Bitcoin's recent price movement shows a downward trend, with cryptocurrency struggling to break free from continuous decline.

Despite investors' ongoing efforts to accumulate Bitcoin and secure profits, these efforts appear to be failing in the face of broader market pressure.

Bitcoin Long-Term Holders Lack Confidence in Rise

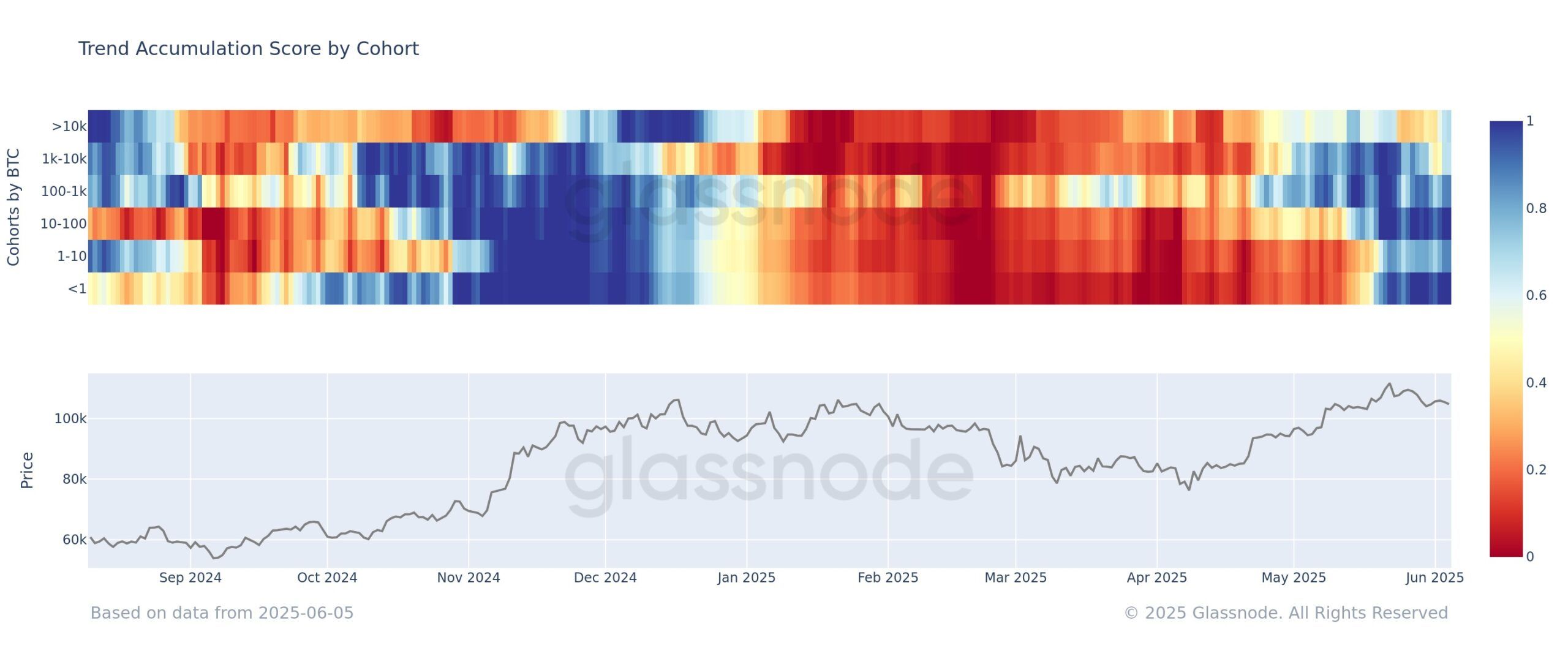

Currently, investor sentiment has clearly shifted towards accumulation. Small holders with 1 BTC and those holding 10 to 100 BTC are actively buying, increasing demand within these groups. Such activity suggests growing confidence in Bitcoin's future potential.

However, large holders with 1,000 to 10,000 BTC or over 10,000 BTC have not shown the same level of buying interest. Their trades have a greater market impact, and without their support, small holders' accumulation is insufficient to raise Bitcoin's price.

Consequently, Bitcoin's price remains stagnant. Small investors' enthusiasm is notable but not enough to break the downward trend.

In the broader market context, Bitcoin's current macro momentum also indicates significant challenges. Realized gains data shows disproportionate selling from long-term holders (LTH).

These investors have seen substantial profits over time and are now cashing out, significantly increasing selling pressure. In fact, LTH sales exceeded $1 billion in a single day this week. The surge in profit-taking combined with low buying activity from large holders is exerting considerable downward pressure on Bitcoin's price.

BTC Price Faces Decline

At the time of writing, Bitcoin's price remains at $103,527, still below the critical resistance level of $105,000. To break free from continuous decline, stronger accumulation is needed. With insufficient buying pressure from large holders, the downward trend is likely to continue unless there are significant changes in investor behavior.

If Bitcoin fails to break through the downward trend, it could drop to $100,000. The combination of long-term decline and weak buying could extend the drop, potentially pushing Bitcoin to $98,000.

However, if Bitcoin can secure $102,734 as a support level, it could trigger a more positive trend. Particularly, strong Bitcoin accumulation by large holders could push the price above $105,000. This would represent a crucial reversal that could invalidate the decline thesis and potentially open the door to price increases.