Source: 1confirmation Newsletter; Translated by: AIMan@Jinse Finance

Original Title: 1confirmation: Stablecoins Native Applications About to Experience Explosive Growth

MakerDAO, basis,. Over the past decade, 1confirmation has supported several ststablecoin projects, experienced with some failing, some achieving modest success, making breakthrough progress. These all validate our long-held belief: ststablecoins represent one of the first crypto products that truly go beyond speculation and meet market needs.

Background Matters

1confirmation has bet on stablecoins from day one. Not because they were hot at the time, but because they showed signs of real-pure speculation.

In 2017, 1confirmation invested in MakerDAO, a decentralized collateralized stablecoin still operating today. In 2018, 1confirmation invested in Basis, algorithmic a stthat ultimately failed and returned investors investor funds. In 2022, 1confirmation invested in Bridge, company which was acquired by Stripe for $1.1 billion, becoming one of the largest crypto acquisitions to date.

One failed, one succeeded, success, a breakthrough validated 1confirmation's long-standing argument: stablecoins are among the first actual use cases of cryptocurrency.

North Star

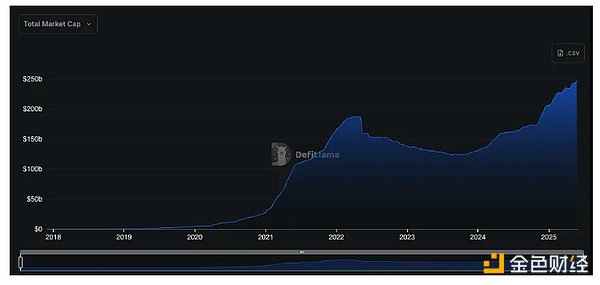

1confirmation believes that on-supply ofablecinsois is key to driving crypto adoption. Currently, the size has reached billion, exceeding the peak of $187 billion in May 2022. Since early 2024, the has grown by 90%.

This north star indicator represents true crypto adoption and indicates whether we are gaining net new users.

Why Now

From a macro perspective, stablecoins have become a strategic necessity for US economic dominance:

US Dollar Export Issue: Foreign central banks' US dollar reserves have dropped from 65% in 2015 to 57% today. BRICS and recent tariff accelerating-. Stablecoins solve this by distributing dollars directly to global populations via the without government support.

Treasury Buyer Solution: Tether is now among the top 20 US Treasury buyers globally, surGermany and Australia. As traditional buyers like Japan and China reduce holdings, stablecoin issuers are becoming crucial funding sources for US government operations.

Legislative Tailwin:ds tblecoinsta legislation Will allow banks and major players like Meta launch to launch their own stablecoins, significantly expanding the market.

ablecoin Native ApplicationsConsumer Applications: Polymarket proved ststablecoin native applications can achieve mainstream adoption mainstream adoption, billions handling billions in volume while delivering truth and information world. This is just the beginning beginning.

EmergingrMarkets: Crypto's long promise was financial inclusion for billions unbanked.. However only speculation. Stablecoins finally realize the original vision. We recently invested in Karsa, a is aew new stablecoin bank for Pakistan markets like Pakistan and Nigeria. With inflation rates up to 32%, USD circulation is crucial for financial stability. karis not making rich people but providing financial tools for for those who need most.

Geographic Expansion: Currently 99.9% of stablecoins are USD-pegged, but this will change. In the next five years, with improved global frameworks frameworks, we expect significant growth in Euro, British, and otherother fiat-pegged stablecoins.

Future Path

Stablecoins represent the clearest path to mainstream crypto applications. Unlike other speculation-driven crypto narratives, stablecoins truly solve real real problems for people today.

Macroroeconomic tailthan. has validated. Regulation is about to become clearer.

We are looking for founders understand the biggest opportunity is building stablecoinative native applications that bring stablecoins to the the next billion users.