The cryptocurrency market is facing potential volatility as approximately $3.7 billion in Bitcoin and Ethereum options are set to expire today.

Bitcoin options amount to $3.1 billion in nominal value, while Ethereum options are $588 million. Traders are closely monitoring the potential impact of these expirations on prices.

Cryptocurrency Market, $370 Million in Bitcoin and Ethereum Options Expiring

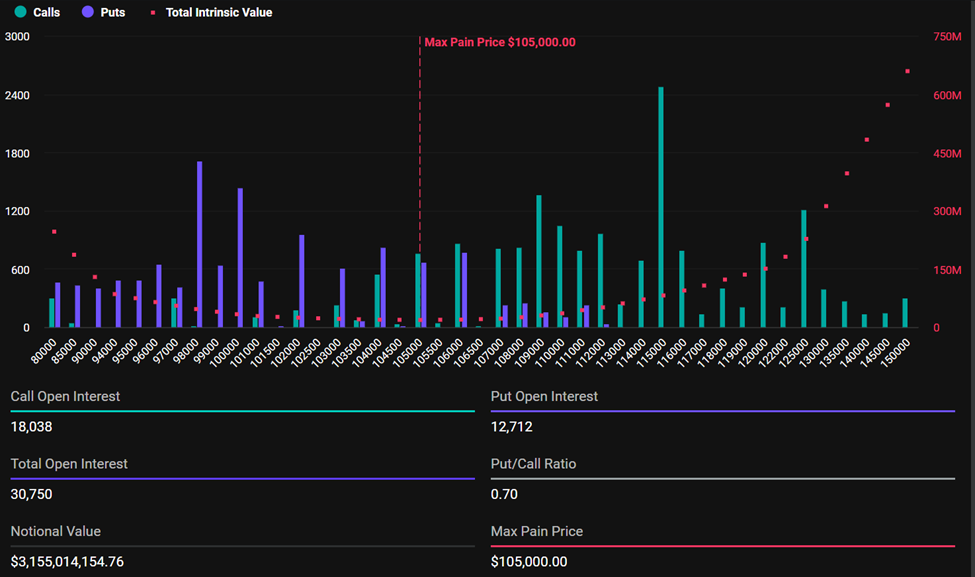

According to data from Deribit, a cryptocurrency derivatives exchange, 30,750 Bitcoin option contracts will expire on June 6th. This tranche is significantly smaller than the 92,459 contracts from last week.

These contracts have a put-call ratio of 0.7 and a maximum pain point of $105,000.

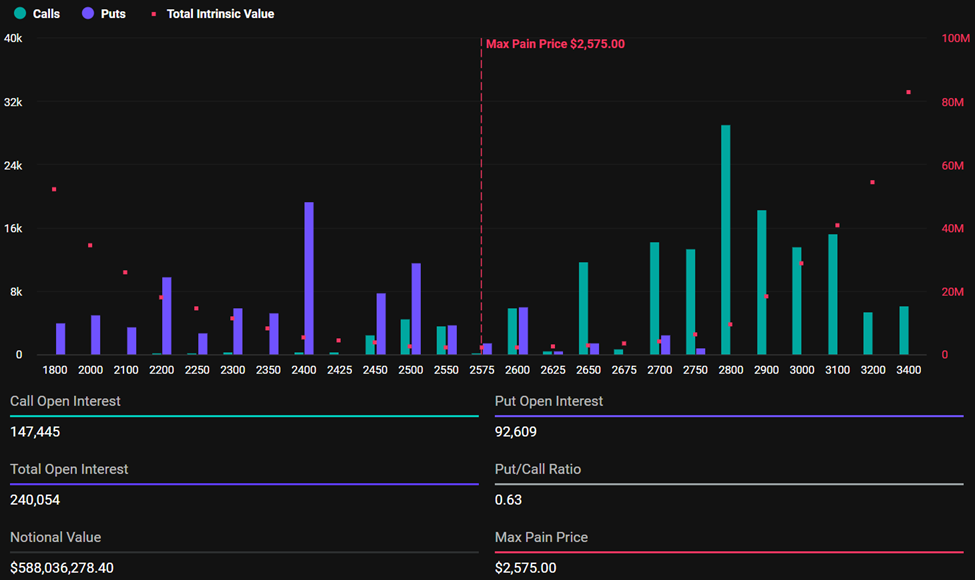

Similarly, the Ethereum options market will see 240,054 contracts expiring. Today's expiring Ethereum contracts have a put-call ratio of 0.63 and a maximum pain point of $2,575.

In cryptocurrency options trading, traders analyze the put-call ratio to gauge market sentiment. Bitcoin's put-call ratio indicates more call options than put options, suggesting higher upward expectations. Ethereum similarly has a put-call ratio below 1.

Specifically, Bitcoin was trading at $102,769, while Ethereum was trading at $2,456. Both assets are currently below their maximum pain levels.

The maximum pain point suggests that Bitcoin and Ethereum prices might hover around these critical levels at option expiration. This indicates that both assets remain below their strike prices, explaining upward expectations. This could result in losses for both bulls and bears.

As these options are settled, they may trigger volatility. There is a possibility of sudden price movements. However, this depends on the market's reaction.

"Calls dominate the curve. What do you expect to happen after expiration?" asked analysts from Deribit, the cryptocurrency derivatives exchange.

Bitcoin Traders Short-Term Bearish... Option Bets Optimistic for Q3

Elsewhere, Bitcoin traders are showing caution, seemingly due to the conflict between Donald Trump and Elon Musk.

According to Greeks.live, most market participants are maintaining a bearish stance and anticipating further correction. The range between $105,000 and $109,000 is considered a strong resistance zone. Many traders believe Bitcoin will struggle to break through this level in the short term.

Volatility remains abnormally low, creating a challenging environment for options traders. In response, many are selling short-term call options expiring on June 7th, particularly at levels between $108,000 and $109,000.

This strategy reflects a belief that Bitcoin will remain below the resistance line in the near future. Some traders are using this approach as a long-term rolling strategy.

Specifically, they anticipate a potential rise to $150,000 by Q4 but expect short-term weakness or correction first.

"Traders suggest implementing short-term call spread strategies as a potential 'flywheel' for a perpetually rolling portfolio position, with the perspective that Bitcoin could reach 150K by Q4," posted Greeks.live.

Many traders are currently observing, despite the temptation to enter the market. They are preparing to enter long positions while waiting for a deeper correction.

Greeks.live analysts also reported the largest cryptocurrency options block trade in history. This trade, valued at $1.19 billion, included 11,350 BTC and generated a $7.5 million premium.

The trade was divided into two parts. The first was a bullish spread for September, anticipating price increases and high volatility by year-end. The second was selling July ATM calls, indicating low short-term upward expectations.

However, the market remains quiet and uncertain ahead of today's option expiration. Some traders are preparing for significant movements by year-end. The large options trade suggests July might be calm, but confidence in a Bitcoin bullish rally is growing through Q3.