2025 will be a year of rise for stablecoins, with the United States introducing the GENIUS Act, and the newly elected South Korean President Lee Jae-myung fulfilling his campaign promise by allowing local companies to issue stablecoins. Beyond the national level, with Standard Chartered Bank, Huawei, JD.com, and Ant Group all exploring the issuance of various stablecoins, both domestic and international corporate giants are delving into this field.

Crypto AI researcher Jeff analyzed the existing problems in crypto+AI projects, noting that these projects are overly "AI-friendly and crypto-averse", which prevents them from establishing a foothold in DeFi. Additionally, Jeff listed some noteworthy AI+stablecoin projects, as compiled by Odaily.

Stablecoins are one of the most important infrastructures created for cryptocurrencies. Without stablecoins, we would lack a stable monetary unit for investors to commit funds (which would make building CEX, DEX, Perps, money markets, and any other vertical domains extremely difficult).

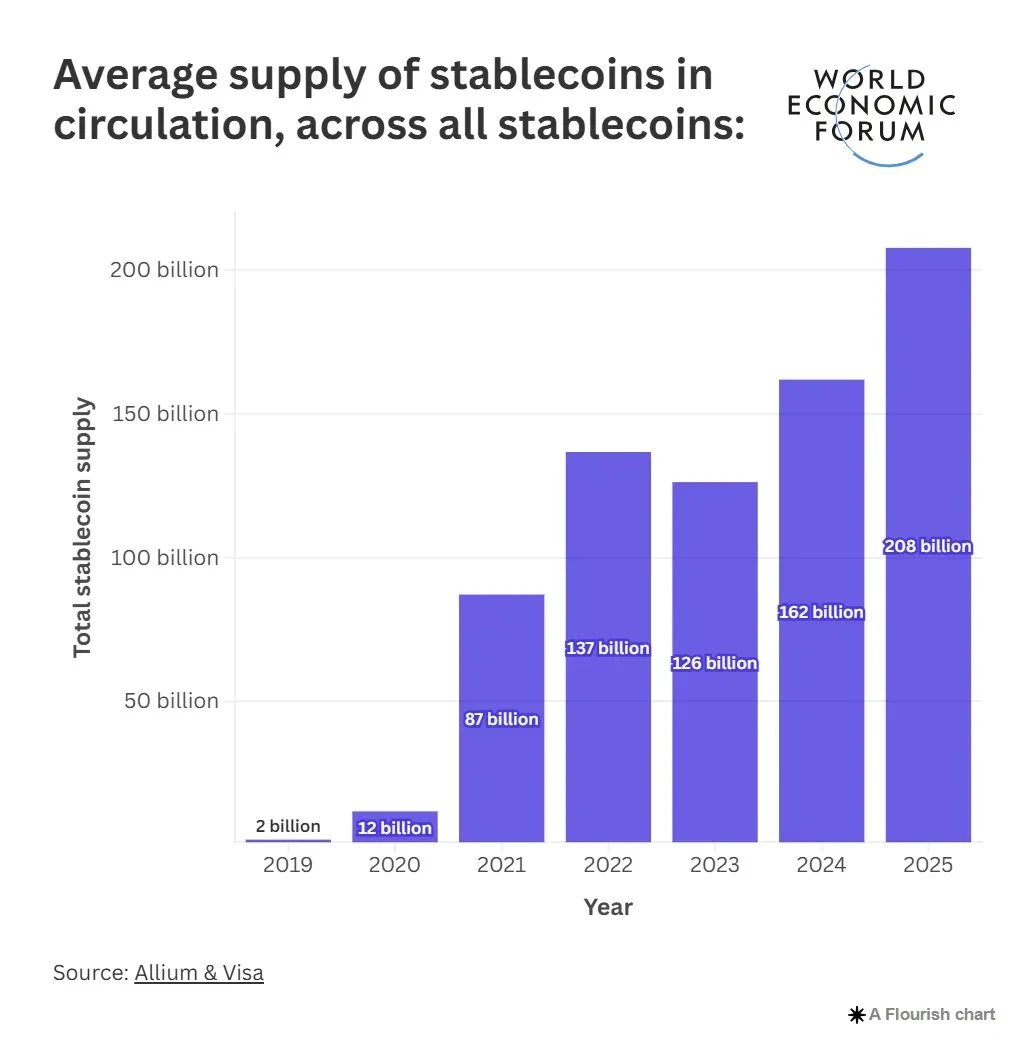

Stablecoins are rapidly gaining popularity—during 2023 to 2025, the total supply, trading volume, and velocity of stablecoins have risen sharply, especially in payments and cross-border transactions.

Moreover, we are seeing clearer regulatory guidelines and further institutional stablecoin adoption, such as Stripe launching stablecoin financial accounts in 101 countries, Société Générale preparing to launch a USD-backed stablecoin, major banks (Bank of America, JPMorgan, Citibank, Wells Fargo) exploring joint stablecoin issuance, and large enterprises investigating stablecoin payment options to reduce Visa and Mastercard transaction fees.

The recent IPO of CRCL (Circle) has also sparked a stablecoin wave, attracting more stakeholders. While we see further TradFi adoption, we are also witnessing stablecoin innovations emerging in the AI field, aimed at addressing challenges faced by service providers and users in Web3 AI.

First Challenge

Although AI teams typically design AI tokens as key components of the AI ecosystem (for payment, governance, utility), they usually invest fewer resources in DeFi, dedicating more to AI products.

Examples:

- Virtuals Protocol used their VIRTUAL/AGENT LP, bringing good value appreciation to VIRTUAL, but simultaneously making it difficult for agent teams and liquidity providers to provide liquidity (due to Impermanent Loss);

- Aethir uses ATH token for computing power payment, which pushed the token but also increased its volatility;

- Bittensor uses dTAO (alpha subnet token) to pay miners, validators, and subnet owners, where participants must sell alpha tokens for stablecoins to maintain operations;

While these examples can be seen as flywheels for AI tokens, the volatility caused by their design also prevents key participants from engaging. (BTW, these 3 examples are relatively excellent, but many AI teams have done quite poorly in token design, especially some fair launch teams).

The increase in token quantity in the market, coupled with non-optimal design, leads to low liquidity and difficulty in building DeFi's Lego blocks.

Projects Addressing "Resource Allocation Imbalance"

MAITRIX—AI Stablecoin Layer

Maitrix introduced over-collateralized AI-native stablecoins (AI USD) tailored for each independent ecosystem, essentially transforming unstable (but high-yield) AI economies into predictable, composable, and vibrant economies with AI-native stablecoins.

[Translation continues in the same manner...]USDAI has not yet been launched, but its target yield is 15-25% APY, with an asset portfolio divided into three stages, ranging from 100% treasury bonds to 100% hardware assets. USDAI uses CALIBER, a system that simplifies the loan/issuance process and complies with legal standards for GPU on-chain tokenization.

Odaily Note: CALIBER: Collateralized Asset Ledger: Insurance, Bailment, Evaluation, Redemption. This system is based on Article 7 of the Uniform Commercial Code (UCC), transforming real-world assets (such as infrastructure) into legally acceptable collateral through asset tokenization and legal framework.

To clarify, USDAI focuses on debt with a broader range of asset types. With its CALIBER model, they can cover various use cases (wherever demand exists), while Gaib is more focused on equity, offering higher expected returns.

You can fill out the form to apply as an early user, and USDAI will provide additional rewards for early participants.

Other AI-related Stablecoin Products

Almanak recently launched alUSD, an ERC-7540 token (an extension of ERC-4626), which is a tokenized AI yield optimization strategy, aimed at maximizing risk-adjusted returns on stablecoin investments in platforms like Aave, Compound, Curve, and Yearn.

The Almanak team will soon launch a points activity to guide liquidity and continue expanding DeFi's composability, allowing people to use alUSD as collateral or cycle it to maximize yields.

The AIxFI project is a vault that can automatically deploy USDC in DeFi protocols. Initially rule-based, it will gradually introduce AI for decision-making. It will be launched this month on Virtuals Protocol.

Future Trends

We will likely see the rise of another Ethena project focused on generating high yields for stablecoins using GPUs. More importantly, how they manage their 1:1 USD peg and ensure the price returns to $1 during critical situations.

In the future, we will see more tokenized AI strategies. We have already witnessed AI's ability to optimize yields more effectively by considering gas fees, rebalancing costs, slippage, and other dynamic variables. Imagine these strategies tokenized as highly composable "vaults" that can be used as collateral or cycled to achieve 5-10x leveraged yields.

As participants like Maitrix build stablecoin infrastructure for top AI ecosystems, we will begin to see increased Web3 AI liquidity. More AI value will become more composable and flow into DeFi, thereby enhancing the value appreciation of the entire Web3 ecosystem.

Although these teams are fascinating, risk/peg management/redemption/liquidation mechanisms are crucial when it comes to stablecoins. Conduct thorough risk assessment before deciding to invest.