Author: David C Source: Bankless Translation: Good Oppa, Jinse Finance

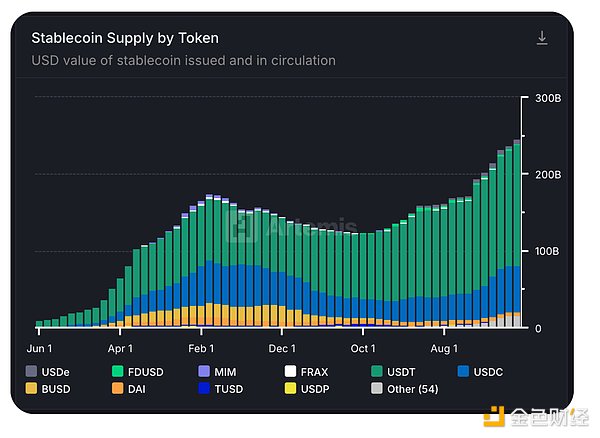

Recently, stablecoins seem to have become the most "product-market fit" track in the crypto industry.

According to research by Artemis, Dragonfly, and Castle Island Ventures, payment companies have settled over $94.2 billion through stablecoins since January 2023, with monthly transaction volume growing from less than $2 billion to over $7.3 billion.

Despite years of solvency doubts and company scandals surrounding Tether, it remains one of the most successful cases in the crypto industry. USDT occupies 62.5% of the total stablecoin supply, deployed across more than ten networks (primarily Ethereum and TRON).

Surprisingly, despite the hot topic of stablecoins, there is almost no underlying chain-level infrastructure specifically designed for such "giants" like USDT.

Plasma has emerged - a brand new blockchain built specifically for stablecoins, with USDT at its core.

Just this morning, Plasma's public offering of $500 million in pre-deposits was instantly sold out. Some users even paid nearly $100,000 in transaction fees to ensure they secured an allocation. This further suggests that Circle's IPO might just be a "prelude" to market interest in stablecoin infrastructure investments.

This article will introduce how Plasma meets the market's infrastructure needs for stablecoins, how it unifies stablecoin activities, and why its deep connection with Tether makes it unique.

Plasma Overview

Plasma is an EVM-compatible Proof of Stake (PoS) blockchain, specifically optimized for stablecoin payments.

Although it is not an official "Tether-exclusive chain", the project is supported by Tether/Bitfinex-related capital (along with well-known investors like Peter Thiel's Founders Fund), forming a direct alignment of interests with the world's largest stablecoin issuer.

While USDT is the core focus, Plasma will not restrict the use of other stablecoins. From the initial launch, it plans to integrate well-known DeFi protocols including Aave, Maker, Curve, and Ethena. The mainnet is expected to launch in the second quarter of this year, when typical DeFi services such as lending and trading around stablecoins will be introduced.

Plasma's Architecture

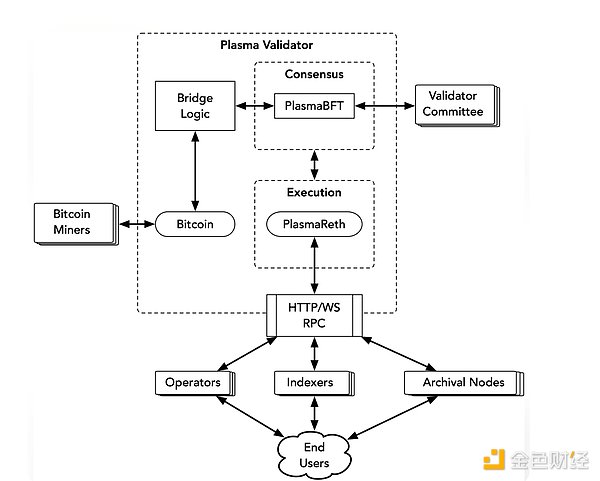

Plasma runs on PlasmaBFT at its base layer, an improved Fast HotStuff design specifically created for high-throughput, low-latency stablecoin transfers - similar to Hyperliquid's consensus method. The execution layer is built on Reth, a Rust-based modular Ethereum engine providing the aforementioned full EVM compatibility.

Plasma adopts a dual validator architecture: one validator cluster responsible for consensus security, another specifically handling gas-free USDT transfers, operating in high-speed, low-cost channels. Initially, these validators will be permission-controlled, with plans to gradually decentralize in the future.

Beyond speed and low cost, Plasma introduces a series of unique features aimed at becoming the "most suitable blockchain for stablecoins":

Zero-fee USDT transfers: This feature is designed specifically for basic USDT payments, running on a parallel block layer to avoid main network congestion. Users can choose to wait slightly longer in exchange for fee-free transfers. To prevent system abuse, restrictions are set such as minimum account balance requirements and transaction frequency limits.

Custom gas tokens: Users can pay transaction fees with authorized tokens (like USDT or BTC) without needing to hold special gas tokens. This allows applications built on Plasma to let users pay directly with familiar tokens. The off-chain system will automatically convert these to Plasma's native gas token XPL at market price, eliminating the need for users to prepare additional transaction currencies.

Private transactions: The team plans to introduce "shielded transfers" functionality to hide transaction details while maintaining compliance.

Bitcoin-anchored security: Plasma will periodically write the latest state summary to the Bitcoin blockchain, meaning tampering with Plasma's historical data would require rewriting Bitcoin's history, which is nearly impossible. Users can also stake BTC through a secure bridge mechanism, with withdrawals implemented via Taproot and threshold signatures without centralized custody. While Plasma's design is inspired by Bitcoin Rollup concepts, it does not depend on future Bitcoin upgrades like OP_CAT or Covenants, instead building on existing Bitcoin functionalities.

Relationship with Tether

Plasma's relationship with Tether goes far beyond a typical on-chain integration.

Beyond receiving financial support and Tether enjoying fee-free and whitelisted gas payment privileges on Plasma, it will also support USDT0 - a cross-chain version of Tether that can extend its influence across more ecosystems.

The deep connection between Plasma and Tether is also reflected at the team level. Plasma co-founder Christian Angermeyer previously helped Tether reinvest substantial profits across multiple industries (such as mining and AI), further strengthening their strategic relationship.

Why Tether?

Why build a blockchain around Tether? In an interview, Plasma CEO Paul Faecks emphasized Tether's role in providing global USD access channels without relying on local banking infrastructure.

Faecks believes people truly need reliable stablecoins, not USDC with a 4% annual yield. He points out that while USDC is more suitable for regulated markets like the US and Europe, Tether dominates countries like Turkey, Thailand, Argentina, and Nigeria, and its usage is rapidly increasing in developed countries - where cryptocurrencies are viewed as "money" rather than an intermediary.

Tether has recently made significant moves into asset tokenization through its Hadron platform, with goals extending beyond gold tokens to future issuance of more RWAs (Real World Assets). Simultaneously, Plasma recently announced a partnership with Uranium Digital, planning to bring uranium assets on-chain.

Is it worth paying attention to?

So far, public chains built for specific purposes have mostly not gained widespread attention, except for a few projects like Hyperliquid. Plasma is following a similar path - building dedicated infrastructure optimized for stablecoins, rather than a general-purpose smart contract platform.

Therefore, how the situation evolves and whether Plasma will become a new inflection point in chain design is worth closely watching.

Plasma's core concept is actually quite simple: if stablecoins are becoming the pillar of the global financial system, they should have infrastructure specifically built for this purpose.