USDC issuer Circle successfully went public on the U.S. stock market, soaring 168% on the first day and raising $1.1 billion, becoming the first stablecoin stock; Gemini also subsequently submitted an IPO filing; and another less-discussed trading platform, Bullish, was reported by media to have secretly submitted a listing application to the SEC.

In the most profitable CEX track in the crypto, Bullish is not a familiar name, but in fact, its "origin" is quite distinguished.

In 2018, EOS emerged out of nowhere, claiming to be the Ethereum killer, and the company behind it, Block.one, rode this wave to conduct the longest and highest-funded ICO in history, raising an astonishing $4.2 billion.

Years later, when EOS's popularity faded, Block.one "started over" and created a crypto trading platform focused on compliance and targeting the traditional financial market—Bullish, and was thus "shown the door" by the EOS community.

In July 2021, Bullish officially launched. Its initial startup funds included: $100 million in cash invested by Block.one, 164,000 BTC (worth about $9.7 billion at the time), and 20 million EOS; external investors added another $300 million, including PayPal co-founder Peter Thiel, hedge fund manager Alan Howard, and well-known crypto investor Mike Novogratz.

Calculated this way, Bullish's total asset scale at launch exceeded $10 billion, truly luxurious.

Close to "Circle", Distant from "Tether", Bullish "Aims for Compliance"

Bullish's positioning has been clear from the beginning: scale is not important, but compliance is.

Because Bullish's ultimate goal is not to earn profits in the crypto world, but to become a "listable" regular trading platform.

Before officially operating, Bullish reached an agreement with a listed company, Far Peak, to invest $840 million to acquire 9% of its shares and merge for $2.5 billion, thus achieving a roundabout listing and lowering the traditional IPO threshold.

Media reports at the time valued Bullish at $9 billion.

The previous CEO of the merged company, Far Peak, Thomas, is now Bullish's CEO, with a strong compliance background: he was previously the Chief Operating Officer and President of the New York Stock Exchange, performed excellently, and established deep connections with Wall Street giants, CEOs, and institutional investors, with extensive resources in regulation and capital.

It's worth mentioning that Farley's external investments and acquisitions are not numerous, but they are notable in the crypto world: Bitcoin staking protocol Babylon, restaking protocol ether.fi, blockchain media CoinDesk.

In short, Bullish can be said to be the trading platform in the crypto world most eager to become a "Wall Street regular army".

But ideals are full, and reality is harsh. Compliance is much more difficult than they imagined.

With the U.S. regulatory attitude becoming increasingly tough, Bullish's original merger and listing agreement was terminated in 2022, and the 18-month listing plan fell through. Bullish had also considered acquiring FTX to achieve rapid expansion but ultimately did not proceed. Bullish was forced to seek a new compliance path—such as turning to Asia and Europe.

Bullish team at the Hong Kong Consensus conference

Bullish obtained a Type 1 license (securities trading) and Type 7 license (providing automated trading services) from the Hong Kong Securities and Futures Commission at the beginning of this year, as well as a virtual asset trading platform license; additionally, Bullish received a license from the German Federal Financial Supervisory Authority (BaFin) for crypto asset trading and custody.

Bullish has about 260 employees globally, with over half stationed in Hong Kong, the rest distributed in Singapore, the United States, and Gibraltar.

Another obvious manifestation of Bullish's "aim for compliance" is: close to "Circle", distant from "Tether".

On the Bullish platform, the first few trading pairs with the largest volume are all USDC, not USDT, which has a larger circulation and longer history. This reflects its clear stance on regulatory attitude.

In recent years, as USDT continues to face regulatory pressure from the U.S. SEC, its market dominance has begun to waver. On the other hand, USDC, as a stablecoin jointly launched by the compliant company Circle and Coinbase, not only successfully went public on the U.S. stock market but also became the "first stablecoin stock" favored by the capital market, with an excellent stock price trend. With good transparency and regulatory adaptability, USDC's trading volume continues to surge.

According to the latest report from Kaiko, USDC's trading volume on centralized exchanges (CEX) has significantly increased in 2024, reaching $38 billion in March alone, far higher than the monthly average of $8 billion in 2023. Among them, Bullish and Bybit are the two platforms with the largest USDC trading volume, together accounting for about 60% of the market share.

Bullish and EOS's "Love-Hate Relationship"

If one sentence were to describe the relationship between Bullish and EOS, it would be "ex and current".

Although the news of Bullish secretly submitting an IPO application caused EOS's price to rise by 17%, in fact, the relationship between the EOS community and Bullish is not good, because Block.one abandoned EOS and then embraced Bullish.

Back to 2017, the public chain track was in its golden age. Block.one released a white paper for EOS, a super public chain project shouting "million TPS, zero transaction fees", which immediately attracted global investors. Within a year, EOS raised $4.2 billion through ICO, breaking industry records and igniting the fantasy of an "Ethereum killer".

However, the dream started quickly and collapsed just as fast. After EOS mainnet went live, users quickly discovered that this chain was not as "invincible" as advertised. Transfers were free, but CPU and RAM had to be staked, with a complex process and high operational barriers; node elections were not the imagined "democratic governance" but quickly controlled by large holders and exchanges, with issues like bribery and vote swapping.

But what truly accelerated EOS's decline was not just technical issues, but more internal resource allocation problems at Block.one.

Block.one originally promised to use $1 billion to support the EOS ecosystem, but actually did the opposite: buying U.S. bonds on a large scale, hoarding 160,000 BTC, investing in the failed social product Voice, and using money to trade stocks and buy domains... Very little was actually used to support EOS developers.

At the same time, power was highly centralized within the company, with core executives almost entirely composed of Block.one founder BB's relatives and friends, forming a small "family business" circle. After 2020, BM announced leaving the project, which became a precursor to the complete split between Block.one and EOS.

What truly ignited the EOS community's anger was the emergence of Bullish.

Block.one founder BB

In 2021, Block.one announced the launch of the crypto trading platform Bullish, claiming to have completed $10 billion in financing, with a luxurious list of investors—including PayPal co-founder Peter Thiel and Wall Street veteran Mike Novogratz. This new platform focused on compliance and stability, building a "bridge" of crypto finance for institutional investors.

But this Bullish was almost unrelated to EOS in both technology and brand—not using EOS technology, not accepting EOS tokens, not acknowledging any connection to EOS, not even offering the most basic thanks.

For the EOS community, this was nothing short of an open betrayal: Block.one used the resources accumulated from building EOS to start a "new love". And EOS was left completely behind.

Thus, the counterattack from the EOS community began.

At the end of 2021, the community initiated a "Fork Uprising" to try to cut off Block.one's control. The EOS Foundation, as a community representative, began negotiations with Block.one. However, after a month of discussions, both parties failed to reach a consensus. Eventually, the EOS Foundation joined 17 nodes to revoke Block.one's power and remove them from the EOS management. In 2022, the EOS Network Foundation (ENF) filed a legal lawsuit, accusing them of betraying their ecosystem promises; in 2023, the community even considered using a hard fork to completely isolate Block.one and Bullish's assets.

Related reading: 《EOS Nodes Stopping Block.one Account Release Event: The Mother Company Kicked Out by the Community》.

After the separation between EOS and Block.one, the EOS community has been in litigation for years over the ownership of the initially raised funds, but so far, Block.one still retains the ownership and usage rights of the funds.

So in the eyes of many EOS community members, Bullish is not a "new project", but more like a symbol of betrayal, and this Bullish that secretly submitted an IPO application has always been the "new love" that exchanged their ideals for reality - glamorous, yet shameful.

In 2025, EOS officially renamed itself Vaulta to cut ties with the past, building Web3 banking services on the public chain, and also renaming the token EOS to A.

How Much Money Does the Wealthy Block.one Have?

We all know that Block.one raised $4.2 billion early on, becoming the largest financing event in crypto history. Theoretically, these funds could support EOS's long-term development, support developers, promote technological innovation, and allow the ecosystem to grow continuously. However, when EOS ecosystem developers begged for funding, Block.one only threw out a $50,000 check - which wasn't even enough to pay two months' salary for a Silicon Valley programmer.

"Where did the $4.2 billion go?" the community asked.

In the email BM wrote to Block.one shareholders on March 19, 2019, part of the answer was revealed: as of February 2019, Block.one's total assets (including cash and invested funds) were $3 billion. Of these $3 billion, about $2.2 billion was invested in US government bonds.

Where did the $4.2 billion go? Broadly speaking, in three main directions: $2.2 billion in government bonds - low-risk, stable returns, ensuring wealth preservation; 160,000 BTC: now worth over $16 billion; small stock trading and acquisition attempts: such as the failed Silvergate investment, purchasing the Voice domain, etc.

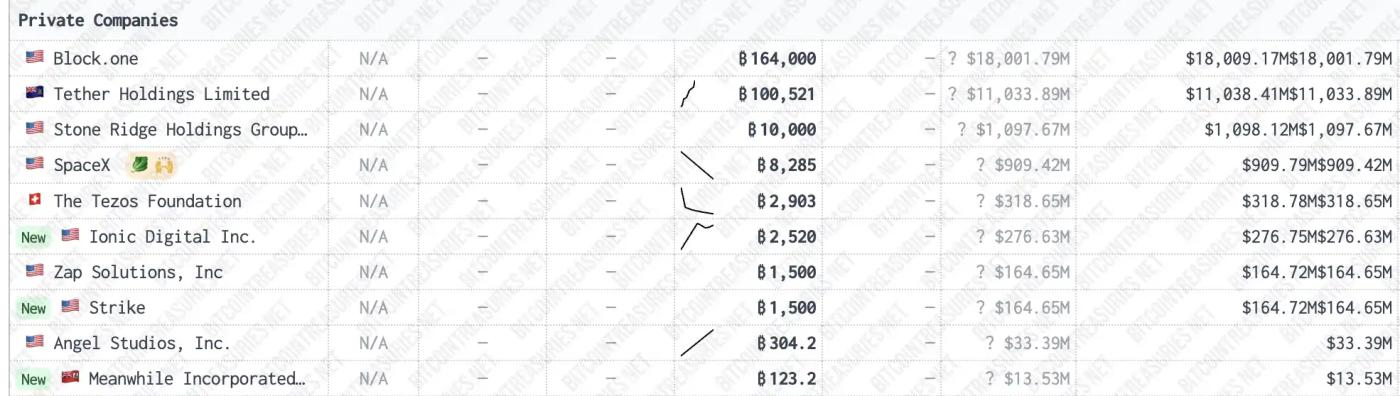

Many people don't know that Block.one, the parent company of EOS, is currently the private enterprise with the most Bitcoin holdings, owning a total of 160,000 BTC, which is 40,000 more than the stablecoin giant Tether.

Data source: bitcointreasuries

At the current price of $109,650, these 160,000 BTC are worth approximately $17.544 billion. This means that just from the appreciation of this Bitcoin, Block.one has earned over $13 billion on paper, about 4.18 times the original ICO fundraising amount.

From the perspective of "cash flow is king", Block.one is very successful today, and can even be said to be more "forward-looking" than MicroStrategy, and one of the most profitable "project parties" in crypto history. However, it didn't achieve this by "building a great blockchain", but by "how to best preserve the principal, expand assets, and exit smoothly".

This is another ironic and true side of the crypto world: in the crypto space, the winner in the end may not be the one with the "best technology" or the "most passionate ideal", but possibly the one who understands compliance best, is most adept at reading the situation, and is most skilled at holding onto money.