Institutional adoption is booming, and macro conditions are driving retail investors to Bitcoin. Most traders are very bullish on Bitcoin, including hyperliquid whale James Wynn.

But his public trading could be the reason why BTC is still down despite hitting an all-time high two weeks ago. Are traders intentionally pushing Bitcoin down to induce Wynn’s liquidation?

James Wynn's Bitcoin Investment That Created a Happening… Will It Have a Negative Impact on the Market?

Today, Bitcoin is trading near $105,000, down 11% from its all-time high two weeks ago. But positive headlines suggest that BTC should be rising now.

Just this week, South Korea’s new president raised hopes for an ETF, a Spanish coffee chain planned a $1 billion purchase, Russia developed a new Bitcoin offering, and even Trump Media raised $2 billion to invest in BTC.

So why is the market stagnating? Some point to hyper-liquid whale James Wynn , whose excessive long bets and public statements have drawn attention.

James Wynn ( @JamesWynnReal ) just got liquidated for 240 $BTC ($25.16M).

— Lookonchain (@lookonchain) June 4, 2025

He also manually closed part of his position to lower the liquidation price.

He still holds 770 $BTC ($80.5M), with a liquidation price of $104,035. https://t.co/FX6sISWuDP pic.twitter.com/ZrroIyP9LZ

According to on-chain data today, Win’s leveraged long position was liquidated for 240 BTC (~$25.16 million) as Bitcoin neared his $104,720 liquidation price.

Meanwhile, his tweets reveal his discontent with market manipulation. They suggest that he believes that coordinated sellers are trying to liquidate him.

It would be ok if it wasn't so damn obvious.

— James Wynn (@JamesWynnReal) June 4, 2025

Who controls these markets?

Billions of inflows yet price declining??

Open up a long time. Straight away hunted and targeted to my Liquidation level.

Everytime.

You've all been exposed.

Criminal!!!!

@EricTrump @realDonaldTrump …

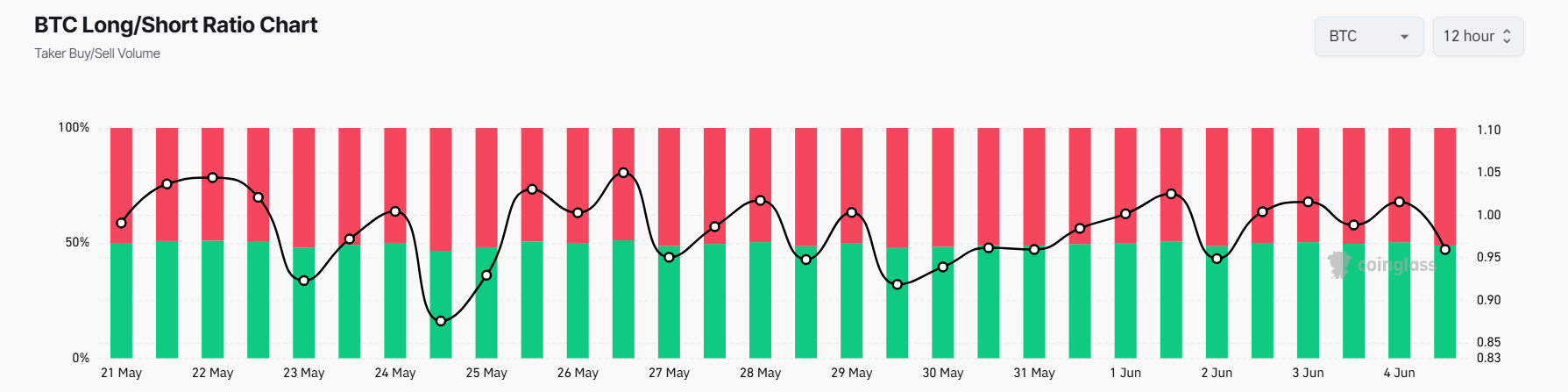

Looking at today's 12-hour long/short ratio, shorts are at 51.03% and longs are at 48.97%. Short volume slightly exceeds long volume, but the difference is minimal.

If there was malicious intent aimed at liquidating Win, we would expect a more pronounced short bias and a sudden influx of large sell orders.

Instead, the on-chain flow is more consistent with overall profit taking since the $111,000 peak two weeks ago.

Global macro and crypto-specific factors also impact prices. Selling pressure was added by traders who were hedging their bets in advance amid profit-taking reports from large institutions and uncertain interest rate cut signals.

Whale psychology and self-fulfilling movements

Win's huge positions can amplify volatility. When a well-known whale releases a liquidation price, some traders may see it as an opportunity to bet against him.

High leverage longs often carry a chain risk. A single forced sell can trigger a margin call and cause a deeper price drop. However, to say that whales move prices alone ignores the broader market forces.

Traders may simply short or sell Bitcoin because they feel the rally is overdone . Wynn’s tweet may reinforce bearish sentiment, but it does not create the sentiment.

For example, if Bitcoin breaks $104,500 and triggers the next liquidation of the win, the forced sell could extend the decline to $103,500 or lower. However, the move usually reflects existing momentum, not a new catalyst. Market makers and large traders often hedge their positions rather than coordinate attacks on individuals.

If the MM's hit the white line I'm liquidated again. Pure and simple market manipulation. No ifs or buts. FACT!

— James Wynn (@JamesWynnReal) June 4, 2025

Hurry up @cz_binance and create a dark liquidity dex pool. Because this is outrageous!!!! pic.twitter.com/Goufqj5K50

Win's narrative portrays his liquidation as an orchestrated operation.

In fact, the surge in sell orders at his threshold is likely to come from algorithmic trading and liquidations, which are common in highly leveraged markets.

Conclusion, More Than Whales' Worries

James Wynn's leveraged longs and colorful tweets add drama to Bitcoin's correction. He could be exacerbating volatility near his liquidation threshold.

But explaining the 11% decline solely based on his position is oversimplifying the market dynamics. Profit taking, technical resistance, and changing macro signals play a bigger role.

While Wynn's forced sell could push prices lower in a tight market, the main driver goes beyond the drama of one trader.