The stablecoin landscape is experiencing turbulent changes again. As stablecoins increasingly solidify their position in the cryptocurrency market, mainstream regulatory agencies are introducing new regulations, attempting to find a balance between protecting financial stability and encouraging innovation.

BlockSec, in collaboration with Guofeng Law Firm, focuses on the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) discussed in the U.S. Senate, deeply analyzing the compliance challenges faced by Web3 projects under the GENIUS Act background, and providing targeted, feasible solutions.

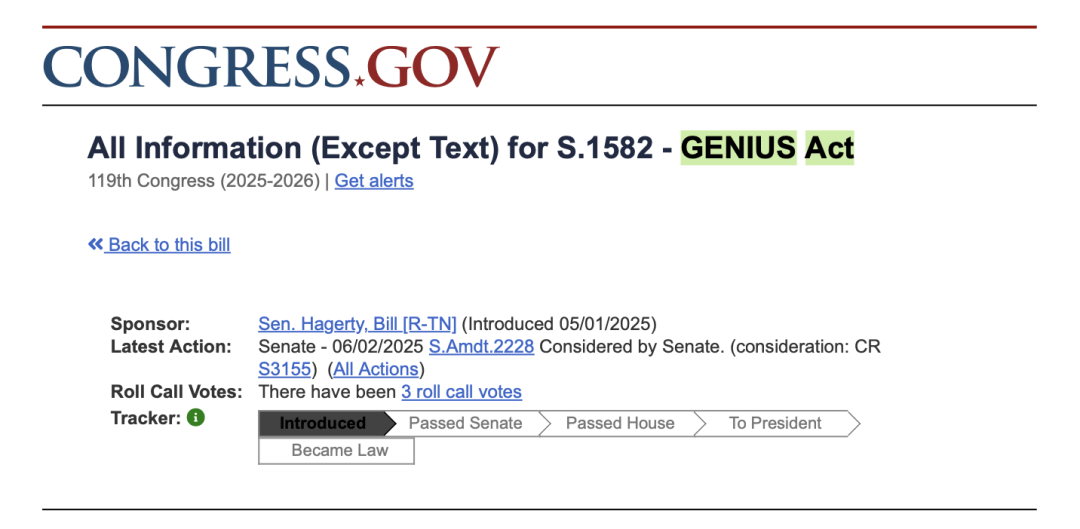

1 GENIUS Act Legislative Process and Core Content

1.1 Key Legislative Milestones

The anti-money laundering innovation section focuses on using innovative technologies to enhance detection and prevention capabilities for illegal activities involving digital assets, including anti-money laundering, with specific measures including:

- Public Opinion Collection and Research

The Treasury Department will launch a 60-day public opinion collection within 30 days after the GENIUS Act takes effect, aimed at identifying innovative methods, technologies, or strategies currently used or potentially adopted by regulated financial institutions to detect and prevent illegal activities involving digital assets, including money laundering. These methods may involve application programming interfaces (APIs), artificial intelligence (AI), digital identity authentication, and blockchain monitoring technologies.

Adopting APIs, AI, and blockchain monitoring technologies will drive regulators' transition from traditional manual review to automated supervision, improving anti-money laundering review and regulatory efficiency.

- Research and Evaluation

After the public opinion collection period ends, the Treasury Department will conduct research based on public feedback. The Financial Crimes Enforcement Network (FinCEN) will assess the innovative methods mentioned in public opinions, comparing them with existing methods to determine their advancements in regulatory effectiveness, costs, privacy risks, operational efficiency, and cybersecurity impacts. After evaluation, FinCEN will develop specific requirements for regulated financial institutions to adopt innovative methods for detecting illegal digital asset activities, operational guidelines for payment stablecoin issuers to identify and report illegal activities involving their payment stablecoins, and operational guidelines for monitoring blockchain transaction systems and practices.

- Risk Assessment and National Strategy

The Treasury Department needs to incorporate the national counter-terrorism and illegal financing strategies required by the Countering America's Adversaries Through Sanctions Act into digital asset illegal activity regulation, focusing on digital asset usage in money laundering and sanction evasion, and high-risk behaviors in foreign jurisdictions that facilitate illegal activities through digital asset conversion to legal tender.

- Congressional Report

The Treasury Department will regularly submit reports to Congress, presenting research findings on innovative detection technologies, technological implementation progress, and proposing legislative recommendations.

(The translation continues in the same manner for the rest of the text, maintaining the specified translations for technical terms and preserving any HTML tags.)Here's the English translation: The GENIUS Act will be a good opportunity to encourage more Web3 projects to rethink their basic operational models. Revenue-generating stablecoin projects need to completely restructure their value propositions; decentralized projects need to find a balance between maintaining decentralized characteristics and meeting compliance requirements; cross-chain projects need to handle compliance complexities across multiple jurisdictions; algorithm-driven projects need to introduce more human supervision and intervention mechanisms. This operational model reconstruction may require project teams to rethink their core competitiveness and market positioning.3 BlockSec's Compliance Solutions

The GENIUS Act provides a clear regulatory framework for US stablecoin issuance. More transparent compliance requirements help reduce industry risks, attract more users, and bring new development opportunities to the industry. More and more institutions no longer view regulation as an obstacle but actively embrace compliance by implementing KYC, identifying and recording suspicious activities related to money laundering and terrorist financing, tracking sanctioned entities, conducting due diligence on large transactions, timely reporting potentially illegal transactions, and taking measures to block, freeze, or reject related transactions, continuously improving their compliance capabilities. However, the anonymity of blockchain and the complexity of on-chain interaction behaviors (especially cross-chain transactions) pose huge challenges for institutions in risk assessment, team collaboration, and responding to compliance reviews. To address this, BlockSec has established a deep collaboration with Grandway Law Firm, providing comprehensive compliance support for institutions through a combination of technology and legal expertise. [The rest of the translation follows the same approach, maintaining the structure and translating the text while preserving the HTML tags and specific terminology as specified.]BlockSec is a leading global blockchain security company founded in 2021 by multiple industry-renowned experts. BlockSec is committed to enhancing security and usability in the Web3 world, providing one-stop security services, including security audit services, security and compliance management platform BlockSec Phalcon, and fund tracking investigation platform MetaSleuth.

Currently, BlockSec has served over 500 global customers, covering well-known Web3 companies such as Coinbase, Cobo, Uniswap, Compound, MetaMask, Bybit, Mantle, Puffer, FBTC, Manta, Merlin, PancakeSwap, and including authoritative regulatory and consulting agencies like the United Nations, FBI, SFC, PwC, and FTI Consulting.

Official Website: https://blocksec.com

Twitter: https://twitter.com/BlockSecTeam