq index. In the eyes of many traditional investors, Bitcoin has become a "high-beta tech stock". Therefore, if the US stock market experiences a sharp sell-off due to liquidity tightening, panic emotions will quickly spread, and Bitcoin and the broader crypto market will likely follow the downward trend. This is a short-term risk that investors must face directly.

However, the ultimate nature of this crisis will determine the long-term fate of crypto assets. If the US stock market downturn is merely a valuation correction or a typical bear market triggered by an economic recession, crypto assets may take a long time to recover. But if the crisis's roots are confirmed to be bond market turbulence, as Hartley fears, with a fundamental challenge to the US dollar's credit, the story will be entirely different.

In this scenario of a "sovereign debt crisis" or "fiat currency discredit", the narrative of Bitcoin as "digital gold" and a non-sovereign value store will be unprecedented strengthened. When investors begin to panic and flee from dollar-denominated bonds and stocks, where will they go? Gold is undoubtedly one option, and Bitcoin, with its digital, easily transferable, and absolutely scarce characteristics, will become another highly attractive safe haven. This is the ultimate test of the "decoupling" theory—whether Bitcoin can rise independently when the traditional world is engulfed in flames.

More interestingly, the crypto world itself provides us with a high-precision "barometer" for observing global liquidity—stablecoins. The total market cap of stablecoins and their on-chain flow can be viewed as a real-time indicator of global speculative US dollar liquidity. When global US dollar liquidity is abundant, funds will overflow into the crypto world, driving up stablecoin market cap; conversely, when liquidity tightens, stablecoin redemptions will increase, and its market cap will shrink. Compared to the lagging monthly fund flow data in traditional financial markets, stablecoins' dynamic changes are almost real-time. Therefore, continuously observing stablecoin supply changes might allow us to perceive the global liquidity storm earlier than traditional analysts.

In summary, the flashing warning lights in the US stock market reveal a complex and tension-filled canvas. On the surface is AI-driven prosperity, but underneath lies a tottering structure and extremely optimistic fragile sentiment. Deeper still are the bond market risks that could potentially shake the foundations of the entire financial system. For participants in the crypto world, this is both a challenge and an opportunity. In the short term, we need to prepare for a potential liquidity storm; but in the long run, this potential crisis might be the historic opportunity for crypto assets to prove their unique value and transition from "speculative tools" to "macro hedging assets". This is a moment that requires extreme caution while also maintaining long-term confidence.