Author: Frank, PANews

The winter of U.S. regulation seems to be quietly receding, with a ray of "innovation exemption" shining into the DeFi field. On June 9th, the positive signals released by SEC senior executives herald a potentially more friendly development environment for DeFi platforms.

However, beneath this policy tailwind, the DeFi market presents an intriguing landscape: on one hand, top protocols like Aave have repeatedly hit new highs in TVL with strong fundamental data; on the other hand, many top DeFi protocols' TVL growth is sluggish, and token prices have yet to recover to early-year levels, suggesting the market's "value discovery" path remains long. Although DeFi tokens have seen a rapid rebound in recent days, PANews focuses on the latest developments and data performance of DeFi top players to analyze the opportunities and challenges behind this.

SEC Releases Positive Signals: DeFi Regulation Welcomes "Innovation Exemption" Framework

The U.S. Securities and Exchange Commission (SEC) has recently released significant positive signals regarding DeFi regulation. At the "DeFi and the American Spirit" crypto roundtable on June 9th, SEC Chair Paul Atkins stated that DeFi's fundamental principles align with core American values such as economic freedom and private property rights, and supports self-custody of crypto assets. He emphasized that blockchain technology enables financial transactions without intermediaries, and the SEC should not hinder such innovations.

Additionally, Chair Atkins first revealed that he has instructed staff to research and develop an "innovation exemption" policy framework for DeFi platforms. The framework aims to "quickly allow SEC-regulated and non-regulated entities to bring on-chain products and services to market". He also clarified that developers building self-custody or privacy-focused software should not be held responsible under federal securities laws merely for publishing code, and mentioned that the SEC's Corporate Finance Division has clarified that PoW mining and PoS staking themselves do not constitute securities transactions.

SEC Crypto Task Force Head Hester Peirce also expressed support, emphasizing that code publishers should not be held responsible for others' use of code, while also warning that centralized entities cannot evade regulation under the "decentralization" label.

Against the backdrop of Republican SEC commissioners pushing for more crypto-friendly policies, these statements were seen as major positive news, temporarily causing DeFi token prices to surge. If the "innovation exemption" is implemented, it could create a more relaxed and clear regulatory environment for U.S. DeFi projects.

Data Review: Sluggish TVL Growth, Strong Token Rebound

After the meeting released regulatory good news, dormant DeFi tokens saw a widespread rally. Particularly, top projects like Aave, LDO, UNI, and COMP generally saw 20%~40% significant increases. But is this merely a fleeting market response to news or a natural growth result of the DeFi industry? PANews reviewed the past half-year data of the top 20 DeFi protocols.

[The rest of the translation continues in the same professional and accurate manner, maintaining the specific translations for technical terms and proper nouns as specified in the initial instructions.]Sky: Starting from 2024, after MakerDAO changed to Sky, Sky embarked on a comprehensive brand upgrade journey. Although its TVL began to decline after the upgrade, another protocol in its ecosystem, Spark, has also demonstrated new potential in the RWA direction. The combined TVL of these two protocols will exceed $11 billion, reaching a top three level. Additionally, its token MKR performed quite impressively in 2025, rising from around $800 to $2,100, an increase of over 170%. However, MakerDAO's upgrade plan "Final Battle" is apparently a relatively complex reorganization, involving governance mechanisms, tokenomics, and product portfolio, which makes it difficult for the market to form a simple perception and is not conducive to market communication.

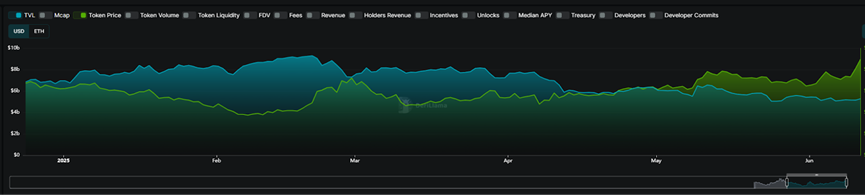

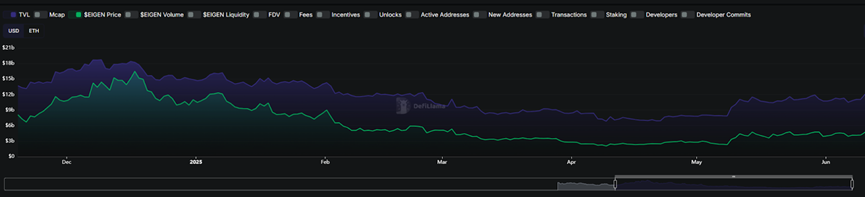

EigenLayer: EigenLayer pioneered the new concept of "reStaking", and since its launch, its TVL has achieved explosive growth to $12.4 billion, currently ranking as the third DeFi protocol. Although the reStaking concept became hot and then cooled down in 2024, and EigenLayer's TVL once declined, from April onwards, its TVL has clearly entered a new growth cycle, increasing from $7 billion to $12.4 billion in less than two months, a 77% increase. Stripped of its conceptual packaging, the real value of reStaking may be being redefined by the market.

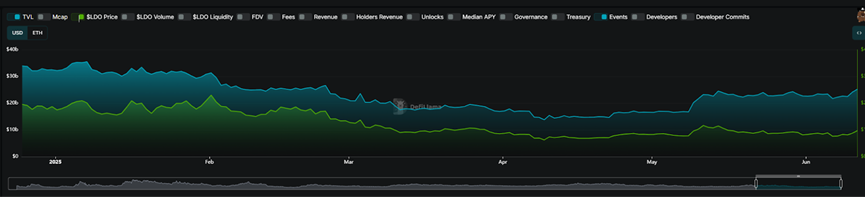

Lido: As the leading project in liquid Staking, Lido once dominated the market with stETH, with its TVL reaching nearly $40 billion in 2024. However, since the second half of 2024, with the rapid growth of Ethereum L2, Lido, which is overly concentrated on the Ethereum mainnet (over 99%), has shown a downturn, and its TVL has been declining. Its token's recent rebound was not significant, with a maximum increase of 61% from its low point to June 10th, far below the average of the top 20 DeFi tokens. Currently, Lido's total TVL still ranks second only to Aave, and the scale effect remains. The primary task for Lido might be how to quickly transform and adapt to more markets to maintain its leading position.

The SEC's regulatory shift undoubtedly injected a strong stimulus into the US DeFi market. The long-standing regulatory uncertainty plaguing projects is expected to ease, and pending innovations like the Uniswap fee switch may finally be implemented. The trend revealed by the data is equally thought-provoking: although Ethereum remains the main carrier of TVL, the development momentum of DeFi is increasingly showing its independence, even beginning to feed back the value of the underlying public chain, as Bitwise analyst Danny Nelson said, "The DeFi ecosystem is becoming the engine of ETH's rise." In the future, regulatory clarity will attract more traditional financial capital to enter the DeFi field with lower risk appetite, bringing valuable new blood; meanwhile, attempts by giants like BlackRock to launch unique DeFi products not only herald a broader integration prospect but also mean that the competition for incremental markets will become more intense. This "Final Battle" opened by regulatory relaxation may be a new starting point for DeFi's maturity and deep integration with traditional finance.